Engineering Economy Global Edition ---- (5.2 Determining the Minimum Attractive Rate of Return (MARR))

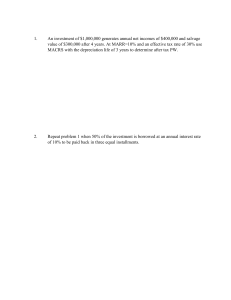

advertisement

220 CHAPTER 5 / EVALUATING A SINGLE PROJECT 5.2 Determining the Minimum Attractive Rate of Return (MARR) The Minimum Attractive Rate of Return (MARR) is usually a policy issue resolved by the top management of an organization in view of numerous considerations. Among these considerations are the following: 1. The amount of money available for investment, and the source and cost of these funds (i.e., equity funds or borrowed funds) 2. The number of good projects available for investment and their purpose (i.e., whether they sustain present operations and are essential, or whether they expand on present operations and are elective) 3. The amount of perceived risk associated with investment opportunities available to the firm and the estimated cost of administering projects over short planning horizons versus long planning horizons Copyright © 2019. Pearson Education, Limited. All rights reserved. 4. The type of organization involved (i.e., government, public utility, or private industry) In theory, the MARR, which is sometimes called the hurdle rate, should be chosen to maximize the economic well-being of an organization, subject to the types of considerations just listed. How an individual firm accomplishes this in practice is far from clear-cut and is frequently the subject of discussion. One popular approach to establishing a MARR involves the opportunity cost viewpoint described in Chapter 2, and it results from the phenomenon of capital rationing. This situation may arise when the amount of available capital is insufficient to sponsor all worthy investment opportunities. The subject of capital rationing is covered in Chapter 13. A simple example of capital rationing is given in Figure 5-1, where the cumulative investment requirements of seven acceptable projects are plotted against the prospective annual rate of profit of each. Figure 5-1 shows a limit of $600 million on available capital. In view of this limitation, the last funded project would be E, with a prospective rate of profit of 19% per year, and the best rejected project is F. In this case, the MARR by the opportunity cost principle would be 16% per year. By not being able to invest in project F, the firm would presumably be forfeiting the chance to realize a 16% annual return. As the amount of investment capital and opportunities available change over time, the firm’s MARR will also change.∗ Superimposed on Figure 5-1 is the approximate cost of obtaining the $600 million, illustrating that project E is acceptable only as long as its annual rate of profit exceeds the cost of raising the last $100 million. As shown in Figure 5-1, the cost of capital will tend to increase gradually as larger sums of money are acquired through increased borrowing (debt) or new issuances of common stock (equity). Determining the MARR is discussed further in Chapter 13. ∗ As we shall see in Chapter 11, the selection of a project may be relatively insensitive to the choice of a value for the MARR. Revenue estimates, for example, are much more important to the selection of the most profitable investment. Sullivan, William, et al. Engineering Economy, Global Edition, Pearson Education, Limited, 2019. ProQuest Ebook Central, http://ebookcentral.proquest.com/lib/cuhk-ebooks/detail.action?docID=5725746. Created from cuhk-ebooks on 2023-03-23 09:20:45.