Post-Secondary Costs - Teacher Resource 3 GRADE 8 LESSON 15

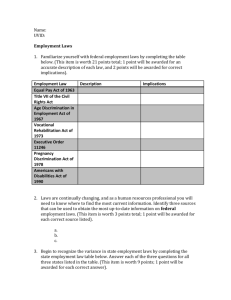

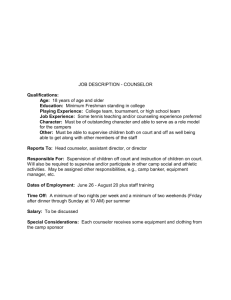

advertisement

Post-Secondary Costs - Teacher Resource 3 GRADE 8 LESSON 15 Student #1 John has completed college prep courses and is graduating with a 3.0 grade point average. His ACT/SAT test scores are good and he has been accepted to WVU. He plans to become a high school math teacher. His parents have good credit and they have saved money for his first four years of college. Source Amount Awarded Banker Federal Government State Government School Counselor Parents College/Institution Military Total Amount Awarded Amount still needed Student #2 Mary is planning to attend a community college to get her Associates Degree as a licensed practical nurse. She has a 2.5 GPA and an 18 on the ACT test. Her parents have not saved for college and are not planning to help pay for college. When they completed the FAFSA, they reported a household income of $40,000. Source Banker Federal Government State Government School Counselor Parents College/Institution Military Total Amount Awarded Amount still needed Amount Awarded Post-Secondary Costs GRADE 8 LESSON 15 Student # 3 Matt wants to become a police officer. He wants to earn an Associate’s Degree in Criminal Justice and then go to the State Police Academy. His parents have good credit. He has a 2.5 GPA. He has a 17 on his ACT test. His parents have not saved for college and have told him they cannot afford to take out a loan. His family income is above $70,000. Source Amount Awarded Banker Federal Government State Government School Counselor Parents College/Institution Military Total Amount Awarded Amount still needed Student #4 Jane has taken all college prep courses. She has a 3.8 GPA and a 24 ACT score. She plans to attend Fairmont State University and major in Accounting. Her parents have poor credit. The family income is $90,000. Source Banker Federal Government State Government School Counselor Parents College/Institution Military Total Amount Awarded Amount still needed Amount Awarded