Powers, functions and duties in the PGPA Act that can be delegated

advertisement

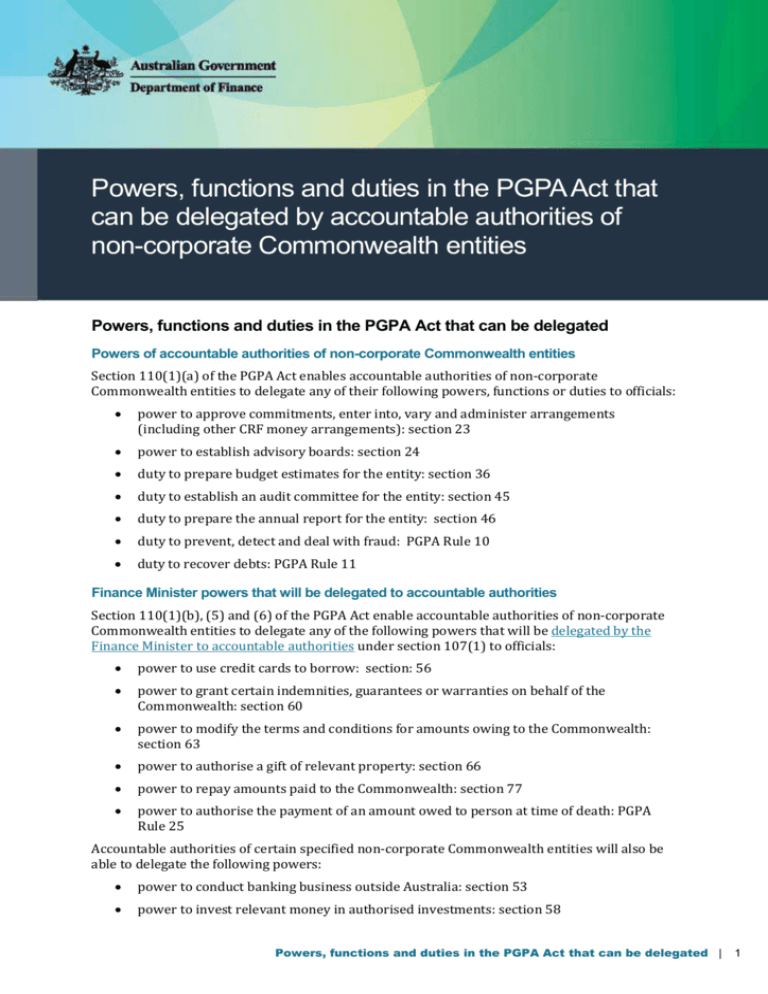

Powers, functions and duties in the PGPA Act that can be delegated by accountable authorities of non-corporate Commonwealth entities Powers, functions and duties in the PGPA Act that can be delegated Powers of accountable authorities of non-corporate Commonwealth entities Section 110(1)(a) of the PGPA Act enables accountable authorities of non-corporate Commonwealth entities to delegate any of their following powers, functions or duties to officials: power to approve commitments, enter into, vary and administer arrangements (including other CRF money arrangements): section 23 power to establish advisory boards: section 24 duty to prepare budget estimates for the entity: section 36 duty to establish an audit committee for the entity: section 45 duty to prepare the annual report for the entity: section 46 duty to prevent, detect and deal with fraud: PGPA Rule 10 duty to recover debts: PGPA Rule 11 Finance Minister powers that will be delegated to accountable authorities Section 110(1)(b), (5) and (6) of the PGPA Act enable accountable authorities of non-corporate Commonwealth entities to delegate any of the following powers that will be delegated by the Finance Minister to accountable authorities under section 107(1) to officials: power to use credit cards to borrow: section: 56 power to grant certain indemnities, guarantees or warranties on behalf of the Commonwealth: section 60 power to modify the terms and conditions for amounts owing to the Commonwealth: section 63 power to authorise a gift of relevant property: section 66 power to repay amounts paid to the Commonwealth: section 77 power to authorise the payment of an amount owed to person at time of death: PGPA Rule 25 Accountable authorities of certain specified non-corporate Commonwealth entities will also be able to delegate the following powers: power to conduct banking business outside Australia: section 53 power to invest relevant money in authorised investments: section 58 Powers, functions and duties in the PGPA Act that can be delegated | 1 power to waiver of amounts owing to the Commonwealth: section 63 Powers, functions and duties in the PGPA Act that cannot be delegated Section 110(2)(a) of the PGPA Act prevents accountable authorities of non-corporate Commonwealth entities from delegating the following powers, functions or duties: duty to govern the entity: section 15 duty to establish and maintain systems relating to risk and control: section 16 duty to encourage cooperation with others: section 17 duty in relation to requirements imposed on others: section 18 duty to keep responsible Minister and Finance Minister informed: section 19 power to give written accountable authority instructions: section 20A duty to govern an entity in a way that is not inconsistent with the policies of the Australian Government: section 21 duty to prepare corporate plan for the entity: section 35 duty to have records about performance of the entity: section 37 duty to measure and assess the performance of the entity: section 38 duty to prepare annual performance statements for the entity: section 39 duty to have accounts and records for the entity: section 41 duty to prepare annual financial statements for the entity: section 42 duty to include audited annual financial statements in the entity’s annual report: section 43 duty to ensure any arrangement entered into relating to the receipt, custody or expenditure of other CRF complies with PGPA Rule 29(2) (note that this is not a power to enter into other CRF arrangements, the power to enter in other CRF arrangements comes from section 23 and this power can be delegated) Powers, functions and duties in the PGPA Act that can be delegated | 2