Proposed transitional arrangement for Commonwealth authorities

advertisement

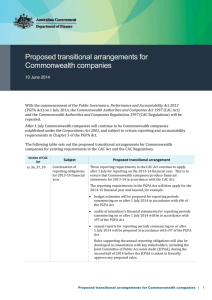

Proposed transitional arrangement for Commonwealth authorities 10 June 2014 With the commencement of the Public Governance, Performance and Accountability Act 2013 (PGPA Act) on 1 July 2014, the Commonwealth Authorities and Companies Act 1997 (CAC Act) and the Commonwealth Authorities and Companies Regulations 1997 (CAC Regulations) will be repealed. On 1 July Commonwealth authorities will become corporate Commonwealth entities. Some other changes to terminology will be: CAC Act PGPA Act Commonwealth authority corporate Commonwealth entity director(s) accountable authority director, senior manager or employee official money held in own account relevant money Finance Minister’s Orders PGPA rule for financial reporting General Policy Order Government Policy Order The following table sets out the proposed transitional arrangements for Commonwealth authorities for: existing requirements in the CAC Act and the CAC Regulations and new requirements commencing in the PGPA Act. Transitional and saving arrangements Section of CAC Act or CAC regulation ss 9, 10, 12, 14 & Schedule 1 Finance Minister’s Orders on the preparation of financial statements Subject Proposed transitional arrangement Continuation of reporting obligations for 2013-14 financial year Certain provisions in the CAC Act relating to the 2013-14 financial year continue to apply after 1 July to ensure that Commonwealth authorities produce their financial statements for 2013-14, and have those statements audited by the Auditor-General, in accordance with the CAC Act. Finance Minister’s Orders on the preparation of financial statements for the 2013-14 financial year will also continue to apply for financial statements for 2013-14. The reporting requirements in the PGPA Act will then apply for the 2014-15 financial year and beyond, for example: budget estimates will be prepared for reporting periods Proposed transitional arrangements for Commonwealth authorities | 1 Section of CAC Act or CAC regulation Subject Proposed transitional arrangement commencing on or after 1 July 2014 in accordance with s36 of the PGPA Act annual financial statements will be prepared and audited for reporting periods commencing on or after 1 July 2014 in accordance with ss42 and 43 of the PGPA Act audits of subsidiary’s financial statements for reporting periods commencing on or after 1 July 2014 will be in accordance with s44 of the PGPA Act annual reports for reporting periods commencing on or after 1 July 2014 will be prepared in accordance with s46 of the PGPA Act. Rules supporting the annual reporting obligations will also be developed in consultation with key stakeholders, including the Joint Committee of Public Accounts Audit (JCPAA), during the second half of 2014 before the JCPAA is asked to formally approve any proposed rules. s 15 Responsible Minister to be notified of significant events Director(s) will be required to notify the responsible Minister of any significant event that event occur before 1 July. This is to ensure that the CAC Act’s accountability framework continues for all events that occur before its repeal. For events that occur after 1 July, Ministers will have to inform Parliament of certain events in accordance with s19 of the PGPA Act. s 16 Keeping responsible Minister and Finance Minister informed Director(s) will be required to keep the responsible Minister and Finance Minister informed of all matters listed in s16 that occur before 1 July (i.e. after 1 July a minister will not need to make a new request under s19 of the PGPA Act – an existing request must still be fulfilled). s 17 Corporate plan for Government Business Enterprises’ (GBEs) Will apply to the corporate plan requirements for the first reporting period that a GBE makes after 1 July (i.e. a GBE’s corporate plan for 2014-15 will be prepared under the CAC Act). For 2015-16 the corporate plan will be prepared in accordance with s35 of the PGPA Act. ss 18(2) and 19(2) Banking and investment Will apply after 1 July for money received before that time. Money received after 1 July will be covered by ss 54 and 55 of the PGPA Act for banking. Surplus money will be treated as investments under section 59 of the PGPA Act. This will cover fixed-term investments made before 1 July that has not matured before 1 July. Finance Minister approvals for other investment types will be preserved under the PGPA Act. s 20 Accounting records Will continue to apply after 1 July to accounting records made before that time. Over time the ordinary record-keeping requirements of the Archives Act 1983 will supersede CAC Act requirements. Proposed transitional arrangements for Commonwealth authorities | 2 Section of CAC Act or CAC regulation ss 24 and 25 Subject Proposed transitional arrangement Duties of officials – use of position and information Will continue to apply after 1 July to ensure that civil penalty proceedings can be taken after 1 July even where it is not apparent that misuse has happened before or after 1 July. For misuse of position or information after 1 July, ss27 and 28 of the PGPA Act will apply to officials. This will ensure that an official cannot be found to have contravened ss27 or 28 by misusing his or her position or information obtained before 1 July, even if the effects of that misuse only become apparent after 1 July. s 27C Disqualification order Will ensure that any existing disqualification orders continue to for contravention of apply after 1 July. Civil Penalty provisions not exist under the PGPA civil penalty Act. provisions ss 27F and 27G Duties of officials – disclosures of interests ss 27F and 27G of the CAC Act only applied to the disclosure of information by Directors. Any standing notices about material personal interests that were given under the CAC Act will be saved after 1 July (i.e. directors do not have to remake pre-1 July standing notices). After 1 July s 29 of the PGPA Act will broaden the duty to disclose interests to all officials. Section 29 will apply to the actions of officials before or after 1 July. A material personal interest arising before 1 July should be disclosed as this could still pose a risk to the Commonwealth entity if it is ongoing. s 27L and Schedule 2 Right of access to an authority’s books Will preserve a director’s access to a Commonwealth authority’s books, for a director that is subject to civil penalty proceedings after 1 July for contraventions that occurred before 1 July. ss 27M and 27N Indemnification and exemption of officer and insurance for certain liabilities of officers Will maintain existing indemnities and contracts of insurance after 1 July, to ensure that these indemnities and contracts do not have to be re-made on 1 July. s 28 Cessation of General Policy Orders All General Policy Orders made under the CAC Act will cease to be in force on 1 July. In addition any notifications made under s28 and preserved by the Commonwealth Authorities and Companies Amendment Act 2008 will also cease to have effect. The PGPA Act provides the opportunity to start afresh in relation to the application of Australian Government policies to corporate Commonwealth entities: after 1 July, a policy can be applied by a government policy order made in accordance with s22 of the PGPA Act. New New Termination of appointment (for the accountable authority or member of an accountable authority) s30 of the PGPA Act will apply to all accountable authority appointments, regardless of when those appointments occur. Corporate plans s35 of the PGPA Act will require all Commonwealth entities who are not already required to prepare corporate plans by existing This will ensure a consistent approach is taken when dealing with breaches of duties and avoids situation in which only some board members would be subject to s30 due to their appointment dates, when a decision is made by the board collectively as the accountable authority. Proposed transitional arrangements for Commonwealth authorities | 3 Section of CAC Act or CAC regulation Subject Proposed transitional arrangement legislation, to prepare their first corporate plan for reporting periods commencing on or after 1 July 2015. This requirement is not commencing until 1 July 2015: as the first complete reporting period that occurs immediately after commencement of ss35 and 95 will be the 2015-16 year and so that rules on corporate planning can be prepared in consultation with stakeholders, including the Parliament and Commonwealth entities and companies, during the second half of 2014. Any requirement in legislation other than the PGPA Act for a Commonwealth entity to prepare a corporate plan (however described) will continue for the 2014-15 financial year. New Annual performance statements ss 39 and 40 of the PGPA Act will require entity’s annual reports to provide an assessment of performance against the matters covered in their corporate plan for reporting periods commencing on or after 1 July 2015 (as for corporate plans). The first performance statements will need to be included in annual reports presented to Parliament in October 2016. This requirement is not commencing until after 1 July 2015: as the corporate plans on which the performance statements will be based will not be available before mid-2015 and to enable consultation with key stakeholders, including the Parliament, on the rules and information required to be met in their preparation. Proposed transitional arrangements for Commonwealth authorities | 4