Chapter_3_Solutions

advertisement

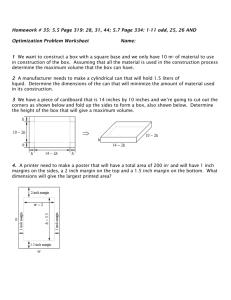

Atkinson, Solutions Manual t/a Management Accounting, 6E Chapter 3 Using Costs in Decision Making QUESTIONS 3-1 Cost information is used in pricing, product planning, budgeting, performance evaluation, and contracting. Examples of specific uses of cost information include deciding whether to introduce a new product or discontinue an existing product (given the price structure), assessing the efficiency of a particular operation, and assessing the cost of serving customer segments. 3-2 Variable costs are costs that increase proportionally with changes in the activity level of some variable. Fixed costs are costs that in the short run do not vary with a specified activity. Fixed costs depend on how much of the resource (capacity) is acquired, rather than on how much is used. 3-3 Contribution margin per unit, which is the difference between revenue per unit and variable cost per unit, is the contribution that each unit makes to covering fixed costs and generating a profit. The contribution margin is therefore an important component of the equation to determine the breakeven point and to understand the effect on profit of proposed changes, such as changes in sales volume in response to changes in advertising or sales prices. 3-4 Contribution margin per unit is the difference between revenue per unit and variable cost per unit. The contribution margin per unit indicates how much the total contribution margin will increase with an additional unit of sales. The contribution margin ratio expresses similar ideas, but as a percentage of sales dollars. Specifically, the contribution margin ratio is the total contribution margin divided by total sales dollars (or contribution margin per unit divided by sales price per unit), and indicates how much the total contribution margin increases with an additional dollar of sales revenue. 3-5 In evaluating whether a business venture will be profitable, the breakeven point is the volume at which the profit equals zero, that is, revenues equal total costs. – 52 – Chapter 3: Using Costs in Decision Making 3-6 A mixed cost is a cost that has a fixed component and a variable component. For example, utilities bills may include a fixed component per month plus a variable component that depends on the amount of energy used. A step variable cost increases in steps as quantity increases. For example, one supervisor may be hired for every 20 factory workers. Mixed costs and step variable costs both have elements of fixed and variable costs. However, mixed costs have distinct fixed and variable components, with fixed costs that are constant over a fairly wide range of activity (for a given time period) and variable costs that vary in proportion to activity. Step variable costs are fixed for a fairly narrow range of activity and increase only when the next step is reached. 3-7 Step variable costs are fixed for a fairly narrow range of activity and increase when the next step is reached. For example, one supervisor may be hired for every 20 factory workers. Fixed costs are costs that in the short run do not vary with a specified activity for a wide range of activity. For example, factory rent per month would likely remain unchanged as production increased or decreased, even if by large amounts. 3-8 Incremental cost is the cost of the next unit of production and is similar to the economist’s notion of marginal cost. In a manufacturing setting, incremental cost is often defined as a constant variable cost of a unit of production. However, in some situations, the variable cost of a unit of production may be more complicated. For example, the variable cost of labor per unit may decrease over time if workers become more efficient (a learning effect. Alternatively, the variable cost of labor per unit will change during overtime hours if workers receive an overtime premium (commonly 50%). Finally, some costs exhibit step-variable behavior, as when one supervisor can supervise a quantity of employees but an additional supervisor is needed beyond a certain number of employees. 3-9 In evaluating the different alternatives from which managers can choose, it is better to focus only on the relevant costs that differ across different alternatives because it does not divert the manager’s attention with irrelevant facts. If some costs remain the same regardless of what alternative is chosen, then those costs are not useful for the manager’s decisions, as they are not affected by the decision. Therefore, it is better to omit them from the cost analysis used to support the decision. Moreover, resources are not expended to find or prepare irrelevant information. 3-10 Sunk costs are costs that are based on a previous commitment and cannot be recovered. For example, depreciation on a building reflects the historical cost – 53 – Atkinson, Solutions Manual t/a Management Accounting, 6E of the building, which is a sunk cost. Therefore, they are not relevant costs for the decision. 3-11 The general principal is that sunk costs are not relevant costs. But, some managers may consider sunk costs to be relevant because they may be concerned about how others will perceive their original decision to incur these costs, and may want to cover up their initial poor judgment. Managers may also feel that they do not want to waste the sunk costs by giving up on the possibility of some benefit from the invested funds, or may continue to believe in potential success despite overwhelming evidence to the contrary. Also, managers may be embarrassed and unwilling to admit they made a mistake. 3-12 No, fixed cost are not always irrelevant. For example, in comparing the status quo and a proposal to substantially increase the quantity of goods or services provided, additional fixed costs (that is, costs not proportional to volume) may be incurred to provide the increased quantity. Such costs might include a large expenditure for more equipment or expanded factory facilities. 3-13 An opportunity cost is the maximum value forgone when a course of action is chosen. 3-14 Yes, avoidable costs are relevant because they can be eliminated when, for example, a part, product, product line, or business segment is discontinued. 3-15 In the context of a make or buy decision, fixed costs such as production engineering staff salaries are relevant if these costs can be eliminated by assigning the staff to other tasks, or by laying off the engineers not required when a part is outsourced. If it is possible to find an alternative use for the facilities made available because of the elimination of a product or a component, the associated fixed costs also are relevant. Conversely, fixed costs that cannot be eliminated or used for other productive purposes are not relevant for the decision. For example, if factory facilities would remain idle if the company buys from outside, then the associated costs are not relevant for the decision. 3-16 There are several qualitative considerations that must be evaluated in a makeor-buy decision. For example, one must question whether the outside supplier has quoted a lower price to obtain the order, and plans to increase the price. Also, the reliability of the supplier in meeting the required quality standards and in making deliveries on time is important. – 54 – Chapter 3: Using Costs in Decision Making 3-17 When a decision to outsource frees up space to produce an alternative product, then the contribution margin on the alternative product is a relevant opportunity cost for the “make” alternative in a make-or-buy decision. 3-18 A difficulty that arises with respect to revenue when analyzing whether to drop a product or department is whether sales by one organizational unit can affect sales in another organizational unit. A difficulty that arises with respect to cost analysis is that many product costs, such as machine and factory depreciation, are the result of sunk costs that often remain in whole or in part after the product is discontinued. The analysis of what costs are avoided when a product is dropped can be difficult due to the closing of plants, severance pay and environmental cleanup costs. 3-19 The answer depends on the time frame and context considered. For example, a one-time order that covers variable production (and selling costs) is advantageous if capacity cannot be changed in the short run and excess capacity exists. Also, for given capacity with one scare resource, maximizing contribution margin per unit of scarce resource will maximize profit. In the long run, prices must cover all their costs, both fixed and variable, in order for the firm to survive. 3-20 No. Products should be ranked by the contribution margin per unit of the constrained resource rather than by the contribution margin per unit of the product. 3-21 Yes. When capacity is fixed in the short run, the firm may need to sacrifice the production of some profitable products to make capacity available for a new order. The contribution margin on the production of profitable products sacrificed for a new order is an opportunity cost that must be considered to evaluate the profitability of the new order. 3-22 The three components of a linear program are the objective function, the decision variables, and the constraints. – 55 – Atkinson, Solutions Manual t/a Management Accounting, 6E EXERCISES 3-23 (a) (b) (c) (d) (e) (f) (g) (h) (i) (j) (k) (l) 3-24 (a) (b) (c) (d) (e) (f) (g) (h) Fixed Variable Variable Fixed Fixed Variable Variable Fixed or variable (if number of production workers can vary in the short run); Fixed Variable Fixed Variable Variable Fixed Fixed or variable (if number of billing clerks can vary in the short run) Fixed Fixed Variable Fixed Fixed (with respect to a unit of product, as stated in the problem. However, gasoline costs will vary with miles driven.) 3-25 Burger ingredients Variable Cooks’ wages Fixed Server’s wages Fixed Janitor’s wages Fixed Depreciation on cooking equipment Fixed Paper supplies (wrapping, napkins, and supplies) Variable Rent Fixed Advertisement in local newspaper Fixed – 56 – Chapter 3: Using Costs in Decision Making 3-26 (a) Contribution margin per unit = $1,000 – $500 – $100 = $400 Contribution margin ratio = (Contribution margin)/Sales = $400/$1,000 = 0.40 (b) Let X = the number of units sold to break even Sales revenue – Costs = Income (Price × Quantity) – Variable costs – Fixed costs = Income $1,000X – $600X – $3,500,000 = $0 $400X – $3,500,000 = 0 X = 8,750 units (c) Because the variable cost per unit will decrease, the contribution margin per unit will increase. The breakeven point equals (fixed costs)/(contribution margin), so the breakeven point will decrease. Specifically, the new contribution margin per unit is $1,000 – $450 – $100 = $450 and the new breakeven point is $3,500,000/$450 = 7,778 units (rounded). 3-27 (a) Let P charges per patient-day. (5,400 P) (5,400 $500) $2,000,000) = 0 5,400 (P $500) = $2,000,000 P $500 = $2,000,000/5,400 = $370.37 P = $870.37 (b) Let X = the average number of patient days per month necessary to generate a target profit of $45,000 per month Revenue – Costs = Income (Price × Quantity) – Variable costs – Fixed costs = Income $2,000X – $500X – $2,000,000 = $45,000 $1,500X = $2,000,000 + $45,000 = $2,045,000 X = 1,363 patient days (rounded) – 57 – Atkinson, Solutions Manual t/a Management Accounting, 6E 3-28 (a) Contribution margin per unit = $30 – $19.50 = $10.50 Contribution margin ratio = (Contribution margin)/Sales = $10.50/$30 = 0.35 (b) Let X = the number of units sold to break even Sales revenue – Costs = Income (Price × Quantity) – Variable costs – Fixed costs = Income $30X – $19.50X – $147,000 = $0 $10.50X – $147,000 = 0 X = 14,000 units (c) Let X = the number of units sold to generate revenue necessary to earn pretax income of 20% of revenue Sales revenue – Costs = Income (Price × Quantity) – Variable costs – Fixed costs = Income $30X – $19.50X – $147,000 = 0.2 × $30X $10.50X – $147,000 = $6X X = 32,667 units (rounded) Desired revenue = $30X = $30 × 32,667 = $980,010 Alternatively, let R = sales revenue necessary to earn pretax income of 20% of revenue Sales revenue – Variable costs – Fixed costs = Income R – 0.65R – $147,000 = 0.2R R = $147,000/0.15 = $980,000 (d) Let X = the number of units sold to generate after-tax profit of $109,200 (Before-tax income) (1 – 0.35) = $109,200 Before-tax income = $109,200/0.65 = $168,000 $30X – $19.50X – $147,000 = $168,000 $10.50X = $315,000 X = $315,000/$10.50 = 30,000 units (e) Let Y = necessary increase in sales units Incremental sales revenue – Incremental variable costs – Incremental fixed costs = $0 $30Y – $19.50Y – $38,500 = $0 Y = 3,667 units (rounded) – 58 – Chapter 3: Using Costs in Decision Making 3-29 (a) Let R = sales dollars necessary for a before-tax target profit of $250,000 The contribution margin ratio = ($1,260,000 – $570,000)/$1,260,000 = 0.547619 (rounded). Sales revenue – Variable costs – Fixed costs = Income Contribution margin – Fixed costs = Income 0.547619 R – $480,500 = $250,000 R = ($250,000 + $480,500)/0.547619 R = $1,333,956.60 (c) Let R = sales dollars necessary to break even Contribution margin – Fixed costs = 0 0.547619 R – $480,500 = $0 R = $480,500/0.547619 R = $877,434.85 3-30 The sales mix in units is 3/5 Domestic and 2/5 International. The Domestic CM = $50 – $30 = $20; the International CM = $40 – $16 = $24 Let X = total number of units that must be sold in the International market to earn $200,000 before taxes, assuming the stated sales mix Total CM – Fixed costs = $200,000 ($20 1.5X) + $24X − $5,000,000 − $1,280,000= $200,000 $54X = $6,480,000 X = $6,480,000/$54 = 120,000 units in the International market 1.5 X = 180,000 units in the Domestic market Equivalently, one can compute a weighted average unit CM: (3/5) × ($20) + (2/5) × ($24) = $21.60 Let Y = total number of units that must be sold to earn $200,000 before taxes, assuming the stated sales mix Total CM – Fixed costs = $200,000 $21.60Y − $5,000,000 − $1,280,000= $200,000 $21.60Y = $6,480,000 Y = 300,000 units, which consists of 3/5 or 180,000 units in the Domestic market and 2/5 or 120,000 units in the International market – 59 – Atkinson, Solutions Manual t/a Management Accounting, 6E 3-31 (a) Units sold Sales mix percentage* Alligators 140,000 .7 Dolphins 60,000 Total 200,000 .3 Weighted average** Weighted average** Sum of weighted averages Sales price per unit $20.00 $14.00 $25.00 $7.50 $21.50 Variable costs per unit $ 8.00 $ 5.60 $10.00 $3.00 $ 8.60 Unit CM $12.00 $ 8.40 $15.00 $4.50 $12.90 * 140,000/(140,000 + 60,000) = .7; 60,000/(140,000 + 60,000) = .3 ** $20 × .7 = $14; $8 × .7 = $5.60; $25 × .3 = $7.50; $10 × .3 = $3 Breakeven units = $1,290,000/$12.90 = 100,000 units. Of these, 100,000 × .7 = 70,000 will be alligators and 100,000 × .3 = 30,000 will be dolphins. (b) Units sold Sales mix percentage* Alligators 60,000 .3 Dolphins 140,000 Total 200,000 .7 Weighted average** Weighted average** Sum of weighted averages Sales price per unit $20.00 $6.00 $25.00 $17.50 $23.50 Variable costs per unit $ 8.00 $2.40 $10.00 $ 7.00 $ 9.40 Unit CM $12.00 $3.60 $15.00 $10.50 $14.10 * 60,000/(140,000 + 60,000) = .3; 140,000/(140,000 + 60,000) = .7 ** $20 × .3 = $6; $8 × .3 = $2.40; $25 × .7 = $17.50; $10 × .7 = $7 – 60 – Chapter 3: Using Costs in Decision Making Breakeven units = $1,290,000/$14.10 = 91,489.36, which we round up to 91,490 units. Of these, 91,490 × .3 = 27,447 will be alligators and 91,490 × .7 = 64,043 will be dolphins. (c) In part (b), the sales mix percentage for the higher-CM product (dolphins) is greater than in part (a). Consequently, fewer total units are required to break even (91,490 in part (b) versus 100,000 in part (a)). 3-32 Product Hamburgers Chicken Sandwiches French fries Total Sales Without Special Promotion $1.09 20,000 $21,800 — Total Sales With Special Promotion $0.69 24,000 $16,560 — 1.29 10,000 $12,900 0.89 20,000 $17,800 1.29 9,200 $11,868 0.89 22,400 $19,936 Difference ($5,240) — (1,032) 2,136 ($4,136) Product Hamburgers Chicken Variable Costs Without Special Promotion $0.51 20,000 $10,200 — Variable Costs With Difference Special Promotion $0.51 24,000 ($2,040) $12,240 — — Sandwiches 0.63 10,000 $6,300 0.63 9,200 $5,796 504 French fries 0.37 20,000 $7,400 0.37 22,400 $8,288 (888) ($2,424) Decrease in sales with special promotion Increase in variable costs with special promotion Decrease in contribution margin with special promotion Incremental advertising expenses with special promotion Decrease in profit with special promotion $4,136 2,424 $6,560 4,500 ($11,060) Therefore, Andrea should not go ahead with this special promotion. A countervailing argument is the creation of new customers who may stay with the firm and generate additional contribution margin in the future. – 61 – Atkinson, Solutions Manual t/a Management Accounting, 6E 3-33 (a) Healthy Hearth has sufficient excess capacity to handle the one-time (short-run) order for 1,000 meals next month. Consequently, the analysis focuses on incremental revenues and costs associated with the order: Incremental revenue per meal Incremental cost per meal Incremental contribution margin per meal Number of meals Increase in contribution margin and operating income $3.50 3.00 $0.50 × 1,000 $ 500 Healthy Hearth will be better off by $500 with this one-time order. Note that total fixed costs remain unchanged, so it is sufficient to evaluate the change in the contribution margin. If the order had been long-term, Healthy Hearth would need to evaluate whether the price provides the desired profitability considering the fixed costs and whether filling the government order might require giving up higher-priced regular sales. (b) Healthy Hearth has insufficient excess capacity to handle the one-time order for 1,000 meals next month, and must give up regular sales of 500 meals at $4.50 each, resulting in an opportunity cost. Incremental contribution margin from one-time order Incremental revenue per meal Incremental cost per meal Incremental contribution margin per meal Number of meals Increase in operating income from one-time order $3.50 3.00 $0.50 1,000 $500 Opportunity cost Lost contribution margin on regular sales: 500 × ($4.50 – $3.00) $(750) Change in contribution margin and operating income $(250) Now, Healthy Hearth will be worse off by $250 with this one-time order. Again, total fixed costs remain unchanged, so it is sufficient to evaluate the change in the contribution margin. 3-34 (a) Relevant costs: • Acquisition cost of Ford Escort • Repairs on the Impala • Annual operating costs on the Ford Escort – 62 – Chapter 3: Using Costs in Decision Making • Annual operating costs on the Impala Irrelevant costs: • (b) Acquisition cost of Impala Don will buy the Ford Escort if he bases the decision only on the available cost information. Year 1: (If Don buys the Ford Escort) Cash savings: Repairs on the Impala Operating cost—Impala $5,400 2,900 8,300 Cash expenditures: Acquisition cost—Ford Escort Operating cost—Ford Escort First Year Savings (c) 5,400 1,800 7,200 $1,100 Additional quantitative considerations: 1. Number of years before car is replaced (decision horizon). 2. Expected resale values of both cars when they will be replaced. 3. Cost of capital (interest rate) to consider the time value of money. (This topic is covered in other courses.) Qualitative consideration: 1. Subjective preference for driving an Impala rather than a Ford Escort. 3-35 Per Unit As Is Rework Sales price $4 $10.00 Rework cost — $5.50* Net after rework $4 $4.50 *55,000 ÷ 10,000 Gilmark should rework the lamps. – 63 – Atkinson, Solutions Manual t/a Management Accounting, 6E 3-36 (a) The original cost of $50,000 and accumulated depreciation of $40,000 are sunk, and therefore irrelevant, when the choice is between overhauling the old machine and replacing it with a new machine. Note that the annual operating costs (before overhaul) of $18,000 are not sunk costs, yet they are irrelevant. (b) Relevant costs include the acquisition cost of the new machine, the cost of overhauling the old machine, current salvage of $4,000 for the old machine (all of which are up-front costs), salvage value at the end of five years for the new and overhauled machines, and the annual operating costs for both the new machine and the overhauled old machine. Net acquisition cost Replacement $66,000a Salvage value at the end of 5 years (500) (200) (300) Operating costs for 5 years Total relevant costs 65,000b $130,500 70,000c $94,800 (5,000) $35,700 (c) a b c Overhauling $25,000 Difference $41,000 $70,000 – $4,000 = $66,000 $13,000 5 = $65,000 $14,000 5 = $70,000 It costs McKinnon Company $35,700 more with the new grinding machine than overhauling the old one. Therefore, the plant manager should overhaul the old grinding machine. However, this analysis is incomplete as it ignores the time value of money, considered in net present value analysis, which is covered in other courses. – 64 – Chapter 3: Using Costs in Decision Making 3-37 Year 1 Year 2 Year 3 Year 4 Year 5 Cash inflow: Sale of old machine Saving because old machine not repaired $40,000 (5,000) 20,000 Salvage value of new machine Decrease in annual operating costs $10,000 20,000 $20,000 $20,000 $20,000 $20,000 (120,000) 0 0 Net cash inflow (outflow) ($40,000) $20,000 $20,000 $20,000 $25,000 Cumulative cash inflow (outflow) ($40,000) ($20,000) $0 $20,000 $45,000 Cash outflow: Purchase of new machines 0 0 Joyce Printers should replace the machines if they expect to use the new machines for more than three years. (A more complete evaluation would use net present value analysis, which is covered in other courses.) 3-38 (a) Insource (Make) Smart phones: $140 50,000 Component: $35.00 50,000 $34.00 50,000 Relevant costs (b) Smart phones: $140 50,000 Component: $30.00 50,000 $34.00 50,000 Relevant costs $7,000,000 Outsource (Buy) $7,000,000 1,750,000 1,700,000 $8,750,000 $8,700,000 Insource (Make) Outsource (Buy) $7,000,000 $7,000,000 1,500,000 1,700,000 $8,500,000 – 65 – $8,700,000 Atkinson, Solutions Manual t/a Management Accounting, 6E 3-39 (a) Assumptions need to be made about the avoidability of the fixed overhead costs if Kane outsources the component. (b) If the variable costs (direct materials, direct labor, and variable overhead) are all avoidable, then Kane will certainly reduce costs by outsourcing the component. Fixed overhead costs may be unavoidable if the facility cannot be converted to alternative uses when the component is outsourced. However, even if the fixed overhead costs are unavoidable, Kane would reduce costs by outsourcing. In this case, the cost savings per unit if the component is outsourced would be: Purchase price (c) 3-40 $64.50 Avoidable costs ($73.10 – $6.90) 66.20 Savings per unit $1.70 Other factors relevant to the decision are the supplier’s ability to live up to expected quality and delivery standards, and the likelihood of suppliers increasing prices of components in the near future. Premier should make the gear model G37 because it costs $87,000 less to make than to buy. (Fixed overhead is irrelevant and may be dropped from the analysis.) Make Cost of purchase: $120 20,000 = Direct material cost: $55 20,000 = Buy $2,400,000 $1,100,000 Direct labor cost: $30 20,000 = 600,000 — Variable overhead: $25 20,000 = 500,000 — Fixed overhead $15 20,000 = 300,000 300,000 — (113,000) $2,500,000 $2,587,000 Savings in facility-sustaining costs Relevant costs – 66 – Chapter 3: Using Costs in Decision Making 3-41 (a) The offer by Superior Compressor should not be accepted if fixed overhead costs are unavoidable. Cost per unit Cost of purchase Make Variable cost: Direct material Direct labor Variable overhead $ 80 60 56 Relevant cost per unit $196 Buy $200 $200 (b) The maximum acceptable purchase price is $213 per unit if the plant facilities are fully utilized at present and the incremental cost of adding more capacity is approximated well by the $17 per unit fixed overhead cost. 3-42 (a) The billiards segment currently produces a segment margin of $40,000 − $25,000 = $15,000, so the bar’s segment margin would have to increase by at least that amount in order for the grill’s income to be at least as high as it is now. George should consider the effect on the other two segments’ revenues if he drops the billiards segment. It may be that the availability of billiards attracts customers to the bar and restaurant segments. Traditional segment margin analysis as in part (a) does not capture such interactive effects. 3-43 In order to accept the new order for 1,500 modules next week, McGee must give up regular sales of 500 modules per week. (b) Variable costs are $800 per module ($2,400,000/3,000 modules). The contribution margin per unit on regular sales is $900 – $800 = $100 per module. Therefore, the opportunity cost (lost CM) of accepting the new order is 500($100) = $50,000, and McGee will be indifferent between filling the special order and not filling the special order when the contribution margins of the two alternatives are equal (fixed costs will remain unchanged). That is, McGee will be indifferent at a price P where 1,500(P – $800) = $50,000, or P = $833.33. This is the floor price that McGee should charge for the new order. – 67 – Atkinson, Solutions Manual t/a Management Accounting, 6E 3-44 This order will require 500 = 5 × (10,000 ÷ 100) machine hours. Since there is excess capacity of 800 = 4,000 × (100% − 80%) machine hours per month, Shorewood Shoes Company can accept this order without expanding its capacity. Therefore, Shorewood should charge at least as much as the incremental variable costs for this order. Direct material Direct labor Variable manufacturing overhead Additional cost of embossing the private label Minimum price to be charged for this order $6.00 4.00 2.00 0.50 $12.50 Shorewood’s costs stated in the problem are average costs per pair of shoes. Shorewood should determine whether the costs are reasonably accurate for the discount store’s order. Shorewood should also consider how its regular customers might react to the lower price offered to the discount store. 3-45 Incremental variable costs = ($16 + $5 + $3) × 10,000 = $24 × 10,000 = $240,000. Incremental revenue = $40 × 10,000 = $400,000. Berry’s operating income will increase by $160,000 if it accepts this offer. 3-46 (a) Variable cost per unit = $198,000 ÷ 36,000 = $5.50. Sales (30,000 units × $10 and 30,000 units × $9) $570,000 Variable manufacturing and selling costs (60,000 units × $5.50) (330,000) Contribution margin $240,000 Fixed costs (99,000) Operating income $141,000 If Ritter accepts the export order, its operating income will increase by $78,000 = $141,000 − $63,000. Although Ritter’s operating income will increase with the special order, Ritter must consider the long-run effect of displeasing its regular domestic customers by not fulfilling their demand. – 68 – Chapter 3: Using Costs in Decision Making (b) Sales (36,000 units × $10 and 30,000 units × $9) Variable manufacturing and selling costs (66,000 units × $5.50) Contribution margin Fixed costs: $99,000 $25,000 Operating income $630,000 (363,000) $267,000 124,000 $143,000 If Ritter operates the extra shift and accepts the export order, operating income will increase by $80,000. Ritter should consider whether the same quality will be achieved with new operators or existing operators working overtime (with possible fatigue). In addition, Ritter should understand whether the additional fixed costs will be incurred on a continuing basis or are avoidable when production drops back to its previous level. Finally, Ritter should also consider the effect of this price reduction on regular customers. 3-47 (a) Superstore faces a problem of maximizing contribution margin per unit of scarce resource. Here, the scarce resource is shelf space. Superstore requires at least 24 square feet for each category. The store manager should assign additional available space to the category with the highest contribution margin per square foot, i.e., ice cream. After assigning a total of 100 square feet to ice cream, there is sufficient available shelf space to assign a total of 100 square feet to frozen dinners and 26 square feet to juices. The frozen vegetable receives the minimum required assignment of 24 square feet. Ice Cream Juices Frozen Dinners Frozen Vegetables Selling price per unit (square-foot package) $12.00 $13.00 $24.00 $9.00 Variable costs per unit (square-foot package) $8.00 $10.00 $20.50 $7.00 Unit CM (square-foot package) $4.00 $3.00 $3.50 $2.00 Minimum required 24 24 24 24 Maximum allowed 100 100 100 100 Allocation to maximize total CM 100 26 100 24 – 69 – Atkinson, Solutions Manual t/a Management Accounting, 6E (b) In setting the minimum required and maximum allowed square footage per category, the manager might consider seasonality (for example, permitting more ice cream space during the summer or more frozen vegetable space during the winter) and the effect on contribution margins of variability in costs and prices. The analysis does not take into account the rate at which products are sold within each category. The analysis should also consider the effect of the mix on other product sales. If the store offers only a limited selection of frozen vegetables, for example, shoppers may switch to another store for their regular grocery shopping. Regular 3-48 Sale price per sq. yard Deluxe $16 $25 Variable costs per sq. yard 10 15 Contribution margin per sq. yard $6 $10 0.15 0.20 DLH required per sq. yard $40a Contribution margin per DLH a b $50b $6 ÷ 0.15 = $40 $10 ÷ 0.20 = $50 Because deluxe grade has a higher contribution margin per unit of scarce resource (DLH) than regular grade, and no more than 8,000 square yards of deluxe grade can be produced, Boyd Wood Company should produce the maximum of 8,000 square yards of deluxe grade first and then use the remaining available capacity of 3,000 DLH (= 4,600 − [8,000 × 0.20]) to produce regular grade. Therefore, the optimal production level for each product is: Deluxe: 8,000 sq. yards Regular: 20,000 sq. yards (= 3,000 ÷ 0.15). – 70 – Chapter 3: Using Costs in Decision Making PROBLEMS 3-49 The following items are variable costs: Carpenter labor to make shelves Wood to make the shelves Sales commissions based on number of units sold Miscellaneous variable manufacturing overhead Total variable costs $600,000 450,000 180,000 350,000 $1,580,000 The variable costs per unit are $1,580,000/50,000 = $31.60. The following items are fixed costs: Sales staff salaries Office and showroom rental expenses Depreciation on carpentry equipment Advertising Miscellaneous fixed manufacturing overhead Rent for the building where the shelves are made Depreciation for office equipment Total fixed costs $80,000 150,000 50,000 200,000 150,000 300,000 10,000 $940,000 Let X = the number of units sold to earn a pre-tax profit of $500,000 Revenue – Costs = Income (Price × Quantity) – Variable costs – Fixed costs = Income $70X – $31.60X – $940,000 = $500,000 X = 37,500 units 3-50 (a) Selling price per unit: $105.00 Variable cost per unit: Direct material Direct labor Variable overhead Commission $30.00 20.00 10.00 10.50 Contribution margin per unit: 70.50 $34.50 – 71 – Atkinson, Solutions Manual t/a Management Accounting, 6E Incremental profit: Increase in contribution margin from new sales Decrease in contribution margin from cannibalization Increase in fixed costs Increase in profits if the new model is introduced (b) $34.50 120,000 $4,140,000 $20 (300,000 – 240,000) (1,200,000) (2,000,000) $940,000 Yes. Introducing the new product will increase profits by $940,000. 3-51 (a) The number of miles driven is an important activity measure in estimating the cost of driving. In comparing the cost of driving to work or taking public transportation, Shannon may also want to consider the cost of parking at work. The cost of parking may vary with the number of days at work or may be a flat rate per month. (b) Incremental costs of driving include gas, oil, maintenance, and tire expenditures. Costs associated with driving also include toll costs and parking fees. (c) Fixed costs include taxes, depreciation of the vehicle, car registration, license fees, and insurance. (d) For a two-week vacation by car, two likely activity measures are number of miles driven and number of days (for lodging and meals). 3-52 (a) Costs that vary with number of passengers: Meals and refreshments = $5 Let X number of passengers needed to break even each week Total revenue per week – costs per passenger per week – costs per flight per week – fixed costs per week = profit per week ($200 X 70) – ($5 X 70) – ($5,000 70) – $400,000 = $0 $13,650X = $750,000 X $750,000 ÷ $13,650 = 54.95 (i.e., 55 passengers per flight) – 72 – Chapter 3: Using Costs in Decision Making (b) Let N number of flights to earn a profit of $500,000 per week Number of passengers per flight = 60% 150 = 90 ($200 90 N) – ($5 90 N) – ($5,000 N) – $400,000 = $500,000 N 71.71 (i.e., 72 flights) (c) Fuel costs are fixed once the flights are scheduled, but these costs vary with the number of flights. (d) In this case, there is no opportunity cost to the airline because the seat would otherwise go empty. The variable cost for the additional passenger is $5 for the meals and refreshments and perhaps a small amount of additional fuel cost. 3-53 (a) Johnson Co. breakeven point in number of rides = (Fixed costs)/(Unit contribution margin) = $300,000/$6 = 50,000 rides Smith Co. breakeven point in number of rides = (Fixed costs)/(Unit contribution margin) = $1,500,000/$15 = 100,000 rides (b) Let x be the number of rides. Johnson Co.’s profit function is: $30x – $24x – $300,000 = $6x – $300,000 Smith Co.’s profit function is: $30x – $15x – $1,500,000 = $15x – $1,500,000 Profit-Volume Chart Profit S J $0 ($300,000) Loss ($1,500,000) (c) 50,000 100,000 133,333 Number of rides We cannot say which firm’s cost structure is more profitable as profits depend on sales volume. If sales drop to below 133,333 rides, Johnson Company’s cost structure leads to more profits. However, if sales remain – 73 – Atkinson, Solutions Manual t/a Management Accounting, 6E above 133,334 rides, then Smith Company’s cost structure leads to more profits. (d) 3-54 (a) The contribution margin generated must first cover the fixed costs and then the balance remaining after the fixed costs are fully covered goes toward profits. If the contribution margin is not sufficient to cover the fixed costs, then a loss occurs for the period. Once the breakeven point has been reached, profit will increase by the unit contribution margin for each additional unit sold. Here, Smith Company is more risky because it has higher fixed costs to cover and a higher unit contribution margin, which makes its profits more sensitive to decreases in the sales activity level. Contribution margin per unit: Selling price $250 Less variable costs: Variable production costs $100 Variable selling and distribution costs 20 Contribution margin per unit (b) $130 Let X the sales volume at which the profit on sales is 10% Profit = 250X 120 X 200,000 62,500 01 . 250 X 130 X 262,500 25 X 105 X 262,500 X 2,500 units. (c) (1) Single-shift operations 0 X 4,400 : Selling price Variable costs Contribution margin per unit $200 120 $80 Fixed costs = $200,000 + $62,500 + $17,500 = $280,000 Breakeven point = $280,000 ÷ $80 = 3,500 units note: 0 3,500 4,400 – 74 – 120 Chapter 3: Using Costs in Decision Making Two-shift operations 4,400 X 8,800 : (2) Selling price Variable costs Contribution margin per unit $200 120 $80 Fixed costs = $310,000 + $62,500 + $17,500 = $390,000 Breakeven point = $390,000 ÷ $80 = 4,875 units note : 4,400 4,875 8,800 (d) Profit to sales ratio in September: 130 3, 000 262 , 500 250 3, 000 390, 000 262 , 500 750, 000 0.17 (1) Single-shift operations 0 X 4,400 200 X 120 X 280,000 017 . 200 X 80 X 280,000 34 X 46 X 280,000 X 6,087 units (Not acceptable because X cannot be more than 4,400 units with single-shift operations) (2) Two-shift operations 4,400 X 8,800 200 X 120 X 390,000 017 . 200 X 80 X 390,000 34 X 46 X 390,000 X 8,478 units note : 4,400 8,478 8,800 – 75 – Atkinson, Solutions Manual t/a Management Accounting, 6E 3-55 Total labor cost Total materials cost Total variable manufacturing overhead cost Total lease payments Total SG&A expenses Total costs $114,800 * 153,600 ** 41,280 *** 36,000 20,000 $365,680 * Labor cost Total labor hours required: 60 × 800 × 0.05 60 4 30 1, 600 0.05 30 4 2,400 240 2,400 120 5,160 Labor hours available Overtime hours required Regular wages (= $20 4,000) Overtime wages (= $30 1,160) Total labor cost 4,000 1,160 $ 80,000 34,800 $114,800 ** Materials cost $1.60 60 800 = $76,800 $1.60 30 1,600 = 76,800 $153,600 *** Variable manufacturing overhead cost $8 5,160 labor hours 3-56 (a) $41,280 This is a special order where the company has sufficient excess capacity to fill the order. Incremental revenue 8,000 $22 Incremental VC 8,000 ($5 + 4+1) Incremental CM 8,000 ($22 10) $176,000 80,000 $96,000 Because fixed costs are unchanged, the $96,000 incremental CM is the increase in income if the company accepts the special order. – 76 – Chapter 3: Using Costs in Decision Making (b) This is a special order where the company has insufficient excess capacity to fill the order, and therefore faces an opportunity cost if it fills the order. Incremental CM from (a) Opportunity cost from lost sales* Net increase in CM 8,000 ($22 10) 5,000 ($25 (5 + 4)) $96,000 80,000 $16,000 *The opportunity cost is the net benefit from the foregone CM on 5,000 boxes of regular sales. Because fixed costs are unchanged, the $16,000 net increase in CM is the increase in income if the company accepts the special order. 3-57 (a) (b) Variable costs per chip = $720,000/1,600 = $450 per chip Profit = ($500 − $450) × 2,000 − $75,000 = $25,000 Fixed costs per chip = $75,000/2,000 = $37.50 per chip Variable cost per chip Fixed cost per chip Reported cost per unit $450.00 37.50 $487.50 There is currently enough surplus capacity to produce the 200 units per week for the new order. The estimated increase in the company’s profit if it accepts the order is ($480 − $450) × 200 = $6,000 per week. (c) Because there is not enough surplus capacity to produce the 600 units per week for the new order, the company faces an opportunity cost if it accepts the order. The company has surplus capacity of 2,000 – 1600 = 400 chips per week. If the company accepts the order, it will have to give up 200 chips per week of regular sales, at $500 revenue per chip. The company will gain ($480 – $450) 600 = $18,000 per week from the special order, but that gain will be offset by lost contribution margin from regular sales, ($500 – $450) 200 = $10,000, for a net gain of $8,000 per week. – 77 – Atkinson, Solutions Manual t/a Management Accounting, 6E 3-58 (a) (b) Acquisition cost and depreciation expense for the existing elevator system are irrelevant. Relevant cost Existing System New System Acquisition cost — $875,000 Salvage value of existing system at present — (100,000) Operating costs for 6 years $900,000 Salvage value after 6 years (25,000) 48,000 (100,000) $875,000 $723,000 The decision to replace the existing elevator system with the new one will require net present value analysis that considers the time value of money. Without considering the time value of money, the new system is less costly. 3-59 (a) Selling price per unit $4.00 Variable cost per unit 3.30 Contribution margin per unit Number of units $0.70 50,000 Increase in operating income $35,000 Genis Battery Company should accept the special order because it is operating under capacity and this order can generate $35,000 in additional operating income. (b) Average unit costs can be misleading. Fixed costs are not relevant to this decision—the decision should be based on incremental costs. (c) Other customers may also demand a reduced price. Therefore, their reaction to the reduced price for the special order must also be taken into account. – 78 – Chapter 3: Using Costs in Decision Making 3-60 (a) Net cost saving over 4 years with new machine Cash inflow: Salvage value difference Decrease in annual operating costs (4 years $60,000) Reduction in rework cost $ 2,000 240,000 10,000a Cash outflow: Acquisition of new machine ($360,000 – $100,000) (260,000) Net cash inflow (outflow): ($ 8,000) a 0.05 (100,000 4) $1 = – 0.025 (100,000 4) $1 = Reduction in rework $20,000 –$10,000 $10,000 Syd Young should not replace the old machine due to net cash outflow of ($8,000). (b) The acquisition cost of the old machine is a sunk cost. (c) Other considerations: 1. Will sales increase because of lower defects with the new machine 2. What is the cost of capital used to discount future cash flows? In this case, discounting will only make the new machine appear worse. (This topic is covered in other courses.) 3-61 (a) Because the distinctive desserts are a source of competitive advantage, Beau should carefully consider the quality, freshness, and distinctiveness of the desserts from the outside providers, as well as the providers’ reliability in delivering the desserts. Beau will want to consider the possibility of price increases from an outside bakery. For the in-house option, Beau may have concerns about his ability to hire a suitable replacement pastry chef. If Beau hires a new pastry chef, the chef may be more responsive than the outside bakers to Beau’s customers’ tastes. Also, there would be no concern about delivery to Beau’s Bistro. (b) This question is designed to generate discussion about the trade-offs among the options. Although the second bid is lower-cost than the first, the first bid promises continual developments of gourmet desserts; the second bid promises only traditional desserts. In-house pastry production is the highest-cost option. The ultimate decision should take into account not only the costs of the different options, but also the issues in part (a) – 79 – Atkinson, Solutions Manual t/a Management Accounting, 6E and the anticipated effect on demand and revenue (for pastry and for Beau’s Bistro) under each option. 3-62 (a) The costs and benefit shown below are relevant for the outsourcing decision. All but the –$20,000 sale of office equipment are annual costs. Costs Labor Rent Phone Other overhead Office equipment Outside call center In-house Outside Call Center Call Center $650,000 60,000 35,000 42,000 ($20,000) 700,000 $787,000 $680,000 (b) Hollenberry must consider the outside call center’s reliability and quality of service in responding to Hollenberry’s customers. Given Hollenberry’s worldwide operations, the greater number of multilingual operators available at the outside call center could be an important feature. Finally, Hollenberry must factor in the prospect of laying off employees, many of whom have worked at Hollenberry for over 20 years. (c) If the outside call center can meet Hollenberry’s expectations for reliability and quality, including better service for international customers, financial considerations point toward Hollenberry outsourcing the call center function. However, although the outsourcing decision seems financially sound, there is great potential for decreasing the remaining employees’ morale because of the layoffs. This question is designed to generate discussion about trade-offs among the company’s stakeholders, including employees. One alternative to firing Hollenberry’s call center employees is reassigning the employees to other jobs and relying on attrition to eventually reduce employee costs to Hollenberry’s desired level. However, this would increase the cost of the outsourcing option and reduce its financial benefits. – 80 – Chapter 3: Using Costs in Decision Making 3-63 (a) Impact of dropping JT484 on operating income: Reduction in contribution margin $100,000 Cost savings: Utilities Supervision Maintenance Administrative (9,000) (30,000) (7,000) (30,000) Decrease in operating income $24,000 Therefore, JT484 should not be eliminated. (b) No, the decision to retain JT484 will only be reinforced by the sales manager’s comments. 3-64 Some examples of articles that describe dropping unprofitable products appear below. The article by Hymowitz provides interesting background for the article in The Economist on Sony’s unprofitable products. These articles describe the need for a turnaround at Sony. The article in The Economist states, “Almost every product line is unprofitable.” Important issues include strong competition, “vanity projects that lacked a market,” and cost cutting through layoffs and factory closings. The article by Ball lays a foundation for activitybased costing through its discussion of high costs and unprofitable products due in part to excessive proliferation of variations of products. Hymowitz, C. “More American Chiefs Are Taking Top Posts At Overseas Concerns.” The Wall Street Journal, October 17, 2005, page B1. “Game on: Sir Howard Stringer believes he is finally in a position to fix Sony.” The Economist, March 5, 2009. http://www.economist.com/node/13234173, accessed December 12, 2010. Ball, D. “Crunch Time: After Buying Binge, Nestlé Goes on a Diet; Departing CEO Slashes Slow Sellers, Brands; ‘No’ to Low-Carb Rolo.” The Wall Street Journal, July 23, 2007, page A1. Wingfield, N. “Amazon to Cut Product Offerings, Plans to Drop Unprofitable Items.” The Wall Street Journal, February 2, 2001, page B6. Kardos, D. and M. Andrejczak. “Earnings Digest -- Food: Heinz Net Rises as Sales Offset Costs.” The Wall Street Journal, November 30, 2007, page C11. – 81 – Atkinson, Solutions Manual t/a Management Accounting, 6E 3-65 (a) XLl $10.00 XL2 $14.00 XL3 $12.00 Direct materials (4.00) (4.50) (5.00) Direct labor (2.00) (3.00) (2.50) Variable overhead (2.00) (3.00) (2.50) Unit contribution margin $2.00 $3.50 $2.00 0.20 0.35 0.25 $10.00 $10.00 $8.00 Sales price Machine hours per unit Contribution margin per machine hour Products XLl and XL2 should be produced first because they have a higher contribution margin per machine hour. Maximum production of these two products requires 110,000 machine hours: XL1: 200,000 units 0.20 machine hours 40,000 machine hours XL2: 200,000 units 0.35 machine hours 70,000 machine hours 110,000 machine hours Therefore, a balance of 10,000 120,000 – 110,000 machine hours are available for XL3 production, which is sufficient for 40,000 units of XL3 (10,000 machine hours ÷ 0.25 machine hours). Optimal Production Levels: XL1: 200,000 units; XL2: 200,000 units, XL3: 40,000 units (b) Under the current capacity constraint, Excel Corporation cannot meet all of XL3’s demand. If additional capacity becomes available, it can produce more units of XL3. To determine whether it is worthwhile operating overtime, Excel needs to analyze the contribution margin of XL3 when operating overtime. – 82 – Chapter 3: Using Costs in Decision Making XL3 $12.00 Sales price Direct materials $5.00 Direct labor 3.75* Variable overhead 2.50 11.25 Unit contribution margin $0.75 * 3.75 2.50 150% Because the unit contribution margin of XL3 using overtime is positive, it is worthwhile operating overtime. 3-66 (a) HCD2 requires $100 ÷ $20 = 5 direct labor hours per unit. The new order requires 1,000 = 200 × 5 direct labor hours, so the existing capacity is adequate. The contribution margin per unit of HCD2 for the new order = $400 − (75 + 100 + 125) = $100. The increase in profit is $20,000 = 200 units × $100 contribution margin. (b) HCD1 $400 Sales price HCD2 $500 Variable cost: Direct material Direct labor Variable overhead Contribution margin per unit DLH per unit Contribution margin per DLH $60 $75 80 100 100 240 125 300 $160 $200 4 5 $40 per DLH $40 per DLH The new order requires a total of 1,500 5 300 DLH, but only 1,000 15,000 – 14,000 DLH are available. This will leave a capacity shortage of 500 1,500 – 1,000 DLH. The contribution margin per DLH is $40 for each product, so the company can forego sales of either product with the same effect. Therefore, the change in profit is – 83 – Atkinson, Solutions Manual t/a Management Accounting, 6E Total contribution margin – opportunity cost = (300 units $100 contribution margin per unit) – (500 DLH $40 contribution margin per DLH) = $30,000 – $20,000 = $10,000 increase. (c) If the plant is worked overtime to manufacture HCD2 for the new order, the contribution margin is negative $12.50 as shown below: Unit Variable Cost for Overtime 1 75 $75.00 Material Labora 1.5 100 150.00 Variable overhead 1.5 125 187.50 Total variable cost $412.50 Sales price 400.00 Contribution margin a $(12.50) or 5 hours $30 per hour Change in Profit 200 100 100 (12.50) Increase 3-67 (a) During $20,000 Regular hours (1,250) Overtime hours $18,750 In order to produce 13,000 standard doors and 5,000 deluxe doors, the following number of direct labor hours and machine hours are required: Cutting: Direct labor hours: 0.5 13,000 1 5,000 11,500 > 8,000 capacity Machine hours: 2 13,000 3 5,000 41,000 > 40,000 capacity Assembly: Direct labor hours: 1 13,000 1.5 5,000 20,500 > 17,500 capacity Machine hours: 2 13,000 3 5,000 41,000 > 40,000 capacity – 84 – Chapter 3: Using Costs in Decision Making Finishing: Direct labor hours: 0.5 13,000 0.5 5,000 9,000 > 8,000 capacity Machine hours: 1 13,000 1.5 5,000 20,500 > 15,000 capacity The direct labor hour capacity in each department and the machine hour capacity in each department are not adequate to meet the next month’s demand. (b) Linear programming can be used to solve this problem. The product contribution margins needed for the objective function are: Standard $150 Deluxe $200 Variable cost per unit 110 155 Contribution margin per unit $40 $45 Sales price per unit Let S denote the number of standard doors to produce and D denote the number of deluxe doors to produce. The linear programming problem is: Maximize $40S + $45D Subject to the following constraints: Cutting: Direct labor hours: 0.5S D ≤ 8,000 Machine hours: 2S 3D ≤ 40,000 Assembly: Direct labor hours: S 1.5D ≤ 17,500 Machine hours: 2S 3D ≤ 40,000 Finishing: Direct labor hours: 0.5S 0.5D ≤ 8,000 Machine hours: S 1.5D ≤ 15,000 Maximum demand: S ≤ 13,000 D ≤ 5,000 Nonnegativity: S > 0, D > 0 – 85 – Atkinson, Solutions Manual t/a Management Accounting, 6E Using the “Solver” function in Excel to solve the linear programming problem, the optimal solution is to produce 13,000 standard doors and 1,333 (rounded down) deluxe doors. Though not required, the contribution margin with this solution is $579,985. (c) The contribution margin for standard doors remains the same, but the contribution margin for deluxe doors is now $50: Deluxe Sales price per unit $200 Variable cost per unit ($80 + $56 + $14) 150 Contribution margin per unit $50 The linear programming problem is now: Maximize $40S + $50D Subject to the following constraints: Cutting: Direct labor hours: 0.5S 0.8D ≤ 8,000 Machine hours: 2S 3D ≤ 40,000 Assembly: Direct labor hours: S 1.5D ≤ 17,500 Machine hours: 2S 3D ≤ 40,000 Finishing: Direct labor hours: 0.5S 0.5D ≤ 8,000 Machine hours: S 1.2D ≤ 15,000 Maximum demand: S ≤ 13,000 D ≤ 5,000 Nonnegativity: S > 0, D > 0 Using the “Solver” function in Excel to solve the linear programming problem, the optimal solution is to produce 12,000 standard doors and 2,500 deluxe doors. Though not required, the contribution margin with this solution is $605,000, as compared to $579,985 in part (b). The slight increase in efficiency with respect to deluxe door production has – 86 – Chapter 3: Using Costs in Decision Making increased the number of deluxe doors in the optimal product mix and increased the total contribution margin. (d) 3-68 (a) The following alternatives may be considered: 1. Add more machines in the finishing department. 2. Use overtime or add a second shift in the cutting department. To maximize monthly commissions while working 160 hours per month, Spencer should devote the maximum allowable time (90 hours) to customer group B because that group provides the largest average commission per hour of Spencer’s time. Spencer should next allocate the maximum of 60 hours to customer group A because that group provides the next largest average commission per hour. Finally, Spencer should devote the remaining 10 hours of his 160 hours to group C. Customer Group A B C Average monthly sales per customer Commission 6% 5% 4% $54 $30 $8 3 1.5 0.5 $18 $20 $16 Current hours 60 90 60 Hours per month 60 90 10 Total: 160 hours (40 hours per week) Average commission Hours per customer per monthly visit Average commission per hour (b) $900 $600 $200 Spencer should also consider the probable future increased profitability from customers in group C, as well as likely future profitability of customers in the other groups. – 87 – Atkinson, Solutions Manual t/a Management Accounting, 6E CASES 3-69 Wage rate = $3,600 ÷ 150 hours = $24/hour. Neighboring laboratory charges $80 ÷ 2 hours = $40/hour, which also equals $100 ÷ 2.5 and $160 ÷ 4. (a) Month June July August Simple Routine 800 600 750 Simple Nonroutine Complex 250 450 200 400 225 450 Total Hours 4,025.0 3,300.0 3,862.5 Equivalent Workers 26.83 22.00 25.75 Workers In-house Hours Short Outside Outside Total Hired Wages* June July August Hours Charges Cost 20 $216,000 1,025 300 862.5 2,187.5 $87,500 $303,500 21 226,800 875 150 712.5 1,737.5 69,500 296,300 22 237,600 725 0 562.5 1,287.5 51,500 289,100 23 248,400 575 0 412.5 987.5 39,500 287,900 24 259,200 425 0 262.5 687.5 27,500 286,700 25 270,000 275 0 112.5 387.5 15,500 285,500 26 280,800 125 0 0.0 125.0 5,000 285,800 27 291,600 0 0 0.0 0.0 0 291,600 *$3,600 per month × 3 months = $10,800 for one worker for a quarter. In-house wages equal $10,800 times the number of workers hired. Dr. Barker should employ 25 workers at a total cost of $285,500. (b) Outside charges will exceed the monthly wages of an additional worker hired by Barrington if the number of outside hours exceeds $3,600 ÷ $40 = 90. Therefore, Barrington should hire an additional employee when the outside services are expected to exceed 90 hours in any month, which corresponds to 90 ÷ 150 = 0.6 equivalent workers. Month June July August Simple Simple Routine Nonroutine Complex 800 250 450 600 200 400 750 225 450 Total Hours 4,025.0 3,300.0 3,862.5 Equivalent Workers 26.83 22.00 25.75 Therefore, Barrington should hire 27 workers in June, 22 in July, and 26 in August. – 88 – Chapter 3: Using Costs in Decision Making Month June July August Total cost Workers Hired 27 22 26 Fixed Outside Cost Hours $97,200 0 79,200 0 93,600 0 Outside Charges 0 0 0 Total Cost $97,200 79,200 93,600 $270,000 3-70 (Numbers in square brackets below refer to reference numbers that appear at the end of the solution for this case.) (a) An organization’s value proposition defines what the organization tries to deliver to its customers. As described in Chapter 2, the value proposition is the unique mix of product performance, price, quality, availability, ease of purchase, service, relationship, and image that a company offers its targeted group of customers. The value proposition represents the “advantage” of a company’s strategy; it should communicate what it intends to deliver to its customers better or differently from competitors. Nordstrom is an upscale retailer, often included among lists of luxury retailers. Nordstrom’s value proposition can be described as “quality, value, selection, and service” (http://about.nordstrom.com/aboutus/?origin=hp=leftnav, December 3, 2002) or “superior service and high quality, distinctive merchandise” (http://about.nordstrom.com/aboutus/investor.asp?origin=footer, April 7, 2003). Nordstrom’s sales force is legendary for its customer service. As mentioned below in part (c), sales staff kept handwritten notes about customers’ sizes and designer preferences, as well as special occasions, in loose-leaf binders [2]. Sales staff would then match the information with new merchandise arrivals and store promotions. Saks Fifth Avenue is a luxury retailer that can be described much like Neiman-Marcus is described in Chapter 2. Both stores target fashionconscious customers with high disposable incomes who are willing to pay more for high-end merchandise. Fred Wilson, former Saks Fifth Avenue divisional CEO, viewed Neiman Marcus as Saks’ closest competitor [4]. Saks Fifth Avenue offers a wide assortment of distinctive luxury fashion apparel, shoes, accessories, jewelry, cosmetics and gifts (10-K Report, Saks Fifth Avenue, Fiscal year ending February 3, 2000). Saks Fifth Avenue’s web site states: “Saks Fifth Avenue today is – 89 – Atkinson, Solutions Manual t/a Management Accounting, 6E renowned for its superlative selling services and merchandise offerings. The best of European and American designers for men and women are sold throughout its 47 stores servicing customers in 23 states.” (http://www.saksfifthavenue.com/html/aboutus/saks_history.jsp?bmUID =iSXpdBi). (b) Nordstrom centralized purchasing in an attempt to leverage its buying power. Previously, Nordstrom’s buying transpired through more than 12 offices [6]. Nordstrom negotiated with suppliers to reduce markups on merchandise [7]. These measures should reduce Nordstrom’s costs without adversely affecting the company’s ability to fulfill its value proposition. Nordstrom also laid off 2,500 employees between September 1 and October 19, 2001. Mindful of the importance of its sales staff, Nordstrom’s layoffs focused on “back-office employees” [7]. Retaining most of the sales staff would help Nordstrom continue to fulfill its value proposition. Nevertheless, a retail analyst noted that Nordstrom needed to dramatically cut costs, pointing out that Nordstrom’s annual selling, general, and administrative expenses of approximately $100 per square foot overshadowed the $60 industry average [2]. (c) Nordstrom invested in computerized inventory-tracking systems [5, 6]. The previous system relied partly on sales staff’s handwritten notes in loose-leaf binders [2]. In addition to inventory management, new technology was introduced to improve customer service: Nordstrom’s salespeople are getting ready to throw out their little black books. Instead of filling pages with handscrawled notes about customers’ sizes and designer preferences, 20,000 sales clerks at the Seattle chain’s 137 stores soon will be using new software and mobile devices to track their customers’ tastes and match them to new merchandise arrivals and store promotions. For Nordstrom, what makes sense is getting customer information to retail sales personnel in real time, whether those customers are conducting business on the Web, in the store or over the telephone [3]. – 90 – Chapter 3: Using Costs in Decision Making Sales staff could also contact customers as soon as a desired item arrived in the store and better serve repeat customers with readily available information on sizes and preferences [3]. Nordstrom’s 2001 Annual Report (p. 4) reports that implementation of the perpetual inventory system is “going very well,” with the expectation that the system will help buyers improve decision-making, manage inventory, and respond quickly to trends. The 2001 Annual Report covers the fiscal year from February 2001 to January 2002. (d) Nordstrom’s efforts affected the classic cost-volume-profit elements of sales prices, product costs, product mix, and selling, general, and administrative expenses. The objective was to increase net income. In an effort to move excess inventory, Nordstrom ran a clearance sale, unusual for the company [7]. Nordstrom also altered its product mix by expanding its offerings of lower-priced merchandise. Nordstrom’s efforts to decrease selling, general, and administrative expenses are described in part (b). Net sales increased about 7% in 2000 (comparing fiscal years ending January 2000 and January 2001) due to new store openings; comparable store sales were flat (Nordstrom 2001 Annual Report, p. 9). Operating income decreased 50% and gross profit as a percent of sales decreased. In 2001 (comparing fiscal years ending January 2001 and January 2002), net sales increased about 2% due to new store openings; comparable store sales decreased during the year. Operating income increased 10% after declining 50% the year before. The following year, net sales increased 6% and operating income increased 30%. Gross profit as a percent of sales decreased in 2001 and increased in 2002 (http://about.nordstrom.com/aboutus/investor/10yr_stats_printable.asp, April 7, 2003). (e) “Reinvent Yourself” was an advertising campaign that began in February 2000 (see [5] for details). The advertising campaign was Nordstrom’s first national television advertising campaign and targeted younger shoppers than its traditional clientele, concurrent with Nordstrom’s push to appeal to a younger clientele with “flashing lights and funky clothes” [1] and store columns painted orange for a more youthful look [7]. The ads did not emphasize Nordstrom’s customer service. Instead, Nordstrom planned to impress customers with its service once they had ventured into the store [5]. – 91 – Atkinson, Solutions Manual t/a Management Accounting, 6E The campaign was less than successful; the company announced that it had “overreached.” Nordstrom had “alienated its faithful clientele” [7] by trying to appeal to younger shoppers. That is, there was an opportunity cost to targeting younger shoppers. Some financial results appear in part (d). Nordstrom may need to reconsider its value proposition. Reference [2] comments: ..the retail world has changed since Nordstrom’s heyday. With the rise of such speciality retailers as Talbots, The Limited, and Ann Taylor, competition is ferocious. And its old winning formula—great customer service—isn’t the easy advantage it once was. Neiman Marcus Group Inc is now No. 1 in service among department-store chains. It generates annual sales of $490 per square foot, handily eclipsing second-place Nordstrom at $342. And Talbots Inc also took a page from Nordstrom’s playbook. The Hingham (Mass.) chain improved its service and stuck to classic merchandise. The result: It ended last year as one of the best-performing retailers in the nation, with same-store sales jumping 17%. The same article points out that in response to growing customer focus on value, Nordstrom needs excellence in inventory management and control of expenses in addition to its recognized excellence in the “art” of retailing. Saks Fifth Avenue’s “Wild About Cashmere” campaign offered a wide range of products in cashmere and was designed to appeal to young, fashion-hungry customers. The campaign not only alienated loyal 45-54 year-old customers with “edgy, midriffbaring fashion,” but also confused customers who did realize the connection between cashmere and the goat mannekins in the store, or why there were audios of goats bleating [4]. Like Nordstrom, Saks appears to have suffered some opportunity cost from this effort to expand its customer base. References [1] Anonymous. 2001. Nordstrom Inc. To Be As Much as 50% Below Expectations. The Wall Street Journal (January 8), B8. – 92 – Chapter 3: Using Costs in Decision Making [2] Anonymous. 2001. Can Nordstroms Find The Right Style? Business Week (July 30), 59–62. [3] Bednarz, A. 2002. The Customer Is King. Network World (December 2), 65– 66. Byron, E. 2006. Struggling Saks Tries Alternations In Management. Wall Street Journal (January 10), B1. [4] [5] Cuneo, A. Z. 2000. Nordstrom Breaks with Traditional Media Plan. Advertising Age (February 14), 4, 71. [6] Lee, L. 2000. Nordstrom Cleans Out Its Closets. Business Week (May 22), 105. [7] Merrick, A. 2001. Nordstrom Accelerates Plans to Straighten Out Business: Upscale Retailer Offers Lower-priced Goods, Lays Off Staff and Holds Clearance Sale. Wall Street Journal (October 19), B4. Nordstrom previously provided the following list of references at its web site http://about.nordstrom.com/aboutus/faq/faq.asp#12: "With a New location in Dadeland Mall, Nordstrom Seeks to Become a Florida Institution," The Miami Herald, November 12, 2004 "Author of Books on Nordstrom Culture to Address Virginia Trade Show," Richmond Times-Dispatch, September 23, 2004 "Nordstrom Regains Its Luster - Challenge Awaits as Rivals Encroach on Image of Affordable Luxury," The Wall Street Journal, August 19, 2004 "Shoppers put Heart, Soles Into Yearly Nordstrom Sale," The Seattle Times, July 17, 2004 "Q&A with Blake Nordstrom - 4th Generation Leads Growth of Nordstrom," The Charlotte Observer, March 12, 2004 "Nordstrom 'Cachet' Hits Wellington Friday," Palm Beach Post, November 10, 2003 "Back in the Family; Fourth Generation Takes Control After a Brief Change in Company Leadership," Seattle Post-Intelligencer, June 27, 2001 "A Time of Change; Company Makes Huge Leaps with Expansion, Public Stock Offering," Seattle Post-Intelligencer, June 26, 2001 – 93 – Atkinson, Solutions Manual t/a Management Accounting, 6E "Still in Style; From Small Shoe Store, to Upscale Retailer, Company has Kept Founder's Values," Seattle Post-Intelligencer, June 25, 2001 "Success Came a Step at a Time; Company Rose From Small Seattle Shoe Store to Retail Giant with National Appeal," Seattle Times, May 29, 2001 Books: The Nordstrom Way by Robert Spector and Patrick D. McCarthy Fabled Service: Ordinary Acts, Extraordinary Outcomes by Bonnie Jameson and Betsy Sanders 3-71 (a) Unit cost AA100 AA101 AA102 $560 $400 $470 Direct materials: AA 100 — 680 680 Direct labor 60 30 60 Variable mfg. overhead 60 30 60 Total variable mfg. cost $680 $1,140 $1,270 20 30 30 $700 $1,170 $1,300 940 1,500 1,700 Contribution margin per ton $240 $330 $400 Hours per ton 4 hrs 6 hrs 8 hrs $60 $55 $50 Direct materials: Chem. & frag. Variable selling cost Total variable cost Sales price Contribution margin per hour (b) AA100 has a higher contribution margin per hour than AA101 and A102. Aramis should produce AA100 up to 600 tons. Since the production of 600 tons of AA100 requires 2,400 = 600 × 4 hours, which equals available capacity, no other products will be manufactured. Therefore, the optimal production levels are: AA100: 600 tons; AA101: 0 tons; and AA102: 0 tons. (c) Opportunity cost is $60 per hour (the contribution margin per hour for AA100 production that must be sacrificed) and each ton of AA101 requires 6 hours. – 94 – Chapter 3: Using Costs in Decision Making Required contribution margin per ton (= $60 × 6) Variable cost per ton Required minimum sales price per ton (d) $360 1,170 $1,530 It is worthwhile operating the plant overtime. The optimal production level is AA100: 600 tons; AA101: 100 tons; and AA102: 0 tons. Explanation: The regular capacity of 2,400 hours (before operating the plant overtime) is used to produce 600 tons of AA100. How should 600 hours of overtime be used? We know that the demand for AA100 has been filled fully. Therefore, we consider AA101 and AA102. AA101 has a higher contribution margin per hour than A102. With 600 hours of overtime, the company can produce 100 tons of A101 (600 hours 6 hours per ton), which is less than the maximum demand. This leaves no hours for A102. Under overtime: AA100 $560 AA101 $400 AA102 $470 Direct materials: AAA100 — 740 740 Direct labor 90 45 90 Variable mfg. overhead 90 45 90 Total variable mfg. cost $740 $1,230 $1,390 20 30 30 $760 $1,260 $1,420 940 1,500 1,700 $180 $240 $280 4 6 8 $45 $40 $35 Direct materials: Chem. & frag. Variable selling cost Total variable cost Sales price Contribution margin per ton Hours per ton Contribution margin per hour Since contribution margins per hour for AA101 and AA102 are positive, it is worthwhile operating the plant overtime. – 95 – Atkinson, Solutions Manual t/a Management Accounting, 6E 3-72 TEACHING NOTE: A VOTRE SANTÉ 1 The A Votre Santé (AVS) case is multi-faceted in that it requires students to incorporate operational measures into product costing results, and also to understand cost accounting from a variety of perspectives, such as: Product versus period costs Variable versus fixed costs Activity based costing Relevant costs and opportunity costs Additionally, the case questions require both quantitative and qualitative analyses of the business issues faced by AVS. AVS has been used in a graduate-level managerial accounting class for MBAs, and would be most appropriate for an advanced undergraduate or a graduate-level accounting or MBA course. The detail in the case is rich enough to support a variety of analyses. Alternative uses could be to have the student construct a cost of goods manufactured statement or a traditional financial statement, both of which reinforce the differences between product and period costs. Additionally, alternative decision analysis questions could be developed using the variable and fixed cost structures described in the case. Case question number two is only one example of a potential decision analysis question. (a) Contribution Margin Income Statement To develop the contribution margin income statement, you first have to calculate the number of bottles of wine produced by AVS. This number is dependent upon the yield from the grapes. The relevant calculations are as follows: Yield: Pounds harvested Loss in processing Yield: 1 Chardonnay Grapes 100,000 10,000 10% 90,000 Generic Grapes 60,000 3,000 5% 57,000 © 2010 Priscilla S. Wisner. Adapted and used by permission of Priscilla S. Wisner. – 96 – Chapter 3: Using Costs in Decision Making Bottles of wine produced: Chardonnay Estate Regular Blanc de Blanc Total Pounds of grapes: Chardonnay grapes Generic grapes Total pounds of grapes 72,000 0 72,000 18,000 9,000 27,000 0 48,000 48,000 90,000 57,000 147,000 Bottles (3 lb./bottle) 24,000 9,000 16,000 49,000 The contribution margin income statement (Teaching Note Exhibit 1) is fairly straightforward, with the following concepts or calculations causing the most difficulty: The inclusion of liquor taxes and sales commissions in variable costs: These are both period expenses, but are clearly based upon the number of bottles sold, and therefore are included in the variable costs. Where to include the wine master expense: Since the wine master is paid according to number of blends, not number of bottles, this expense is listed as a fixed cost. Arguably, it could be listed as a variable cost, given that the cost will be based on the number of wines produced. As part of the discussion we will examine the rationale behind listing wine master as a fixed or a variable expense. Barrel expense: The case states that the barrels produce the equivalent of 40 cases of wine. A case of wine is post-fermentation/bottling and therefore after the 10% loss has occurred. The barrels contain the wine at the start of the process. Therefore, there have to be enough barrels to hold all the wine at the beginning of the process, not at the end. This factor results in 63 (62.5) barrels being required for the harvest 2. 2 Each case of wine requires 36 pounds of grapes (post-fermenting). A barrel holds the equivalent of 40 cases of wine (post-fermenting), or 1,440 pounds of grapes (40 × 36). To convert the post-fermenting grapes to pre-fermenting grapes, they must be divided by 0.9, or 1,440/0.9 equals 1,600 pounds of grapes. The harvest of 100,000 pounds of grapes therefore requires 62.5 barrels for storage (100,000/1,600). – 97 – Atkinson, Solutions Manual t/a Management Accounting, 6E Teaching Note Exhibit 1: Contribution Margin Income Statement Number Sales Price of Bottles Chardonnay - Estate $ 22 24,000 $528,000 Chardonnay (non-Estate) $ 16 9,000 $144,000 Blanc de Blanc $ 11 16,000 $176,000 Total Revenues 49,000 $848,000 Variable Costs Grapes $124,000 Bottle, labels, corks 122,500 Harvest labor 14,500 Crush labor 2,400 Indirect materials 6,329 Liquor taxes 147,000 Sales distribution 98,000 Barrels 4,725 Total Variable Costs $519,454 61.3% Contribution Margin $328,546 38.7% Fixed Costs Admin. rent and office $ 20,000 Depreciation 8,100 Lab expenses 8,000 Production office 12,000 Sales 30,000 Supervisor 55,000 Utilities 5,500 Waste treatment 2,000 Wine master 15,000 Administrative salary 75,000 Total Fixed Costs $230,600 Operating Margin $ 97,946 11.6% Average revenue per bottle $ 17.31 of sales of sales of sales $ 2.00 per bottle – 98 – Chapter 3: Using Costs in Decision Making (b) Additional Purchase Opportunity, Quantitative Analysis Part b asks, “What is the maximum amount that AVS would pay to buy an additional pound of Chardonnay grapes?” There are three parts to calculating this answer: the benefit from the additional Chardonnay wine to be sold, the relevant costs related to producing this wine and the opportunity cost of not producing as much Blanc de Blanc wine. Teaching Note: Exhibit 2 displays the calculations relevant to this decision. Chardonnay regular wine requires a 2 to 1 mixture of Chardonnay and generic white grapes. Therefore, the 18,000 pounds of Chardonnay grapes will be combined with 9,000 pounds of generic white grapes. The 27,000 pounds of grapes will result in an additional 9,000 bottles of new Chardonnay regular wine being produced. However, it will also result in a 3,000-bottle decrease in the amount of Blanc de Blanc wine produced, since some generic grapes will now be used for the Chardonnay-regular wine. Recall that only Chardonnay wine is processed in barrels. Teaching Note Exhibit 2: Decision Analysis, Additional Grape Purchase Yield: Pounds Loss in processing Yield: Bottles of wine: Chardonnay Grapes 20,000 2,000 18,000 9,000 Additional Chardonnay Product Line Sales Revenue $ 126,000 Costs Generic grapes $ 6,079 Bottle, labels, corks 22,500 Indirect materials 1,163 Liquor taxes 27,000 Sales distribution 18,000 Barrels 975 – 99 – 10% 2 lbs. of Chardonnay grapes per bottle (along with 1 lb. of generic grapes) 9,000 bottles × $14/bottle 9,000 pounds × $0.6754/pound # bottles × $2.50 # bottles × $1.55/12 $3/bottle $2/bottle 13 barrels × $300/4 years Atkinson, Solutions Manual t/a Management Accounting, 6E Wine master 5,000 Total costs $ 80,717 Gain from new Chardonnay $ 45,283 Lost Sales of Blanc de Blanc Wine Sales Revenue Costs Generic grapes Bottle, labels, corks Indirect materials Liquor taxes Sales distribution Total costs $ 33,000 3,000 bottles × $11/bottle $ 6,079 7,500 388 9,000 6,000 9,000 pounds × $0.6754/pound # bottles × $2.50 # bottles × $1.55/12 $3/bottle $2/bottle $ 28,967 Lost Contribution Margin $ 4,033 Net Impact $ 41,250 Required 15% Return on Sales $ 18,900 Total Net Benefit $ 22,350 Pounds of Grapes 20,000 Maximum Price per Pound 15% $ 1.1175 (c) Additional Purchase Opportunity, Qualitative Analysis The following factors would support AVS’s decision to purchase the additional grapes: Potential increase in market share Diversification of suppliers Ability to leverage fixed costs over more production If quality of purchased grapes is perceived to be better To block a competitor from buying the grapes Ability to focus time and effort on wine making (rather than harvesting and crushing) – 100 – Chapter 3: Using Costs in Decision Making Creates an incentive for the current grower to control costs The following factors would support AVS’s decision to reject the grape purchase: Poor quality of the grapes An additional AVS Chardonnay wine creates confusion in the marketplace Lack of control over the harvest and crush process Lack of confidence in the additional sales forecast Inability of the current capacity (e.g. bottling line, space) to support additional production Inability to use the additional barrels purchased in future years Cannibalization of the current Chardonnay, Chardonnay-Estate or Blanc de Blanc sales Reliability concerns with the new supplier Other hidden costs Summary The AVS case is based upon actual wine industry data, although the data has been simplified to reinforce the teaching points and concepts. It is also true to the wine making process, with the exception of AVS’s process of making the Chardonnay regular wine from the fermented Chardonnay and Blanc de Blanc wines. This can be done, but most commonly the juice from the wine grapes is combined at the start of the fermenting process, so that they can ferment together. Because of the different yield rates in the fermenting process, the case had the wines ferment separately and blend at the end. Note: The full case, which includes activity-based cost analysis, can be taught in a 75-minute class, or by omitting the decision analysis question 50 minutes would be sufficient. The case author has also used it to teach the differences between the financial income statement reporting (product and period costs) and the contribution margin income statement reporting (variable and fixed costs), and then assigned decision analysis and/or the ABC costing as an additional assignment. – 101 –