Follow Up Questions for ATM Council GAO ATM Fees Engagement

advertisement

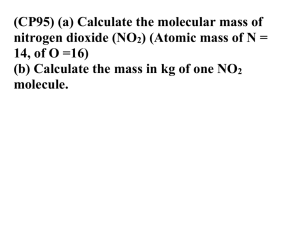

Follow Up Questions for ATM Council GAO ATM Fees Engagement (250640) Overview of ISO industry 1. Please describe the types of businesses that are considered part of the ISO industry. Is ISO still the most appropriate terminology? a. What is the difference between an ISO, a sub-ISO, an affiliate, and an agent? b. How does an organization get the legal distinction of an ISO? (Does the network determine if someone qualifies as an ISO? Or the bank? Or the government?) 2. Does the graphic of the typical ATM transaction from a previous GAO report accurately depict an ATM transaction from the ISO perspective? If not, what is different? 3. For Curt and Bryan, please describe your ATM business, including: a brief description of your business, approximate number of ATMs your organization owns and operates and where, and if you’re involved in branding ATMs 4. How has the development of cash back at point of sale affected your industry? Interactions with Banks 5. Last time we talked about how ISOs must have a relationship with a bank. Is our understanding correct that nonbank ATM operators either get certified as an ISO, or they find an ISO to sponsor them? What would this relationship (between a small nonbank ATM owner and an ISO) entail? a. Are there certain laws that require this type of partnership? b. Does this have an effect on the cost consumers pay for an ATM transaction? 6. We are trying to better understand branding agreements between banks and ISOs (or other entities?). Can you explain these to us, including a. Who pays the main expenses (rent, maintenance, cash replenishment, etc) for the ATM? b. Do banks pay the ATM owner to have their branding on the machine? Is this a flat rate or per transaction? Is an interchange fee paid for transactions that involve that bank’s customers? c. For ATMs that are branded across a chain – such as CVS stores having Chase ATMs—are these agreements worked out by the ISO or by the bank? (con’t on next page) Page 1 Collecting Data 7. We’re considering surveying banks, credit unions and ISOs to gather information about fees consumers pay and costs of providing ATM transactions. a. In thinking about the nonbank ATM industry, are there any ways you would segment the industry so that we are capturing different types of nonbank ATM owners and finding views that appropriately represent the industry? b. What challenges do you expect ISOs/nonbank ATM owners would have in providing data on fees over the past 10 years? Past 5 years? c. What challenges do you expect ISOs/nonbank ATM owners would have in providing data on operating expenses over the past 10 years? Past 5 years? d. Do you think ISOs will agree to participate in a survey? Can you think of things that GAO can do to encourage participation? Page 2