Financial Risk Management Policy

advertisement

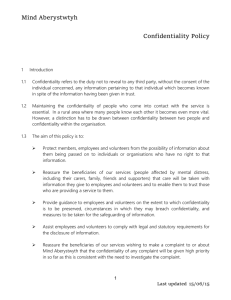

Mind Aberystwyth Financial Risk Management Policy Financial Risk Management Policy 1 Purpose of this policy 1.1 The purpose of this is policy is to make explicit the financial risks that have been identified as applicable to Mind Aberystwyth and to make clear how these risks are managed. 1.2 "Risk" describes the uncertainty surrounding events and their outcomes that may have a significant effect on the organisation in its operational performance, ability to achievement of aims and objectives’ or to meeting expectations of stakeholders. 1.3 Risk management does not focus solely upon the prevention of disaster but by managing risk, enable directors to focus on the mitigation of risks that would prevent Mind Aberystwyth from achieving its strategic objectives. 1.4 This risk management policy forms part of the organisations internal control arrangements and should therefore be read in conjunction with the Reserves policy and (where available) the investment policy. 2 Responsibility 2.1 The directors of Mind Aberystwyth recognise that risk is an inherent feature of all activity and may arise from inaction as well as new initiatives. They also accept that if the organisation is to achieve its charitable purposes then it will from time to time need to take risks. 2.2 The directors also have a duty to ensure that the charity is financially sound and legislatively compliant and that it operates to a high quality standard. 2.3 The directors therefore agree a risk policy to balances the charity’s need to take risks and their duty to ensure that the charity’s financial and legal standing and the quality of its service are not compromised. 1 Last Updated 06/07/15 Mind Aberystwyth Financial Risk Management Policy 2.4 The Chief Executive is to carry out an annual risk analysis that identifies and evaluates the severity of the risks facing. This is informed by the views of the directors, staff and membership and of key external stakeholders. 2.5 The directors in consultation with the Chief Executive, staff and members will agree the actions necessary to mitigate those risks which will inform the following years strategic / business plan. 3 3.1 The risk register Each year Mind Aberystwyth will assess the financial risk that the organisation is exposed to; these may include those listed below, and identify actions taken to manage the risk appropriately. Loss of core funding Pension liabilities Financial risk 3.2 4 4.1 Financial claims by employees or service users; while this is seen as a very low risk its potential effects are mitigated against through having employer's liability and public liability insurance. The risk register will be presented at the AGM for the inspection and comment of members to ensure people with an interest in the organisation are informed of the risks that the organisation is presently exposed to. Risk management In order to manage its financial risks, Mind Aberystwyth will take proactive action to identify risks and take a deliberate course of action to either: Minimise the impact of risk for example with contingency planning Accept the risk Transfer the risk (insurance) Reduce the risk (if complete avoidance is impossible or disproportionately expensive in time or money) 2 Last Updated 06.07.15 Mind Aberystwyth Financial Risk Management Policy Monitor the risk and potentially exploit any upside, for instance using it as a case to strengthen funding bids 5 5.1 5.2 5.3 6 6.1 Internal control systems Underpinning this proactive approach to risk management is the need for a sound internal control system; therefore Mind Aberystwyth has set up an appropriate system that: Can respond to significant risks Is embedded in day to day processes Is capable of responding to external and internal changes Can immediately report major control weaknesses This control system provides the directors with reports on: Identification, evaluation and management of key risks Assessment of effectiveness of related controls Actions to remedy weaknesses including considering costs and benefits The adequacy of monitoring of internal control system The process supporting reporting Such information will not only meet the SORP requirements but will give comfort to the directors that their charity is well run. Annual review of effectiveness of internal control A Task and Finish Group, on behalf of the directors, will be responsible for reviewing the effectiveness of internal control of Mind Aberystwyth’s Chief Executive. This group will review the organisation’s record on risk management and internal control for the previous financial year and consider the internal and external risk profile for the coming financial year. 3 Last Updated 06/07/15