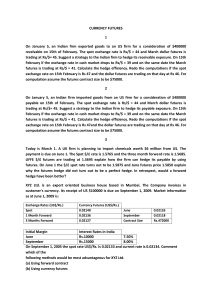

Chapter Ten Foreign Exchange Futures Answers to Problems and Questions

advertisement

Chapter Ten Foreign Exchange Futures Answers to Problems and Questions 1. There is no single correct answer to this. Some research suggests that hedging foreign exchange risk in investment portfolios is not a good idea because it reduces the risk/return ratio of the portfolio. On the other hand, when a specific, unacceptable risk arises, you should seriously consider removing it. 2. It would give you greater flexibility, but it would also be more risky. By replacing the forward contract twice, you would not know in advance the precise price at which the currency transaction would occur. 3. a) A rise in inflation generally results in an increase in interest rates. b) Because the increase in inflation was the same in both countries, the relative exchange rates probably will not change. 4. Economic exposure measures the risk that the value of an investment will fall because of adverse foreign exchange movements. Accounting exposure deals with the consolidation of financial statements. 5. The forward market is not intended to be an opportunity for speculation or investment. People should not expect “gains or losses” from using them. 6. A U.S. business might sell something to a German firm, and the German company might be invoiced in Deutschmarks. The value of the DM could change before the bill is collected, so the U.S. firm might hedge this risk by promising to deliver the DM at a set exchange rate when they are received. 7. Table 10-6 shows the basic foreign currency futures pricing relationship. If the local currency rate rises, the futures price will decline. This is not what a person with a long position in euro futures wants. 8. If you hedge a greater quantity of an asset than your economic interest, the “extra” hedge amounts to a speculation. A parallel example from the option market is the case of someone who owns 500 shares of XYZ stock and purchases 7 at-the-money “protective” puts. Delta considerations aside, you could argue that the extra 2 contracts are speculative. 36 Chapter Ten. Foreign Exchange Futures 9. $1.00 = G1.4456 $0.6918 per unit of G .6918 .7100 12 x x100 15.38% .7100 2 The country G interest rate should therefore be 8.68% + 15.38% = 24.06% 10. Individual response 11. Individual response 12. C$1.00 = $0.75 If U.S. inflation increases by 1%, the U.S. dollar will depreciate by 1%. $0.75 = C$1.00 $1.00 = C$1.3333 Changing by 1%, $1.01 = C$1.3333 $1.00 = $1.320 13. Individual response 14. Individual response 15. There are CHF125,000 per contract. To hedge CHF58 million, sell CHF58 million 464 contracts CHF125,000 contract 16. Bonds accumulate interest, so the hedge might choose to increase the number of contracts to account for the final interest check in addition to the principal. 37 Chapter Ten. Foreign Exchange Futures 17. Calculate the new hedge ratio: CHF60 million 480 contracts CHF125,000 contract This means the hedger needs to sell 16 more contracts. 38