Variations in farm performance in the transitional economies: a case

advertisement

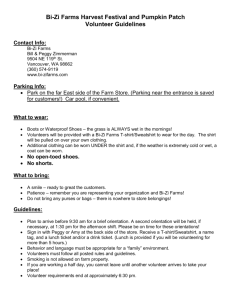

Joint Research Project Working Paper Series Work Package 5, Working Paper 2/8, September 2001 Variations in Farm Performance in Transition Economies: a case study of the Czech Republic Sophia Davidova, Matthew Gorton, Belen Iraizoz1 and Tomas Ratinger Research Group of Agricultural Economics and Business Management, Imperial College at Wye, University of London This Research Project is Financed by the EU Commission's 5th Framework Programme (QLRT-1526) 1 Belen Iraizoz is grateful to Universidad Publica of Navarra, Spain, and Gobernio of Navarra for their financial support during her research at Imperial College at Wye. 1. Introduction In the initial literature on the transition of the CEECs, debates concerning the restructuring of farming systems and whether certain structures have inherent productivity advantages over others featured prominently (Mathijs and Swinnen, Nelson 1993; Schmitt, 1993). This literature focused on the debate over whether collective farms and their successor forms would survive, and on the economics of farm size, which was linked to arguments about land reform and desirability of land restitution. On the basis of theoretical arguments concerning the superior efficiency of family farming (Schmitt, 1991), many predicted the disappearance of co-operatives and that variations in productivity would lead to a wholesale transfer to individual farming. Empirical evidence on changing farm structures in the region indicates that the cooperative sector's share of total agricultural area (TAA) has shrank, but the complete collapse of co-operative farming, predicted by some, has not occurred. Moreover, others have argued that the superiority of individual family farming has been overstated and that the capacity of other structures of production to be efficient has been underestimated (Gorton and Davidova, 2001). This paper revisits this literature by looking at the nature of variations in productivity and profitability between farms in the Czech Republic using data from 1999 and 1998. This allows the examination of variations in total factor productivity (TFP) and farm profitability for different structures, sizes and regions. The managerial and operational characteristics of clusters of farms identified for the Czech Republic are investigated in greater depth to draw out a clearer categorisation of farms, rather than just relying on size and structural type. These clusters form the basis of a discussion of the overall survivability of different groups of farms and, thus, the likelihood of future restructuring. This paper is divided into seven sections. The next section discusses the literature on farm performance in the Czech Republic in the context of wider debates on decollectivisation. Section 3 briefly discusses the results from previous studies on farm efficiency in the Czech Republic. The data used for the empirical analysis is discussed in Section 4. Section 5 details the TFP and profitability indexes produced for 1998 and 1999, compared with previous studies, considering variations by farm type, size and region. Section 6 looks at the variations between farms in greater depth by identifying clusters of farms, considering their managerial and operational characteristics. Relevant conclusions about the overall survivability of different groups of farms and the likelihood of future restructuring are presented in Section 7. 2. Debates on Farm Performance and De-collectivisation in the Czech Republic At the outset of transition, Czech agriculture was widely perceived to be inefficient (Csaki and Lerman, 1996). In 1989, collective farms accounted for more than 60 per cent of Total Land Area (TAL) in the Czech Republic and state farms one quarter of the TAL. This preponderance of large farm collective structures sparked in the early 1990s a debate on two issues. The first was whether there was a clear superiority of one organisational type, namely family farms, over corporate structures (production co-operatives and various types of farming companies) and if so, whether the structures will align to those prevailing in the EU, namely family farms. The second aspect concerned the relationship between size and productivity in agriculture. The question about “optimal farm structure” and “optimal farm size” has a long history in agricultural economics, in general, and in transition economies, in particular. When land reform strategies were being formulated at the outset of transition some argued that it was desirable to preserve large farm structures and pursue attempts to administratively impede farm fragmentation on the basis that smaller farms are less efficient. These authors tended to see restitution strategies, where they would lead to farm structures returning to the pre-war pattern of smallscale peasant units, as highly undesirable (Kanchev, 2000). Large farms have been seen to have advantages stemming from economies in using lumpy inputs, better administrative organisation, better marketing, access to credit and research and development (Hill and Brookes, 1993). In contrast, others argued that the large farms in Eastern Europe suffered from diseconomies of scale, so that land reform strategies must include proposals to reduce the mean size of farms (Koester and Striewe, 1999). The superiority of family farms over other organisational types in agricultural production has been justified on the basis of the need to minimise both production and transaction costs. As the costs of supervision and monitoring of hired labour in agriculture can be high, it has been claimed that family farms appear to be the best suited organisational form as they minimise transaction costs (Schmitt, 1993). Focusing on collectivised agriculture in the centrally planned economies, Schmitt (1993) adds to this argument the principal-agent problem in producer co-operatives where the members can vote out the manager and, therefore, there can be disincentives for the manager to monitor workers. The formulated hypothesis (Schmitt, 1990; Hagedorn, 1994) is that “if the freedom of self-organisation is guaranteed, mainly family farms develop and survive, except for explicable exceptions, because they have low transaction costs” (Hagedorn, 1994: 5). Since 1989, the Czech Republic has witnessed a growth in individual farming but not a rapid transformation to a predominance of family farms envisaged by some (Beckmann, 1996). The most dramatic changes were observed in 1992 and 1993, after farming entities were forced to adopt new legal forms. By 1999, individual farms, involving part-time farming, managed just over 20 per cent of TAL; the rest is managed in a corporate way. Corporate farming is organised in three different legal and management forms. Producer co-operatives are mainly successors of the previous collective farms, however, some of them are transformed state farms. Most of them still have outstanding liabilities to owners of co-operative assets. Limited liability companies have their origin in the privatisation of the state farms. At the beginning of the process, state farms’ assets were leased to small groups of people, normally involving the former farm managers (Ratinger and Rabinowicz, 1997). Gradually the non-land assets were sold to the lessees at favourable conditions with rescheduled payments. The joint stock companies have a large number of shareholders (a few hundreds). A portion of them has their roots either as state farms or as inter cooperative enterprises. However, some of the companies were created post-reform. In 1990’s several producer co-operatives were transformed in joint stock companies, as this allowed easier transactions with company’s shares. Thus, the Czech Republic has a set of legal and management forms that is still significantly different from the West European 'family farm' model. 3. Previous Studies on Farm Efficiency in the Czech Republic Three previous studies on variations in farm efficiency in the Czech Republic have found mixed support for initial propositions drawn from the literature on the economies of size and structure debate (Table 1). The expected pattern of sharply rising average productivity, reflecting scale efficiencies followed by diseconomies of scale at higher farm sizes, is present with economies of scale for arable farming up to 750 ha. Arable farms under 150 ha are significantly less efficient in all three studies. These studies on data for the mid-1990s point to small farms in the Czech Republic being relatively less efficient than in several other CEECs. Hughes (1998) argues that Czechoslovakia had a much less conducive environment for small-scale private farming than, for example Poland and Hungary, and this accounts for why small-scale farming appeared relatively less efficient in the early and mid-1990s in the Czech and Slovak Republics. The availability of external services for crop production, such as harvesting services and inputs for small farms, have been historically more developed in Hungary and Poland and the availability of such services are an important means of overcoming some of the sources of diseconomies of size. For the Czech Republic, both Hughes (1998) and Mathijs and Swinnen (2000) found that individual private farms were significantly more productive than corporate farms for livestock farming but not crop production. Curtiss (2000) analysed crop production in the Czech Republic. She found that co-operatives performed better for wheat and rapeseed cultivation compared to individual farms but the latter were superior with regard to sugar beet production. It, therefore, appears that arguments that co-operatives or other forms of corporate farming are inherently less efficient, for all types of farming, compared to family farms is misplaced. Even for produce or types of farming where the average corporate farm is less productive than the average family farm, one still sees some co-operatives and companies which are on the frontier or registering high TFP scores (Hughes, 2000; Mathijs and Vranken, 2000). It appears that at least some corporate farms can solve the governance problems alluded to in the literature or that there are some types of farming for which such problems are less severe. These productivity studies present some interesting findings but it is argued that further work is required on three counts. First, it is important to see if the trends identified for the early and mid-1990s reflect short-term characteristics of restructuring or are more long-lasting phenomena. For example, is the comparative inefficiency of small farms in the Czech Republic still present or has the switch to a more market based economy created a more conducive environment for small-farms allowing them to overcome their initial size disadvantages? Second, from the efficiency studies it is possible to identify farms which are relatively more efficient (e.g. on the production frontier or with a higher TFP index score) in a particular sample. However, this says nothing about profitability and return on assets in agriculture which will guide further restructuring in the sector. Finally, previous studies have focused principally on the farm size, structure and efficiency debate. The performance of farms will be shaped by many other factors than just size and ownership type, such as agri-environmental region, inherited debts and managerial characteristics. There is a need to consider a fuller range of factors in guiding our assessment of farm performance in the CEECs, identifying groups of farms with common characteristics. These points guide the profitability, productivity and cluster analysis presented in this paper. 4. Data employed in the productivity, profitability and cluster analysis The paper utilises data from the Czech Republic's Farm Accountancy Data Network (FADN) which is administered by the Institute of Agricultural Economics (VÚZE). FADN, which is implemented in all existing EU states, aims to provide a detailed breakdown of revenues and costs incurred in agricultural enterprises based on a sample of bookkeeping farms. The Czech sample is surveyed annually in March and includes about 1,000 agricultural enterprises of physical and legal persons (Table 2). As in this paper the results for 1999 are mainly presented, data used for 1999 are discussed below. The initial sample included 1,087 farms. After checking the individual data, 264 farms were excluded due to data inconsistency. Thus, the sample analysed included 823 farms. Fig 1 details the characteristics of the sample according to management form and average utilised area per management form. Considering management form, the largest group in the sample are the individual farms, 513 (62 per cent). Producer co-operatives are the second largest group, 154 (19 per cent). The rest of the sample is made up of 95 joint stock companies (12 per cent) and 61 limited liability companies (7 per cent). Due to their different history, different management forms have different average sizes. The most important difference is between the individual farms and the other management forms, with the former being much smaller than the successors of the previous state and collective farms. Table 2 compares the characteristics of the individual and corporate farms included in the FADN sample (the 823 useable records for 1999) against returns from the Czech Republic's agricultural census. In the Czech Republic there are two main legal types of individual undertaking in agriculture: (a) trade law farmers, subjected to business regulations (Trade Law) like other full liability businesses and (b) solely operating farmers, with less strict regulations. Comparing the FADN sample with returns from the agricultural census, the former is biased to larger individual farms (in both the trade law and solely operating categories). For example, the average size of individual farms in the FADN sample is 134 ha compared against 18 ha in the agricultural census. In part this difference is derived from the fact that FADN is based on bookkeeping records and so effectively includes only farms with commercial activities (although some farms also produce for own consumption). The FADN sample therefore excludes subsistence producers and this sector is not discussed in the scope of this paper. Comparing the average size of co-operatives and joint stock companies in the FADN and census samples, there are not significant differences although the mean size of limited liability companies in the FADN sample is larger than that recorded in the census. The data for each farm in the sample contained total revenue and five cost items. The five cost items were: total labour costs for hired labour including wages and social insurance contributions, intermediate consumption (working capital), land rent, interest, and depreciation. In addition, land and labour were also given in physical units, annual work units (AWU) and hectares respectively. Labour was sub-divided into hired and family. Labour costs referred to hired labour only. Land area was given as a total and rented. For the purposes of this analysis family labour was valued at regional farm unit labour costs (farms in FADN are classified in 76 administrative regions). The variation in the regional labour costs is between 62,000 CZK and 200,000 CZK per year (£ 1,2503,900). As far as land is concerned, the regional rent was applied to the own land. In this case, agri-environmental regions were used as they better reflect the differences in land quality. The variation in rent is from 210 CZK/ha to 1,100 CZK/ha (from £ 4 to 22). According to the regional conditions for farming, the Czech Republic is divided into five agri-environmental zones. They are notionally called maize region, sugar beet region, cereal-potato region, potato region, and mountainous-forage region (Hughes 2000). The best for agriculture is the first zone (maize region) and they are listed in a descending order. 5. Productivity and Profitability Indices Productivity Productivity differences are analysed by the construction of a Tornquist-Theil TFP index for all farms relative to a base case ‘average farm’ and a comparison of the mean indexes across sub-groups of farms. The Tornquist-Theil TFP measurement used is based on index number theory and is recognised, as a measure of technical efficiency, to be an acceptable alternative to econometric estimation in cases where the data does not permit an underlying production function to be estimated (Capalbo and Antle, 1988; Hughes, 1998). The Tornquist TFP index applied here is a relative measure of productivity that comprises the difference between an aggregated output index and an aggregated input index. Supposing there are two firms i and b which produce n outputs Qj (j=1,…n) using m inputs Xk (k=1,…m), then the index t can be defined as in equation 1: t1 1 n 2 j 1 R R ln Q ln Q 12 S i b j j i j b j m k 1 i k S k ln b X i k ln X b k [1] Where for firm i, Rij represents the share of the value of the j’th output in the total value of all n outputs, and Sik represents the share of the costs of the k’th input in the total input costs of all m inputs. The mean TFP measures for the different sub-groups in the sample are presented in Table 3. The indexes are constructed such that the sample mean would be unity in the case of common products throughout, with results interpreted relative to these sample means, showing cohorts as having above or below average TFP. The indexes reveal that producer co-operatives have the highest mean TFP, followed by joint-stock companies and then individual farms and limited liability companies. This pattern for 1999 is similar to the order identified by Hughes (1998) for 1996 data. However, these variations between farm structures are outweighed by differences between agrienvironmental regions. The lowest TFPs for all farm types are found in the mountainous forage area and the most productive farms are located in the maize region for all farm types (except production co-operatives). An analysis of covariance (ANCOVA) for the 1999 TFP results indicates that size (measured in terms of total assets), agri-environmental region and degree of specialisation are significant determinants of farm productivity (Table 4). When these variables are controlled for, the farm type (legal form) is not significant. Individual farms have the highest standard deviation in TFP scores. Small farms specialised in crop production (with assets up to 3 million CZK) had above average TFP scores in 1999, while small, mixed farms (weighted to livestock) were characterised by relatively low productivity. It appears that individual farms are better in crop production than in livestock, which is in contrast to some previous findings (Mathijs and Swinnen, 2000). The TFP analysis was repeated for 1998 FADN returns. It was possible to directly compare the scores of 486 farms for 1998 and 1999, which were included in both FADN samples. This analysis was undertaken to see if amongst these farms the efficient and inefficient ones were more or less the same in both years. The results indicate a high similarity in the ranking of farms (Table 5). The Spearman Correlation coefficient indicates a significant correlation at the one percent level. From this it is possible to conclude that there was a high degree of stability in the results between the two years, i.e. farms that were highly productive in relative terms in one year were highly productive in the other year and vice versa. However, while the productivity analysis reveals differences in the relative efficiency of farms it does not say anything about absolute profitability. Profitability Farm profitability is mainly analysed with reference to a private cost benefit ratio (P_CB). For the i'th farm, the P_CB is taken to be: P _ CB i C C t f i i R [2] i Where Cti is the cost of tradable inputs, Cfi is the cost of non-tradable factors of production (based on private prices or estimates for non-paid land and labour input) and Ri is total revenue. Two other ratios are also calculated. The first, cost-revenue plus subsidies (C_Rs), is exactly matching the entries in FADN and, therefore, CfI does not include estimates for non-paid labour and land and Ri includes the budgetary transfers. The second one, cost-revenue without subsidies (C_R), does not include estimates for non-paid labour and land, but also excludes the budgetary transfers. The rationale for calculating three different ratios is to give an insight into the effect of the direct budgetary transfers and the valuation of all factors at opportunity costs on different farm types and farms located in different agri-environmental regions. The most striking feature of the profitability results is the low level of farm returns (Table 6). The majority of farms are unprofitable under the three ratios. Out of 823 farms, 662 were loss making (80.4 per cent) applying the P_CB measure. In general, less than a quarter of UAA and labour input are within profitable farms, and they produced between 21 and 28 per cent of the total agricultural output in 1999 (the percentage varies with the measure). Looking at returns by legal form, only 22, 10, 17 and 18 per cent of individual farms, limited companies, joint-stock companies and production co-operatives were profitable respectively, when P_CB ratio is applied (Table 7). At first glance, individual farms are performing well. When C_Rs is used, 65 per cent of them seem profitable, compared to 16 per cent of the limited liability companies, 22 per cent of joint stock companies and 24 per cent of co-operatives. This could misleadingly lead to an easy conclusion about the superiority of individual farms. However, once the budgetary transfers are subtracted, and particularly when the nonpaid labour and land are valued, it can be seen that the percentage of profitable individual farms is not substantially different to those of joint stock companies or cooperatives. Considering agri-environmental region, the worst results were recorded not surprisingly in the mountainous forage region, where on the basis of the P_CB measure no farms were profitable (Table 8). However, even in the best agrienvironmental regions (maize and sugar beet) the majority of farms were loss making. In the cereal and potato regions, 22 and 13 per cent of farms were profitable respectively according to P_CB ratio. When the results by region and legal type are considered together, individual farmers register the best results in the maize region but they have the worst returns in the cereal-potato, potato and mountainous forage regions (Table 9). The poor performance of individual farms is principally due to the high labour inputs per unit of land, which is valued at equivalent market rates (opportunity costs) in the P_CB calculations. If only paid factors were to be considered in the profitability calculations, as individual farms rely much more heavily on own labour and land, they would then record the highest incomes per unit of land. These themes are explored in more detail through the application of cluster analysis. 6. Cluster Analysis Cluster analysis was conducted on the 1998 and 1999 FADN sample of Czech farms. As the results did not show large differences between the two years, here only 1999 results are presented and discussed. Cluster analysis is adequate for defining groups of objects, or individual farmers or corporate farms in our case, with the maximum homogeneity within the groups while having maximum heterogeneity between the groups (Hair et al., 1998). In identifying the variables for the cluster formation, the analysis was hampered by multicollinearity among the variables, and variables that are multicollinear are implicitly weighted more heavily. Ketchen and Shook (1996) suggest two solutions to address this problem. One is to use the Mahalanobis distance measure, which adjusts for high correlation, the other is to apply factor analysis (with orthogonal rotation) and use the resultant uncorrelated factor scores for each observation as the basis for clustering. The latter procedure was followed. Table 10 records the variables included in the analysis. From the FADN sample it is possible to identify the structural characteristics of farms and also their financial performance. Important variables considered included measures of size: total labour (TOTALAWU), total output including the net current subsidies (OUTTOT3), total assets (TOTASSET), and the utilised agricultural area (SAUTOT). A variable to account for specialisation of the farm in arable farming (PROCRO) was included alongside two measures of the degree of intensification. The first one is the amount of land per annual work unit (LANAWU): with larger scores indicating lower levels of intensification. The second one is the quantity of depreciation per annual work unit (DEPAWU), in which case higher values are used as proxies that there is more capital per worker employed. Two variables to account for the degree of dependence on direct subsidies were also considered: total net current subsidies (SUBNETCR) and the percentage of revenue derived from direct subsidies (SUBOUTP). Two variables to account for the use of paid primary factors, the percentage of rented land (PORRESAU) and the percentage of paid labour (PORPALAB), were included alongside standard financial ratios (DEBTOAS, LEVERAGE, RENGO and RENGM). To these continuous variables, two sets of dummy variables were added. First, legal and management structure was split into four categories (individual farms, limited liability companies, joint-stock companies and production co-operatives). Individual farms were taken to be the reference group with dummy variables DLFORM2, DLFORM3 and DLFORM4 for limited companies, joint stock companies and production co-operatives respectively. A similar approach was taken for agri-environmental region. In this case five categories (maize, sugar beet, cereal, potato and mountain areas) are delineated with four dummy variables (DREG2, DREG3, DREG4 and DREG5) with region 1 (maize) used as a reference. The Kaiser-Meyer-Olkim measure of sampling adequacy is 0.67 (values below 0.50 are unacceptable) indicating that the data matrix has sufficient correlation to justify the application of factor analysis. Bartlett’s test of sphericity accounts for the significance of the correlation matrix. In this case it is large and statistically significant at the 1 per cent level, so that the hypothesis that the correlation matrix is the identity matrix can be rejected. Thus, the factorial analysis is meaningful (Table 11). The method of principal component analysis with varimax rotation is adopted. This method assures that the obtained factors are orthogonal and so avoiding the problem of multicollinearity between the variables used in the cluster analysis. An eight-factor solution is adopted, choosing the factors that present an eigenvalue greater than one (Table 12). This solution explains nearly 74 per cent of the total variance in the data set, which is satisfactory2. The cut-off for interpretation purposes is factor loadings greater or equal to 0.5 on at least one factor. With this criteria it is possible to see that the first factor is related with the size of the farm measured by the quantity of land (total land, the percentage of paid labour and the percentage of rented land). The second factor is specialisation in crop production, which is related to the quantity of land per annual work unit. Factor 3 can be labelled subsides (the percentage of revenue derived from subsidies) and this factor is correlated with the dummy for region five, where the farms receive more subsidies. Factor 4 is related to type of region (positively with region 2 and negatively with region 3, indicating that the characteristics of these regions must result in different patterns of farm behaviour. Factor 5 is related to the level of debt held by the farm and with the legal form of limited companies. Factor 6 is related to the level of financial stress (amount of rent and interest paid with respect to gross output or the gross margin, which is also related 2 Hair et al. (1998) point out that in the social sciences it is not uncommon to consider a solution that accounts for 60 percent of the total variance as satisfactory. with depreciation per unit of labour). Factor 7 is positively related with one legal form (production co-operatives) and negatively with another (joint-stock companies), indicating that farms have a different behaviour depending on the legal form. Finally, Factor 8 includes only the regional dummy for mountainous areas. The factors formed the basis of the cluster analysis, following a two stage hierarchical approach. First, a hierarchical technique was used to establish the number of clusters and profile the cluster centres. Then, the observations were clustered by a nonhierarchical method with the cluster centres from the hierarchical results as the initial seed points. This combined procedure allows one to take maximum benefit of the advantages associated with hierarchical and non-hierarchical methods, while at the same time minimising the drawbacks (Punj and Stewart, 1983; Flavian and Polo, 2000). The algorithm used in the hierarchical technique is the Ward’s method based on squared Euclidean distances, one of the most frequently used in the literature. To decide how many clusters exist, in many applications the method used is the analysis of the dendogram, but with large samples this is difficult to interpret. Instead, the criteria suggested by Fiegenbaum and Thomas (1990, 1993) is applied. It focuses on the simultaneous analysis of the overall fit obtained within each grouping and the improvement that is obtained in this fit with the inclusion of an additional group. Thus, the number of groups that exist will be determined when the two conditions are satisfied simultaneously.3 With this criteria a seven-cluster solution is obtained (Table 13). The average values of the eight factor scores for every cluster are used as seed points for the non-hierarchical technique. The main characteristics of the clusters can be identified as: Cluster 1: Individual farms located in the region of sugar beet production (for classification by legal form and region see Tables 14 and 15 respectively). These are small farms specialised in crop production. They do not have a bad financial situation and have large values for the quantity of land and capital per unit of labour. The percentage of rented land and paid labour is relatively small. They receive relatively low levels of subsidies, in absolute terms and as a percentage of total revenue. This group is one of the best in terms of the performance results achieved. This cluster contains farms with relatively high productivity index scores and smaller cost revenue ratios. Cluster 2: Production co-operatives located in the regions of sugar beet and cereal production. These are large farms with the majority of the land rented and a dependence on paid labour. They are not specialised. Their financial situation is one of the worst in the sample. They receive on average a high level of subsidies but in relative terms this is low (5 per cent of gross output). This is a group with good results in terms of productivity and in terms of the cost-revenue ratio but suffer from inherited debts. Cluster 3: Individual farms, located in the cereal production region. These are the smallest farms and present some degree of specialisation in crop production. They 3 The criteria are: (a) the percentage of intra-group variance explained with the obtained grouping being higher than a minimum percentage which we place at 50% and (b) that the percentage increase in the explanation of the intra-group variance, obtained with the inclusion of an additional group, does not exceed 5%. have a good financial situation and they use the lowest percentage of rented land and paid labour in the sample. The difference between this group and cluster one, in addition to the region and the level of specialisation, is that in these farms have a high labour to land ratio and use much less capital. The results that they obtain are one of the worst, low productivity of labour and low total factor productivity, with high costrevenue ratios. Cluster 4: This cluster is comprised of limited liability companies situated mostly in the sugar beet, cereal and potato production regions. These are large farms utilising rented land and paid labour. They are not specialised in any one type of production and they are characterised by a poor financial situation. However, they have limited financial stress (as they pay little in rent and interest in relation to their total output). They receive comparatively low levels of direct subsidies. The productivity and profitability results of these farms are roughly equal to the average for the total sample. Cluster 5: In this group are all the farms from region 5 and only farms situated in this (mountain) region. In general they are individual farms (65 per cent per cent of all farms in the cluster) which are more extensive and broadly specialised in livestock production. They have large values of land per unit of labour but also have high depreciation per unit of labour. Their financial situation is not good and the levels of financial stress are one of the highest. These farms are the ones that receive more subsidies in relative terms: almost 25 per cent of their revenue is derived from subsidies. The level of rented land is above the sample average and the percentage of paid labour is lower than the average. The farms in this group are the worst in terms of productivity and profitability. Cluster 6: Is comprised of individual farms (55 per cent) and production cooperatives (34 per cent) which are all situated in region 4 (potato agri-environmental region). They are medium size farms with an average financial situation for the sample. These farms have less capital per unit of labour but they receive a relatively high level of subsidies as a percentage of revenue. In terms of productivity and profitability they present poor results, but as in the previous case, when revenue including subsidies is accounted for, their relative situation improves because they receive relatively more subsidies than the majority of the farms in the sample. Cluster 7: It consists of joint-stock companies located in the sugar beet and cereal regions. The biggest farms are in this group, with more livestock than crop production. They have the majority of the land rented and all the labour is paid labour. The financial situation is in the average (but with a high financial stress). These farms present the lowest ratios of land and capital per unit of labour. These are farms with a low percentage of output coming from subsidies, although they receive the biggest quantity of subsidies per farm in absolute terms. Their results are not bad compared with the sample average but without direct subsidies, their situation would be significantly worse. 7. Conclusions The analysis of farm level productivity and profitability in the Czech Republic provides results supporting the view that by the end of 1990s, there is no strong evidence that family farms perform better than the corporate type of farming. Nor is there strong support for the view that the decrease in farm size, resulting from land restitution, created a more inefficient structure of agricultural production where the result was the creation of individual, well capitalised farms above 150 hectares. The best performing farms are the individual farms employing mainly own land and labour, with an average land area that is far smaller than the mean for the FADN sample (164 and 654 ha respectively). At the same time, the largest farms, the joint stock companies in cluster 7, with an average land area of 2008 ha, present a worse performance. Their TFP is lower than the average for the sample and their total costs are larger than revenues. It is true that the smallest individual farms in the sample (average UAA 95 ha) have one of the worst performance, but they also differ by employing far less capital per unit of labour. Farm location, the degree of specialisation and capital employed are stronger determinants of farm performance than the size of the farm. The previous literature on decollectivisation has focused mainly on land shares (size of utilised agricultural areas of successor farms etc.). However, evidence from the Czech Republic points to the importance of capital employed and thus the distribution of capital (rather than just land) as an important issue in land reform programmes. The differences in performance of the above clusters 1 and 3, incorporating individual farms only, broadly support the results from previous studies, stating that in the Czech Republic arable farms under 150 ha are significantly less efficient. Some of the production co-operatives (cluster 2), registered a very good performance in respect to total factor productivity and profitability. They, in fact, have the highest TFP relative to the average. This once again points out the need for more careful approach to farm structures in the region. Due to the initial conditions, which were completely different from Western Europe and the experience of corporate farming, some of the farms (mainly co-operatives) managed to restructure and to overcome any governance problems. Still there is no clear evidence about the superiority of individual (family) farming. At the same time, producer co-operatives typically register a bad financial situation, but this, to a great extent relates to the initial conditions and the political design of the reform process. Producer co-operatives in the Czech Republic have mainly non-bank long-term liabilities that can be referred to as ‘reform debts’. These are liabilities to owners of co-operative assets who received shares during the land reform and farm transformation, but decided not to farm. According to the Law, they could not withdraw these assets from the co-operatives for seven years unless they wanted the assets in order to farm individually. For cooperatives these liabilities account for 58 per cent of the total long- and short-term liabilities. Limited liability companies (cluster 4) do not have an outstanding performance but their results are not worse than the average for the sample. However, they have a very bad financial situation, which is again related to the ‘reform debts’. For the limited liability companies these are outstanding liabilities to the State for acquiring assets from the former state farms. For them the percentage of non-bank liabilities is even higher than for co-operatives (62 per cent). Even ten years after the start of transition, the overall performance of farms (especially corporate farms), is thus not only shaped by current markets but also by inherited debts. One of the main determinants of farm performance is the agri-environmental region to which a farm belongs. Cluster 5 incorporates only farms located in the worst region for agriculture. Government policy, through budgetary transfers, tries to offset this disadvantage. Farms continue to be unproductive, but when the subsidies are taken into account, they become profitable as a group. These farms are thus heavily dependent on the existence of direct subsidies for less favoured areas. There are not strong economic grounds to predict the survival of these farms under a liberal CAP. Most probable, they may survive if there are environmental or broader rural objectives to justify government support to keep these farms active. By and large, the analysis shows that subsidies in the Czech Republic shelter unprofitable and unproductive farms. The best performing farms (cluster 1) receive little subsidies expressed as a percentage of output (3 per cent), compared to 25 per cent for the farms in the mountainous-forage area. Speculating about the overall survival of the different farm structures, it is likely that corporate farming will continue to exist in parallel with family farms. The farm restructuring process is likely to continue for all farm types and not only for corporate farms. There are large numbers of individual farms that are loss making, with low factor productivity scores. The main problem for almost all farms in the Czech Republic appears to be that their revenues cannot cover costs incurred. References Beckmann, V. (1996). Transaction Costs and Institutional Choice In Agriculture: the example of family vs. hired labour. Paper presented at the VIIIth Congress of the European Association of Agricultural Economists, Edinburgh, 3rd-7th September 1996. Capalbo, S. M. and Antle, J.M. (1988) (eds.) Agricultural Productivity, Measurement and Explanation. Washington, D.C.: Hopkins University Press. Csaki, C. and Lerman, Z. (1996). Agricultural Transformation in Central and Eastern Europe and the Former USSR: Issues of Land Reform and Farm Restructuring. Paper presented at the VIIIth Congress of the European Association of Agricultural Economists, Edinburgh, , 3rd-7th September 1996. Curtiss, J. (2000). Technical Efficiency and Competitiveness of the Czech Agricultural Sector in Late Transition - The Case of Crop Production. Paper presented to the KATO Symposium, Berlin, November 2nd-4th 2000. Fiegenbaum, A. and Thomas, H. (1990). Strategic groups and performance: The US insurance industry, 1970-84, Strategic Management Journal 11: 197-215. Fiegenbaum, A. and Thomas, H. (1993). Industry and of strategic group dynamics: competitive strategy in the insurance industry, 1970-84, Journal of Management, 30: 69-105 Flavian, C. and Polo, Y. (2000). The study of strategic diversity by way of strategic groups analysis, 1681-1707 in Dahiya, S.B. (ed.), The Current State of Business Disciplines, Dehli: Jan Tinbergen Institute of Development Planning, vol. 4. Gorton, M. and Davidova, S. (2001). Farm Productivity and Efficiency in the CEE Applicant Countries: a synthesis of results, EU IDARA project Working Paper 2/5, Imperial College at Wye. Hagedorn, K. (1994). Changing Organisation of Agriculture as a Result of the Transformation Process. Paper presented at workshop on The Impact of CEE Agricultural Reform on Domestic and International Markets, Leuven, 10th-11th June, 1994. Hair, J.F., Anderson, R.E., Tatham, R.L. and Black, W.C. (1998). Multivariate Data Analysis (Fifth Edition). Prentice Hall International. Hill, B. and Brookes, B. (1993). Farm Incomes in the European Community in the 1980s. Document series. Brussels: The Commission of the EC. Hughes G. (1998). Agricultural Productivity and Farm Structure in the Czech Republic, EU FAIR project: Agricultural Implications of CEEC Accession to the EU Working paper 2/7, Wye College, University of London. Hughes, G. (2000) Total productivity of emergent farm structures in Central and Eastern Europe, 61-87 in Banse M. and Tangermann, S. (eds.), Central and Eastern European Agriculture in an Expanding European Union. Walingford: CABI Publishing. Kanchev, I. (2000). Agrarian structures in Bulgarian- problems and development, 205-213 in Tillack, P. and Pirscher, F. (eds.) Competitiveness of Agricultural Enterprises and Farm Activities in Transition Countries. Kiel: Wissenschaftsverlag Vauk. Ketchen, D.J. and Shook, C.L. (1996). The application of cluster analysis in strategic management research: an analysis and critique, Strategic Management Journal, 17: 441-458. Koester, U. and Striewe, L. (1999). Huge potential, huge losses - the search for ways out of the dilemma of Ukrainian agriculture, 257-270 in Siedenberg, A. and Hoffman, L. (eds.), Ukraine at the Crossroads: economic reforms in international perspective, New York: Physica – Verl. Mathijs E, Blaas G. and Doucha T. (1999). Organisational form and technical efficiency of Czech and Slovak farms, MOCT-MOST: Economic Policy in Transitional Economies, 9: 331-344. Mathijs, E. and Swinnen, JFM. (1996). The Economics of Agricultural Decollectivisation, EU FAIR project: Agricultural Implications of CEEC Accession to the EU Working paper 3/1. Mathijs E, Swinnen JFM (1988). The economics of agricultural decollectivization in East Central Europe and the former Soviet Union, Economic Development and Cultural Change, 47: 1-26. Mathijs E, Swinnen JFM (2000). Technical efficiency and the competitiveness of agricultural enterprises: results from Eastern Germany and the Czech Republic, 8697 in Tillack, P. and Pirscher, F. (eds.) Competitiveness of Agricultural Enterprises and Farm Activities in Transition Countries, Kiel: Wissenschaftsverlag Vauk, pp.86-97. Nelson, G.C. (1993). Agricultural policy reform in Eastern Europe: discussion, American Journal of Agricultural Economics, 75: 857-859. Punj, G. and Steward, D. (1983). Cluster Analysis in Marketing Research: Review and Suggestions for Application, Journal of Marketing Research, 20: 134-148. Ratinger, T. and Rabinowicz, E. (1997). Changes in Farming Structures in the Czech Republic as a Result of Land Reform and Privatisation, 80-99 in Swinnen, JFM., Buckwell, A. and Mathijs, E. (eds.) Agricultural Privatization, Land Reform and Farm Restructuring in Central Europe, Aldershot: Ashgate. Schmitt, G. (1991). Why is the agriculture of advanced Western countries still organised by family farms? Will this continue to be so in the future? European Review of Agricultural Economics, 18: 443-458. Schmitt, G. (1993). Why Collectivisation of Agriculture in Socialist Countries has failed: A transaction cost approach, 143-159 in Csaki, C. and Kislev, Y (eds) Agricultural Cooperatives in Transition, Boulder: Westview Press. TABLES Table 1: Previous studies on farm efficiency in the Czech Republic Hughes (1998) Data set(s) VUZE panel. 1996 Methodology Tornquvist - Theil TFP Index Economies of scale up to 750 ha for arable farming and up to 1 mil. CZK in 1996 for livestock farms. Individual private farms significantly more productive for livestock, but not crop, farming. Co-ops. Perform better than farming companies. Size effects Structural effects Other factors Mathijs and Swinnen (2000) Agrocensus and VUZE panel data for 1996 Data envelopment analysis (DEA). Economies of scale up to 750 ha. for crops. For livestock family farms more efficient than co-operatives and companies. No differences between cooperatives and companies. Co-ops can be found on technology frontier of all specialisations. Curtiss (2000) VUZE FADN 19961998 Stochastic Frontier Analysis (SFA). Farms above 150 ha perform on average better than smaller farms for wheat and rapeseed production. Co-operatives perform better than individual farms and companies except for sugar beet where individual private farms perform best. Regional variations (mountainous areas poor performance). Table 2 - Structure and Representativeness of the FADN farm sample for the Czech Republic Agrocensus (2000) FADN Sample (1999) Number Agricultural Average area Number Agricultural Average area Land Land 53 460 962 325 18 513 68741 134 Individual Farms Total Not identified legal 18 098 26 908 1 form Trade Law Farmers 3 384 68 772 20 Solely Operating 31 721 863 870 27 Farmer Other 257 2 775 11 Corporate Farms 3 027 2 680 843 886 Total Ltd 1 479 795 359 538 Joint Stock 621 779 732 1 256 Co-ops 746 1 059 453 1 420 State organisations 105 38 997 371 Other 75 7 007 93 Czech Republic Total 56 487 3 643 168 64 Source: Czech statistical office, Agrocensus, 2000, Own calculations 11 502 4248 64493 386 128 310 473120 1526 61 95 154 65499 166165 241456 1074 1749 1568 823 541 861 658 Table 3: Class means of TFP index for 1999 Czech FADN Sample Class means Individual farmers Ltd Companies Joint Stock Comp. Production Coops Regional averages Maize Sugar beet Cereal-Potato Potato reg. Mountainous Legal type region region reg. forage reg. averages 1.120 1.020 0.927 0.864 0.714 0.9526 1.122 1.000 0.965 0.867 0.896 0.9511 1.049 0.967 1.060 0.965 0.799 0.9911 0.891 1.111 0.999 0.946 0.825 1.0118 1.087 1.025 0.955 0.904 0.764 Table 4: Analysis of covariance for 1999 Czech FADN sampledependent variable: TFP index Source Type III df Mean Square F Sig. Sum of Squares Corrected Model 4.626 6 .771 14.833 .000 Intercept 29.966 1 29.966 576.443 .000 Size (Total assets) .715 1 .715 13.748 .000 Specialisation index .687 1 .687 13.208 .000 Agri-Env. Regions 2.392 4 .598 11.502 .000 Error 42.419 816 5.198E-02 Total 818.189 823 Corrected Total 47.045 822 R Squared = .098 (Adjusted R Squared = .092) Table 5: Rank correlation of relative efficiencies in 1999 and 1998 TFP Index 1999x98 Spearman correlation Significance *** *** significant at =0.01 0.55 Table 6. Profitability ratios, 1999 Max Min Average StandDev No of profitable farms No of loss making farms % of sample UAA in profitable farms % of sample output in profitable farms % of sample labour input in profitable farms C_R s (+subsidies) 3.614 0.423 1.006 0.250 399 424 26 28 22 C_R (without subsidies) 3.593 0.423 1.089 0.307 309 514 19 23 17 PC_B 4.938 0.442 1.227 0.376 161 662 17 21 16 Table 7: Number of profitable and loss making farms according to farm type (1999) Profitable Loss making Profitable Loss making Profitable Loss making Individual Ltd Companies Joint Stock Comp. farmers C_Rs 332 10 181 51 C_R 256 6 257 55 PC_B 111 6 402 55 Production Coops 21 74 36 118 17 78 30 124 16 79 28 126 Table 8: Number of profitable and loss making farms by agri-environmental region (1999) Maize region Sugar beet region Cereal-Potato Potato reg. reg. Mountainous forage reg. C_Rs Profitable Loss making 13 7 160 163 Profitable Loss making 13 7 137 186 Profitable Loss making 7 13 70 253 153 151 54 82 19 21 124 180 32 104 3 37 66 238 18 118 0 40 C_R PC_B Table 9: Class means for P_CB ratios by region and legal type. Class means Maize region Sugar region beet Cereal-Potato Potato reg. Mountainous Legal type reg. forage reg. averages Individual farmers 1.046 1.166 1.293 1.366 1.694 1.2623 Ltd Companies 1.064 1.129 1.217 1.274 1.270 1.2035 Joint Stock Comp. 1.178 1.214 1.104 1.244 1.429 1.1944 Production Coops 1.256 1.068 1.143 1.178 1.341 1.1372 Regional averages 1.089 1.156 1.242 1.282 1.563 Regions and legal forms significant at =0.01. (ANOVA) Table 10: Variables included in the factor / cluster analysis VARIABLE Definition SAUTOT OUTTOT3 TOTALAWU TOTASSET SUBNETCR SUBOUTP PORPALAB PORRESAU PROCRO HERFINDA LANDAWU DEPAWU DEBTOAS LEVERAGE RENGO RENGM Total land (UTIL_UAA) Output including the net current subsidies (GrossOut) Total labour (AWU) Total asset (TotAS) Net current subsidies (BAL_CURR) Percentage of the gross output coming from net current subsidies Percentage of paid labour Percentage of rented land Percentage of crop production (OutSTR) Herfindal Index Land per unit of labour Capital (depreciation) per unit of labour Debt to asset ratio Leverage Rental (rents and interests paid)/gross output Rental (rents and interests paid)/gross margin Gross margin: gross output – intermediate consumptions Labour costs/paid awu Rents/rented land WAGE LANDRENT Table 11: Diagnostics for the Factor Analysis MSA Total Bartlett's Test With dummy 0.679 12828*** Table 12: Factor Analysis for 1999 Czech FADN Sample SAUTOT OUTTOT3 TOTALAWU TOTASSET SUBNETCR PORPALAB PORRESAU PROCRO HERFINDA LANDAWU DREG5 SUBOUTP DREG3 DREG2 DLFORM2 DEBTOAS LEVERAGE DEPAWU RENGO RENGM DLFORM3 DLFORM4 DREG4 Eigenvalue % variance (73.89) 1 0.950 0.940 0.920 0.919 0.759 0.738 0.519 -0.188 -0.294 -0.167 -0.031 -0.036 -0.053 0.033 0.050 0.366 -0.065 -0.065 0.062 0.038 0.525 0.490 0.042 6.240 27.13 2 -0.099 -0.128 -0.160 -0.148 -0.081 -0.153 0.087 0.805 0.718 0.604 -0.148 -0.031 -0.054 0.192 -0.001 -0.069 -0.131 0.182 0.151 -0.315 -0.125 -0.179 -0.123 2.357 10.25 3 -0.015 -0.093 -0.086 -0.091 0.290 -0.051 0.116 -0.179 -0.118 0.137 0.833 0.803 -0.154 -0.216 0.127 0.087 -0.206 -0.047 0.155 -0.073 -0.061 -0.103 0.013 1.957 8.51 4 -0.016 0.057 0.050 0.052 -0.081 0.068 -0.026 0.132 0.201 -0.129 0.104 -0.141 -0.909 0.818 0.023 -0.007 -0.012 0.005 0.078 0.138 0.026 -0.047 0.041 1.545 6.72 5 0.049 -0.019 -0.031 -0.056 0.011 0.380 0.281 -0.112 -0.059 -0.048 0.016 -0.025 -0.037 -0.020 0.861 0.598 0.514 0.069 0.004 -0.049 -0.020 -0.134 0.042 1.432 6.22 6 -0.001 -0.033 -0.067 -0.012 0.031 -0.042 0.236 0.082 0.030 0.505 -0.012 0.102 -0.081 0.139 -0.120 0.111 0.115 0.670 0.639 0.580 -0.013 -0.033 -0.084 1.199 5.21 7 0.034 -0.004 0.011 -0.018 -0.035 0.206 0.229 0.022 -0.062 -0.046 0.020 -0.026 0.018 -0.037 0.008 0.472 -0.163 0.032 0.014 -0.038 -0.679 0.758 0.018 1.140 4.80 8 0.014 -0.032 -0.004 -0.044 0.063 0.047 0.173 -0.056 -0.182 0.095 -0.190 0.249 -0.330 -0.323 -0.031 0.138 0.027 -0.020 -0.085 0.012 0.088 0.072 0.961 1.046 4.55 Table 13: Cluster analysis for the 1999 Czech FADN Sample Cluster N FARMS SAUTOT TOTALAWU OUTTOT3 TOTASSET PROCRO HERFINDA DEBTOAS LEVERAGE RENGO RENGM LANDAWU DEPAWU PORRESAU PORPALAB SUBOUTP SUBNETCR 1 2 229 111 163.97 1,510.52 4.74 78.46 4,271 48,402 7,892 76,709 0.762 0.502 0.773 0.518 0.192 0.632 0.500 -0.118 0.05 0.04 0.189 0.222 51.36 23.27 129.08 72.51 67.79 97.23 28.20 99.88 0.032 0.051 153 2023 3 194 94.91 2.57 1,909 3,897 0.627 0.647 0.121 0.326 0.03 0.027 41.97 76.43 60.05 13.11 0.056 118 4 53 1,089.44 42.95 27,911 37,893 0.515 0.551 0.928 17.683 0.03 0.052 27.44 77.78 93.68 100 0.054 1284 5 40 552.92 22.19 11,714 23,641 0.357 0.572 0.386 -3.242 0.05 0.241 42.64 84.82 82.90 46.59 0.248 1853 6 108 674.48 34.27 18,400 30,699 0.504 0.537 0.387 0.492 0.03 0.183 34.87 70.09 79.33 50.74 0.112 1099 7 77 2007.59 112.72 68,801 113,332 0.431 0.505 0.307 0.558 0.04 0.256 19.62 64.82 93.00 100 0.042 2735 Total 812 653.83 31.82 19,648 32,111 0.592 0.627 0.330 1.315 0.04 0.154 38.08 89.30 76.32 49.79 0.064 928 157.319*** 136.24*** 150.414*** 147.571*** 44.339*** 55.14*** 103.389*** 10.789*** 4.813*** 3.101*** 13.276*** 7.641*** 33.463*** 178.272*** 49.027*** 55.015*** Cluster N INCFWU VABAWU WAGE LANDRENT RETASSAV TFP11 TFP31 P_CB C_R C_Rs 1 229 149 307 61.24 0.826 -0.020 1.026 1.019 1.157 0.992 0.958 3 194 40 167 40.74 0.666 -0.046 0.931 0.937 1.287 1.043 0.972 4 53 0 185 126.05 0.277 -0.039 0.968 0.970 1.182 1.172 1.101 5 40 -294 206 74.18 0.522 -0.022 0.764 0.769 1.563 1.363 0.966 6 108 153 178 70.27 0.402 -0.032 0.899 0.904 1.302 1.147 1.004 7 77 0 183 132.41 0.404 -0.034 1.012 1.012 1.153 1.145 1.096 Total 812 79 219 77.94 0.574 -0.028 0.970 0.971 1.224 1.086 1.003 f 3.208*** 6.34*** 44.64*** 11.36*** 1.462 12.28*** 11.498*** 10.973*** 12.621*** 5.836*** 2 111 -1,418 216 125.45 0.339 -0.002 1.039 1.039 1.119 1.110 1.048 F Table 14: Classification of Legal Forms by Cluster Groups 1 2 3 4 T MILFORM Count % row % column % of Total Count % row % column % of Total Count % row % column % of Total Count % row % column % of Total Count % row % column % of Total 1 225 44.50 98.30 27.70 0 0 0 0 3 3.30 1.30 0.40 1 0.60 0.40 0.10 229 28.20 100 28.20 2 2 0.40 1.80 0.20 1 1.70 0.90 0.10 0 0 0 0 108 70.10 97.30 13.30 111 13.70 100 13.70 3 194 38.30 100 23.90 0 0 0 0 0 0 0 0 0 0 0 0 194 23.90 100 23.90 4 0 0 0 0 52 86.70 98.10 6.40 0 0 0 0 1 0.60 1.90 0.10 53 6.50 100 6.50 5 26 5.10 65.00 3.20 7 11.70 17.50 0.90 2 2.20 5.00 0.20 5 3.20 12.50 0.60 40 4.90 100 4.90 6 59 11.70 54.60 7.30 0 0 0 0 12 13.00 11.10 1.50 37 24.00 34.30 4.60 108 13.30 100 13.30 df 18 18 1 Asymp. Sig. (2-sided) 0 0 0 Chi-Square Tests Pearson Chi-Square Likelihood Ratio Linear-by-Linear Association Value 1922.490 1316.414 77.112 7 0 0 0 0 0 0 0 0 75 81.50 97.40 9.20 2 1.30 2.60 0.20 77 9.50 100 9.50 Total 506 100 62.30 62.30 60 100 7.40 7.40 92 100 11.30 11.30 154 100 19.00 19.00 812 100 100 100 Table 15: Classification of Farms by Region and Cluster PREG 1 Count % row % column % of Total 2 Count % row % column % of Total 3 Count % row % column % of Total 4 Count % row % column % of Total 5 Count % row % column % of Total T Count % row % column % of Total 1 2 3 4 5 6 7 TOTAL 11 55.00 4.80 1.40 218 68.80 95.20 26.80 0 0 0 0 0 0 0 0 0 0 0 0 229 28.20 100 28.20 2 10.00 1.80 0.20 43 13.60 38.70 5.30 65 21.70 58.60 8.00 1 0.70 0.90 0.10 0 0 0 0 111 13.70 100 13.70 1 5.00 0.50 0.10 0 0 0 0 193 64.30 99.50 23.80 0 0 0 0 0 0 0 0 194 23.90 100 23.90 3 15.00 5.70 0.40 18 5.70 34.00 2.20 16 5.30 30.20 2.00 16 11.90 30.20 2.00 0 0 0 0 53 6.50 100 6.50 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 40 100 100 4.90 40 4.90 100 4.90 0 0 0 0 0 0 0 0 0 0 0 0 108 80.00 100 13.30 0 0 0 0 108 13.30 100 13.30 3 15.00 3.90 0.40 38 12.00 49.40 4.70 26 8.70 33.80 3.20 10 7.40 13.00 1.20 0 0 0 0 77 9.50 100 9.50 20 100 2.50 2.50 317 100 39.00 39.00 300 100 36.90 36.90 135 100 16.60 16.60 40 100 4.90 4.90 812 100 100 100 Chi-Square Tests Pearson Chi-Square Likelihood Ratio Linear-by-Linear Association Value 2018.788 1486.635 290.056 df 24 24 1 Asymp. Sig. (2-sided) 0 0 0 Figure 1: Characteristics of the FADN Sample, 1999 Number of farms Average Utilised Agricultural Area 600 500 2000 400 300 Ha 1500 200 1000 100 500 0 Individual farmers Ltd. Joint Stock Coops 0 Individual farms Ltd. Joint Stock Coops