CHAPTER 1 - Holy Family University

advertisement

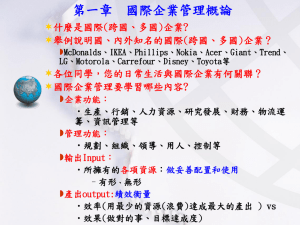

CHAPTER 1: INTRODUCTION 1 CHAPTER 1 INTRODUCTION 1. Explain how globalization may affect even a small business in your local area. A small business in any local area now faces competition from both large MNCs and similarly situated businesses that take advantage of their international experience as well as internationally sourced products. 2. Opponents of globalization and outsourcing argue that locating manufacturing activities abroad causes a loss of U.S. jobs. However, total employment figures reveal that rather than resulting in a net loss of jobs, employment has actually increased. Also, the average wages of workers have increased. How would you account for this discrepancy between what the critics say and what statistics reveal? ANSWER. Globalization is a two-way street. While some U.S. firms locate their plants overseas, several foreign companies have also invested in the U.S. economy and located their plants here. For example, major foreign automobile manufacturers such as Toyota and BMW have set up manufacturing plants in the U.S. and created numerous U.S. jobs. Also, over the last 25 years, the U.S. economy has experienced unprecedented productivity growth due to the increase in trade from globalization. The net impact of this productivity growth as measured in output per hour has been such as to increase the inflation-adjusted worker compensation. Thus, while critics of globalization look at only one side of the picture and point to job losses due to outsourcing, they neglect to take into account the job creation due to foreign investment in the U.S. and the increase in trade due to globalization. Critics also ignore the fact the increased opportunities for trade due to globalization result in high-value-added services being performed in the U.S. and the increase in productivity of the U.S. worker. As a result, worker wages have also gone up. 4. What are the various reasons for the emergence of multinational firms? SEARCH FOR RAW MATERIALS. Some firms become MNCs to exploit the raw materials that can be found overseas, such as oil, coal, minerals, and other natural resources. MARKET SEEKING. Some firms become MNCs to exploit foreign markets for their products. Since the same product may be demanded in different countries, MNCs not only take advantage of the marketing opportunities, but also gain from the economies of scale obtained by selling large volumes across different foreign markets. COST MINIMIZATION. Companies also become MNCs to seek out lower-production-cost sites. Specific skills needed for production may be available at lower costs in some countries, and MNCs may locate plants specializing in specific aspects of production, such as assembly or fabrication, in those countries. KNOWLEDGE SEEKING. Some firms enter foreign markets to gain information and experience that are expected to prove useful elsewhere. Especially in industries characterized by rapid product innovation and technical breakthroughs, firms obtain technical product and process knowledge, which they leverage in other countries. 2 INSTRUCTORS MANUAL: FOUNDATIONS OF MULTINATIONAL FINANCIAL MANAGEMENT, 6TH ED. KEEPING DOMESTIC CUSTOMERS. Suppliers of goods or services to MNCs often follow their customers abroad to guarantee them a continuing product flow. In the process, these firms also become MNCs. EXPLOITING FINANCIAL MARKET IMPERFECTIONS. Companies may find it advantageous to reduce taxes and circumvent currency controls when operating in multiple foreign markets. Doing so enables them to obtain greater project cash flows and lower costs of funds compared to a purely domestic firm. 5. Given the added political and economic risks that appear to exist overseas, are MNCs more or less risky than purely domestic firms in the same industry? Consider whether a firm that decides not to operate abroad is insulated from the effects of economic events that occur outside the home country. Individual foreign projects may face more political and economic risks than comparable domestic projects. Yet MNCs are likely to be less risky than purely domestic firms because much of the risk faced overseas is diversifiable. Moreover, by operating and producing overseas, the MNC has diversified its cost and revenue structure relative to what it would be if it were a purely domestic firm producing and selling in the home market. It is important to note that domestic firms are not insulated from economic changes abroad. For example, domestic firms face exchange risk because their competitive positions depend on the cost structures of both foreign and domestic competitors. Similarly, changes in the price of oil and other materials abroad immediately lead to changes in domestic prices. 8. What are the various ways in which domestic firms enter international markets? What are the benefits and risks of each strategy of foreign market entry? Entry Exporting Benefits Minimal capital requirements and start-up costs Relatively low risk compared to other entry strategies Risk is low Full sales potential of the product is not realized Profits are immediate Licensing Risks Learn about present and future supply and demand, competition, distribution channels, payment conventions, financial institutions, and financial techniques in host country Foreign importer is in greater control of marketing, and thus the image, of the firm’s branded products in the foreign country Minimal investment requirements Cash flow is relatively low Faster market-entry time May be problems in maintaining product quality standards Fewer financial and legal risks Foreign licensee may engage in unauthorized exports of the firm’s products, resulting in loss of future revenues for the licensing firm Foreign licensee may become a strong competitor when license agreement ends Overseas Production The firm can more easily stay abreast of market developments, adapt its products and production schedules to changing local tastes and conditions, fill orders faster, and provide more comprehensive after-sales service Firm can exploit local skills, including R&D Signals a greater commitment to the local Tremendous capital and top management commitment is required Financial and operational risks are greater than those for other entry strategies Companies face greater political risks, including the risk of expropriation of plants and facilities CHAPTER 1: INTRODUCTION 3 market, which in turn increases sales and assurance of supply stability 10. What factors help determine whether a firm will export its output, license foreign companies to manufacture its products, or set up its own production or service facilities abroad? Identify the competitive advantages that lead companies to prefer one mode of international expansion over another. i) PRODUCTION ECONOMIES OF SCALE. If these are important, then exporting might be appropriate. ii) TRADE BARRIERS. Companies that might otherwise export to a market may be forced by regulations to produce abroad, either in a wholly owned operation, a joint venture, or through a licensing arrangement with a local manufacturer. iii) TRANSPORTATION COSTS. These have the same effect as trade barriers. The more expensive it is to ship a product to a market, the more likely it is that local production will take place. iv) SIZE OF THE FOREIGN MARKET. The larger the local market, the more likely local production will take place, particularly if significant production economies of scale exist. Conversely, with smaller markets, exporting is more likely to take place. v) PRODUCTION COSTS. The real exchange rate, wage rates, and other cost factors will also play a part in determining whether exporting or local production takes place. vi) INTANGIBLE CAPITAL. If the MNC’s intangible capital is embodied in the form of products, exporting will generally be preferred. If intangible capital takes the form of specific product or process technologies that can be written down and transmitted objectively, foreign expansion will usually take the licensing route. If intangible capital takes the form of organizational skills that are inseparable from the firm itself, then the firm is likely to expand overseas via direct investment. vii) NECESSITY OF A FOREIGN MARKET PRESENCE. By investing in fixed assets abroad, companies can demonstrate to local customers their commitment to the market. This can enhance sales prospects. 1.a. What are the various categories of MNCs? Raw materials seekers, market seekers, and cost minimizers. 8.a. Are MNCs riskier than purely domestic firms? Although MNCs are confronted with many added risks when venturing overseas, they can also take advantage of international diversification to reduce their overall riskiness. We will also see in Chapter 16 that foreign operations enable MNCs to retaliate against foreign competitive intrusions in the domestic market and to more closely track their foreign competitors, reducing the risk of being blindsided by new developments overseas. 9. Is there any reason to believe that MNCs may be less risky than purely domestic firms? Explain. ANSWER. Yes. International diversification may actually enable firms to reduce their total risk. Much of the general market risk facing a company is related to the cyclical nature of the domestic economy of the 4 INSTRUCTORS MANUAL: FOUNDATIONS OF MULTINATIONAL FINANCIAL MANAGEMENT, 6TH ED. home country. Operating in a number of nations whose economic cycles are not perfectly in phase may, therefore, reduce the overall variability of the firm’s earnings. Thus, although the riskiness of operating in any one country may exceed the risk of operating in the U.S. (or other home country), much of that risk is eliminated through diversification. In fact, as shown in Chapter 15, the variability of earnings appears to decline as firms become more internationally oriented. SUGGESTED ANSWERS TO APPENDIX 1A QUESTIONS 3. Given the resources available to them, countries A and B can produce the following combinations of steel and corn. Country A Country B Steel (tons) Corn (bushels) Steel (tons) Corn (bushels) 36 0 54 0 30 3 45 9 24 6 36 18 18 9 27 27 15 12 18 36 6 15 9 45 0 18 0 54 3.a. Do you expect trade to take place between countries A and B? Why? ANSWER. Yes. Given the data presented, if country A has 6 units of resources and it devotes X of these units to steel production, where X is an integer, it can produce a total of 6X tons of steel and 3(6 - X) bushels of corn Similarly, with 54 units of resources, country B of which it devotes Y units to steel production, it can produce Y tons of steel plus (54 - Y) bushels of corn. The net effect of these production functions is that one bushel of corn is worth 2 tons of steel in country A. In contrast, one bushel of corn is worth only one ton of steel in country B. These relative prices indicate that country A has a comparative advantage in the production of steel, whereas B has a comparative advantage in the production of corn. 3.b. Which country will export steel? Which will export corn? Explain. ANSWER. Given these comparative advantages, A will export steel and B will export corn. The price of corn will settle somewhere between one and two tons of steel. Suppose it settles at 1.5 tons of steel. Then, instead of producing, say, 30 tons of steel and 3 bushels of corn, it can devote an additional resource unit to the production of an additional 6 tons of steel. It can trade these 6 tons of steel with B for 6/1.5 = 4 bushels of corn, leaving it one bushel of corn better off. Similarly, B can now get 6 tons of steel for the 4 bushels of corn it trades to A instead of the 4 tons of steel it could produce on its own with the resources it took to produce the 4 bushels of corn.