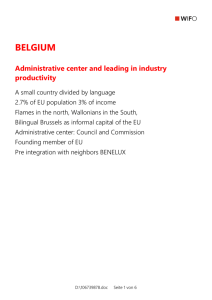

Folie mit WIFO-Logo - of Prof Karl Aiginger

advertisement

AUSTRIA From technology import to a top 5 economy Small country geographically in the center In a divided Europe a bridge to the East Largest border with accession countries 2% of population, 2½ of EU-GDP Well known for Alps, tourism, culture Large and efficient manufacturing sector EU-membership 1995 Starting from a moderate position in the fifties/sixties Due to civil war and stagnation in period between WWI and WWII Surpassed EU average in 1971 GDP per capita 2000: 25.000 EURO 11% above EU 4th after DK, IRE, NL; (5th if Luxembourg is ranked) 5% higher than in Germany 9% higher than in Italy GDP per hour 2nd after Denmark D:\106737895.doc Seite 1 von 13 Macroeconomic performance Growth of GDP 1990/2000: 2.3% (EU 2.1%) employment rate 2000: 73% (EU 65%) unemployment rate 2000: 3.7% (EU 8.2% low inflation rate 2000: 2.3% (EU 2.7%) industry growth 90/2000 3.8% (EU 3.3%) productivity growth in manufacturing 5.4% (higher than in US: 4.2%) productivity acceleration in the nineties Income distribution: lowest spread low/high incomes: 1 : 4.4 Ecological indicators: top 3 position with Denmark and Sweden Social expenditures GDP: 28% (EU 27%) Excelling in low unemployment, industry dynamics and equity Growth differential fades away in 90s Specifically low growth of output in “non-manufacturing” sectors: utilities, construction, services D:\106737895.doc Seite 2 von 13 The policy framework Social partnership: continental style Government focus on macro management High but declining share of nationalized firms Focusing on security and stability Internationalization guarantees technology import and toughness of competitive Internal financing (out of retained earnings) Inadequate capital market Lack of venture capital and fast growing small firms Deficit in merchandise trade and outward FDI Few large firms, inadequate capital market Major investor in accession countries D:\106737895.doc Seite 3 von 13 Social partnership Broad and comprehensive system of social security Paid by taxes/ employers and employees Strong influence of trade unions and employers federation on all economic questions incl. training, health, media, culture Macroeconomic orientation: stability, productivity internationalization upgrading of locational advantages History: after confrontation (“class struggle”) between the wars Strong informal cooperation between 4 interest groups Social partnership with centrally coordinated institutions Chambers of Commerce, Agriculture, Labor, Trade Union “chambers” are representative organizations with compulsory membership 1948 – 1960: moderation of price and wage increases wage council coordinated wage negotiation price commission set price ceilings (dependant on cost increase) Regimes changes parallel to internationalization labor markets: stepwise more flexible industrial policy: from subsidies to technology promotion competition policy; still lenient and favoring size entry: accompanied with administrative and financial burdens Social partners finally lobbied for EU membership Putting the macro perspective ahead of vested interests D:\106737895.doc Seite 4 von 13 Elements of the Austrian model Favoring change in existing structures Low entry and low death of firms Insider advantages, low mobility Internal financing (out of retained profits) and credits instead of capital market Hierarchical carriers, steep income growth with age Low entry rates, low exit rates Low market capitalization/GDP ratio Insufficient venture capital Open economy, focus on productivity Membership in EFTA 1960-1994 Membership in EU 1995 Supporting opening of borders to transition countries EURO since 2002 Open to FDI (net importer) Subsidies contingent on productivity change Competition policy, Competitiveness, dynamics Mergers more favored than restricted Soft competition policy State owned and regulated utilities Productivity oriented incomes policy Price and Wage controls up to eighties Large differences of wages across industries Nationalized industries up to nineties D:\106737895.doc Seite 5 von 13 Growth drivers High savings/ investment ratio (2nd after Portugal) Highest relation physical vs. intangible investment Research/GDP: catching up to EU average: 1.95% in 2002 below that of countries at the same income level Relying on South Germany and North Italy fir research base Low position in patents publication Rank 7-9 in innovation ratings High expenditures on education Excellent vocational training (schools + firms) Below average rate of secondary education Deficit in university degrees/work force Small proportion of scientists among third degrees Medium position in ICT Small share of production High share of mobile telephones and internet use D:\106737895.doc Seite 6 von 13 Manufacturing: the growth structure-paradox (Peneder 2001) Competitive strength 4th largest share of manufacturing in GDP Higher growth in output and productivity Productivity level 2nd position in Europe Exports rise from 2.2% (1985) to 3.0% of European market Traditional structure High share of labor and capital intensive industries Low share of technology driven and high skill industries Largest industry: machinery Traditional strength Wood paper cluster Steel/metals New strengths Pharmaceuticals Plastics Publishing Telecom equipment Vehicle parts for European and US car manufacturers Upgrading quality in existing industries Share of exports in highest quality segment 3rd position in EU incremental innovation (often in small/medium firms) D:\106737895.doc Seite 7 von 13 Privatization of a large nationalized industry About one fourth of manufacturing nationalized State owned or owned by nationalized banks “German property” without owners in 1945 Some of large firms were built in the “Deutsches Reich” Nationalized industry was first successful at the start Rebuilding and expansion of capacities Technological frontier Increasing sales Crisis with structural change in sixties Instrument to stabilize employment in the seventies Cyclical losses, later structural losses and finally Breakdown at beginning of the nineties Privatization 1993 Holding company restructured Selling of majority of all companies demanded Flexible privatization regime with the goal of optimizing Revenues, expected value added and Domestic employment Result: headquarters of large firms remained in Austria Small and medium sized firms private or part of multinational firm D:\106737895.doc Seite 8 von 13 Nationalized industry: status 2002: Government has minority share (about 25%) in four companies OMV (35%, syndicates with an firm from Abu Dabi) VA Stahl, a former basic steel company now focusing On flat steel e.g. for car industry BUAG Boehler Uddeholm a merger of a Austrian and Swedish Company producing speciality steel VA Tech an engineering company Banks: the 2 largest banks were merged and then sold to German Bank (Landesbank) Now a regional player under the name of Bank Austria Telekom Austria: after a minority holding of Telecom Italia and a public offering (one fifth of the shares) government owns involuntary ¾ again Intention to sell these shares to a strategic investor The same hold for the mobile telecom subsidiary (which is the largest of four main players) Largest firms OMV Oil gas Erste Bank BML VA Tech Telekom Austria Banking incl. Leading banks in Czech Republic, Croatia Retail Special steel products Telecom Inward FDI much larger than outward Siemens, Philips, Steyr-BMW, Chrysler have large subsidiaries in Austria D:\106737895.doc Seite 9 von 13 Macro economic policy: Austro Keynesianism Demand management plus incomes policy plus hard currency policy A consensus that government has a role in dampening cyclical fluctuation Fiscal policy has to increase spending More than by automatic stabilizers Monetary policy has to stabilize specifically In case of overheating Incomes policy guarantees wage restraints And dampens price increase Hard currency policy underscores price stability And presses for structural change System is intensively discussed and has been scrutinized by many agencies (OECD) and economists Because of Austria's ability to match Growth, full employment and low inflation To some extent: Similar problems as in other countries Asymmetry of good times/bad times (increasing debts) Decreasing impact in an internationalized economy Rising inefficiency in sheltered sectors Over-capacities in construction Insufficient incentives for structural change and growth However: flexible policy mix successful for a long time leading to a top 5 position D:\106737895.doc Seite 10 von 13 Status 2002: A successful model on a cross road Some elements of past success fade away Cost position Wages still not high, but higher than EU average Tax rate 45% (4 points above EU) Dampening of cycles more difficult in globalized markets Import of technology via FDI no longer feasible for High productivity country Determinants of long run growth partly insufficient Research Education Technology driven industries ICT Capital market Entry and high growth of new firms Accession/transition countries Low cost competitor Advantage for Austria: fast growing neighbor markets Chance for outsourcing: combining cheap inputs with Sophisticated manufacturing and value added by services D:\106737895.doc Seite 11 von 13 Overall evaluation Successful combination of growth Stability, equity, social and environmental concerns To an increasing extent at the cost of dynamics and change Liberalization, deregulation, flexibilization, privatization had been pursued less rigorously and with some bias towards insiders steering capacities for crises and dampening of shocks Insufficient investment into future growth The challenge is to increase dynamics without loosing all the favorable consequences of consensus and stability D:\106737895.doc Seite 12 von 13 References Peneder, M. (co-ordinator), Structural change and economic growth, Reconsidering the Austrian "old-structures/high-performance" paradox, Study by the Austrian Institute of Economic Research commissioned by the Federal Ministry of Economics and Labour, June 2001. Aiginger, K., Europe's Position in Quality Competition: Working Paper and Background Paper for the Report in the Competitiveness of European Manufacturing, DG Enterprise, Brussels, 2000. Aiginger, K., "The privatisation experiment in Austria", in Parker, D. (ed.), Privatisation in the European Union, Theory and Policy Perspectives, Routledge, London, New York, 1998, pp. 70-87. Marterbauer, M., The loss of the positive growth margin, macroeconomic performance of Austria from 1970 to 1999, in Peneder, M. (coordinator), Structural change and economic growth, Reconsidering the Austrian "old-structures/high-performance" paradox, June 2001. D:\106737895.doc Seite 13 von 13