September 8, 2005 ECONOMY Katrina Stirs Up Rate Dilemma As It

September 8, 2005

ECONOMY

Katrina Stirs Up Rate Dilemma

As It Hits Growth, Lifts Prices

By GREG IP

Staff Reporter of THE WALL STREET JOURNAL

September 8, 2005; Page A2

Less than five months from retirement, Federal Reserve Chairman Alan

Greenspan faces an unusually delicate challenge in deciding whether Hurricane

Katrina should force a pause in the Fed's 14-month campaign to raise interest rates.

The storm has hurt near-term economic growth prospects, which normally would call for lower interest rates, but it also has elevated prices and potential inflationary pressure, which normally would call for higher interest rates. The question facing Mr. Greenspan and his colleagues is: Which is the dominant concern?

CAST YOUR VOTE

1

How should Federal Reserve policy makers adjust the federal-funds rate at their next meeting? Vote in the Question of the Day 2 .

Fed officials say they will see how markets and the economy behave between now and their next meeting on Sept. 20 before deciding what action to take. Before Katrina, markets had assumed the Fed would raise short-term interest rates for the 11th consecutive time by a quarter of a percentage point, from 3.5%. Now, though, markets see some possibility that the Fed will pause in its rate-increase campaign, though they put the odds at less than 50%.

Fed officials haven't ruled out a pause but disagree with some of the rationales

circulating on Wall Street. They dispute that raising rates would appear unseemly so soon after a national tragedy. They agree there will be a hit to economic growth, but some also believe inflationary pressures will be aggravated by higher energy prices.

But officials also believe that if they pause, they can use the accompanying statement to keep the option of resuming rate increases on the table.

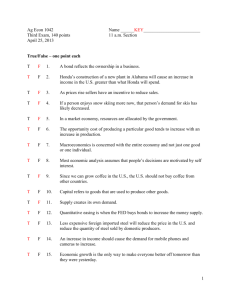

In a survey of forecasters by WSJ.com to be released today, 15 economists say the

Fed should stop raising rates in light of

Katrina, and 35 say it shouldn't.

Some of those expecting a pause say it would seem heartless to raise rates so soon. The Fed "may simply feel that it is inappropriate to take a business-as-usual approach," Goldman Sachs economists wrote in a note to clients this week.

Some congressmen also have urged the Fed to let up. "Given the economic uncertainty and negative impact of the Katrina catastrophe, it would be reasonable for the Fed to pause, evaluate the upcoming economic data, and reappraise the timing of any future rate increases," Rep. Jim Saxton, New Jersey

Republican and chairman of the Joint Economic Committee, said in a statement.

But several Fed officials reject this argument. They believe it is a mistake for the

Fed ever to subordinate its goals of low inflation and maximum growth to political considerations. Moreover, they fear that pausing for noneconomic reasons actually could undermine confidence by suggesting the Fed is more worried about the economy than it actually is.

There is little doubt overall economic output will take a sizable hit in coming months. The Congressional Budget Office estimates Katrina will knock half to one percentage point, at an annual rate, off second-half growth this year and wipe out 400,000 jobs. Fed officials say there may be additional effects if sharply higher gasoline prices seriously erode consumer confidence. They will have little firm data on Sept. 20, and pausing would give them time to collect some. Some officials say they could give that as a rationale in the accompanying statement, while signaling an intention to keep raising rates once they're confident the impact is transitory. If the pause turns out to have been unnecessary, the Fed could make up for it with half-point rate increases later.

Moreover, officials are likely to take comfort in the fact that the behavior of

inflation-index bonds suggests investors see no lasting effect on inflation from the recent energy-price jump. "This weakens the arguments by some that the inflationary consequences of Katrina will prevent the FOMC from pausing," said

Brian Sack, an economist at economic advisory Macroeconomic Advisers LLC, referring to the Fed's policy-making Federal Open Market Committee.

Yesterday, the Labor Department delivered mixed news on the inflation front. It said that productivity, or output per hour, rose at just a 1.8% revised annual rate in the second quarter, low by recent standards. Higher productivity growth enables companies to increase sales without additional labor costs. But it also found that productivity excluding financial companies and unincorporated businesses rose a hefty 6.8%.

But for some Fed officials, Katrina merely has amplified concerns they already had that higher energy prices were working their way into underlying inflation.

While higher oil prices might reduce growth, "there is also a risk on the inflation front, and the risk is higher now than it was a year ago," Federal Reserve Bank of

Chicago President Michael Moskow said yesterday. With the economy running close to capacity, businesses are more likely to pass higher energy costs on to other goods and services, he told the Futures Industry Association in Chicago yesterday. If inflation accelerates, it could become embedded in workers' and companies' wage-and-price behavior, he said. "The Fed would need to respond accordingly in order to restore price stability."

Write to Greg Ip at greg.ip@wsj.com

3

URL for this article: http://online.wsj.com/article/0,,SB112613713904034684,00.html

Hyperlinks in this Article:

(1) mailto:greg.ip@wsj.com

Copyright 2005 Dow Jones & Company, Inc. All Rights Reserved

This copy is for your personal, non-commercial use only. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. For nonpersonal use or to order multiple copies, please contact Dow Jones Reprints at 1-800-

843-0008 or visit www.djreprints.com

.