1201019

1

3

RISK FACTORS INFLUENCING INTERNATIONAL

2

FUNDED PUBLIC INFRASTRUCTURE PROJECTS IN

THAILAND

4

5

6

Running head: Risk factors influencing international funded public infrastructure projects in Thailand

7

Borvorn Israngkura Na Ayudhya

8

10

9 Department of Civil Engineering, Rajamangala University of Technology

Krungthep, 2 Nanglinchee, Sathorn Tungmahamaek, 10120, Bangkok,

Thailand. E-mail: borvorn.i@rmutk.ac.th, ayudhya2003@yahoo.com 11

12

13

14

Abstract

15 Risks associated with the construction of international funded public projects

16 in Thailand are determined. A face-to-face interview technique was used in a

17 field survey of 120 public infrastructure projects. The interviews focused on

18 39 factors grouped into seven categories: estimator, project, competition,

19 fraudulent practices, construction, economic and political. The survey

20 revealed critical risk factors influencing success of project delivery were

21 adjustment and anchoring, delay in payments, civil disorder, political

22 instability, market conditions, influence of power groups, fluctuation in labor

23 cost and materials, project complexity, exchange rate and motivational

1

24 biases. Minimal risks in international funded public projects would require

25 transparency in evaluation of estimators, familiarity in overseas

26 disbursement procedures, adequate skilled staff, selection of a competent

27 consultant and a reliable contractor.

28

29 Keywords: International risk, public work, Thailand

30

31

Introduction

32 Construction organizations are vulnerable to numerous risks. It is inevitable to

33 avoid influences by surrounding environments. International funded public

34 infrastructure projects in particular are exposed to international-domestic

35 economy social and domestic political risk (Walewski and Gibson, 2003).

36 Completion of project relies on the decision making of key persons in the process

37 of analyzing risks. The decisions require expertise knowledge of the global

38 financial market and prior knowledge of national, regional and global economic

39 prospects (Yates, 2007). The strength of national economies, exchange rates and

40 currency controls are vital factors that need to be understood and taken into

41 consideration in strategic decision-making in international construction projects

42 (Kapila and Hendrickson, 2001). Similar studies have been reported in Nigeria

43 (Aibinu and Odeyinka, 2006), Vietnam (Long et al ., 2004) and Malaysia (Lim and

44 Mohamed, 2000). Thailand is still recognized by World Bank as one of several

45 South-East Asia recipient countries. Large and complex infrastructure projects

46 still need financial and assistance from international financial institutions and

2

47 agencies (PDMO, 2011). In 2005, Thailand received an official development fund

48 from World Bank and JBIC of US$ 84.29 millions and US$ 1,956.82 millions

49 respectively. With these amounts, 88% of loan went to transportations projects,

50 5% energy projects and 4% potable water projects (PDMO, 2005). Factors

51 influencing bilateral and multilateral agencies investment decisions with

52 international capital facilities can be complex and vary significantly from region

53 to region and project to project. Han et al . (2008) reported that risk factors

54 associated with overseas construction projects could diminish project profitability.

55 Kangari and Lucas (1997) also mentioned that client communication,

56 understanding new market, avoiding local politics and supervising the diverse

57 group of professionals were major causes leading to failure in the international

58 project success. Similarly, Will and Levitt (2010) reported an increasing of

59 misunderstanding, delay and costs resulting from unfamiliar environment and

60 different institution such as regulations, norm, and cognitive-cultural belief with

61 diverse participant are critical factors. For a decade, construction practitioners

62 have introduced several conceptual frameworks of procurement (Ahmad, 1990;

63 Cheung et al ., 2003; Eriksson and Westerberg, 2010). However, contractors still

64 take a greater proportion of the risks. These risks were transferred from owner to

65 contractor, most of which would have traditionally been taken by the client

66 (Eriksson and Laan, 2007). It requires an effort and support from the legal, design

67 and construction team in order to minimize the dispute, claims and delays among

68 construction teams. It is imperative to understand the underlying such risks for

69 any corrective actions to be effective. Therefore, this research identified and

3

70 evaluated the common risk factors in international funded public projects from the

71 viewpoint of construction practitioners. The severity index method was used to

72 evaluation the risk factors. Spearman’s ranking technique was employed. The

73 present’s results aim to add relevant knowledge to construction practitioner

74 concerns and decisions which affect success of project in international funded

75 public projects in Thailand.

76

77

Literature Review

78 In developing countries, it is likely that large projects will be from several sources,

79 since government funds are invariably inadequate. It is common practice for the

80 governments of the countries to seek aid from external sources. Construction

81 activities in developing countries such as Thailand can be affected by fluctuation

82 in foreign exchange rates, governmental exchange controls and many other risks

83 associated with undertaking work in a foreign country (Israngkura Na Ayudhya,

84 2006). The risks influence the international construction projects from the bidding

85 stage through to project completion (Ogunlana et al ., 1996; Raftery et al ., 1998;

86 Wang, 2000; Chan, 2001). These risks can be legal requirements, construction

87 systems, technology and management techniques (Dikmen et al ., 2007). By

88 concentrating on the lowest bidder offer, owner aims to tender the contractor who

89 performs the work at the lowest cost. Consequencely, this increases the risk of

90 cost and schedule growth due to a higher number of change orders (Assaf and Al-

91 Hejji, 2006; Wardani et al ., 2006). The projects that fail to meet scope, budget and

92 schedule can result in a host of impacts with serious economic, social and political

4

93 ramifications. Therefore, the success of contractor can hinge on an understanding

94 of the risks associated with such projects. Dikmen and Birgonul (2004) report that

95 contractors face less difficulties when they have a more comprehensive

96 understanding of the commercial, political, construction and operations

97 uncertainties and risks with the projects. Naturally, owners tend to choose familiar

98 procurement procedure and a habit of using, regardless of any differences between

99 projects (Love et al ., 2005). However, international funded projects oblige an

100 international recognition procurement procedure. Construction practitioners of

101 recipient countries feel unconfident of how to use it and have negatives attitudes

102 towards its effect on outcomes (Tysseland, 2008). Moura (2003) reported that

103 increase of claims and disputes in public construction projects bring up negative

104 effects to project management. (Toor and Ogunlana, 2008) mentioned that lack of

105

106 resources, poor contractor management, shortage of labor, design delays, planning and scheduling deficiencies, changed orders and contractors’financial difficulties

107 are problems causing delays in major construction projects in Thailand.

108 Additional, Matijevic (2008) reported that distinctive problems that cause disputes

109 in international construction projects included negotiations, litigation with expert

110 analysis and domestic or international arbitration. Many contractors are unfamiliar

111 with risk factors in international funded projects and also lacking experiences and

112 knowledge in manage risks, which lead to failed-delivery works. Therefore,

113 construction practitioners including the owner, consultant and main contractor

114 should fully understand the risk impact that they know how to avoid risks in a

115 way that agreed completion of project can be delivered. In this study, main groups

5

116 of international funded public projects risk factors were identified through the

117 extensive literature review, preliminary reports and discussions with construction

118 practitioners. The key objective of the study was to identify the risks frequently

119 occur during construction phase in owners, consultants and main contractors’

120 perspectives. The risk factors were categorized into seven main risk groups:

121 estimator-related, project-related, competition-related, fraudulent practices-related,

122 construction- related, economic-related and political-related.

123

124

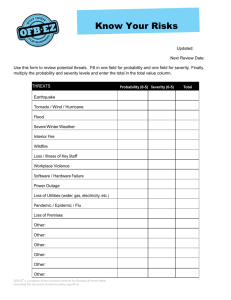

Method

125 In this study, risk factors were identified from a combination of literature review

126 and field survey. The face-to-face interview technique was used in the field

127 survey. The fifteen construction practitioners (owners, consultants, and main

128 contractors) help in identification of risks in international funded projects. The

129 purpose of the interviews was to validate a preliminary set of construction risk

130 causes gleaned from the literature and to determine from their experiences other

131 factors which cause construction dispute, delay and claim on international funded

132 projects. This phase resulted in identification of seven main risk group and thirty-

133 nine (39) risk factors. The development of questionnaire was based on the

134 literature review and experiences of construction practitioners including academic

135 lecturers. In the distribution and collection of questionnaire stage, the

136 questionnaires were dispensed to each group of the respondents: owners,

137 consultants and main contractors. The questionnaires were hand-delivered to

138 minimize low responses. Furthermore, face-to face interview technique was also

6

139 used for twenty interviewees. The interviewees were randomly selected among

140 construction practitioners in related projects. The interviewees were asked to

141 provide their individual perceptions by rating each risk factor on how

142 international funded risk factors affected project performance within their projects.

143 The interviewees stated their point of views as the probability of occurrence of

144 risk and the severity of risk in the form of 5 level scale (seldom, not often,

145 moderated, often and very often) and (none severe, fairly severe, moderately

146 severe, severe and most severe) respectively. The survey resulted were analyzed

147 by using the severity index approach. Based on the responses to the survey, a

148 severity index was calculated to interpret the degree of seriousness effect of the

149 risks. This index was calculated as follows (Babbie, 2009)

150

151

Severity index ( SI )

( i

0

( 4

( a i

)( x i

) x i

)

100

152 where

153 a i

= constant expressing weight given to i th response: i = 0,1,2,3,4

154 x i

= variable expressing frequency of i

155 The response for I = 0, 1, 2, 3, 4 illustrated as follows:

156 x

0

= frequency of very often response and corresponds to a

1

= 4;

157 x

1

= frequency of often response and corresponds to a

2

= 3;

158 x

2

= frequency of moderate response and corresponds to a

3

= 2;

159 x

3

= frequency of not often response and corresponds to a

2

= 1;

160 x

4

= frequency of seldom response and corresponds to a

1

= 0;

161

(1)

7

162 The calculated severity index was categorized into five levels (Babbie, 2009). The

163 0-15.5% was categorized as none severe, 15.5-38.5% fairly severe, 38.5-63.5%

164 moderately severe, 63.5-88.5% severe, and 88.5-100% most severe. The severity

165 index of a category was the average severity indexes of all its related problems.

166 The results of the survey are shown in Table 4.

167

168

Rank Agreement

169 In order to measure the agreement in the quantitative ranking between different

170 groups of participant, rank agreement was used for any two groups which showed

171 the average absolute difference in the factors. The spearman’s rank correlation,

172 coefficient, r s

was used to measure the degree of agreement in the ranking of

173 owners and main contractors. The significance level was at 5%. The coefficient

174 was computed as follows:

175

176

177 r s

1

6

N ( N d

2

2 1 )

178 where

179 r s

= Spearman’s rank correlation coefficient.

(2)

180 d = The difference in ranking in international funding projects, and

181 N = The number of variables, equals to 39 and 7 for all the risk factors and the

182 main risk groups of international funded projects, respectively.

183

8

184 Several studies have classified the risks in international projects. The literature

185 review and the interviews with the construction practitioners in the related area of

186 study resulted in the identification of 39 common risk factors. The identified

187 problems were classified into seven main groups. The grouping of the main risks,

188 was recommended by Balio and Price (2003) in global risk classification.

189

190 Table 1 Questionnaire return rate

191 Table 2 Profiles of financial sources

192 Table 3 Comparison severity index factors in international funded projects

193 Table 4 Comparison of ranking of main risk group

194 Table 5 Ranking the ten highest risk factor agreed by construction practitioners

195 Table 6 Comparison spearman rank correlation in risks on international funded

196 projects

197 Table 7 Comparison results with other studies for source of global risks

198

199

Results and Discussions

200 The responses of the questionnaire were analyzed, organized, summarized and

201 tabulated. Preliminary data analysis of international funded risk factors involved

202 calculation of averages, measures of dispersion and severity index. Considering

203 the above-mentioned risk factors between construction practitioners, Table 1

204 presents the survey results on type of organization with their response rate. The

205 total rate of return was 64%. The owners returned questionnaire with the return

206 rate of 78% whilst domestic and international main contractor returned

9

207 questionnaires with the rates of 53 and 89% respectively. The evaluation of

208 overall return rate was considered as good (Babbie, 2009). He suggested that any

209 rate of return over 50% can considerably be reported, while the overall value

210 above 60% can be mentioned as good. In Table 2 shows type and number of

211 international funded projects from where the data were collected. Comparison

212 severity factors in international funded projects and comparison of ranking of

213 main risk groups are shown in Tables 3 and 4 respectively. These profiles

214 indicated that risks in international funded projects were fairly common in

215 Thailand. The construction practitioners have different expectations and their

216 perspectives of risk in international funded projects under various sources of fund.

217 In Table 5 shows ten highest severity index factors agreed by construction

218 practitioners. Table 6 shows the comparison spearman rank correlation on risks in

219 international funded public works projects. In Table 7 shows various identified

220 international risk categories from other researchers. Based on the surveyed and the

221 severity index analyzed thereof, the following conclusion could be drawn. The

222 results from rank correlation analysis suggested from 120 cases that there were a

223 strongly disagreement between owner-consultant perception (12% agreement) on

224 main risk groups while owner-main contractor perception and consultant-main

225 contractor were rated as acceptable (43%) and disagreement (36%) respectively.

226 Ranks correlation on all risk factors were shown positive for owners and

227 consultants (42%), owners and main contractors (66%) and consultants and main

228 contractors perception (79%). However, it was found from Table 5 that

229 international funded projects affected from these seven main risk groups at

10

230 average level of severity index of 62.2%. It was categorized as moderately severe

231 level. It was further found that estimator related group was rated as the highest

232 overall severity of main risk groups. It was also found that adjustment and

233 anchoring factor was the most serious risk factor that affects project performance.

234 This might be results of bureaucratic transparency and shortage of experienced

235 engineers which lead to unclear judgement that can be subject to errors, biases and

236 heuristics. Furthermore, interviewees mentioned that public owner had highly

237 bureaucracy, negative attitude, technical, managerial and organizational

238 incompetency of main contractor.

239

240

Estimator Related Risk Group

241 Table 3 shows that foundation work in the construction of the frame and the

242 enclosure, in the utilization of spaces such as method and materials and the

243 required end were common places in which estimating were errornous.

244 Interviewees mentioned factors affecting the accuracy of evaluating and

245 estimating was variability of lowest tenders, the source of cost data used in

246 estimating, the inherent error attached to the estimating technique and the in

247 suitability of cost data. Interviewees agreed that using previous cost data from

248 projects where quantity surveyors had experiences and using single source of cost

249 data was likely to improve the accuracy of cost estimates. Furthermore, a common

250 issue that often arose during the interview sessions was motivational biases when

251 superiors and subordinated. Many times subordinated were afraid to speak their

252 opinions out of fear of contradicting or embarrassing their bosses, which could

11

253 negatively affect their position or future prospects within organization. Similarly,

254 author witnessed numerous instances where expert consultants are unwilling to

255 challenge the assumptions of their clients for fear of jeopardizing current or future

256 work.

257

258

Project Related Group

259

260

It was found from the construction practitioners that engineering and construction complexities caused by project’s location or early design work led to internal

261 coordination errors between project components. Internal coordination errors

262 caused conflicts and problems between persons involved in the planning and

263 design of a project. Due to the overall scope vagueness , the accumulation of many

264 minor scopes changes to increased. While individual scope changes had only

265 minimal cost effects, the accumulation of these minor changes, which were often

266 not essential to the intended function of the facility, could result in a significant

267 cost increase over time. However, projects seem to often grow naturally as the

268 project progresses from inception through development to construction.

269

270

Competition Related Group

271 Construction practitioners admitted to worry on the threat of new entrants and

272 bargaining power of buyers and suppliers. The interest of construction companies

273 in cost-cutting increased because of the decreasing profit margins or fees for this

274 kind of contract. The advent of increasing competition prompted construction

275 companies to seek greater equity-risk sharing by alliances in construction industry.

12

276 This allowed financially stable construction firms to expand into new markets.

277 Market conditions could affect the costs of a project, particularly large projects.

278 The interviewees mentioned that the size of the project affected competition for a

279 project and the number of bidders that government agencies received for the work.

280 Inaccurate assessment of the market conditions could lead to incorrect project cost

281 estimation. Similarly, several researchers have been found that changing market

282 conditions during the development of a project can reduce the number of bidders,

283 affect the available labor force, or result in increased commodity prices, all of

284 which can disrupt the project schedule and budget (Chang, 2002; Woodrow

285 Wilson Bridge, 2002; Pearl, 2004).

286

287

Fraudulent Practices Related Group

288 Construction practitioners mentioned that there were still fraudulent practices in

289 construction projects. It could be listed down from false application for the

290 payment, change order manipulation, billing for work not performed, diverting

291 purchases, non-payment of subcontractors and material suppliers to theft of

292 equipment/tools. Fraud could be committed by contractor employees, owner

293 employees, contractors, subcontractors, consultants and participants in successful

294 and unsuccessful projects. This kind of fraudulent practices can damage the

295 construction cost and performance of the project. The construction practitioners

296 also mentioned that it was inevitably to eliminate any kind of fraudulent practices

297 even though frequent checking and further tighten monitoring policies were

298 implemented. Additional to large and/or complexity of projects, the inter-

13

299 relationship between the various parties to the contract and events was often

300 uncertain. In many cases, involved persons working on a project disagreed on

301 discussed matters. This made it easier to blame other participants for problems. It

302 created a reason to pay a bribe, as decisions on cause and effect and their cost

303 consequences could have enormous impact. However, the interviewees mentioned

304 that influential factors which caused fraudulent practice might rise from

305 understaffing or ineffective, internal audit functions. Even if companies had

306 proper controls, these may not be effective if there had not been enough qualified

307 people to manage them.

308

309

Construction Related Risk Group

310 As shown in Table 4, the construction related risk group was ranked at 7 th

, 2 nd

,

311 and 6 th

place by the owners, consultants and main contractors respectively. Within

312 this group, delay in payments factor was highest severity compared with other

313 factors in the same group. The impact to construction performance was rated as

314 severe level. With regard to delay in payment factor, interviewees stressed that

315 disbursement of procedure in Thailand had to comply with Bank of Thailand rules

316 and regulations which might not be suitable and workable considering oversea

317 rules and regulations. Therefore, there might be difficulties in bringing the

318 performance of disbursement as it was stated in the contract agreement.

319 Experiencing in disbursement procedure was also one of the important factors

320 which had influence on improving the performance of disbursement procedures.

321 Nonetheless, the performance of disbursement of project should be kept as

14

322 contract written. This is a result of prevention in fearing of conspiracy and

323 generosity theory from public thought and awareness. In engineering aspect,

324 interviewees mentioned that unexpected site conditions were unanticipated

325 occurrences that were not controllable by government authority. Unforeseen

326 geological conditions were major problems for project cost overruns. It affected

327 excavation, compaction, and structure foundations. Thus, resulting in the need for

328 special mitigation work. Utilities were also often present that were not described

329 or were described incorrectly on existing drawings. The interviewees mentioned

330 that a main contractor usually subcontract work to other contractors who would do

331 the work for less than what the owner paid to the main contractor. This payment

332 difference results in that subcontractor adopting cheap and poor quality work

333 practice to generate certain profits. Subcontractors normally reused old timber till

334 it was worn-out instead of replacing it. This often resulted in such problems as

335 concrete bulging and honeycombed concrete. However, the interviewees admitted

336 that saving materials cost was considered an effective way to cut cost in Thailand

337 practice. There was also lack of supervision from the main contractor to different

338 levels of subcontractors, which was the main cause for the non-compliance in

339 performing quality work and specification. As the number of subcontracting layer

340 increased, limited profit could be gained for the subcontractor who actually did

341 the work.

342

343

344

15

345

Economic Related Risk Group

346 It was found from Table 4 that economic related risk group affected to the

347 construction performance at fairly severe level. It was ranked as 4 th

, 5 th

, and 6 th

348 place by the main contractors, consultants and owners respectively. Medium size

349 construction companies with a short economic position would be greater affected

350 by foreign currency changes. It further caused loss in expected future cash flow.

351 However, a rise in the exchange rate would contribute to further falls in

352 construction costs as it was likely that cuts in public capital construction projects

353 would not be compensated by improvement in the commercial construction sector.

354 This would cause the sector to lag behind any improvement in the general

355 economy. The interviewees also mentioned that market conditions could affect the

356 costs of a project, particularly large and complex infrastructure projects.

357 Additionally, inaccurate assessment of the market conditions could further lead to

358 incorrect project cost estimation. Changing market conditions during the

359 development of a project could reduce the number of bidders. Inflation caused the

360 price of commodities and services to increase which affected to owners and main

361 contractors liabilities in a short-medium term. The financial expertise’

362 interviewees also admitted that during Hamburger crisis in 2008, the inflation

363 added cost to a project. This situation initially had an impact on the debtors’

364 ability to make mortgage loan payments under real estate purchase agreements,

365 and then the impact spread to the financial sector. Inflation adversely affected to

366 the project performance. It was further found that the interviewees have various

367 views regarding how inflation should be accounted for in the project estimates and

16

368 in budgets by funding sources. Similar results were found by Arditi et al . (1985)

369 and Akinci and Fischer (1998). However, there was no ground to support on type

370 of currency used affecting the performance of inspection.

371

372

Political Related Risk Group

373 It found from Table 4 that owners, consultants and main contractors’ perspective

374 on severity ranked this related risk group as 5 th

, 7 th

, and 4 th

place. While, political

375 instability and civil disorder factor was among the two highly concern factor in

376 political related risk group.

Civil disorder for new constitution or agitation for

377 higher wages by construction workers might lead to a delay in the delivery of

378 projects. It often experienced that inflation and an increased in the interest rate

379 were the causes of agitation for higher wages. This caused the non-availability of

380 transportation and the closure of the site by a protest-action group. Construction

381 practitioners mentioned to influence of power groups and government relation

382 factor that put political and diplomatic pressure on the competition on bidding,

383 procurement types and procedures. A joint venture with financial donor’s

384 construction company was more likely to gain possibility to suspect tender results

385 to be pre-determined. Regarding labor restriction, one of the frequently violation

386 of labor standard was unqualified labor and illegal oversea workers. This was the

387 result of a shortage of skilled labor and legal oversea workers in chain

388 subcontractor level. The subcontractor who actually would do the work, the

389 payment from the owner was so significantly deduced to the level that could not

390 cover the necessary materials and qualified or legal labor cost. Therefore, the

17

391 subcontractor employed cheap labors and poor materials, resulting in the poor

392 quality of work and further time spent on correction of unacceptable work done.

393

394

Comparison with Other Studies

395 In Table 7 showed the sources of global risk factors from previous researchers. It

396 can be categorized into technical, managerial, resource, productivity, design,

397 payment, client and subcontractor, estimator related, design related, competition

398 related, fraudulent practices related, construction related, economic related and

399 political related risk. With a questionnaire survey of construction practitioners, the

400 results showed that the major cause of project performance in international funded

401 projects was adjustment and anchoring, delay in payments, civil disorder, political

402 instability, market conditions, influence of power groups, fluctuation in labor cost

403 and materials, project complexity, exchange rate and motivational biases.

404 However, there were differing perceptions among interviewees. Based on their

405 viewpoints in each survey, the degree of seriousness of each risk is varied by

406 many influences, especially, those from those involved in the project. Therefore,

407 construction practitioners must refrains currently prevalent adversarial attitudes

408 and shift to more cooperative and partnering methods in order to minimize and

409 mitigate risks in construction projects.

410

411

412

413

18

414

Conclusions

415 This study overviews the risk factors in the construction industry which is hoped

416 to raise construction practitioners’ awareness. Mainly, this study categorized the

417 risks into seven main related groups which were related to estimator, project,

418 competition, fraudulent practices, construction, economic and political. The

419 identified results showed that all the three groups of respondents generally agreed

420 that out of a total of 39 factors the top ten risk factors arranged in descending

421 order of severity were:

422

423

424

425

426

427

428

429

430

431

Adjustment and anchoring

Delay in payments

Civil disorder

Political instability

Market conditions

Influence of power groups

Fluctuation in labor cost and materials

Project complexity

Exchange rate

Motivational biases

432 The results (Table 5) showed that the owners, consultants and main contractors all

433 agreed that estimator related group was the most severe which affected

434 construction performance. Competition related group was considered the second

435 most severe in international funded public projects followed by project related

436 group, economic related group, construction related group, political related group

19

437 and fraudulent practices related groups. The accumulated risk experiences among

438 construction practitioners have clearly pointed to transparency in evaluation of

439 estimator as a main contributing factor to causes a great concern of success of

440 international funded public projects. Addition, delay in payment which attributed

441 to an efficiency of the staff involved in the payment procedure. This might be a

442 close link between disbursement procedure of each fund and working culture of

443 each country. Nonetheless, there was no evident to analyze and conclude.

444 However, shortage of staff was mentioned during interview that caused an

445 overload to their staffs which affected their performance. The author hopes this

446 paper is a useful reference to the project team in managing conflicts, delay,

447 dispute and cost overruns for future international funded public projects in

448 Thailand.

449

450

References

451 Akinci, B. and Fischer, M. (1998). Factors affecting contractors’risk of cost

452

454 overburden. J. Manage. Eng.,14(1):67-76.

453 Arditi, D., Gunzin, T.A., and Gurdamar, S. (1985). Cost overruns in public projects. Int. J. Project Manage., 3(4):218-224.

455 Ahmad, I. (1990). Decision-support system for modelling bid/no-bid decision

456 problem. J. Constr. Eng. Manage., 116(4):595-608.

457 Adnan, H. (2008). An assessment of risk management in joint venture projects

458 (JV) in Malaysia. Asian Soc. Sci., 4(6):99-106.

20

459 Aibinu, A.A. and Odeyinka, H.A. (2006). Construction delays and their causative

460 factors in Nigeria. J. Constr. Engrg. Mgmt., 132(7):667-676.

461 Assaf, S.A. and AlHejji, S. (2006). Causes of delay in large building construction

462 projects. Int. J. Project Manage., 24(4):349-357.

463 Babbie, E. (2009). The practice of social research. 12 th ed. Wadsworth, Publishing,

464 Belmont, CA, USA, 530p.

465 Balio, D. and Price, A.D.F. (2003). Modelling global risk factors affecting

466

468 construction cost performance. Int. J. Project Manage., 21(4):261-269.

467 Bing, L., Tiong, R.L.K., Fan, W.W., and Chew, D.A.S. (1999). Risk management in international construction joint ventures. J. Constr. Engrg. Mgmt.,

469 125(4):277-284.

470 Chan, A.P.C. (2001). Time-cost relationship of public sector projects in Malaysia.

471

473

Int. J. Project Manage., 19(4):223-229.

472 Chang, A.S.T. (2002). Reasons for cost and schedule increases for engineering design projects. J. Manage Eng., 18(1):29-36.

474 Cheung, S., Ng, T., Wong, S.-P., and Suen, H. (2003). Behavioral aspects in

475 construction partnering. Int. J. Project Manage., 21(5):333-343.

476 Dikmen, I. and Birgonul, M.T. (2004). Neural network model to support

477 international market entry decisions. Construct Engrg. Mgmt., 130(1):59-

478

480

66.

479 Dikmen, I and Birgonul, M.T (2006). A review of international construction research: Ranko Bon's contribution. Construct. Manage. Econom., 24:725-

481 733.

21

482 Dikmen, I. Birgonul, M.T., and Gur, A.K. (2007). A case-based decision support

483 tool for bid mark-up estimation of international construction projects.

484

486

Automat. Constr., 17:30-44.

485 Eriksson, P.E. and Laan, A. (2007). Procurement effects on trust and control in client-contractor relationships. Eng. Construct. Architect. Manag.,

487 14(4):387-399.

488 Eriksson, P.E. and Westerberg, M. (2010). Effects of cooperative procurement

489

490 procedures on construction project performance: A conceptual framework.

Int. J. Project Manage., (inpress).

491 Han, S.H., Kim, D.Y., Kim, H., and Jang, W.S. (2008). A web-based integrated

492

493 system for international project risk management. Automat. Constr.,

17:342-356.

494 He, Z. (1995). Risk management for overseas construction projects. Int. J. Project

495 Manage., 13(4):231-237.

496 Israngkura Na Ayudhya, B. (2006). Study of payment procedures of public works

497

498 in Thailand, [Ph.D. thesis]. School of Civil Engineering, University of

Tokyo. Tokyo, Japan, 304p.

499 Kapila, P. and Hendrickson, C. (2001). Exchange rate risk management in

500 international construction ventures. J. Manage Eng., 17(4):186-191.

501 Kangari, R. and Lucas, C.L. (1997). Managing international operations: a guide

502

503 for engineers, Architects and Construction Managers. ASCE Press, USA,

154p.

22

504 Lim, C.S. and Mohamed, M.Z. (2000). An exploratory study into recurring

505 construction problems. Int. J. Project Manage., 18(3):267-273.

506 Long, N.D., Ogunlana, S., Quang, T., and Lam, K.C. (2004). Large construction

507

508 projects in developing countries: a case study from Vietnam. Int. J. Project

Manage., 20(7):553-561.

509 Love, P.E.D., Tse, R.Y.C., and Edwards, D.J. (2005). Time- Cost relationships in

510 Australia Building Construction Projects. J. Construct Eng. Manage.,

511

513

131(2):187-194.

512 Matijevic, I. (2008). Construction industry and meditation, International Finance

Corporation IFC. Belgrade, 44p.

514 Miller, R. and Lessard, D. (2001). Understanding and managing risks in large

515 engineering projects. Int. J. Project Manage., 19:437-443.

516 Moura, H.M.P. (2003). As reclamações nas empreitadas de obras públicas:

517

518 alterações e atrasos, (construction claims in public works: changes and delays), [Msc thesis]. Minho University,111p.

519 Public Debt Management Office [PDMO]. (2011). Monthly report public debt

520 data.Bangkok:PDMO. Avaiable from: www.pdmo.go.th. Accessed date:

521 Mar 14, 2012.

522 Public Debt Management Office [PDMO]. (2005). Monthly report public debt

523

524 data. Bangkok:PDMO. Avaiable from: www.pdmo.go.th. Accessed date:

March 14, 2012.

23

525 Ogunlana, S.O., Promkuntong, K., and Jearkjiran, V. (1996). Construction delays

526 in a fast-growing economy: comparing Thailand with other economies. Int.

527

529

J. Project Manage., 14(1):37-45.

528 Pearl, R. (1994). The Effect of Market Conditions on Tendering and Forecasting.

In: 2000 AACE Transactions, Association for the Advancement of Cost

530

531

Engineering International. Gransberg, D.D., (eds). Morgantown, WV., p

124-132.

532 Raftery, J., Pasadilla, B., Chiang, Y.H., Hui, E.C.M., and Tang, B.S. (1998).

533

534

Globalization and construction industry development: implications of recent developments in the construction sector in Asia. Construct Manage.

535 Econom., 16:729-737.

536 Toor, S.R. and Ogunlana, S.O. (2008). Critical COMs of success in large-scale

537

538 construction projects: Evidence from Thailand construction industry. Int. J.

Project Manage., 26:420-430.

539 Tysseland, B. (2008). Life cycle cost based procurement decisions: a case study of

540

541

Norwegian defence procurement projects. Int. J. Project Manage.,

26(4):366-375.

542 Walewski, J. and Gibson, G. (2003). International project risk assessment: method,

543 procedures and critical factors, Central construction industry studies,

544

546 report no.31, The University of Texas at Austin, 36p.

545 Wang, Y. (2000). Coordination issues in Chinese large building projects. J.

Manage. Eng., 16(6):54-61.

24

547 Wardani, M., Messner, J., and Horman, M. (2006). Comparing procurement

548 methods for design-build projects. J. Construct. Eng. Manage., 132(3):230-

549

551

238.

550 Will, A.N. and Levitt, R.E. (2010). Mobilizing institutional knowledge for international projects. J. Construct. Eng. Manage., (in press).

552

553

Woodrow Wilson Bridge Project, (2002). Bridge Superstructure Contract (BR-3):

Review of the Engineer’s Estimate vs the Single Bid. February 28,

554

556

Available from: Virginia Department of Transport, VA, USA.

555 Yates, J.K. (2007). Global Engineering and Construction. John Wiley&Sons, Inc,

NJ, 378p.

25

557 Table 1. Questionnaire return rate

558

Organization

Owner

Number of questionnaires

Sent Filled

50 41

Main contractor (Domestic)

Main contractor (International)

Consultant

Total

50

30

50

180

34

27

32

132

559

560

561

Percentage return

78

53

89

44

64

26

562 Table 2. Profiles of financial sources

Classification

Bridges

Buildings

Express way

Highways

Underground railways

Water irrigations

Total

Type of funds

563

Total

ADB 1 IBRD 2 JBIC 3

14 - 4

564

18

565

- 7

-

5

14

12

566

14

567

12

-

10

36

17

-

5

29

13

12

7

55

42

568

12

569

22

570

120

571

572

573 Note :

574 1 = Asian Development Bank

575 2 = International Bank for Reconstruction and Development

576

577

3 = Japan Bank for International Cooperation

27

578 Table 3. Comparison severity index factors in international funded projects

Risk factors

Owner Consultant Main contractor

SI (%) Rank SI (%) Rank SI (%) Rank

Estimator related group

Motivational biases

Adjustment and anchoring

Incentives

Cognitive

Project related group

Project complexity

Scope vagueness

Project size

Project type

Competition related group

Contractor policies

Need for job

Market conditions

Number of bidders 74.0

Fraudulent practices related group

Corruption

Fraudulent practices

Theft

61.5

63.3

65.2

59.6

66.3

64.6

79.6

51.0

61.9

64.2

70.0

62.3

60.2

72.3

16

1

35

21

17

6

5

20

25

2

23

19

14

27

11

66.5

81.0

63.1

62.1

64.8

64.0

54.8

61.0

59.2

60.0

72.3

65.6

51.5

57.5

56.0

9

1

15

16

12

13

30

20

24

23

4

10

33

26

29

66.0

75.2

68.1

64.6

12

3

8

16

65.8

69.0

50.0

56.3

66.7

54.4

53.1

64.2

67.9

65.6

57.3

13

7

33

27

11

30

31

17

9

14

24

28

Collusion among contractors

Construction related group

Geological conditions

Unexpected site conditions

Weather conditions

Accessibility

Client-generated

Subcontractor-generated

Delay in payments

Economic related group

Price fluctuations

Inflation

Exchange rate

Interest rates

Political related group

Political instability

Political system

Nature of the firm's operation

Civil disorder

Influence of power groups

Labor restrictions

Fluctuation in labor cost and

17

8

19

5

36

37

21

27

3

6

32

7

22

31

34

2

28

18

25

61.7

66.9

61.3

60.6

57.3

71.7

43.1

38.1

75.4

69.4

51.5

68.5

60.2

51.9

50.0

78.5

56.3

61.5

58.3

24

17

28

7

36

37

22

32

4

9

15

13

31

34

33

2

30

28

26

60.8

64.0

59.0

61.7

57.3

69.4

44.0

41.3

72.5

67.1

64.8

65.8

58.1

51.9

52.1

74.2

58.5

59.4

59.8

20

10

26

4

36

37

20

32

2

6

35

5

22

28

25

1

23

17

21

63.8

67.7

56.7

63.5

52.7

73.3

40.8

37.3

78.8

70.2

45.2

70.8

59.4

55.2

56.9

80.0

57.9

64.0

61.7

29

579 materials

Change in taxation

Supply of local materials

Government relations

580

581

582

66.7

68.5

66.0

10

8

12

65.4

49.4

63.8

11

35

14

54.8

48.3

64.8

30

34

15

30

583 Table 4. Comparison of ranking of main risk group

584

Main risk group

Estimator related group

Project related group

Competition related group

Owner Rank Consultant Rank Main contractor Rank

63.7 3 68.2 1 68.5 1

65.3

67.5

2

1

61.1

64.3

4

3

61.0

62.2

5

2

Fraudulent practices related group

Construction related group

Economic related group

62.7 4 56.7 6

59.1

60.5

7

6

59.5

61.5

2

5

Political related group

Means

62.6

63.1

5 59.6

61.6

7

60.1

62.1

60.2

58.4

61.8

7

3

6

4

585

31

586

587

588

Table 5. Ranking the ten highest risk factor agreed by construction practitioners

Risk factor Severity index (%) Impacted

Adjustment and anchoring

Delay in payments

Civil disorder

Political instability

Market conditions

Influence of power groups

Fluctuation in labor cost and materials

Project complexity

Exchange rate

Motivational biases

78.6

77.6

75.6

71.4

70.4

68.9

68.4

66.3

66.2

65.7

Moderately severe

Moderately severe

Moderately severe

Moderately severe

Moderately severe

Moderately severe

Moderately severe

Moderately severe

Moderately severe

Moderately severe

589

590

32

591

592

593

Table 6. Comparison spearman rank correlation in risks on international funded projects.

Correlation Spearman rank correlation coefficient

Owner-Consultant

Owner-Main contractor

Consultant-Main contractor

Main risk groups

0.12

0.43

0.36

All risk factors

0.42

0.66

0.79

594 Correlation is signification at the 0.5 level of significant

595

596

33

597 Table 7. Comparison results with other studies for source of global risks.

Adnan (2008)

Dikmen and Birgonul (2006)

Balio and Price (2003)

Miller and Lessard (2001)

Bing et al . (1999)

He (1995)

Internal risk, project-specific risk, external risk

Technical risk, managerial risk, resource risk, productivity risk, design risk, payment risk, client risk and subcontractor risk

Estimator related, design related, competition related, fraudulent practices related, construction related, economic related and political related

Completion risks (technical, construction and operational) Market related risks (demand, financial and supply) and Institutional risks (regulatory, social acceptability and sovereign)

Internal risk factors, Project-specific risk factors and external risk factors

Nation/region risk, Construction industry risk and,

Company and Project risk

598

599

600

34