IFM7 Chapter 13

advertisement

Chapter 13

Financial Options with Applications to Real Options

ANSWERS TO BEGINNING-OF-CHAPTER QUESTIONS

13-1

See Part 1, Financial Options, of ch13boc-model.xls model, which is

printed out at the end of these answers.

Based on the Black-Scholes

model, we see that the value of the option increases with the stock

price, time to expiration, variance, and the risk-free rate, and the

option value declines with increases in the strike price.

Companies take account of these factors when they structure

incentive stock options.

They want to provide some specific level of

compensation, and total compensation might consist of regular salary, a

cash bonus for targeted performance levels, and stock options.

The

value of the options must be estimated if a rational compensation

package is to be established.

High tech companies have made the greatest use of options.

The

companies benefited from reduced cash requirements during their rapid

growth phase, and many employees of successful companies became

millionaires.

However, options produced problems in 2000 and 2001,

when stock prices fell sharply, driving down the values of options

awarded in earlier years. The stock collapses were due primarily to a

general decline in the market from its “bubble” high, not by poor

employee performance. If an employee had received options whose value

was based on an unrealistically high stock price, and if that price

later declined sharply, then it could be argued that his or her “true”

past compensation was too low.

Should the company now re-price its

outstanding options, lowing the strike price so as to make the options

valuable and thus provide the expected level of total compensation?

And, if options are re-priced, is this fair to stockholders, who don’t

get any comparable treatment? This is an issue that many companies are

currently struggling with today.

13-2

Financial

options

deal

with

securities

like

stocks

and

debt

instruments, whereas real options deal with physical assets like

capital budgeting projects. There are literally hundreds of different

types of real options, ranging from those related to whole plants to

options on commodities such as oil, electricity, gas, and copper.

We

focused primarily on real options as they relate to capital budgeting,

and we specifically considered (a) timing options, under which

investment decisions can be delayed, (b) abandonment options, under

which an operation can be closed down if it is more profitable to do so

than to continue with it, (c) growth options, under which companies can

expand operations if things work out especially well, and (d)

flexibility options, under which inputs and/or outputs can be changed

if market conditions change.

Harcourt College Publishers

Answers and Solutions: 13 - 1

The text discusses several approaches to dealing with real options:

Ignore them.

Just use traditional DCF approaches to capital

budgeting.

Recognize them and deal with them in a qualitative, judgmental

manner.

Take a decision tree, or scenario analysis, approach, and find

the NPV of a project with and without considering the real option

or options.

The difference between the with- and without cases

represents the value of the option.

Employ an option pricing model, especially the Black-Scholes

model, to determine the value of the real option. If the option

has a positive value, then this will lead to a specific decision.

For example, in the timing option analysis, if the timing option

is positive, then the project should be delayed so as to avoid

“killing off” an option with a positive value.

Go into “financial engineering,” wherein specialized option

models are developed to deal with specific issues.

Financial

engineering literally employs “rocket scientists” who develop

complex mathematical models, and it goes beyond the scope of the

text.

In the chapter spreadsheet model, we analyze a project timing option

using the first 4 procedures.

The Tool Kit for the chapter also

analyzes growth and timing options.

13-3

See the model printout at the end of these answers for examples of a

scenario analysis and a Black-Scholes analysis of an investment timing

option.

Similar analyses for growth and abandonment options are

contained the chapter Tool Kit.

First, it’s worth noting that both types of analysis are much, much

easier today than in the past due to the existence of spreadsheets like

Excel.

We highly recommend that students learn how to use both the

Scenario Analysis tool and the procedures for a Black-Scholes analysis.

Some controversy exists regarding the use of decision trees versus

formal option pricing models.

The primary advantage of the decision

tree approach is that it is relatively easy to perform (especially with

the Scenario Analysis tool), and it is easy to explain to decision

makers.

One doesn’t even need to discuss options per se—simply

calculate the project’s NPV with or without the option, and choose the

decision that results in the higher NPV. One can define the difference

between the NPVs as the value of the option, and, if there is a cost to

structuring the project so that the option is available, determine if

the benefits are worth the cost.

There are three significant advantages to the Black-Scholes

approach. (1) If the project is one where actual traded options can be

used, as would be true for projects related to oil exploration and

development and certain other types of projects, then the option

pricing approach can produce more accurate results than the decision

tree approach.

This advantage rests on the existence of traded

options, however, and in many instances, including the timing option in

the chapter model, there is no traded option that can be used in the

Answers and Solutions: 13 - 2

Harcourt College Publishers

analysis. (2) New traded options are being developed every day, and

specialized options can be created to deal with specific situations.

This being the case, it is useful for students to become familiar with

the approach, as it will become increasing advantageous in the future.

(3) The Black-Scholes approach forces one to think about the specific

reasons why options are valuable, and to at least make judgments about

the effects of option maturity, variance, and the like. Thinking about

these things often leads to improvements in the structure of projects

so as to increase (or create) real option values.

The bottom line, to us, is that if one focuses just on a particular

decision, such as the project in the ch13boc-model.xls model, where we

consider the decision the decision to proceed now or to wait, there is

no significant advantage to either method. The decision tree approach

is more straightforward and easier to explain to a manager, but both

lead to the same decision (to wait). Moreover, both rely on the same

information about cash flows and the probabilities of different levels

of cash flows, so both would seem to have the same degree of accuracy

or inaccuracy.

However, the Black-Scholes approach does get us

thinking in a way that is often far better, and that is a major

advantage.

13-4

With regard to when to proceed with a capital budgeting project,

several factors should be considered.

First, if projects are never

undertaken, then they never provide any benefits in the form of NPV, so

companies do need to invest at some point. Second, and related to the

first point, a dollar of cash flow today is better than a dollar in the

future, so, other things held constant, it pays to undertake positive

NPV projects as soon as possible. Third, delays may not provide much in

the way of new information about the likely outcomes from a project.

In our timing example, we assumed that we would gain a great deal of

new and valuable information if we delayed the project for a year, but

in some cases we might get no new information whatever.

And fourth,

delay can mean giving up the opportunity to build market share before

competitors have time to react and gain a toehold in the market.

Note that either the decision tree or option pricing analyses, if

performed properly, would take account of these factors, hence lead to

the correct timing decision.

13-5

Each of these options would probably increase the expected NPV and

reduce the standard deviation and coefficient of variation of the

expected NPV.

This would probably occur because the worst-case

scenarios would be mitigated.

See the model output, where the timing

option eliminates the low demand scenario.

Thus, these options would

probably reduce the risk of the project, and that would mean that a

lower WACC should be used.

13-6

The answer to this question has really been discussed in the preceding

answers. The company could delay the decision to get more information

on the demand for power, it could build in flexibility with regard to

fuel used (gas, oil, or coal), and it could consider the possibility of

abandonment if things turned out badly.

Companies in the power

industry like Enron most definitely do consider these types of options,

Harcourt College Publishers

Answers and Solutions: 13 - 3

as well as options to buy fuel on a fixed price basis versus on the

spot market, and they use options for hedging purposes.

Different

plant designs, fuel acquisition programs, sales arrangements (sell on

the open market at varying prices versus sell on a fixed price, takeor-pay basis to an entity like the California energy authorities), and

so on are all considered, and companies like Enron make very heavy use

of option pricing techniques in their decisions.

Note, though, that

the existence of traded options for electricity and for fuels

facilitate the use of option pricing models in capital budgeting for

power plants.

If similar options do not exist for the inputs and

outputs in some other industry, option pricing models will still be

useful, but not quite as useful.

Answers and Solutions: 13 - 4

Harcourt College Publishers

Part 1

A

B

C

D

E

F

G

H

I

1 Worksheet for Chapter 13 BOC Questions. Option Pricing and Real Options (ch13BOC-Model)

2

5/28/01

3 Part 1 of this model analyzes financial (stock) options, while Part 2 analyzes real options.

4

5 Part 1. Financial Options

A call option gives its holder the right to buy an asset at a predetermined price within a specified period of time, while a put

option allows the holder to sell at the predetermined price. It is easy to determine the value of an option at the time of its

expiration, as we demonstrate just below. It is harder, but possible, to estimate the option's value prior to its expiration, as

6 we demonstrate later in the spreadsheet.

7

8 Value of options at the expiration date:

9 Assume that put and call options exist on two stock, A and B, as shown below:

10

Stock A

Stock B

11

Call

Put

Call

Put

12 Cost of the option

$8.90

$8.90

$1.20

$1.20

13 Price of stock, P, at expiration

$95.50

$95.50

$63.75

$63.75

14 Strike, or exercise, price, X

$80.00

$80.00

$65.00

$65.00

15

The holder of an option can exercise or not exercise it, and exercise will occur only if it is profitable to do so. We can use

16 this fact to evaluate the options shown above. We use Excel's IF function, as explained below.

17

18 Value of the option at expiration:

$15.50

$0.00

$0.00

$1.25

19 Profit or loss on the option:

$6.60

($8.90)

($1.20)

$0.05

20

21

22

Click fx > Logical > IF

23

> OK. Then fill out

24

the menu items as shown

25

to get A's value.

26

Copy this formula to B's

27

column to get its call

28

option value. Reverse

29

the procedure to get

30

the put options values.

31

32 LOOKING AT EXERCISE AND MARKET VALUE OF AN OPTION

33

34

35

36

37

38

39

40

41

42

43

Although it is easy to find an option's value at expiration, it is hard to determine the value before expiration, because

there will exist a premium due to possible gains on the option.

Consider the case of Space Technology, Inc. (STI) whose common stock is currently trading at $21 and whose call

option strike price is $20.

We treat the market values for the option as given information that was obtained from the financial section of a

newspaper. The last column--the premium-- represents the difference between the market value and the exercise value

of this option in these different states of the world. We have graphed this relationship below.

Harcourt College Publishers

Answers and Solutions: 13 - 5

A

B

C

D

E

F

G

H

I

47

Option Value

48

Price of

Strike

Exercise

Market

49

the stock

Price

Value

Price

Premium

50

$0.00

$20.00

$0.00

$4.50

$4.50

51

$10.00

$20.00

$0.00

$6.00

$6.00

52

$20.00

$20.00

$0.00

$9.00

$9.00

53

$21.00

$20.00

$1.00

$9.75

$8.75

54

$22.00

$20.00

$2.00

$10.50

$8.50

55

$35.00

$20.00

$15.00

$21.00

$6.00

56

$42.00

$20.00

$22.00

$26.00

$4.00

57

$50.00

$20.00

$30.00

$32.00

$2.00

58

$73.00

$20.00

$53.00

$54.00

$1.00

59

$98.00

$20.00

$78.00

$78.50

$0.50

60

61

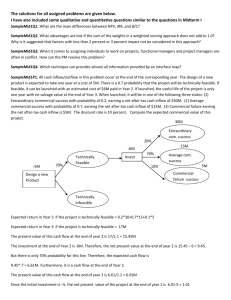

Exercise Value vs. Market Value of Options

62

63

64

$80

65

66

$60

67

Exercise Value

$40

68

Market Value

69

$20

70

71

$0

72

$0

$0

$0

$1

$1

$1

$1

73

74

Stock Price

75

76

77 Three factors drive the premium: (1) The option's term to maturity, (2) the variability of the stock price, and (3) the

risk-free rate. Thus, if we had an option on another stock with the same stock and strike prices, but the second stock was

more volatile, then the second option's premium would be larger. By the same token, if the second stock were more volatile,

that too would increase its option premium. The Black-Scholes Option Pricing Model estimates the option's value and thus

78 the premium based on these three drivers.

79

80 In deriving their model, Black and Scholes made the following assumptions:

81 1. The stock underlying the call option pays no dividends.

82 2. There are no transaction costs for buying or selling either the stock or the option.

83 3. The short-term, risk-free interest rate is known and is constant during the life of the option.

84 4. Investors may borrow at the short-term, risk-free interest rate.

85 5. Short selling is permitted, and the short seller will receive the sale price immediately.

86 6. The call option can be exercised only on its expiration date.

87 7. Trading in all securities takes place continuously, and stock prices move randomly.

88

89

90 The derivation of the Black-Scholes model is based on the concept of a riskless hedge. By buying shares of a stock

91 and simultaneously selling call options on that stock, an investor can create a risk-free investment position, where

92 gains on the stock are exactly offset by losses on the option. The model utilizes these three formulas:

93

d1 =

{ ln (P/X) + [k rf + s2 /2) ] t } / (s t1/2)

94

d2 =

d1 - s (t

95

96

97

98

99

100

V =

P[ N (d1) ] - Xe

1/2

)

-krf t

[ N (d2) ]

V is the value of the option. P is the current stock price. N(d 1) is the area beneath

the standard normal distribution corresponding to (d1). X is the strike price. k rf is the risk-free rate. t is the

time to maturity. N(d2) is the area under the standard normal distribution corresponding to (d 2). S, or

usually sigma, is the volatility of the stock price, as measured by the standard deviation.

Answers and Solutions: 13 - 6

Harcourt College Publishers

102

103

104

105

106

107

A

B

C

D

E

F

G

H

I

The Black-Scholes model is widely used and is generally considered to be the gold standard for option pricing. Many

hand-held calculators and computer programs have this formula built in. We now use Excel to write a program to price

an option. The stock has a current market price of $20, the strike price is $20, the risk-free rate is 12%, time to

maturity is 3 months (0.25 years), and the stock's annual variance is 0.16. The value of the option if it were exercised

now is zero, but it actually has a positive value. Here are the data in input format, ready for use in the Black-Scholes

model:

108 P

$20

kRF

109 X

$20

t

110

111 We first use the formula from above to solve for d1.

12%

0.25

2

s

0.16

112

(d1)

=

{ ln (P/X) + [k rf + s2 /2) ] t } / (s t1/2)

113

=

(LN(B108/B109)+(E108+(H108/2))*E109)/((H108^0.5)*(E109^0.5))

114

=

0.250

115 Having solved for d1, we can now find d2.

116

117

118

119

120

121

122

123

124

125

126

127

128

129

130

131

132

133

134

135

136

137

138

139

140

141

142

143

144

145

146

147

1/2

(d2)

=

d1 - s (t )

=

C114-(H108^0.5)*(E109^0.5)

=

0.050

We now have all of the necessary inputs for solving for V, the value of the option. However, there is a complication,

because N(d1) and N(d2) are areas under the normal distribution. We could use a table from a statistics text, but Excel

has a function that determines cumulative probabilities of the normal distribution, NORMDIST. Click fx > Statistical

> NORMDIST to access the menu, and then fill it in as shown below for N(d1). (Nd2) is found the same way, except

that "C118" would be entered for "X" rather than "C114".

N(d1) =

(Nd2) =

0.59870627

0.51993887

Explanation

The "X" value is the d1 or

d2 value. This is a

cumulative normal

distribution function, so

the "Mean" is 0,

"Standard_dev" is 1, and

we enter TRUE for

"Cumulative".

Using this method for dealing with the cumulative distributions, we can solve for V using the Black-Scholes formula:

V

=

$1.883

We see that even though the value would be $0 if the option were exercised now, its actual market value is $1.883.

Harcourt College Publishers

Answers and Solutions: 13 - 7

A

B

C

D

E

F

G

H

I

The following data tables show the sensitivity of the option's price to each of the five input variables, holding the other

149 variables at their expected levels:

150

151

Strike

152 % change

Price, P

$1.883

% change

Price, X

$1.883

153

-30%

$14

0.0705

-30%

$14

6.4470

154

-15%

$17

0.5512

-15%

$17

3.8263

155

0%

$20

1.8827

0%

$20

1.8827

156

15%

$23

4.0554

15%

$23

0.7719

157

30%

$26

6.7341

30%

$26

0.2715

158

159

Time to

Risk free

160 % change

maturity, t

$1.883

% change

rate, kRF

$1.883

161

-30%

0.175

1.5379

-30%

8.4%

1.7930

162

-15%

0.213

1.7162

-15%

10.2%

1.8376

163

0%

0.250

1.8827

0%

12.0%

1.8827

164

15%

0.288

2.0397

15%

13.8%

1.9284

165

30%

0.325

2.1892

30%

15.6%

1.9746

166

167

Variance,

2

s

168 % change

$1.883

169

-30%

0.112

1.6304

$8

170

-15%

0.136

1.7620

$7

171

0%

0.160

1.8827

172

15%

0.184

1.9947

$6

173

30%

0.208

2.0996

$5

174

$4

175

$3

176

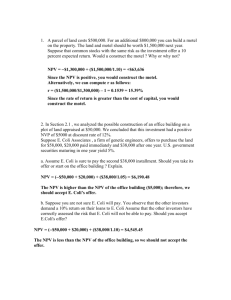

Variance

177

$2

178

Maturity

$1

179

Risk-free

$0

180

Strike

181

-30%

-10%

10%

30%

Deviation from Expected Value

182

Price

183

Option Price

Option Price Sensitivity

From this graph, we see that the strongest influences on option value are the stock and the exercise prices. Time tomaturity,

the risk-free rate, and variance appear to have only marginal effects on the option's value. However, that conclusion is in a

sense deceiving, at least for judging the values of existing options. For example, suppose options exist on two stocks, S and L.

Both stocks sell for $20, and the strike price is also $20 in both cases, and both have a variance of 0.16. However, S's option

expires in 1 month (0.0833 years) while L's expires in one year. Logically, L's option should be more valuable, and indeed it

is. Similarly, if one stock has a variance of 0.08 versus 0.32 for another, then with other things held constant, the option with

the higher variance will be much more valuable than the other. Finally, if the risk-free rate increases, so will the value of the

184 options. These results are shown in the following data tables.

185

186

Option

Option

Option

187

(E109)

Value

(H108)

Value

(E108)

Value

188 Deviation

Maturity

$1.883

Variance

$1.883

Variance

$1.883

189

-50%

0.125

$1.274

0.080

$1.431

0.060

$1.735

190

0%

0.250

$1.883

0.160

$1.883

0.120

$1.883

191

100%

0.500

$2.815

0.320

$2.524

0.240

$2.198

192

193

194

Effects of Maturity, Variance, and kRF

195

3.00

2.50

2.00

1.50

1.00

-50%

Option Value

196

197

198

199

200

201

202

203

204

205

206

207

Maturity

Variance

Risk-free

0%

Answers and Solutions: 13 - 8

50%

100%

% Deviation

Harcourt College Publishers

Part 2

A

B

C

1 Chapter 13, Part 2. Real Options

D

E

F

G

H

5/28/01

I

J

There are many different types of real options, including timing options, growth options, abandonment options, and

flexibility (input and output) options. The Tool Kit for this chapter considers most of these types of options, but since the

2 analysis for them is generally the same, we examine only the timing option.

3

4 A. Timing Option. A proposed project whose data (dollars in millions) is shown below is being evaluated.

5

6 Initial cost:

($50)

7 Expected annual cash flows:

8 Probability Cash Flow Prob. x CF

9

25%

$33

$8.25

10

50%

$25

$12.50

11

25%

$5

$1.25

12 Expected annual CF:

$22.00

13

14 Assumed WACC:

14%

15 Risk-free rate:

6%

16

17 A-1. Simple DCF Analysis

18 Year

0

1

2

3

19 Expected CF

($50)

$22.00

$22.00

$22.00

20 NPV:

$1.08

21

22 A-2. Scenario Analysis #1 : NPV in 2001 assuming we proceed with project today

23

Future Cash Flows

NPV of this

Probability

Data for

24

2001

Demend

2002

2003

2004

Scenario Probability

x NPV

Std Deviation

25

High

$33

$33

$33

$26.61

0.25

$6.65

163

26

($50)

Average

$25

$25

$25

$8.04

0.50

$4.02

24

27

Low

$5

$5

$5

-$38.39

0.25

-$9.60

389

28

1.00

29

Variance of PV:

577

30

Expected value of NPVs =

$1.08

Standard Deviationa =

31

$24.02

Coefficient of Variationb =

32

22.32

a

33 The standard deviation is calculated as in Chapter 2.

b

34 The coefficient of variation is the standard deviation divided by the expected value.

35

36 A-3. Scenario Analysis #2: NPV in 2001 assuming we delay for 1 year

37

Future Cash Flows

NPV of this

38

39

40

41

42

43

44

45

46

47

2001

Wait

a

2002

High

Average

Lowb

-$50

-$50

$0

2003

2004

$33

$25

$0

$33

$25

$0

The NPV in Part 2 is as of 2001. Therefore, each project cash flow

is discounted back one more year than in Part 1.

b

If demand is low, the project will not be funded.

Harcourt College Publishers

Scenarioa

2005

$33

$25

$0

$23.35

$7.05

$0.00

Probability

0.25

0.50

0.25

1.00

Probability

Data for

x NPV

Std Deviation

$5.84

$3.53

$0.00

Variance of PV:

Expected value of NPVs =

Standard Deviation =

Coefficient of Variation =

49

3

22

73

$9.36

$8.57

0.92

Answers and Solutions: 13 - 9

A

B

C

D

E

F

G

H

I

J

49 A-4. Scenario Analysis #3: NPV in 2001 assuming we delay for 1 year and discount the cost at k RF = 6%

50

51 It has been argued that if we wait and then invest only if the high or average scenarios occur, then the cost should be discounted

52 at the risk-free rate. In that case, the PV of the cost is higher, and that reduces the NPV of the project. Here are the calculations:

53

54

Future Cash Flows

NPV of this

Probability

Data for

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

2001

High

Average

Low

2002

-$50

-$50

$0

2003

2004

$33

$25

$0

a

2005

$33

$25

$0

a

The operating cash flows in years 2003-2005 are discounted at the WACC

of 14% and the cost in 2002 is discounted at the risk-free rate of 6%.

$33

$25

$0

Scenario

Probability

$20.04

0.25

$3.74

0.50

$0.00

0.25

1.00

Variance of PV =

Expected value of NPVs =

Standard Deviation =

Coefficient of Variation =

x NPV

$5.01

$1.87

$0.00

Std Deviation

43

5

12

60

$6.88

$7.75

1.13

A-5. Sensitivity of NPV WACC Used to Discount Cost and Cash Flows

It could also be argued that the investment in toto is less risky if we wait, because then there is no possibility of suffering a loss.

That would suggest using a lower discount rate for the inflows as well as for the cost. The lower discount rate for the inflows

would increase the calculated NPV. Here is a data table of IPV's based on different discount rates.

WACC for

Op CF (C14)

$6.88

6.0%

8.0%

10.0%

12.0%

14.0%

WACC Used to Discount the 2002 Cost (C15)

6.0%

8.0%

10.0%

12.0%

$16.95

$17.60

$18.23

$18.84

$14.14

$14.79

$15.42

$16.03

$11.53

$12.19

$12.82

$13.43

$9.12

$9.78

$10.41

$11.02

$6.88

$7.54

$8.17

$8.78

14.0%

$19.43

$16.62

$14.02

$11.60

$9.36 = NPV using 14% for all discounting

There is no way to specify precisely what discount rate or rates should be used. But for the sake of argument, let us assume that

management decides to use a WACC of 8% for the cost and 12% for the inflows, and thus concludes that the NPV for waiting is

$9.78 versus $1.08 for the project if the investment is made this year. Obviously, the option to delay is valuable, so it should

not be exercised, i.e., the project should be delayed.

We can use the analysis thus far to get an approximate value for the option to delay--it is the expected value of the project if we

delay minus the expected value if we do not delay:

E(Value) if delay (use $12.119):

$12.19

E(Value) if proceed immediately:

$1.08

Approximate value of option:

$11.11

A-6. Applying Call Option Techniques to the real option to delay

The option to defer the project is like a call option. The company has until 2002 to decide whether or not to implement the project, so the

time to maturity of the option is one year. If it exercises the option, it must pay an exercise price equal to the cost of implementing the

project, and it will then gain the value of the project. If you exercise a call option, you will own a stock that is worth whatever its price is.

If the company implements the project, it will gain a project, whose value is equal to the present value of its cash flows. Therefore, the

present value of a project's future cash flows is analogous to the current value of a stock, and the rate of return on the project is equal to its

cost of capital. To find the value of a call option, we need the standard deviation of its rate of return. Similarly, to find the value of this

96 real option, we need the standard deviation of the project's expected rate of return.

97

Answers and Solutions: 13 - 10

Harcourt College Publishers

A

B

C

D

E

F

G

H

98 Step 1. Find a proxy for the stock price. Will be used in the option pricing model; discounted to 2001

99

Future Cash Flows

PV of this

I

Probability

a

Scenario

100

2001

2002

2003

2004

2005

Probability

x PV

101

High

$33

$33

$33

$67.21

0.25

$16.80

102

Average

$25

$25

$25

$50.91

0.50

$25.46

103

Low

$5

$5

$5

$10.18

0.25

$2.55

104

1.00

105 This project, like a stock, is expected to provide cash flows,and

Variance of PV =

106 the value of the project, like the price of a stock, is equal to the

Expected value of PVs =

$44.80

Standard Deviation =

107 PV of the expected cash inflows.

$21.07

Coefficient of Variation =

108

0.47

a

109 The WACC is 14%. All cash flows in this scenario are discounted back to 2001.

110

111 Step 2. Find the Value and Risk of Future Cash Flows at the Time the Option Expires; discounted to 2002

112

PV in 2002

113

Future Cash Flows

for this

Probability

114

2001

2002

2003

2004

2005

Scenario

Probability

x PV2002

115

116

High

$33

$33

$33

$76.61

0.25

$19.15

117

Average

$25

$25

$25

$58.04

0.50

$29.02

118

Low

$5

$5

$5

$11.61

0.25

$2.90

119

1.00

120 The expected value as calculate here is a proxy for the expected

Variance of PV =

121 price in 2002, when the option expires and must be exercised or

Expected value of PV2002 =

$51.08

122 discarded.

Standard Deviation of PV2002 =

$24.02

123

Coefficient of Variation of PV2002 =

0.47

124

Step

3.

Variance

Estimate

#1.

Use

the

scenario

data

to

directly

estimate

the

variance

of

the

project's

return

125

126

127

128

129

130

131

132

133

134

135

136

137

Probability

Price2001a

High

$44.80

Average

Low

PV2002b

$76.61

$58.04

$11.61

Harcourt College Publishers

J

Data for

Std Deviation

125

19

300

444

Data for

Std Deviation

163

24

389

577

Data for

Return2002c

71.0%

29.5%

-74.1%

Probability x Return2002 Std Deviation

0.25

17.8%

8.1%

0.50

14.8%

1.2%

0.25

-18.5%

19.4%

1.00

Variance of PV =

28.7%

Expected return =

14.0%

Standard deviation of return =

53.6%

Variance of return =

28.7%

Answers and Solutions: 13 - 11

A

B

C

D

E

F

G

H

138 Step 4. Variance Estimate #2. Use the scenario data to indirectly estimate the variance of the project's return

Expected "price" at the time the option expiresd =

139

$51.08

Standard deviation of expected "price" at the time the option expires e =

140

$24.02

141

Coefficient of variation (CV) =

0.47

142

Time (in years) until the option expires (t) =

1

f

2

Variance of the project's expected return = ln(CV +1)/t =

143

20.0%

I

J

a

The 2001 price is the expected PV from Step 1.

b

145 The 2002 PVs are from Part 1.

c

146 The returns for each scenario are calculated as (PV2002 - Price2001)/Price2001.

144

d

147 The expected "price" at the time the option expires is taken from Step 2.

e

148 The standard deviation of expected "price" at the time the option expires is taken from Part 1.

f

149 This formula for variance is a statistical formula not covered in the text.

150

151 Part 1. Find the Value of a Call Option Using the Black-Scholes Model

152

kRF =

Risk-free interest rate

=

153

t=

Time until the option expires

=

154

X=

Cost to implement the project

=

155

P=

Current value of the project

=

156

Variance of the project's rate of return

=

6%

1

$50.00

$44.80

20.0%

{ ln (P/X) + [kRF + 2 /2) ] t } / ( t1/2 )

=

0.112

=

=

=

=

-0.33

0.54

0.37

$7.04

157

d1 =

158

d2 =

d1 - (t )

159

N(d1)=

160

N(d2)=

P[ N (d1) ] - Xe-kRF t [ N (d2) ]

161

V =

162

163

164 Part 2. Sensitivity Analysis of Option Value to Changes in Estimated Variance

1/2

165

166

167

168

169

170

171

172

173

174

175

176

177

178

Variance

14.0%

16.0%

18.0%

20.0%

22.0%

24.0%

26.0%

Option Value

$7.04

$5.74

$6.20

$6.63

$7.04

$7.42

$7.79

$8.15

We would obviously get different values for the option if we used different inputs in the OPM. Still, it should be noted that

the value calculated by the Black-Scholes model, $7.04, is reasonably close to the option value found above, $9.78.

This same timing option, along with growth and abandonment options, is analyzed in the Tool Kit for this chapter, using

essentially the same procedures as were discussed in this spreadsheet.

Answers and Solutions: 13 - 12

Harcourt College Publishers

ANSWERS TO END-OF-CHAPTER QUESTIONS

13-1

a. An option is a contract which gives its holder the right to buy or

sell an asset at some predetermined price within a specified period

of time. A call option allows the holder to buy the asset, while a

put option allows the holder to sell the asset.

b. A simple measure of an option’s value is its exercise value.

The

exercise value is equal to the current price of the stock

(underlying the option) less the striking price of the option. The

strike price is the price stated in the option contract at which the

security can be bought (or sold).

For example, if the underlying

stock sells for $50 and the striking price is $20, the exercise

value of the option would be $30.

c. The Black-Scholes Option Pricing Model is widely used by option

traders to value options.

It is derived from the concept of a

riskless hedge. By buying shares of a stock and simultaneously

selling call options on that stock, the investor will create a riskfree investment position. This riskless return must equal the riskfree rate or an arbitrage opportunity would exist.

People would

take advantage of this opportunity until the equilibrium level

estimated by the Black-Scholes model was reached.

d. Real options occur when managers can influence the size and risk of

a project’s cash flows by taking different actions during the

project’s life.

They are referred to as real options because they

deal with real as opposed to financial assets. They are also called

managerial options because they give opportunities to managers to

respond to changing market conditions.

Sometimes they are called

strategic options because they often deal with strategic issues.

Finally, they are also called embedded options because they are a

part of another project.

e. Investment timing options give companies the option to delay a

project rather than implement it immediately.

This option to wait

allows a company to reduce the uncertainty of market conditions

before it decides to implement the project.

An abandonment option

allows the company to abandon a project if market conditions

deteriorate too much. Growth options allow a company to expand if

market demand is higher than expected.

This includes the

opportunity to expand into different geographic markets and the

opportunity

to

introduce

complementary

or

second-generation

products.

Flexibility options allow a firm to alter operations

depending on how conditions change during the life of the project.

f. Decision trees are a form of scenario analysis in which different

actions are taken in different scenarios.

Harcourt College Publishers

Answers and Solutions: 13 - 13

13-2

The market value of an option is typically higher than its exercise

value due to the speculative nature of the investment.

Options allow

investors to gain a high degree of personal leverage when buying

securities.

The option allows the investor to limit his or her loss

but amplify his or her return.

The exact amount this protection is

worth is the premium over the exercise value.

13-3

Postponing the project means that cash flows come later

sooner; however, waiting may allow you to take advantage

conditions. It might make sense, however, to proceed today

important advantages to being the first competitor to enter

13-4

Timing options make it less likely that a project will be accepted

today. Often, if a firm can delay a decision, it can increase the

expected NPV of a project.

13-5

Having the option to abandon a project makes it more likely that the

project will be accepted today.

Answers and Solutions: 13 - 14

rather than

of changing

if there are

a market.

Harcourt College Publishers

SOLUTIONS TO END-OF-CHAPTER PROBLEMS

13-1

P = $15; X = $15; t = 0.5; kRF = 0.10; 2 = 0.12; d1 = 0.32660;

d2 = 0.08165; N(d1) = 0.62795; N(d2) = 0.53252; V = ?

Using the Black-Scholes

option’s value as:

V =

=

=

=

13-2

Option

Pricing

Model,

you

calculate

the

P[N(d1)] - XekRFt [N(d2)]

$15(0.62795) - $15e(-0.10)(0.5)(0.53252)

$9.4193 - $15(0.9512)(0.53252)

$1.8211 $1.82.

Option’s exercise price = $15; Exercise value = $22; Premium value =

$5; V = ? P0 = ?

Premium = Market price of option - Exercise value

$5 = V - $22

V = $27.

Exercise value = P0 - Exercise price

$22 = P0 - $15

P0 = $37.

13-3

a.

0

|

-20

1

|

3

2

|

3

20

|

3

NPV = $1.074 million.

Harcourt College Publishers

Answers and Solutions: 13 - 15

b. Wait 1 year:

Tax imposed

50% Prob.

0

1

k = 13%

|

|

0

-20

2

|

2.2

3

|

2.2

Tax not imposed

50% Prob.

|

0

|

3.8

|

3.8

|

-20

21

|

2.2

|

3.8

PV @

Yr. 1

15.45

26.69

Tax imposed: NPV @ Yr. 1 = (-20 + 15.45)/(1.13) = -4.027

Tax not imposed: NPV @ Yr 1 = (-20 + 26.69)/ (1.13) = 5.920

Expected NPV = .5(-4.027) + .5(5.920) = 0.947

Note though, that if the tax is imposed, the NPV of the project is

negative and therefore would not be undertaken.

The value of this

option of waiting one year is evaluated as 0.5($0) + (0.5)($ 5.920) =

$2.96 million.

Since the NPV of waiting one year is greater than going ahead and

proceeding with the project today, it makes sense to wait.

13-4

a.

0

-8

10%

1

2

3

4

4

4

4

4

NPV = $4.6795 million.

b. Wait 2 years:

0

1

| k = 10% |

10% Prob. 0

0

2

|

-9

3

|

2.2

4

|

2.2

5

|

2.2

6

|

2.2

|

90% Prob. 0

|

-9

|

4.2

|

4.2

|

4.2

|

4.2

|

0

PV @

Yr. 2

$6.974

$13.313

Low CF scenario: NPV = (-9 + 6.974)/(1.1)2 = -$1.674

High CF scenario: NPV = (-9 + 13.313)/(1.1)2 = $3.564

Expected NPV = .1(-1.674) + .9(3.564) = 3.040

If the cash flows are only $2.2 million, the NPV of the project is

negative and, thus, would not be undertaken. The value of the option

of waiting two years is evaluated as 0.10($0) + 0.90($3.564) = $3.208

million.

Since the NPV of waiting two years is less than going ahead and

proceeding with the project today, it makes sense to drill today.

Answers and Solutions: 13 - 16

Harcourt College Publishers

13-5

a.

0

1

| 13% |

-300

40

2

|

40

NPV = -$19.0099 million.

20

|

40

Don’t purchase.

b. Wait 1 year:

0

1

k = 13%

|

|

50% Prob. 0

-300

2

|

30

3

|

30

4

|

30

|

50% Prob. 0

|

50

|

50

|

50

|

-300

NPV @

Yr. 0

21

|

30

-$78.9889

|

50

45.3430

If the cash flows are only $30 million per year, the NPV of the

project is negative. However, we’ve not considered the fact that the

company could then be sold for $280 million. The decision tree would

then look like this:

0

1

k = 13%

|

|

50% Prob. 0

-300

2

|

30

3

|

30 + 280

4

|

0

|

50% Prob. 0

|

50

|

50

|

50

|

-300

NPV @

Yr. 0

21

|

0

-$27.1468

|

50

45.3430

The expected NPV of waiting 1 year is 0.5(-$27.1468) + 0.5($45.3430) =

$9.0981 million.

Given the option to sell, it makes sense to wait 1 year before

deciding whether to make the acquisition.

13-6

a.

0

12%

|

-6,200,000

1

|

600,000

14

|

600,000

15

|

600,000

Using

a

financial

calculator,

input

the

following

data:

CF0 = -6,200,000; CF1-15 = 600,000; I = 12; and then solve for NPV =

-$2,113,481.31.

b.

0 12%

1

|

|

-6,200,000 1,200,000

14

|

1,200,000

15

|

1,200,000

Using

a

financial

calculator,

input

the

following

data:

CF0 = -6,200,000; CF1-15 = 1,200,000; I = 12; and then solve for NPV =

$1,973,037.39.

Harcourt College Publishers

Answers and Solutions: 13 - 17

c. If they proceed with the project today, the project’s expected NPV =

(0.5 -$2,113,481.31) + (0.5 $1,973,037.39) = -$70,221.96.

So,

Hart Enterprises would not do it.

d. Since the project’s NPV with the tax is negative, if the tax were

imposed the firm would abandon the project. Thus, the decision tree

looks like this:

0

1

k = 12%

50% Prob.

|

|

Taxes

-6,200,000

6,000,000

No Taxes

|

50% Prob. -6,200,000

|

1,200,000

2

|

0

|

1,200,000

15

|

0

NPV @

Yr. 0

-$

842,857.14

|

1,200,000

1,973,037.39

Expected NPV $ 565,090.13

Yes, the existence of the abandonment option changes the expected NPV

of the project from negative to positive. Given this option the firm

would take on the project because its expected NPV is $565,090.13.

e.

NPV @

50% Prob.

Taxes

0

1

k = 12%

|

|

NPV = ?

-1,500,000

+300,000 = NPV @ t = 1wouldn’t do

No Taxes

50% Prob.

|

NPV = ?

|

-1,500,000

+4,000,000 = NPV @ t = 1

Yr. 0

$0.00

2,232,142.86

Expected NPV $1,116,071.43

If the firm pays $1,116,071.43 for the option to purchase the land,

then the NPV of the project is exactly equal to zero.

So the firm

would not pay any more than this for the option.

Answers and Solutions: 13 - 18

Harcourt College Publishers

13-7

P = PV of all expected future cash flows if project is delayed. From

Problem 13-3 we know that PV @ Year 1 of Tax Imposed scenario is $15.45

and PV @ Year 1 of Tax Not Imposed Scenario is $26.69. So the PV is:

P = [0.5(15.45)+ 0.5(26.690] / 1.13 =

X = $20.

t = 1.

kRF = 0.08.

2 = 0.0687.

$18.646.

d1 = ln[18.646/20] + [0.08 + .5(.0687)](1) = 0.1688

(.0687)0.5 (1)0.5

d2 = 0.1688 - (.0687)0.5 (1)0.5 = -0.0933

From Excel function

Appendix A:

N(d1) = 0.5670

N(d2) = 0.4628

NORMSDIST,

Using the Black-Scholes

option’s value as:

V =

=

=

=

Option

or

approximated

Pricing

Model,

from

Table

A-1

you

calculate

in

the

P[N(d1)] - XekRFt [N(d2)]

$18.646(0.5670) - $20e(-0.08)(1)(0.4628)

$10.572 - $8.544

$2.028 million.

Harcourt College Publishers

Answers and Solutions: 13 - 19

13-8

P = PV of all expected future cash flows if project is delayed. From

Problem 13-4 we know that PV @ Year 2 of Low CF Scenario is $6.974 and

PV @ Year 2 of High CF Scenario is $13.313. So the PV is:

P = [0.1(6.974)+ 0.9(13.313] / 1.102 =

X = $9.

t = 2.

kRF = 0.06.

2 = 0.0111.

$10.479.

d1 = ln[10.479/9] + [0.06 + .5(.0111)](2) = 1.9010

(.0111)0.5 (2)0.5

d2 = 1.9010 - (.0111)0.5 (2)0.5 = 1.7520

From Excel function

Appendix A:

N(d1) = 0.9713

N(d2) = 0.9601

NORMSDIST,

Using the Black-Scholes

option’s value as:

V =

=

=

=

Option

or

approximated

Pricing

Model,

from

Table

A-1

you

calculate

in

the

P[N(d1)] - XekRFt [N(d2)]

$10.479(0.9713) - $9e(-0.06)(2)(0.9601)

$10.178 - $7.664

$2.514 million.

Answers and Solutions: 13 - 20

Harcourt College Publishers

SOLUTION TO SPREADSHEET PROBLEMS

13-9

The detailed solution for the problem is available both on the

instructor’s resource CD-ROM (in the file Solution to Ch 13-9 Build a

Model.xls) and on the instructor’s side of the accompanying book site,

http://www.harcourtcollege.com/finance/ifm.

13-10 The detailed solution for the problem is available both on the

instructor’s resource CD-ROM (in the file Solution to Ch 13-10 Build a

Model.xls) and on the instructor’s side of the accompanying book site,

http://www.harcourtcollege.com/finance/ifm.

13-11 a. The input variables are:

P = $10; X = $10; t = 6 months = 0.5 years; 2 = 0.16; and kRF = 12%.

Now, we proceed to use the OPM:

V = $10[N(d1)] - $10e-(0.12)(0.5)[N(d2)].

d1 =

ln($10/$10) [0.12 (0.16/2)](0.5)

0.0 0.10

=

= 0.35355.

(0.4)(0.7071)

0.28284

d2 = d1 - 0.28284 = 0.35355 - 0.28284 = 0.07071.

N(d1) = N(0.35355) = 0.5000 + 0.13812 = 0.63812.

N(d2) = N(0.07071) = 0.5000 + 0.02817 = 0.52817.

Thus, V = $10(0.63812) - $10e-0.06(0.52817)

= $6.3812 - $10(0.94176)(0.52817)

= $6.3812 - $4.9743 = $1.4069 $1.41.

Harcourt College Publishers

Solution to Spreadsheet Problems: 13 - 21

b. Now, 2 = 0.09 rather than 0.16. Thus, repeat the above process with

one change in the input variables:

d1 =

ln($10/$10) [0.12 (0.09/2](0.5)

0.0 0.0825

=

= 0.38891.

(0.3)(0.7071)

0.21213

d2 = d1 - 0.21213 = 0.38891 - 0.21213 = 0.17678.

N(d1) = N(0.38891) = 0.5000 + 0.15127 = 0.65127.

N(d2) = N(0.17678) = 0.5000 + 0.07012 = 0.57012.

Thus, V = $10(0.65127) - $10e-0.06(0.57012)

= $6.5127 - $10(0.94176)(0.57012)

= $6.5127 - $5.3692 = $1.1435 $1.14.

We see that the value of the option is decreased by $1.41 - $1.14 =

$0.27 by the reduction in variance.

Through the use of a calculator and the formulas demonstrated

above (or the computer diskette), we find that an increase in

variance to 0.20 produces a call price of $1.53.

When the security underlying the call option possesses a lower

variance of returns, the price of the call is likewise lower. Call

options on securities with higher variances have higher prices.

With call options, a higher variance is desirable.

Along with the

higher variance comes the possibility that the price of the

underlying stock will increase far enough above the exercise price

to generate a profit for the investor.

c. Assuming a current stock price of $15, the option's value (as

calculated using the Black-Scholes OPM on the computer diskette)

jumps to $5.65. The call is much more valuable because its current

price already exceeds the exercise price. An investor who purchases

this call, then, is expecting the price to go even farther above the

exercise price.

d. In this case, the value of the option decreases to $0.18.

The

reduction in the value of the option is due to the fact that the

exercise price is well above the current stock price.

Solution to Spreadsheet Problems: 13 - 22

Harcourt College Publishers

CYBERPROBLEM

13-12 The detailed solution for the cyberproblem is available

instructor’s

side

of

the

accompanying

book

http://www.harcourtcollege.com/finance/ifm.

Harcourt College Publishers

on

the

site,

Solution to Cyberproblem: 13 - 23

MINI CASE

ASSUME THAT YOU HAVE JUST BEEN HIRED AS A FINANCIAL ANALYST BY TROPICAL

SWEETS

INC.,

A

MID-SIZED

CALIFORNIA

COMPANY

THAT

SPECIALIZES

IN

CREATING

EXOTIC CANDIES FROM TROPICAL FRUITS SUCH AS MANGOES, PAPAYAS, AND DATES.

THE

FIRM'S CEO, GEORGE YAMAGUCHI, RECENTLY RETURNED FROM AN INDUSTRY CORPORATE

EXECUTIVE CONFERENCE IN SAN FRANCISCO, AND ONE OF THE SESSIONS HE ATTENDED

WAS ON REAL OPTIONS.

SINCE NO ONE AT TROPICAL SWEETS IS FAMILIAR WITH THE

BASICS EITHER FINANCIAL OR REAL OPTIONS, YAMAGUCHI HAS ASKED YOU TO PREPARE A

BRIEF REPORT THAT THE FIRM'S EXECUTIVES COULD USE TO GAIN AT LEAST A CURSORY

UNDERSTANDING OF THE TOPICS.

TO BEGIN, YOU GATHERED SOME OUTSIDE MATERIALS THE SUBJECT AND USED THESE

MATERIALS TO DRAFT A LIST OF PERTINENT QUESTIONS THAT NEED TO BE ANSWERED.

IN FACT, ONE POSSIBLE APPROACH TO THE PAPER IS TO USE A QUESTION-AND-ANSWER

FORMAT.

NOW THAT THE QUESTIONS HAVE BEEN DRAFTED, YOU HAVE TO DEVELOP THE

ANSWERS.

A.

WHAT IS A REAL OPTION?

WHAT IS A FINANCIAL OPTION?

WHAT IS THE

SINGLE MOST IMPORTANT CHARACTERISTIC OF AN OPTION?

ANSWER:

REAL OPTIONS EXIST WHEN MANAGERS CAN INFLUENCE THE SIZE AND RISK OF

A

PROJECT’S

CASH

FLOWS

BY

TAKING

DIFFERENT

ACTIONS

DURING

PROJECT’S LIFE IN RESPONSE TO CHANGING MARKET CONDITIONS.

THE

ALERT

MANAGERS ALWAYS LOOK FOR REAL OPTIONS IN PROJECTS. SMARTER MANAGERS

TRY TO CREATE REAL OPTIONS.

GIVES

ITS

HOLDER

THE

A FINANCIAL OPTION IS A CONTRACT WHICH

RIGHT

TO

BUY

(OR

SELL)

AN

PREDETERMINED PRICE WITHIN A SPECIFIED PERIOD OF TIME.

ASSET

AT

A

AN OPTION’S

MOST IMPORTANT CHARACTERISTIC IS THAT IT DOES NOT OBLIGATE ITS OWNER

TO TAKE ANY ACTION; IT MERELY GIVES THE OWNER THE RIGHT TO BUY OR

SELL AN ASSET.

Mini Case: 13 - 24

Harcourt College Publishers

B.

OPTIONS HAVE A UNIQUE SET OF TERMINOLOGY.

DEFINE THE FOLLOWING

TERMS: (1) CALL OPTION; (2) PUT OPTION; (3) EXERCISE PRICE; (4)

STRIKING, OR STRIKE, PRICE; (5) OPTION PRICE; (6) EXPIRATION DATE;

(7) EXERCISE VALUE; (8) COVERED OPTION; (9) NAKED OPTION; (10) INTHE-MONEY CALL; (11) OUT-OF-THE-MONEY CALL; AND (12) LEAP.

ANSWER:

1. A CALL OPTION IS AN OPTION TO BUY A SPECIFIED NUMBER OF SHARES

OF A SECURITY WITHIN SOME FUTURE PERIOD.

2. A PUT OPTION IS AN OPTION TO SELL A SPECIFIED NUMBER OF SHARES

OF A SECURITY WITHIN SOME FUTURE PERIOD.

3. EXERCISE

PRICE

STATED IN THE

IS

ANOTHER

NAME

FOR

OPTION CONTRACT AT

STRIKE

PRICE,

THE

WHICH THE SECURITY

PRICE

CAN BE

BOUGHT (OR SOLD).

4. THE STRIKE PRICE IS THE PRICE STATED IN THE OPTION CONTRACT AT

WHICH THE SECURITY CAN BE BOUGHT (OR SOLD).

5. THE OPTION PRICE IS THE MARKET PRICE OF THE OPTION CONTRACT.

6. THE EXPIRATION DATE IS THE DATE THE OPTION MATURES.

7. THE EXERCISE VALUE IS THE VALUE OF A CALL OPTION IF IT WERE

EXERCISED TODAY, AND IT IS EQUAL TO THE CURRENT STOCK PRICE

MINUS THE STRIKE PRICE.

NOTE:

THE EXERCISE VALUE IS ZERO IF

THE STOCK PRICE IS LESS THAN THE STRIKE PRICE.

8. A COVERED OPTION IS A CALL OPTION WRITTEN AGAINST STOCK HELD IN

AN INVESTOR'S PORTFOLIO.

9. A NAKED OPTION IS AN OPTION SOLD WITHOUT THE STOCK TO BACK IT

UP.

10. AN IN-THE-MONEY CALL IS A CALL OPTION WHOSE EXERCISE PRICE IS

LESS THAN THE CURRENT PRICE OF THE UNDERLYING STOCK.

11. AN OUT-OF-THE-MONEY CALL IS A CALL OPTION WHOSE EXERCISE PRICE

EXCEEDS THE CURRENT STOCK PRICE.

Harcourt College Publishers

Mini Case: 13 - 25

12. LEAP STANDS FOR LONG-TERM EQUITY ANTICIPATION SECURITIES.

THEY

ARE SIMILAR TO CONVENTIONAL OPTIONS EXCEPT THEY ARE LONG-TERM

OPTIONS WITH MATURITIES OF UP TO 2½ YEARS.

C.

CONSIDER TROPICAL SWEETS' CALL OPTION WITH A $25 STRIKE PRICE.

FOLLOWING

TABLE

CONTAINS

HISTORICAL

VALUES

FOR

THIS

OPTION

THE

AT

DIFFERENT STOCK PRICES:

STOCK PRICE

$25

30

35

40

45

50

CALL OPTION PRICE

$ 3.00

7.50

12.00

16.50

21.00

25.50

1. CREATE A TABLE WHICH SHOWS (A) STOCK PRICE, (B) STRIKE PRICE, (C)

EXERCISE VALUE, (D) OPTION PRICE, AND (E) THE PREMIUM OF OPTION

PRICE OVER EXERCISE VALUE.

ANSWER:

C.

PRICE OF

STOCK

(A)

$25.00

30.00

35.00

40.00

45.00

50.00

STRIKE

PRICE

(B)

$25.00

25.00

25.00

25.00

25.00

25.00

EXERCISE VALUE

OF OPTION

(A) - (B) = (C)

$ 0.00

5.00

10.00

15.00

20.00

25.00

MARKET PRICE

OF OPTION

(D)

$ 3.00

7.50

12.00

16.50

21.00

25.50

PREMIUM

(D) - (C) =

(E)

$3.00

2.50

2.00

1.50

1.00

0.50

2. WHAT HAPPENS TO THE PREMIUM OF OPTION PRICE OVER EXERCISE VALUE AS

THE STOCK PRICE RISES?

ANSWER:

AS

THE

TABLE

SHOWS,

WHY?

THE

PREMIUM

OF

THE

OPTION

PRICE

EXERCISE VALUE DECLINES AS THE STOCK PRICE INCREASES.

TO

THE

DECLINING

DEGREE

OF

LEVERAGE

PROVIDED

BY

OVER

THE

THIS IS DUE

OPTIONS

AS

THE

UNDERLYING STOCK PRICES INCREASE, AND TO THE GREATER LOSS POTENTIAL

OF OPTIONS AT HIGHER OPTION PRICES.

Mini Case: 13 - 26

Harcourt College Publishers

D.

IN 1973, FISCHER BLACK AND MYRON SCHOLES DEVELOPED THE BLACK-SCHOLES

OPTION PRICING MODEL (OPM).

1. WHAT ASSUMPTIONS UNDERLIE THE OPM?

ANSWER:

THE ASSUMPTIONS WHICH UNDERLIE THE OPM ARE AS FOLLOWS:

THE STOCK UNDERLYING THE CALL OPTION PROVIDES NO DIVIDENDS DURING

THE LIFE OF THE OPTION.

NO TRANSACTIONS COSTS ARE INVOLVED WITH THE SALE OR PURCHASE OF

EITHER THE STOCK OR THE OPTION.

THE SHORT-TERM, RISK-FREE INTEREST RATE IS KNOWN AND IS CONSTANT

DURING THE LIFE OF THE OPTION.

SECURITY BUYERS MAY BORROW ANY FRACTION OF THE PURCHASE PRICE AT

THE SHORT-TERM, RISK-FREE RATE.

SHORT-TERM

SELLING

IS

PERMITTED

WITHOUT

PENALTY,

AND

SELLERS

RECEIVE IMMEDIATELY THE FULL CASH PROCEEDS AT TODAY'S PRICE FOR

SECURITIES SOLD SHORT.

THE CALL OPTION CAN BE EXERCISED ONLY ON ITS EXPIRATION DATE.

SECURITY TRADING TAKES PLACE IN CONTINUOUS TIME, AND STOCK PRICES

MOVE RANDOMLY IN CONTINUOUS TIME.

Harcourt College Publishers

Mini Case: 13 - 27

D.

2. WRITE OUT THE THREE EQUATIONS THAT CONSTITUTE THE MODEL.

ANSWER:

THE OPM CONSISTS OF THE FOLLOWING THREE EQUATIONS:

V = P[N(d1) - XekRFt [N(d2)].

d1 =

ln(P/X) [k RF ( 2/2)]t

t

.

d2 = d 1 - t .

HERE,

V = CURRENT VALUE OF A CALL OPTION WITH TIME t UNTIL EXPIRATION.

P = CURRENT PRICE OF THE UNDERLYING STOCK.

N(di) = PROBABILITY THAT A DEVIATION LESS THAN di WILL OCCUR IN A

STANDARD NORMAL DISTRIBUTION.

THUS, N(d1) AND N(d2) REPRESENT

AREAS UNDER A STANDARD NORMAL DISTRIBUTION FUNCTION.

X = EXERCISE, OR STRIKE, PRICE OF THE OPTION.

e 2.7183.

kRF = RISK-FREE INTEREST RATE.

t = TIME UNTIL THE OPTION EXPIRES (THE OPTION PERIOD).

ln(P/X) = NATURAL LOGARITHM OF P/X.

2 = VARIANCE OF THE RATE OF RETURN ON THE STOCK.

Mini Case: 13 - 28

Harcourt College Publishers

D.

3. WHAT IS THE VALUE OF THE FOLLOWING CALL OPTION ACCORDING TO THE OPM?

STOCK PRICE = $27.00.

EXERCISE PRICE = $25.00

TIME TO EXPIRATION = 6 MONTHS.

RISK-FREE RATE = 6.0%.

STOCK RETURN VARIANCE = 0.11.

ANSWER:

THE INPUT VARIABLES ARE:

P = $27.00; X = $25.00; k RF = 6.0%; t = 6 months = 0.5 years; and 2

= 0.11.

NOW, WE PROCEED TO USE THE OPM:

V = $27[N(d1)] - $25e-(0.06)(0.5)[N(d2)].

ln($27/$25) [(0.06 0.11/2)](0.5)

(0.3317)(0.7071)

0.0770 0.0575

=

= 0.5736.

0.2345

d1 =

d2 = d1 - (0.3317)(0.7071) = d1 - 0.2345

= 0.5736 - 0.2345 = 0.3391.

N(d1) = N(0.5736) = 0.5000 + 0.2168 = 0.7168.

N(d2) = N(0.3391) = 0.5000 + 0.1327 = 0.6327.

THEREFORE,

V = $27(0.7168) - $25e-0.03(0.6327) = $19.3536 - $25(0.97045)(0.6327)

= $19.3536 - $15.3500 = $4.0036 $4.00.

THUS, UNDER THE OPM, THE VALUE OF THE CALL OPTION IS ABOUT $4.00.

Harcourt College Publishers

Mini Case: 13 - 29

E.

WHAT IMPACT DOES EACH OF THE FOLLOWING CALL OPTION PARAMETERS HAVE

ON THE VALUE OF A CALL OPTION?

1. CURRENT STOCK PRICE

2. EXERCISE PRICE

3. OPTION’S TERM TO MATURITY

4. RISK-FREE RATE

5. VARIABILITY OF THE STOCK PRICE

ANSWER:

1. THE VALUE OF A CALL OPTION INCREASES (DECREASES) AS THE CURRENT

STOCK PRICE INCREASES (DECREASES).

2. AS THE EXERCISE PRICE OF THE OPTION INCREASES (DECREASES), THE

VALUE OF THE OPTION DECREASES (INCREASES).

3. AS THE EXPIRATION DATE OF THE OPTION IS LENGTHENED, THE VALUE OF

THE OPTION INCREASES.

THIS IS BECAUSE THE VALUE OF THE OPTION

DEPENDS ON THE CHANCE OF A STOCK PRICE INCREASE, AND THE LONGER

THE OPTION PERIOD, THE HIGHER THE STOCK PRICE CAN CLIMB.

4. AS THE RISK-FREE RATE INCREASES, THE VALUE OF THE OPTION TENDS TO

INCREASE AS WELL.

SINCE INCREASES IN THE RISK-FREE RATE TEND TO

DECREASE THE PRESENT VALUE OF THE OPTION'S EXERCISE PRICE, THEY

ALSO TEND TO INCREASE THE CURRENT VALUE OF THE OPTION.

5. THE

GREATER

THE

VARIANCE

IN

THE

UNDERLYING

STOCK

PRICE,

THE

GREATER THE POSSIBILITY THAT THE STOCK'S PRICE WILL EXCEED THE

EXERCISE PRICE OF THE OPTION; THUS, THE MORE VALUABLE THE OPTION

WILL BE.

Mini Case: 13 - 30

Harcourt College Publishers

F.

WHAT ARE SOME TYPES OF REAL OPTIONS?

ANSWER:

1. INVESTMENT TIMING OPTIONS

2. GROWTH OPTIONS

A.

EXPANSION OF EXISTING PRODUCT LINE

B.

NEW PRODUCTS

C.

NEW GEOGRAPHIC MARKETS

3. ABANDONMENT OPTIONS

A.

CONTRACTION

B.

TEMORARY SUSPENSION

C.

COMPLETE ABANDONMENT

4. FLEXIBILITY OPTIONS.

G.

WHAT ARE FIVE POSSIBLE PROCEDURES FOR ANALYZING A REAL OPTION?

ANSWER:

1. DCF ANALYSIS OF EXPECTED CASH FLOWS, IGNORING OPTION.

2. QUALITATIVELY ASSESS THE VALUE OF THE REAL OPTION.

3. DECISION TREE ANALYSIS.

4. USE A MODEL FOR A CORRESPONDING FINANCIAL OPTION, IF POSSIBLE.

5. USE FINANCIAL ENGINEERING TECHNIQUES IF A CORRESPONDING FINANCIAL

OPTION IS NOT AVAILABLE.

Harcourt College Publishers

Mini Case: 13 - 31

H.

TROPICAL SWEETS IS CONSIDERING A PROJECT THAT WILL COST $70 MILLION

AND WILL GENERATE EXPECTED CASH FLOWS OF $30 PER YEAR FOR THREE

YEARS.

THE COST OF CAPITAL FOR THIS TYPE OF PROJECT IS 10 PERCENT

AND THE RISK-FREE RATE IS 6 PERCENT. AFTER DISCUSSIONS WITH THE

MARKETING DEPARTMENT, YOU LEARN THAT THERE IS A 30 PERCENT CHANCE OF

HIGH DEMAND, WITH FUTURE CASH FLOWS OF $45 MILLION PER YEAR.

THERE

IS A 40 PERCENT CHANCE OF AVERAGE DEMAND, WITH CASH FLOWS OF $30

MILLION PER YEAR.

IF DEMAND IS LOW (A 30 PERCENT CHANCE), CASH

FLOWS WILL BE ONLY $15 MILLION PER YEAR. WHAT IS THE EXPECTED NPV?

ANSWER:

INITIAL COST = $70 MILLION

EXPECTED CASH FLOWS = $30 MILLION PER YEAR FOR THREE YEARS

COST OF CAPITAL = 10%

PV OF EXPECTED CFS = $74.61 MILLION

EXPECTED NPV = $74.61 - $70

= $4.61 MILLION

ALTERNATIVELY, ONE COULD CALCULATE THE NPV OF EACH SCENARIO:

DEMAND

PROBABILITY ANNUAL CASH FLOW

HIGH

30%

$45

AVERAGE

40%

$30

LOW

30%

$15

FIND NPV OF EACH SCENARIO:

PV HIGH:

N=3

I=10

PV=?

PMT=-45

FV=0

PMT=-30

FV=0

PV= 111.91

NPV HIGH = $111.91 - $70 = $41.91 MILLION.

PV AVERAGE:

N=3

I=10

PV=?

PV= 74.61

NPV AVERAGE = $74.61 - $70 = $4.71 MILLION.

PV LOW:

N=3

I=10

PV=?

PMT=-15

FV=0

PV= 37.30

NPV LOW = $37.30 - $70 = -$32.70 MILLION.

FIND EXPECTED NPV:

E(NPV)=.3($41.91)+.4($4.61)+.3(-$32.70)

E(PV)= $4.61.

Mini Case: 13 - 32

Harcourt College Publishers

I.

NOW SUPPOSE THIS PROJECT HAS AN INVESTMENT TIMING OPTION, SINCE IT

CAN BE DELAYED FOR A YEAR.

THE COST WILL STILL BE $70 MILLION AT

THE END OF THE YEAR, AND THE CASH FLOWS FOR THE SCENARIOS WILL STILL

LAST THREE YEARS.

HOWEVER, TROPICAL SWEETS WILL KNOW THE LEVEL OF

DEMAND, AND WILL IMPLEMENT THE PROJECT ONLY IF IT ADDS VALUE TO THE

COMPANY.

PERFORM A QUALITATIVE ASSESSMENT OF THE INVESTMENT TIMING

OPTION’S VALUE.

ANSWER:

IF WE IMMEDIATELY PROCEED WITH THE PROJECT, ITS EXPECTED NPV IS

$4.61 MILLION.

HOWEVER, THE PROJECT IS VERY RISKY.

IF DEMAND IS

HIGH, NPV WILL BE $41.91 MILLION. IF DEMAND IS AVERAGE, NPV WILL

BE $4.61 MILLION. IF DEMAND IS LOW, NPV WILL BE -$32.70 MILLION.

HOWEVER,

IF

INFORMATION

WE

WAIT

REGARDING

ONE

YEAR,

DEMAND.

WE

WILL

IF

DEMAND

FIND

IS

OUT

LOW,

ADDITIONAL

WE

WON’T

IMPLEMENT PROJECT. IF WE WAIT, THE UP-FRONT COST AND CASH FLOWS

WILL STAY THE SAME, EXCEPT THEY WILL BE SHIFTED AHEAD BY A YEAR.

THE VALUE OF ANY REAL OPTION INCREASES IF THE UNDERLYING PROJECT

IS VERY RISKY OR IF THERE IS A LONG TIME BEFORE YOU MUST EXERCISE

THE OPTION.

THIS PROJECT IS RISKY AND HAS ONE YEAR BEFORE WE MUST DECIDE, SO

THE OPTION TO WAIT IS PROBABLY VALUABLE.

J.

USE DECISION TREE ANALYSIS TO CALCULATE THE NPV OF THE PROJECT WITH

THE INVESTMENT TIMING OPTION.

ANSWER:

THE PROJECT WILL BE IMPLEMENTED ONLY IF DEMAND IS AVERAGE OR HIGH.

HERE IS THE TIME LINE:

0

1

2

3

4

HIGH

$0

-$70

$45

$45

$45

AVERAGE

$0

-$70

$30

$30

$30

LOW

$0

$0

$0

$0

$0

TO FIND THE NPVC, DISCOUNT THE COST AT THE RISK-FREE RATE OF 6

PERCENT SINCE IT IS KNOWN FOR CERTAIN, AND DISCOUNT THE OTHER RISKY

CASH FLOWS AT THE 10 PERCENT COST OF CAPITAL.

Harcourt College Publishers

Mini Case: 13 - 33

HIGH: NPV = -$70/1.06 + $45/1.102 + $45/1.103 +$45/1.104 = $35.70

AVERAGE: NPV = -$70/1.06 + $30/1.102 + $30/1.103 +$30/1.104 = $1.79

LOW: NPV = $0.

EXPECTED NPV = 0.3($35.70) + 0.4($1.79) + 0.3($0) = $11.42.

SINCE THIS IS MUCH GREATER THAN THE NPV OF IMMEDIATE IMPLEMENTATION

(WHICH IS $4.61 MILLION) WE SHOULD WAIT.

IN OTHER WORDS,

IMPLEMENTING IMMEDIATELY GIVES AN EXPECTED NPV OF $4.61 MILLION, BUT

IMPLEMENTING IMMEDIATELY MEANS WE GIVE UP THE OPTION TO WAIT, WHICH

IS WORTH $11.42 MILLION.

K.

USE A FINANCIAL OPTION PRICING MODEL TO ESTIMATE THE VALUE OF THE

INVESTMENT TIMING OPTION.

ANSWER:

THE OPTION TO WAIT RESEMBLES A FINANCIAL CALL OPTION-- WE GET TO

“BUY” THE PROJECT FOR $70 MILLION IN ONE YEAR IF VALUE OF PROJECT IN

ONE YEAR IS GREATER THAN $70 MILLION.

THIS IS LIKE A CALL OPTION

WITH AN EXERCISE PRICE OF $70 MILLION AND AN EXPIRATION DATE OF ONE

YEAR.

X = EXERCISE PRICE = COST OF IMPLEMENT PROJECT = $70 MILLION.

KRF = RISK-FREE RATE = 6%.

T = TIME TO MATURITY = 1 YEAR.

P = CURRENT PRICE OF STOCK = CURRENT VALUE OF THE PROJECT’S FUTURE

CASH FLOWS.

2 = VARIANCE OF STOCK RETURN = VARIANCE OF PROJECT’S RATE OF RETURN.

WE EXPLAIN HOW TO CALCULATE P AND 2 BELOW.

JUST AS THE PRICE OF A STOCK IS THE PRESENT VALUE OF ALL THE STOCK’S

FUTURE CASH FLOWS, THE “PRICE” OF THE REAL OPTION IS THE PRESENT

VALUE OF ALL THE PROJECT’S CASH FLOWS THAT OCCUR BEYOND THE EXERCISE

DATE.

NOTICE THAT THE EXERCISE COST OF AN OPTION DOES NOT AFFECT

THE STOCK PRICE.

SIMILARLY, THE COST TO IMPLEMENT THE REAL OPTION

DOES NOT AFFECT THE CURRENT VALUE OF THE UNDERLYING ASSET (WHICH IS

THE PV OF THE PROJECT’S CASH FLOWS).

IT WILL BE HELPFUL IN LATER

STEPS IF WE BREAK THE CALCUATION INTO TWO PARTS.

Mini Case: 13 - 34

FIRST, WE FIND THE

Harcourt College Publishers

VALUE OF ALL CASH FLOWS BEYOND THE EXERCISE DATE DISCOUNTED BACK TO

THE EXERCISE DATE.

THEN WE FIND THE EXPECTED PRESENT VALUE OF THOSE

VALUES.

STEP 1: FIND THE VALUE OF ALL CASH FLOWS BEYOND THE EXERCISE DATE

DISCOUNTED BACK TO THE EXERCISE DATE.

HERE IS THE TIME LINE.

THE

EXERCISE DATE IS YEAR 1, SO WE DISCOUNT ALL FUTURE CASH FLOWS BACK

TO YEAR 1.

0

1

2

3

4

HIGH

$45

$45

$45

AVERAGE

$30

$30

$30

LOW

$15

$15

$15

HIGH: PV1 = $45/1.10 + $45/1.102 + $45/1.103 = $111.91

AVERAGE: PV1 = $30/1.10 + $30/1.102 + $30/1.103 = $74.61

LOW: PV1 = $15/1.10 + $15/1.102 + $15/1.103 = $37.30

THE CURRENT EXPECTED PRESENT VALUE, P, IS:

P = 0.3[$111.91/1.1] + 0.4[$74.61/1.1] + 0.3[$37.30/1.1] = $67.82.

FOR A STOCK OPTION, 2 IS THE VARIANCE OF THE STOCK RETURN, NOT THE

VARIANCE OF THE STOCK PRICE.

THEREFORE, FOR A REAL OPTION WE NEED

THE VARIANCE OF THE PROJECT’S RATE OF RETURN.

TO ESTIMATE THIS VARIANCE.

THERE ARE THREE WAYS

FIRST, WE CAN USE SUBJECTIVE JUDGMENT.

SECOND, WE CAN CALCULATE THE PROJECT’S RETURN IN EACH SCENARIO AND

THEN CALCULATE THE RETURN’S VARIANCE.

THIS IS THE DIRECT APPROACH.

THIRD, WE KNOW THE PROJECTS VALUE AT EACH SCENARIO AT THE EXPIRATION

DATE, AND WE KNOW THE CURRENT VALUE OF THE PROJECT.

THUS, WE CAN

FIND A VARIANCE OF PROJECT RETURN THAT GIVES THE RANGE OF PROJECT

VALUES THAT CAN OCCUR AT EXPIRATION.

THIS IS THE INDIRECT APPROACH.

FOLLOWING IS AN EXPLANATION OF EACH APPROACH.

SUBJECTIVE ESTIMATE:

THE

TYPICAL

STOCK

HAS

2

OF

ABOUT

12%.

MOST

PROJECTS

WILL

BE

SOMEWHAT RISKIER THAN THE FIRM, SINCE THE RISK OF THE FIRM REFLECTS

THE

DIVERSIFICATION

Harcourt College Publishers

THAT

COMES

FROM

HAVING

MANY

PROJECT.

Mini Case: 13 - 35

SUBJECTIVELY SCALE THE VARIANCE OF THE COMPANY’S STOCK RETURN UP OR

DOWN TO REFLECT THE RISK OF THE PROJECT.

THE COMPANY IN OUR EXAMPLE

HAS A STOCK WITH A VARIANCE OF 10%, SO WE MIGHT EXPECT THE PROJECT

TO HAVE A VARIANCE IN THE RANGE OF 12% TO 19%.

DIRECT APPROACH:

FROM OUR PREVIOUS ANALYSIS, WE KNOW THE CURRENT VALUE OF THE PROJECT

AND THE VALUE FOR EACH SCENARIO AT THE TIME THE OPTION EXPIRES (YEAR

1).

HERE IS THE TIME LINE:

CURRENT VALUE

VALUE AT EXPIRATION

YEAR 0

YEAR 1

HIGH

$67.82

$111.91

AVERAGE

$67.82

$74.61

LOW

$67.82

$37.30

THE ANNUAL RATE OF RETURN IS:

HIGH: RETURN = ($111.91/$67.82) – 1 = 65%.

HIGH: AVERAGE = ($74.61/$67.82) – 1 = 10%.

HIGH: RETURN = ($37.30/$67.82) – 1 = -45%.

EXPECTED RETURN = 0.3(0.65) + 0.4(0.10) + 0.3(-0.45)

= 10%.

2 = 0.3(0.65-0.10)2 + 0.4(0.10-0.10)2 + 0.3(-0.45-0.10)2

= 0.182 = 18.2%.

THE DIRECT APPROACH GIVES AN ESTIMATE OF 18.2% FOR THE VARIANCE OF

THE PROJECT’S RETURN.

THE INDIRECT APPROACH:

GIVEN A CURRENT STOCK PRICE AND AN ANTICIPATED RANGE OF POSSIBLE

STOCK PRICES AT SOME POINT IN THE FUTURE, WE CAN USE OUR KNOWLEDGE

OF THE DISTRIBUTION OF STOCK RETURNS (WHICH IS LOGNORMAL) TO RELATE

THE VARIANCE OF THE STOCK’S RATE OF RETURN TO THE RANGE OF POSSIBLE

OUTCOMES

FOR

COEFFICIENT

EXPIRES.

OF

STOCK

PRICE.

VARIATION

OF

TO

USE

STOCK

THIS

PRICE

AT

FORMULA,

THE

WE

TIME

NEED

THE

THE

OPTION

TO CALCULATE THE COEFFICIENT OF VARIATION, WE NEED THE

EXPECTED STOCK PRICE AND THE STANDARD DEVIATION OF THE STOCK PRICE

(BOTH OF THESE ARE MEASURED AT THE TIME THE OPTION EXPIRES).

FOR

THE REAL OPTION, WE NEED THE EXPECTED VALUE OF THE PROJECT’S CASH

Mini Case: 13 - 36

Harcourt College Publishers

FLOWS

AT

DEVIATION

THE

OF

DATE

THE

THE

REAL

PROJECT’S

OPTION

VALUE

AT

EXPIRES,

THE

DATE

AND

THE

THE

STANDARD

REAL

OPTION

EXPIRES.

WE PREVIOUSLY CACULATED THE VALUE OF THE PROJECT AT THE TIME THE

OPTION EXPIRES, AND WE CAN USE THIS TO CALCULATE THE EXPECTED VALUE

AND THE STANDARD DEVIATION.

VALUE AT EXPIRATION

YEAR 1

HIGH

$111.91

AVERAGE

$74.61

LOW

$37.30

EXPECTED VALUE =.3($111.91)+.4($74.61)+.3($37.3)

= $74.61.

VALUE = [.3($111.91-$74.61)2 + .4($74.61-$74.61)2

+ .3($37.30-$74.61)2]1/2

= $28.90.

COEFFICENT OF VARIATION = CV = EXPECTED VALUE / VALUE

CV = $74.61 / $28.90 = 0.39.

HERE IS A FORMULA FOR THE VARIANCE OF A STOCK’S RETURN, IF YOU KNOW

THE COEFFICIENT OF VARIATION OF THE EXPECTED STOCK PRICE AT SOME

POINT IN THE FUTURE.

THE CV SHOULD BE FOR THE ENTIRE PROJECT,

INCLUDING ALL SCENARIOS:

2 = LN[CV2 + 1]/T = LN[0.392 + 1]/1 = 14.2%.

Harcourt College Publishers

Mini Case: 13 - 37

NOW, WE PROCEED TO USE THE OPM:

V = $67.83[N(d1)] - $70e-(0.06)(1)[N(d2)].

ln($67.83/$70) [(0.06 0.142/2)](15)

(.142)0.5(1)0.5

d1 =

= 0.2641.

d2 = d1 - (0.142)0.5(1)0.5 = 0.2641 - 0.3768

= -0.1127.

N(d1) = N(0.2641) = 0.6041.