Problem_SolutionsCh1

advertisement

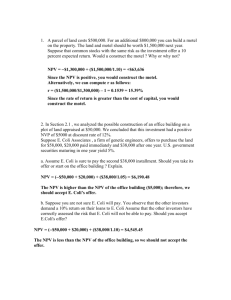

The solutions for all assigned problems are given below. I have also included some qualitative and quantitative questions similar to the questions in Midterm I SampleMid1Q1. What are the main differences between NPV, IRR, and B/C? SampleMid1Q2. What advantages are lost if the sum of the weights in a weighted scoring approach does not add to 1.0? Why is it suggested that factors with less than 2 percent or 3 percent impact not be considered in this approach? SampleMid1Q3. When it comes to assigning individuals to work on projects, functional managers and project managers are often in conflict. How can the PM resolve this problem? SampleMid1Q4. Which technique can provides almost all information provided by an interface map? SampleMid1P1. All cash inflow/outflow in this problem occur at the end of the corresponding year. The design of a new product is expected to take one year at a cost of 5M. There is a 0.7 probability that the project will be technically feasible. If feasible, it can be launched with an estimated cost of $6M paid in Year 2. If launched, the useful life of the project is only one year with no salvage value at the end of Year 3. When launched, it will be in one of the following three states: (1) Extraordinary commercial success with probability of 0.2, earning a net after-tax cash inflow of $30M. (2) Average commercial success with probability of 0.7, earning the net after-tax cash inflow of $15M. (3) Commercial failure earning the net after-tax cash inflow is $5M. The discount rate is 10 percent. Compute the expected commercial value of this project. 30M Extraordinary com. success 20% 15M -6M -5M 70% Technically Feasible Invest 70% Average com. success 5M 10% Commercial failure success Design a new Product Technically Infeasible Expected return in Year 3 if the project is technically feasible = 0.2*30+0.7*15+0.1*5 Expected return in Year 3 if the project is technically feasible = 17M The present value of this cash flow at the end of year 2 is 17/1.1 = 15.45M The investment at the end of Year 2 is -6M. Therefore, the net present value at the end of year 2 is 15.45 – 6 = 9.45. But there is only 70% probability for this line. Therefore, the expected cash flow is 9.45*.7 = 6.61M. Furthermore, it is a cash flow at the end of Year 2. The present value of this cash flow at the end of year 1 is 6.61/1.1 = 6.01M Since the initial investment is –5, the net present value of the project at the end of year 1 is 6.01-5 = 1.01 Expected commercial value at the end of year 0 is 1.01/1.1 = 0.92 Chapter 1 Problem19. I have solved this problem in 3 ways 1) Using statistics 2) Using Excel 3) Using a crystal ball The analytical solution is preferred. a) Analytical solution The Present Value of the “Mean” of each cash flow is: Mean I0 = -75000 Mean P1 = 20000(1.2)(-1) = 16666.7 Mean P2 = 25000(1.2)(-2) = 17361.1 Mean P3 = 30000(1.2)(-3) = 17361.1 Mean P4 = 50000(1.2)(-4) = 24112.7 The Present Value of the “Mean” of NPV is: Mean NPV = -75000+16666.7+17361.1+17361.1+24112.7 = 501.6 The Present Value of the “Standard Deviation ” of each cash flow is: Standard Deviation Standard Deviation Standard Deviation Standard Deviation Standard Deviation I0 = 0 P1 = (1.2)(-1) (1000) P2 = (1.2)(-2) (1500) P3 = (1.2)(-3) (2000) P4 = (1.2)(-4) (3500) = 833.3 = 1041.7 = 1157.4 = 1687.9 The Present Value of the “Standard Deviation ” of NPV is: Variance NPV = Variance I0 +Variance P1+ Variance P2 + Variance P3+ Variance P4 Variance NPV = 5968064 Standard Deviation of NPV = 2443 Therefore, NPV is a Normal Variable with Mean of 501.6 and Standard Deviation of 2443 Z = (0-501.6)/2443 = -0.21 If you look at the Normal table in your book, you will see that the probability associated with +0.21 is 58.3%. That is the area to the left or +.21. Therefore the area to the right of -0.21 is the same 58.3%. P(NPV≥0) = 58.3 If you solve the problem using Crystal Ball – see below – you will get P(NPV≥0) = 59.6. If you solve the problem using Crystal Ball – see below – you will get P(NPV≥0) = 56.9. The analytical solution is a rigorous reliable solution. b) Solution to Problem 19 using random Year 0 1 2 3 4 Distribution Constant N(20000,1000) N(25000,1500) N(30000,2000) N(50000,3500) Cash Flow -75000 19277.38608 23617.89846 27145.2099 45474.30949 PV index 1 0.8333333 0.6944444 0.5787037 0.4822531 NPV PV -75000 16064.49 16401.32 15709.03 21930.13 -4895.03 This is the result for only one replication. Ti see the functions please double click on the Table. The histogram of NPV for 1000 replications is shown below Histogram 100 90 80 70 Frequency Bin Frequency Cumulative Cum. Freq. -6941.4 1 -6436.4 0 1 0.001 -5931.39 3 4 0.004 -5426.39 4 8 0.008 -4921.38 5 13 0.013 -4416.38 6 19 0.019 -3911.38 11 30 0.03 -3406.37 23 53 0.053 -2901.37 28 81 0.081 -2396.36 37 118 0.118 -1891.36 47 165 0.165 -1386.36 58 223 0.223 -881.351 72 295 0.295 -376.347 62 357 0.357 0 74 431 0.431 633.6613 77 508 0.508 1138.665 87 595 0.595 1643.67 85 680 0.68 2148.674 73 753 0.753 2653.678 57 810 0.81 3158.682 49 859 0.859 3663.686 42 901 0.901 4168.69 25 926 0.926 4673.694 27 953 0.953 5178.698 19 972 0.972 5683.702 12 984 0.984 6188.706 7 991 0.991 6693.71 5 996 0.996 7198.714 1 997 0.997 7703.719 0 997 0.997 8208.723 1 998 0.998 More 2 1000 1 60 50 40 30 Frequency 20 10 0 Bin As we can see. P(NPV≤0) = 43.1% P(NPV≥0) = 56.9% c) Solution to Problem 19 using Crystal Ball o o Cells B5 through B8 were defined as assumption cells. Cell B5 was defined as an Assumption Cell with a normal distribution with a mean of 20,000 and standard deviation of 1,000, and Cell B9 was defined as a Forecast Cell. The results of simulating this situation 1,000 times in Crystal Ball are shown below. According to the results, the expected NPV is $589 while there is a 59.6% probability that the NPV will be positive. The distribution of potential NPVs is generated with the simulation approach providing the decision maker with insight into the uncertainty and risk associated with the situation. In this case, we see the NPV ranges from a low of -$6,742 to a high of $8,935. A B 1 Req Rate of Return 20.0% 2 Year Cash Flow 3 4 0 -$75,000 5 1 $20,000 6 2 $25,000 7 3 $30,000 8 4 $50,000 NPV $502 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 Problem 23. C D E Assumption Cells Forecast Cell F G Factor Class of Clientele Rent Indoor Mall Volume Weight Normal Weight 100 28.78 90 25.90 85.5 24.60 72 20.72 347.5 100 1 fair good good good Factor Class of Clientele Rent Indoor Mall Volume Normal Weight 28.777 25.899 24.604 20.719 1 2 3 3 3 271 Loca tion 2 3 good poor fair poor poor good fair good 1 Loca tion 2 3 3 1 2 1 1 3 2 3 204 191 3 4 4 good good poor poor 4 3 3 1 1 209 271 2 Chapter 3 Problem 24. Prepare an action plan using MSP with the steps that must be completed before Vern Toomey can contact outsourcing vendors. If Vern starts on August 1, 2005, how long will it take to get ready to contact outsourcing vendors? Based on the information in the Gantt chart it would be Tuesday, August 23, '05 before Vern would be able to contact vendors for the outsourcing proposals, Chapter 4 Problem 13. As can be seen from the following Table, the number of hours needed to prepare the slides (given an 85% learning rate) would be 50 hours in session 1, 42.5 hours in session 2, 36.1 hours in session 4, and 30.7 in session 8. This enables the total cost per session to be calculated … and thus the total for the eight sessions. Session 1 2 3 4 5 6 7 8 Total Hours 50 42.5 38.6 36.1 34.3 32.8 31.7 30.7 V.C. $5,000 $4,250 $3,865 $3,613 $3,428 $3,285 $3,168 $3,071 Fixed Cost Total Cost Cum Cost Cum Rev $600 $5,600 $5,600 $5,172 $600 $4,850 $10,450 $10,344 $600 $4,465 $14,915 $15,516 $600 $4,213 $19,127 $20,688 $600 $4,028 $23,155 $25,860 $600 $3,885 $27,040 $31,032 $600 $3,768 $30,809 $36,204 $600 $3,671 $34,479 $41,376 $34,479 The total cost for the eight sessions is $34,479 to which your firm adds a 20 percent profit margin to give a bid price of $41,375. The per session price, therefore, is $5,172. Comparing the cumulative revenue with the cumulative cost, your firm will break even in the third session. Problem 14. If you compute MAD and TS t 1 2 3 4 5 6 7 8 Ft 179 217 91 51 76 438 64 170 At 163 240 67 78 71 423 49 157 At-Ft -16 23 -24 27 -5 -15 -15 -13 |At-Ft| 16 23 24 27 5 15 15 13 MAD 16 19.5 21.0 22.5 19.0 18.3 17.9 17.3 TS -1 0.36 -0.81 0.44 0.26 -0.55 -1.40 -2.20 Column1 TS 1 0.5 0 -0.5 1 2 3 4 5 6 7 8 TS -1 -1.5 -2 -2.5 Mean Standard Error Median Mode Standard Deviation Sample Variance Kurtosis Skewness Range Minimum Maximum Sum Count If you have computed MAR and TS Period 1 2 3 4 5 6 7 8 Total Estimate 179 217 91 51 76 438 64 170 Actual 163 240 67 78 71 423 49 157 (At/Et) - 1 |(At/Et) - 1| -8.9% 8.9% 10.6% 10.6% -26.4% 26.4% 52.9% 52.9% -6.6% 6.6% -3.4% 3.4% -23.4% 23.4% -7.6% 7.6% -12.9% 139.9% MAR Tracking Signal 0.098 0.153 0.247 0.211 0.181 0.189 0.175 0.170 -1.615 1.142 1.027 1.005 -0.276 -0.735 -4.75 6.75 -14 -15 19.10 364.79 -0.29 1.15 51 -24 27 -38 8 The mean bias is -1.61% (-0.129/8) and the MAR is 0.175. Thus, the new model is slightly less accurate, but has significantly less bias. Problem 15. alternative. Alternative a b c d As shown in the table below, alternative d has the lowest expected cost and is thus the best Rainy 0.3 6 2 1 5 Cloudy 0.2 3 4 2 4 Sunny 0.5 4 5 7 3 Expected Cost 4.4 3.9 4.2 3.8 16. The worst possible outcomes for Alternatives a, b, c and d are 6, 5, 7 and 5 respectively. Alternative a b c d Rainy 0.3 6 2 1 5 Cloudy 0.2 3 4 2 4 Sunny 0.5 4 5 7 3 Worst Case 6 5 7 5 Alternatives b and d have the best (lowest) worst outcome. Problem 17. In the spreadsheet shown below the project cost, nonengineering labor hours, material cost, and downtime hours were all modeled using a triangular distribution. The engineering labor hours were modeled using a uniform distribution over the range of 510 to 690 hours. As shown in the spreadsheet below, the project has a 92.37% chance of meeting the firm’s NPV hurdle. Hours Proj Cost Eng Labor Non Eng Labor Matl Downtime Total Cost 600 1633 112 Cost $1,033,333 48,000 57,167 130,000 55,833 1,324,333