THE SOCIETY OF BEXHILL MUSEUMS LIMITED

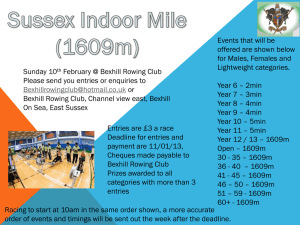

advertisement

GIFT AID DECLARATION Charity Name: Charity No. SOCIETY OF BEXHILL MUSEUMS LIMITED 1102638 Details of Donor: Title……….Forenames………………………………Surname……………………… Address…………………………………………………………………………………. …………………………………………………………………………………………… Post Code…………………………………….. I would like the Society of Bexhill Museums Limited to treat the following as a Gift Aid Donation. * 1 The enclosed donation of £……………………….. * 2 All donations I make from the date of this declaration until I notify you otherwise. Signature of Donor……………………………………. Date……………………….. * Please delete as appropriate Please return this completed form to the Membership Secretary, Society of Bexhill Museums Ltd, Bexhill Museum, Egerton Road, Bexhill on Sea, Sussex TN39 3HL You can cancel your declaration at any time by notifying the Membership Secretary. It will then not apply to any donations you make to the Society on or after the date of cancellation or any such later date as you may specify. You must be paying an amount of income tax and/or capital gains tax at least equal to the amount of tax that the Charity reclaims on your donations in the tax year (currently 22p per £1 donated). If you pay tax at the higher rate you can claim further tax relief in your Self Assessment tax return. If you are unsure whether your donations qualify for Gift Aid Tax Relief, ask the Charity or obtain leaflet IR65 from your local tax office. Society of Bexhill Museums Bexhill Museum • Egerton Road • Bexhill on Sea • TN39 3HL Tel: 01424 787950 • Email: museum@rother.gov.uk • Website: www.bexhill-museum.co.uk A Registered charitable company limited by guarantee • Reg. Charity No. 1102638