Chap

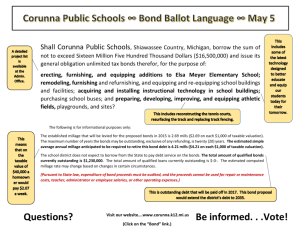

advertisement

Chen Lung Chin Chap.16 LONG-TERM LIABILITIES The objective of this chapter 1. Explain why bonds are issued. 2 Prepare the entries for the issuance of bonds and interest expense. 3 Describe the entries when bonds are redeemed or converted. 4 Describe the accounting for long-term notes payable. 5 Contrast the accounting for operating and capital leases. 6 Identify the methods for the presentation and analysis of long-term liabilities. Feature story: University of Kentucky=> issue revenue bonds to build buildings. 6%=>10% Standard & Poor's Corp. Moody's Investors Service 中華信用評等公司 AAA, AA, A, BBB, BB, B, CCC, CC, R, SD, D (一) Introduction (OBJECTIVE 1) (1) Feature (A) Obligations that are expected to be paid after one year (B) Include bonds, long-term notes, and lease obligations (C) Bond Basics (a)interest-bearing notes payable (b)issued by corporations, universities, and governmental agencies (c)like common stock, can be sold in small denominations (d) attract many investors (2) Bond Basics (A) Why Issue Bonds? (advantages of Bonds) Long-term liability, offer the following advantages over common stock: (a)Stockholder control not affected (b)Tax savings (c)Earnings per share may be higher Assume that M, Inc. is considering two plans for financing the construction of a new $5,000,000 plant. (A) issuance of 200,000 shares of c. s. at the market price of $25 per share. (B) issuance of $5,000,000, 8% bonds at face value. Income before interest and taxes on the new plant is $1,500,000. Income taxes are expected to be 30%. M. Inc. currently has 100,000 shares of c. s. outstanding. 1 Chen Lung Chin => financial leverage! (B) Disadvantages of Bonds (a)Interest must be paid on a periodic basis (b)Principal (face value) must be repaid at maturity (3) Types of Bonds (A) Secured bonds: Specific assets of the issuer pledged as collateral for the bonds (a) mortgage bond: is secured by real estate) (b) sinking fund bond Story: Trans World Airlines=>light-bulb bonds (B) Unsecured bonds: Issued against the general credit of the borrower; they are also called debenture bonds. => Story: Du Pond issue over $2 billion… (C) Term bonds: bonds that mature at a single specified future date (D) Serial bonds: bonds that mature in installments (E) Registered bonds: issued in the name of the owner (F)Bearer or coupon bonds: not registered (G)Convertible: convert the bonds into common stock at holder’ option (H)Callable: subject to call and retirement at a stated dollar amount prior to maturity at the option of the issuer. (4) Issuing procedure (A) Authorizing a Bond Issue: (a) State laws grant corporations the power to issue bonds (b) approval by both the board of directors and stockholders is usually required (c) Board of directors stipulate (1)the number of bonds to be authorized, (2)total face value, and (3)contractual interest rate (B) Issuing Procedures (a) Face value: (b)Contractual interest rate, or stated rate 2 Chen Lung Chin (c)Bond indenture: terms of the bond issue are set forth in a formal legal document (d) Bond certificates: provide information such as name of issuer and maturity date, are printed (C) Bond Trading (a) traded on national securities exchanges bondholders (b) Bond prices are quoted as a percentage of the face value of the bond => face value $1,000; 98%, 103% Note: General Motors Stated rate 7.2%, face value $1,000 bonds that mature in 1/15/2011. They currently yield a 7.007% return. (Dividend / Market value) $62,427,000 of these bonds were traded. At the close of trading, the price was 101.110% of face value. (c) Transactions between a bondholder and other investors are not journalized by the issuing corporation (d) A corporation only makes journal entries : 1)when it issues or buys back bonds, and 2)when bondholders convert bonds into common stock. (D) To determine the Market Value of Bonds The market value (present value) of a bond is determined by: (a) the dollar amounts (b) the length of time (c) the market rate of interest, which is the rate investors demand for loaning funds. =>The process of finding the present value is referred to as discounting the future amounts. => Appendix C 1) time value of money (二) ACCOUNTING FOR BOND ISSUES (1) Issuing Bonds at Face Value (A) Bonds may be issued at face value, below face value (at a discount), or above face value (at a premium). (B) Assume that Devor Corporation issues 1,000, 10-year, 9% $1,000 bonds 3 Chen Lung Chin on 1/1/2005, at 100 (100% of face value). Interest is paid on 7/1 and 1/1. Bonds payable: the long-term liability section of the balance sheet Bond interest payable is classified as a current liability. (2) Discount or Premium on bonds (A) Bonds may be issued below or above face value. (a)Market (effective) rate of interest = the contractual (stated) rate • the bonds will sell at face value (b) Market (effective) rate of interest > the contractual (stated) rate • the bonds will sell at less than face value, or at a discount (c) Market rate of interest < the contractual rate • the bonds will sell above face value, or at a premium (3) Issuing Bonds at a Discount (A) ex: Assume that on 1/1/2005, C, Inc. sells $100,000, 5-year, 10% bonds for 92,639 (92.639% of face value) with interest payable on July 1 and January 1.=> MARKET rate= 12% 4 Chen Lung Chin (B) Presentation: (a)Discount on Bonds Payable =>contra account=>deducted from bonds payable (b)The $92,639 represents the carrying (or book) value of the bonds. (c)On the date of issue this amount equals the market price of the bonds. (C) Total cost of borrowing bonds issued at discount (a) Discount: the difference between the issuance price and face value 1) an additional cost of borrowing=> why? 2) recorded as interest expense over the life of the bonds (b) Alternative computation Q: Does the sale of bond at a discount mean=> financial strength is suspect? (3) Issuing Bonds at a Premium (A)Assume the C, Inc. bonds described above are sold for $108,111 (108.111% of face value) rather than for $ 92,639=>MARKET rate= 8% (B) Presentation: (a) Premium on Bonds Payable => added to bonds payable (C) Total cost of borrowing bonds issued at Premium (a) Premium: the difference between the issuance price and face value 1) reduction in the cost of borrowing that 5 Chen Lung Chin 2)credited to Bond Interest Expense over the life of the bonds. (b) Alternative computation (三) ACCOUNTING FOR BOND RETIREMENTS (1) Redeeming Bonds at Maturity (OBJECTIVE 3) (A) Regardless of the issue price of bonds, the book value of the bonds at maturity will equal their face value. (2) Redeeming Bonds before Maturity=> why? (A) Assume that at the end of the eighth period (January 1, 2009), C, Inc. retires its bonds at 103. The carrying value of the bonds at the redemption date is $101,623.=> Q: What is the market interest rate on 1/1/2009? Notes: Loss on bond redemption is recorded as extraordinary loss. (3) Converting Bonds into Common Stock (CS) => why? (A) Two method: (a) carrying (Book) value method:=> text! (b) market value method=> intermediate accounting 6 Chen Lung Chin (B) carrying (Book) value method: (a) the market prices of the bonds and the stock are ignored. (b) the carrying value of the bonds is transferred to paid-in capital accounts=> No gain or loss is recognized. Assume that on 7/1 S. converts $100,000 bonds sold at face value into 2,000 shares of $10 par value CS (Both the bonds and the CS have a market value of $130,000. (C) market value method: (a) the market prices of the bonds and the stock are consider. (b) the market value of the bonds is transferred to paid-in capital accounts=> Gain or loss is recognized. (四) OTHER LONG TERM LIABILITIES (1) Long-term notes payable: similar to short-term interest-bearing notes payable (2) Mortgage notes payable (A)long-term note may be secured by a mortgage (B)recorded initially at face value (C) subsequent entries are required for each installment payment Assume that P. Technology Inc. issues a $500,000, 12%, 20-year mortgage note on 12/31/2005. The terms provide for semiannual installment payment of $33,231. Q: HOW to calculate the amount $33,231.? 7 Chen Lung Chin (D) the reduction in principal for the next year is reported as a C.L. The remaining unpaid principal balance is classified as a long-term liability. E.X. 12/31/ 2006, the total liability is $493,344. : $7,478 ($3,630 + $3,848) =>current $485,866 ($493,344 — $7,478) => long-term. (3) LEASE (OBJECTIVE 5) (A) Types: (a) Operating Leases 1) intent is temporary use of the property by the lessee 2) lessor continues to own the property 3)lease (or rental) payments are recorded as =>an expense by the lessee =>an revenue by the lessor Notes: The lessee may incur other costs during the lease period. For example, gas and oil.=>These costs are also reported as an expense. (b) Capital Leases=> 1) Capital lease is in substance an installment purchase by the lessee. 2)The present value of the cash payments for the lease are capitalized and recorded as an asset 3)Lessee records the lease as an asset (a capital lease) if any one of the following conditions exist: a)Lease transfers ownership of the property to the lessee. b)Lease contains a bargain purchase option c)Lease term is equal to 75% or more of the economic life of the leased property. d)Present value of the lease payments equals or exceeds 90% of the fair market value of the leased property. E.X. Assume that GC decides to lease new equipment. (1)The lease period is 4 years; (2) the economic life of the leased equipment is estimated to be 5 years. 8 Chen Lung Chin (3)The present value of the lease payments is $190,000, which is equal to the fair market value of the equipment. (4)There is no transfer of ownership during the lease term, nor is there any bargain purchase option. Ans: Conditions 3 and 4 have been met. (1)the lease term is 75% or more of the economic life of the asset. (2)the present value of cash payments is equal to the equipment’s MV. Notes: The leased asset=> plant assets. The lease liability=>liability. 4) The portion of the lease liability expected to be paid in the next year=> current liability. The remainder=> long-term liability. 5) Off-balance-sheet financing: The practice of keeping liabilities off the B/S=> How to do it? HOW: ~Enron=> Special purpose entity (SPE) ~Operating lease WHY: ~Removing debt => enhancing the quality of B/S=>↓cost of capital ~Debt covenant: imposing the limitation of Debt. What do the authority concerned? => Sarbanes-Oxley act! Q: Most lessees do not like to report leases on their balance sheets. Why? (四) Presentation and Analysis of L.L. Liabilities (1) Presentation: (A) reported in a separate section of the balance sheet immediately following current liabilities (B) current maturities of long-term debt: CL if they are to be paid from CA. (C) Supporting schedule: other information (interest rate, maturity date,…). 9 Chen Lung Chin (2) Analysis (A)Debt to total assets (a) measures the percentage of total assets provided by creditors, indicating the degree of leverage utilized. (b) formula: total debt ÷ total assets. (B) Times Interest Earned Ratio (a) indicates the company’s ability to meet interest payments as they come due. (b) formula: income before income taxes and interest expense ÷ interest expense. => extremely safe! Appendix 16 A (一) PRESENT VALUE (16 A) Q: The state has provided you with three options for payment: 1. Receive $10,000,000 in 3 years. 2. Receive $7,000,000 immediately. 3. Receive $3,500,000 at the end of each year for 3 years. 10 Chen Lung Chin => which option is better? (二) Present Value of Interest Payments (Annuities) (三) Present Value of a Bond 11 Chen Lung Chin Appendix 16 B Effective-Interest Amortization (一) PRESENT VALUE (16 A) (1) INTRODUCTION 12 Chen Lung Chin (A) An alternative to straight-line amortization. (B)Both methods result in the same total amount of interest expense over the term of the bonds. (C)If materially different the effective-interest method is required under GAAP (2) Computation (A) Bond interest expense = carrying value of the bonds at the beginning × the effective-interest rate (B) Bond discount or premium amortization= the difference between the interest expense and the bond interest paid Q: Bond discount amortization (1) C Inc. issues $100,000 of 10%, 5-year bonds on 1/1/ 2005 with interest payable each July 1 and January 1. (2) The bonds will sell for $92,639 with an effective interest rate of 12%; (3) the bond discount is $7,361 ($100,000 - $92,639). 13 Chen Lung Chin Q: Bond premium amortization (A) C. Inc. issues $100,000 of 10%, 5-year bonds on 1/12005 with interest payable each July 1 and January 1. (B) The bonds will sell for $108,111 with an effective interest rate of 8%; (C) The bond premium is $8,111 ($108,111-$100,000). Appendix 16C Straight-Line Amortization (1) INTRODUCTION (A) Matching principle: bond discount allocated systematically to each accounting period that benefits from the use of the cash proceeds (B) allocates the same amount to interest expense each interest period Q: Bond discount amortization (1) In the previous example, the bond discount amortization is $736 ($7,361 /10 periods). (2) The entry to record the payment of bond interest and the amortization of bond discount on July 1, 2005 is: 14 Chen Lung Chin Q: Bond premium amortization Appendix 16 D Issuing Bonds between Interest Dates (1) INTRODUCTION (1) When bonds are issued between interest payment dates, the issuer requires the investor to pay the market price for the bonds plus accrued interest since the last interest date. 15 Chen Lung Chin Assume that D. Corporation sells $1,000,000, 9% bonds at face value plus accrued interest on March 1. Interest is payable semiannually on July 1 and January 1. The accrued interest is $15,000 ($1,000,000 x 9% x 2/12). The total proceeds on the sale of the bonds, therefore, are $1,015,000. 3/1 Cash Bond payable Bond Interest Payable 1015,000 1000,000 15,000 7/1 Bond Interest expense 15,000 Bond Interest Payable Cash 30,000 45,000 16