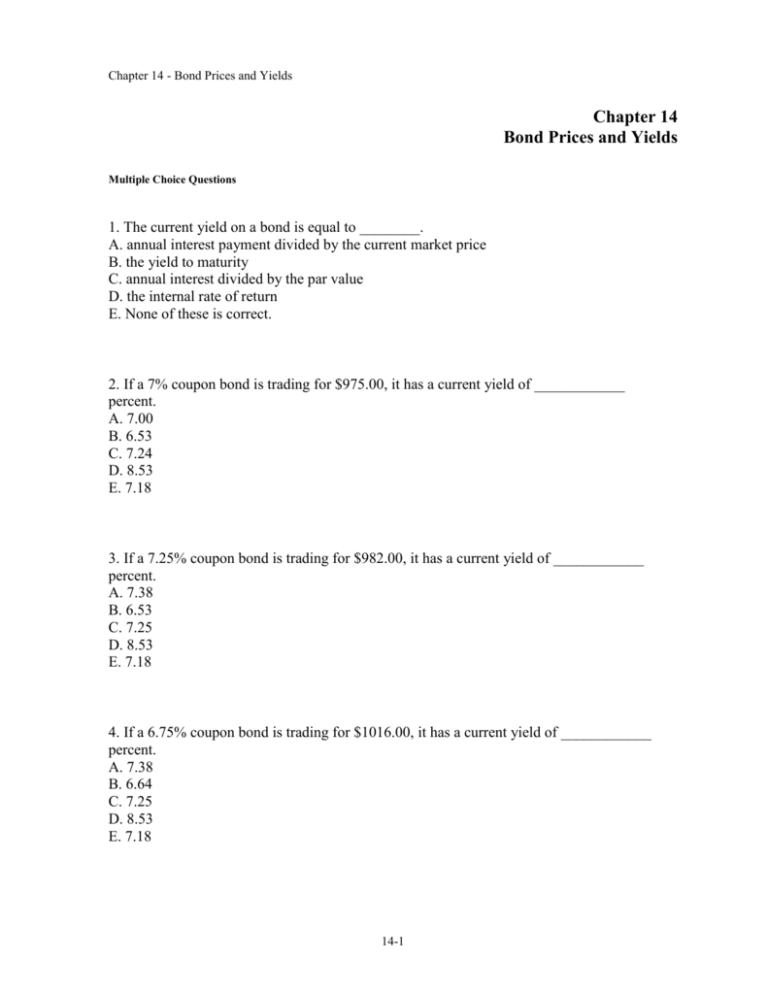

Chapter 14 Bond Prices and Yields

advertisement