1. MTM Inc., is considering the purchase of a new machine which

advertisement

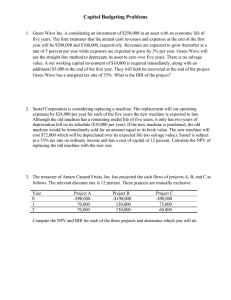

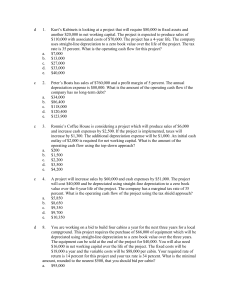

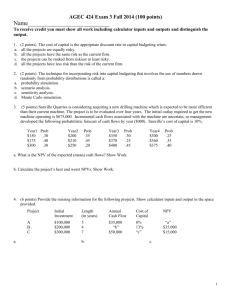

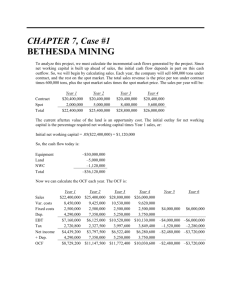

1. MTM Inc., is considering the purchase of a new machine which will reduce manufacturing costs by $5,000 annually. MTM will use the straight-line method to depreciate the machine, and it expects to sell the machine at the end of its 5 year life for $10,000. The firm expects to be able to reduce working capital by $15,000 when the machine is installed. The firm's marginal tax rate is 34% and it uses a 12% cost of capital to evaluate projects of this nature. If the machine costs $60,000, what is the NPV of the project's cash flows? [-$23,685] 2. After a disastrous ski season last year, Valley, Inc., is considering the installation of a snow machine. The machine has an invoice price of $100,000, and it will cost $10,000 to install the machine. It is estimated that the machine will increase revenues by $25,303 annually, although operating expenses other than depreciation will also increase by $5,000. The machine will be depreciated on a straight-line basis over its useful life (10 years) to a zero salvage value. If the tax rate on ordinary income is 34%, what is the project's IRR (approximately)? [IRR = 9%] 3. As the capital budgeting director for Harding Industries, Inc., you are evaluating the construction of a new plant. The plant has a net cost of $4.921 million in year 0, and it will provide net cash inflows of $1 million in year 1, $1.5 million in year 2, and $2 million in years 3 through 5. As a first approximation, you may assume that all cash flows occur at year-end. What is the plant's approximate IRR? [IRR = 19%] 4. Ferrari of Ohio is considering the purchase of land and the construction of a new plant. The land, which would be bought immediately, has a cost of $100,000 and the building, which would be erected at the end of the year, would cost $500,000. It is estimated that the firm's after-tax cash flow will be increased by $100,000 beginning at the end of the second year and this incremental flow would increase at a 10% rate annually over the next 10 years. What would be the payback period (approximately)? [6 years] 5. Two projects being considered are mutually exclusive and have the following projected cash flows: Year 0 1 2 3 4 5 Project A -$50,000 15,625 15,625 15,625 15,625 15,625 Project B -$50,000 0 0 0 0 99,500 Beyond what level of required return (approximately) would you change your selection? [12%] 6. Two projects being considered by MTX are mutually exclusive and have the following projected cash flows: Year 0 1 2 3 Project A -$100,000 39,550 39,550 39,550 Project B -$100,000 0 0 133,500 Based ONLY on the information given, what is the IRR for the two projects? Which would you chose? What are the NPV’s of the two projects if the cost of capital is 7%? [IRR A = 9% IRR B = 10% B Has Higher Irr; NPV Project A = $3,791.70, NPV Project B = $8,975.77] 7. What are the respective IRRs for Projects A, B, C, and D? = 13%: IRR C = 24% : IRR D = 14%] Project Cost A $10,000 B 5,000 C 12,000 D 3,000 8. Annual Cash Inflows $11,700 2,997 6,057 1,030 Life (years) 1 2 3 4 [IRR A = 17% : IRR B IRR ? ? ? ? As the DCB for Midterm INC., you are evaluating two mutually exclusive projects with the following net cash flows: Year 0 1 2 3 4 Project X -$100,000 50,000 40,000 30,000 10,000 Project Z -$100,000 10,000 30,000 50,000 60,000 If Midterm's cost of capital is 15%, which of the machines (if either) would the firm accept? [NPV X = -$832.97 NPV Z = -$1,439.03 BOTH NEGATIVE] 9. Two projects being considered are mutually exclusive and have the following projected cash flows: Year 0 1 2 3 4 5 Project A -$50,000 15,625 15,625 15,625 15,625 15,625 Project B -$150,000 0 0 0 0 299,500 Calculate the crossover rate. Below this rate, which project do you choose? Above? [14.35%, below choose B, above chose A] 10. Tyler Products, Inc., requires a new machine to produce a part for a heat generator. Two companies have submitted bids, and you have been assigned the task of choosing one of the machines. Cash flow analysis indicates the following: Year 0 1 2 3 4 Machine A -$1,000 0 0 0 1,938 Machine B -$1,000 417 417 417 417 If a graph of net present values were developed for these two investments, at what discount rate would the values cross? [10.09%] 11. Consider the following set of investment alternatives. A. B. C. D. E. NPV $15 $25 $10 $ 8 $45 IRR 18% 29% 15% 12% 25% PAYBACK 6.0 YRS. 2.5 YRS. 3 3 YRS. 4.0 YRS. 3.0 YRS. INITIAL INVESTMENT $150 $ 85 $160 $ 45 $365 Assuming the capital budget is fixed at $400, which projects should be accepted? [Projects A, B, And C] (Note that this requires some thinking. You are trying to maximize the total NPV and can only invest $400. Traditional methods may not work here.) 12. Red and Blue, Inc., is considering replacing its old bottling machine with a new, more efficient machine. Relevant data for this decision are given below: OLD NEW INITIAL COST $ 60,000 $ 80,000 CURRENT AGE 20 YRS 0 REMAINING USEFUL LIFE 10 YRS 10 YRS SALVAGE VALUE AT END $ 0 $ 10,000 MAINTENANCE COSTS $ 15,000/YR $ 3,000/YR REQUIRED INCREASE IN WORKING CAPITAL $ 2,000 $ 6,000 CURRENT MARKET VALUE $ 25,000 $ 80,000 Assuming a 34% tax rate, straight-line depreciation, and a 6% required rate of return, what is the NPV of this replacement decision? [$17,921.56] 13. Missouri Metals, Inc. is considering the replacement of its existing lathe, which cost $200,000 at the time of purchase five years ago, and which now has a remaining life of five years with no salvage value. It can be sold currently for $100,000. A new, more operationally efficient lathe costs $300,000 and has a useful life of five years with a salvage value of $50,000. It is expected to reduce operating costs by $66,000 annually. The firm's required rate of return for replacement decisions is 12%. Assume straight-line depreciation and a tax rate of 34 percent. What is the net present value of this capital budgeting decision? [$22,164.05] 14. Davis & Associates is considering the purchase of a new pizza oven. The original cost of the old oven was $30,000. The machine is now 5 years old and has a current market value of $5,000. The oven is being depreciated over a 10 year life toward a zero estimated salvage value on a straight line basis. Management is contemplating the purchase of a new oven whose cost is $25,000 and whose estimated salvage value is zero. Expected cash savings from the new oven are $7,000 a year (before tax). Depreciation is on a straight line basis over a 5 year life, and the cost of capital is 10%. Assume a 34% tax rate. What is the net present value of the new machine? [$3,491.17] 15. Heel & Sole, Inc., is considering the purchase of a new leather-cutting machine to replace an existing machine that has a book value of $3,000 and can be sold for $1,500. The estimated salvage value of the old machine in 4 years is zero. The new machine will reduce costs (before tax) by $7,000 per year; that is, $7,000 cash savings over the old machine. The new machine has a 4 year life, costs $14,000, and can be sold for an expected $2,000 at the end of the fourth year (it will be depreciated to a book value of $2,000). Assuming straight line depreciation for both machines, a 34% tax rate, and a cost of capital of 16%, find the NPV. [$4,182.91] 16. DC, Inc., has a stamping machine which is 5 years old and which is expected to last another 10 years. It has a book value of $100,000 and is being depreciated by the straight line method to zero. Allstate Industries has demonstrated a new machine with an expected useful life of 10 years (scrap value $50,000) that should save DC $38,000 a year in labor and maintenance costs. The firm's tax rate is 34%, and the new machine will cost $200,000. The market value of the old machine is $10,000 and a $10,000 increase in working capital will be needed to support the new machine. If DC's cost of capital is 10%, should the replacement be made? [$18,282.39] 17. Stork Company is considering the purchase of a new machine to replace an existing one. The old machine was purchased 5 years ago at a cost of $50,000 and is being depreciated on a straight line basis to a zero salvage value 5 years from today. The current market value of the old machine is $15,000. The new machine has an estimated life of 5 years, costs $75,000, and has an estimated zero salvage value. It is expected to generate cash savings (before taxes) of $25,000 per year. What is the NPV of the proposed purchase if the tax rate is 34% and the cost of capital is 11%? [$16,948] 18. You have been asked by the CEO of Gadsden Co. to evaluate the proposed acquisition of a new machine. The machine's price is $50,000, and it will cost $10,000 to transport and install. It will be depreciated by the straight line method over its 5 year useful life to a $10,000 salvage value. The machine will increase revenues by $10,000 per year, and it will decrease operating costs by $20,000 per year. Also, the machine will allow the firm to reduce inventories by $5,000. If the firm's cost of capital is 12%, and its marginal tax rate is 34%, what is the new machine's NPV? [$29,016.69]