Sample questions for LP applications

advertisement

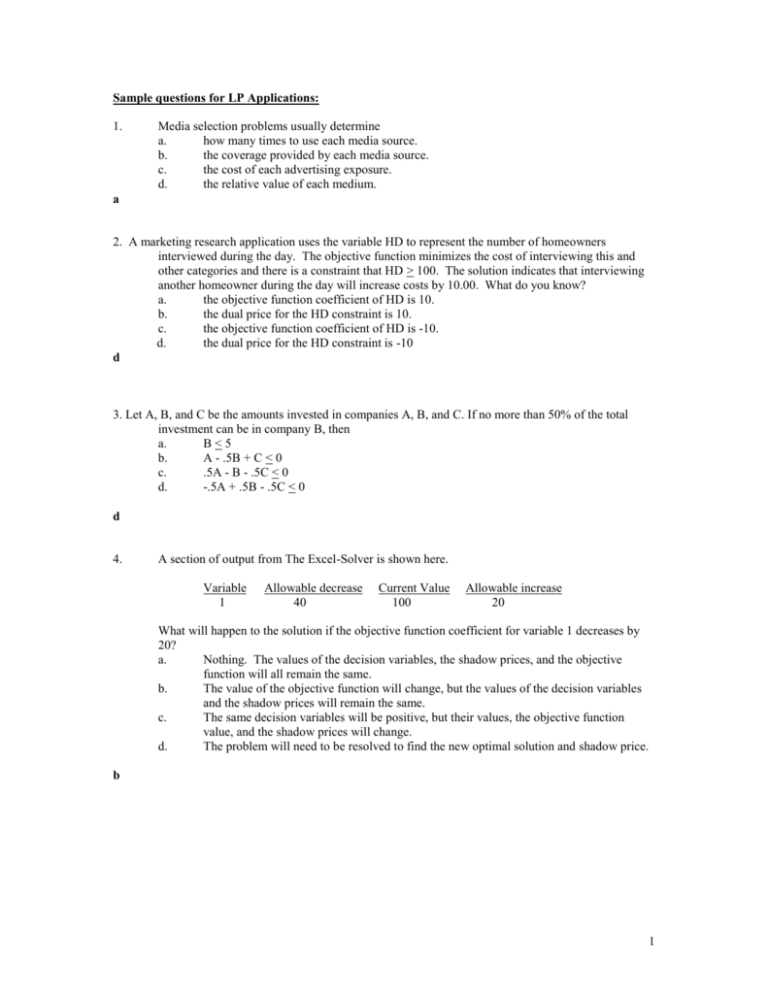

Sample questions for LP Applications: 1. Media selection problems usually determine a. how many times to use each media source. b. the coverage provided by each media source. c. the cost of each advertising exposure. d. the relative value of each medium. a 2. A marketing research application uses the variable HD to represent the number of homeowners interviewed during the day. The objective function minimizes the cost of interviewing this and other categories and there is a constraint that HD > 100. The solution indicates that interviewing another homeowner during the day will increase costs by 10.00. What do you know? a. the objective function coefficient of HD is 10. b. the dual price for the HD constraint is 10. c. the objective function coefficient of HD is -10. d. the dual price for the HD constraint is -10 d 3. Let A, B, and C be the amounts invested in companies A, B, and C. If no more than 50% of the total investment can be in company B, then a. B<5 b. A - .5B + C < 0 c. .5A - B - .5C < 0 d. -.5A + .5B - .5C < 0 d 4. A section of output from The Excel-Solver is shown here. Variable 1 Allowable decrease 40 Current Value 100 Allowable increase 20 What will happen to the solution if the objective function coefficient for variable 1 decreases by 20? a. Nothing. The values of the decision variables, the shadow prices, and the objective function will all remain the same. b. The value of the objective function will change, but the values of the decision variables and the shadow prices will remain the same. c. The same decision variables will be positive, but their values, the objective function value, and the shadow prices will change. d. The problem will need to be resolved to find the new optimal solution and shadow price. b 1 5. A section of output from The Excel-Solver is shown here. Constraint 2 Allowable decrease 60 Current Value 300 Allowable increase 120 What will happen if the right-hand-side for constraint 2 increases by 200? a. Nothing. The values of the decision variables, the shadow prices, and the objective function will all remain the same. b. The value of the objective function will change, but the values of the decision variables and the shadow prices will remain the same. c. The same decision variables will be positive, but their values, the objective function value, and the shadow prices will change. d. The problem will need to be resolved to find the shadow price. d 6. Excel’s Solver tool has been used in the spreadsheet below to solve a linear programming problem with a maximization objective function and all < constraints. Input Section Objective Function Coefficients X Y 4 6 Constraints #1 #2 #3 3 3 1 5 2 1 Avail. 60 48 20 13.333333 53.333333 4 24 77.333333 Output Section Variables Profit Constraint #1 #2 #3 Usage Slack 60 1.789E-11 48 -2.69E-11 17.333333 2.6666667 a. Give the original linear programming problem. b. Give the complete optimal solution. a. Max 4X + 6Y s.t. 3X + 5Y 3X + 2Y 1X + 1Y X, Y < < < > 60 48 20 0 b. The complete optimal solution is X = 13.333, Y = 4, Z = 73.333, S lack1 = 0, Slack2 = 0, Slack3 = 2.667 2 7. The following is a linear programming model for analyzing the product mix of a company that produces three types of products. Assume that the objective function coefficients are the contribution to profits, whereas Xj is the units produced and sold per week of product j. Maximize: Z =$7X1 +$5X2 + $2X3 Subject to: 3X1 + 5X2 + X3 > 150 (Machine A time in hours) 5X1 + 3X2 + 2X3 < 150 (Machine B time in hours) X1 + 2X2 + X3 < 160 (Machine C time in hours) X1, X2, X3 > 0 a. What are the optimal production levels for the three products? b. What is the total profit? c. Is there any slack/surplus? d. Which constraints are active? e. Over what range of profits is the optimal solution stays the same for the first product? f. What is the range of feasibility for Machine B? Interpret its management value. g. What is the range of optimality for Product 2? Interpret it. h. Suppose that an additional 200 hours of Machine B time became available. What would the current solution, total profit and shadow price be? i. What would happen to current solution and total profit if the profit of Product 3 is increased by $1? j. What would happen if the RHS of the Machine C time constraint is decreased by 200 hours? 3