Sensitivity Analysis in Linear Programming

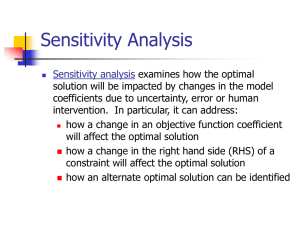

SENSITIVITY ANALYSIS

SENSITIVITY ANALYSIS

What happens to the optimal solution if:

• Coefficients of Objective function change,

• Values to the right of Constraints change,

Binding and Non-Binding Constraints

• Binding constraints have zero slack or zero surplus and vice versa.

• If the availability of an additional unit of resource alters the optimal production plan, thereby increasing the profit, then that constraint is said to be a 'Binding Constraint'.

• If the availability of an additional unit of a resource has no effect on the production plan, then that constraint is said to be non-binding.

• Non-binding constraints have a Shadow (or Dual Price) = 0

SENSITIVITY ANALYSIS

SHADOW PRICE (DUAL VALUE)

• It is the marginal value of increasing the righthand side of any constraint. In another words, it is the additional profit generated by an additional unit of that resource.

• Shadow price for not binding constraints is zero.

• Lower and upper bounds given for each constraint (resource) provide the range over which the shadow price for that constraint is valid.

Resource Ranging

• How much is it possible to increase or decrease the units of a resource whilst the shadow price is effective?

REDUCED COST

• A decision variable with a positive value in the optimum solution will generally have zero reduced cost.

• Likewise, a decision variable with value zero in the optimum solution will have a non-zero reduced cost, which shows the amount the variable's objective function coefficient would

have to improve (increase for maximization problems, decrease for minimization problems) before this variable could assume a positive value in the objective function.

SENSITIVITY ANALYSIS

Dual Value RHS max Z (Profit) min Z (Cost)

Positive increase increase decrease

Positive decrease decrease increase

Negative increase decrease increase

Negative decrease increase decrease

Note: As long as increases/decreases in RHSs are within the given lower and upper bounds

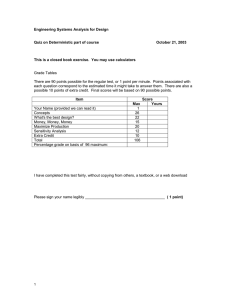

EXAMPLE 2

Tucker Inc. needs to produce 1000 Tucker automobiles. The company has four production plants. Due to differing workforces, technological advances, and so on, the plants differ in the cost of producing each car. They also use a different amount of labor and raw material at each. This is summarized in the following table:

Plant Cost ('000) Labor Material

1 15 2 3

2 10 3 4

3 9 4 5

4 7 5 6

The labor contract signed requires at least 400 cars to be produced at plant 3; there are 3300 hours of labor and 4000 units of material that can be allocated to the four plants.

Questions for Example 1

1. What is the optimum solution? What is the current cost of production?

2. How much will it cost to produce one more vehicle? How much will we save by producing one less?

3. How would our solution change if it costs only

$8,000 to produce at plant 2?

4. For what ranges of costs is our optimal solution

(except for the objective value) valid for plant 2?

5. How much are we willing to pay for one more labor hour?

Questions for Example 2

6. What would be the effect of reducing the 400 car limit down to 200 cars? To 0 cars? What would be the effect of increasing it by 100 cars? by 200 cars?

7. How much is our raw material worth (to get one more unit)? How many units are we willing to buy at that price? What will happen if we want more?