Elective

advertisement

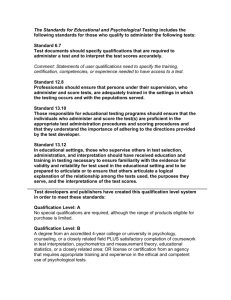

FAIS Road show February 2005 Unit standards are: Registered statements of desired training outcomes and their associated assessment criteria. Building blocks of o Short learning programmes (either short courses or skills programmes) selected by an organisation. Credits can only be awarded if the short course is aligned to unit standards. The credits carry no real value unless the unit standards are registered on the NQF as part of a qualification. o Skills programmes that lead to credits for unit standards registered on the NQF as part of a qualification. Employers can claim back the mandatory grant as well as the allocated grant for skills programmes that meet a need identified in their workplace skills plans in terms of the Skills Development Regulations Guidelines. o National qualifications according to the prescribed rules of combination. Qualifications A qualification is a planned combination of learning outcomes with a defined purpose that: Enriches the learner in terms of Status Recognition Employability Licensing Access to further learning Marketability Benefit to society and the economy. Promotes lifelong learning Is nationally and internationally comparable. Is awarded when the learner has accumulated the correct number of credits in the required combination. At least 120 credits are needed for a National Certificate At least 240 credits are needed for a National Diploma. The credits in a qualification are divided into 3 categories of learning Fundamental Knowledge, skills and attitudes that are the foundation for all learning at the level of the qualification. These are compulsory. Core Specific knowledge, skills and attitudes that are compulsory in a particular qualification. Elective Selected additional credits either specified in the rules of combination or approved in writing on an individual basis by the ETQA manager Qualifications structure in insurance and investment qualifications A Qualification: Is registered by SAQA on the National Qualifications Framework (NQF). Contains Fundamental, Core and Elective learning prescribed in the rules of combination for the Qualification. (See the Qualification document for each Qualification for the rules of combination). Penny Mackrory: FAIS Presentation February 2005 1 Fundamental learning Knowledge, skills and attitudes that are the foundation or basis required for all learning in the qualification. These Unit Standards are compulsory. Core learning Specific knowledge, skills and attitudes which are compulsory in a particular qualification. Elective learning Selected additional credits usually specified in the rules of combination. Electives allow for specialisation and ensure that the qualification is fit for purpose. Summary of structure of the qualifications relevant for licensing purposes: Level National Certificate in… Fundamental 41 66 66 66 46 Core Elective 5 Wealth Management 62 4 Wealth Management 52 4 Short Term Insurance 48 4 Risk Management 59 2 Financial Services 60 Qualification awaiting registration: Submitted to SAQA November 2004. 4 FETC: Long Term Insurance 68 52 Proposed Qualification to be submitted to SAQA in February 2005 4 FETC: Retail Insurance 68 59 17 22 26 15 14 Minimum credits 120 140 140 140 120 20 140 11 140 Short learning programmes may be developed against any part of a qualification but will only have currency in terms of the full qualification. In order to ensure that articulation with that qualification may take place, short learning programmes should be conceptualised within the framework of a particular qualification. Note that for the purpose of licensing by the FSB a qualification must be registered on the NQF and deemed an appropriate qualification by the FSB. Simplified version of the qualifications path 8 7 OVS: Certified Financial Planner (FPI approved) Higher Certificates and Diplomas offered at Higher Education Institutions. 6 D WM Needed for FAIS To start in February Fundamentals registered (2003) 5 National Certificate in WM C: LTRA D: LTRA To be submitted to SAQA by end February Penny Mackrory: FAIS Presentation February 2005 Fundamentals registered (2003) 2 2005 4 WM LT LTRA FETC: ST RM RI FSM (2003) (2003) (2001) (2001) MCA (2002) (2003) Work in (Supervisors) Replaces FETC: FETC: (2004) Review progress CI from LT LTRA replaces started. To be 2005 (2004) (2004) HBA: Priority submitted Claims in 2005 by end (2001) February 3 2 Generic Industry Qualifications NC in Insurance (2001) replaced by NC in Financial Services (2004) (Also Replaces L4 CI for admin people in CI managers) FSM (2003) (Team leaders) Generic Industry Qualifications NC in Insurance Administration (2000) replaced by NC in Financial Services (2004) 1 2 Unit Standards: Members- Retirement Funds and Medical Schemes Key (D = Diploma: NC = National Certificate) US FSM CI WM LT LTRA HBA ST RM RF EWRM PM MCA RI Unit Standard Financial Services Management Collective Investments Wealth Management Long Term (Life, GB, Healthcare Benefits Administration ) Long Term Risk Assessment (claims, underwriting, quoting, tendering) Healthcare Benefits Administration: Claims Assessing Short Term Risk Management Risk Finance Enterprise Wide Risk Management Product Management (Medical Schemes) FETC: Medical Claims Assessment Retail Insurance Penny Mackrory: FAIS Presentation February 2005 3