Module 2 Sample Review Test

advertisement

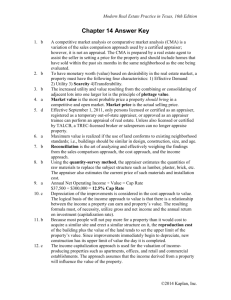

MODULE 2: The Decision to Estimate Market Value Chapters 4,5,6,7 Part 1a 1. Which of the following would not be a type of vaIue for which an appraisal would be made? a. assessed value b. insurable value c. market value d. escheat value 2. Mary Beth wants to list her farm with a sales agent. What type of value does she need to know? a. condemnation value b. assessed value c. financing value d. market value 3. Which of the following approaches to estimate value should the appraiser attempt to use? a. income approach b. cost approach c. sales comparison approach d. a, b, and c 4. In appraising a church, which method would be the most appropriate? a. potential gross income multiplier b. cost approach c. sales price per square foot of building size d. all of the above would be equally as good 5. Which of the following would not be a part of the activities an appraiser would undertake in preparing an appraisal based on the sales comparison approach? a. find comparable properties b. determine the total construction costs of the comparable properties. c. analyze financial terms and motivations of the sale of the comparable properties. d. formulate an estimate of market value of the subject property based on an analysis of comparable properties. 6. Which of the following appraisal methods would use market data from similar 58 properties? a. reproduction cost b. sales comparison c. income d. economic life 7. Which of the following items are necessary in order to determine fair market value using the cost approach? a. the value of the site as though vacant b. the return on passbook savings accounts c. all revenues and expenses associated with the property d. the market rate of return 8. Which of the following would not have an impact on current market values: a. demographic changes b past events c. physical attributes d. all of the above would affect current market value 9. Which of the following is not an economic factor of a neighborhood: a. employment opportunities b. proportion of owners to renters c. development patterns d. level of citywide retail sales 10. When a financial institution practices redlining, which of the following is most likely to occur: a. the lender has decreased its mortgage portfolio risk. b. the lender has not violated any laws. c. property values typically decrease in the neighborhood d. all of the above occur. 11. If two neighborhoods have the same quantity and quality of public services, but the tax bill in neighborhood A is greater than the tax bill in neighborhood B., the value of the subject property in neighborhood A would be: a. higher than if in neighborhood B b. lower than if in neighborhood A c. lower than if in neighborhood B d. a determination on value cannot be made with only information given 12. Which of the following information is not needed for site analysis: a. property rights b. square footage or number of acres c. zoning and building code 59 d. all of the above are needed 13. Carver owns a section of land described as Section 19 T8N, R29E. The section directly to the west would be described as: (Hint: use the government rectangular survey method of land description) a. Section 24, T8N, R30E b. Section 20, T8N, R29E c. Section 18, T7N, R29E d. Section 24, T8N, R28E 14. Jo owns a parcel of land identified as the NW1/4 of the SW1/4 of Section 10. How many acres are in this parcel? a. 10 b. 40 c. 5 d. 20 15. Which of the following is the largest in area? a. the SE1/4 of the SE1/4 of Section 8 b. the NW1/4 of Section 12 c. the NW1/4 of the NW1/4 of the SW1/4 of Section 10 d. the N1/2 of the NEl/4 of Section 13 16. One method of a legal description is to refer to the properties boundaries and compass readings. These are called: a. metes-and-bounds b. governmental surveys c. lot-and-block d. townships 17. Which of the following legal descriptions would be the most accurate way to describe a parcel of land: a. lot-and-block b. metes-and-bounds c. government survey d. all of the above would provide an equally adequate description for a parcel of land. 18. The township directly to the south east of T1N, RlE is: (Hint: use the government rectangular survey) a. T1N, R2E b. T2N, R1W c. T1S, R1W c. T1S, R2E 60 19. In comparing two commercial lots X and Y, you have the following information: Lot X has 150 feet of frontage and a depth of 100 feet, and Lot Y has 125 feet of frontage and 120 feet of depth. Which lot is more valuable, all other things being equal? a. Lot X b. Lot Y c. Both are of equal value. d. Cannot be determined. 20. Which of the following steps would an appraiser use to determine the highest and best use? a. market analysis b. legal restrictions on the subject property c. land use restriction analysis d. all of the above 21. The highest and best use of property is the use that: a. places the most expensive improvement on the property b. generates the highest present value in residual income c. is always the existing use d. does not violate the zoning regulations 22. A client has come to you seeking your advice. The exterior of the home is in poor condition. After some investigation, you ascertain that the home "as is" can be sold for $48,000. If the home is painted, at a cost of $2,000, it will be more appealing to perspective buyers and should sell for $52,500. Another alternative is to put aluminum siding on the home at a cost of $8,000, and this would make the selling price $57,000. What is your suggestion? a. sell the home "as is" for $48,000 b. paint the home and sell it for $52,500 c. aluminum side the home and sell it for $57,000 d. either b or c as they are equivalent SOLUTIONS 1. 2. 3. 4. 5. 6. 7. d d d b b b a 61 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. d d a c d d b b a d d a d b b 62 Part 2b 1. If demand is declining and supply remains constant, what will happen to the price of existing units in the market? a. they will rise b. they will fall c. they will remain unchanged d. cannot be determined 2. Which of the following is not a condition in a competitive market? a. well informed buyer and seller b. reasonable time on the market c. similar financing terms available d. property is under foreclosure 3. Which of the following is the first element of comparison in the appraisal process: a. physical features of the on-site improvements b. differences in locational and neighborhood features c. time of the sale d. bundle of rights 4. Which of the following is the least curable form of depreciation from a home owner's point of view? a. physical deterioration b. functional obsolescence c. economic obsolescence d. all of the above are equally curable 5. A client has asked you to prepare an appraisal of property based on the cost approach. Which of the following will you need? a. reproduction cost of the structure b. accrued depreciation c. market value of the vacant land d. all of the above 6. What is the difference between the reproduction cost new and the replacement cost approaches to estimate value: a. no difference as they are the same b. reproduction is the current cost of an exact replica and replacement is the current cost of the same utility c. replacement cost is current cost and reproduction is the cost when it was built d. reproduction cost includes the site value and replacement does not 63 The next three questions use the following information: Subject Property Price Comparable Properties A B C $60,000 $67,000 $72,500 Date of Sale now current 1 yr. ago 2 yrs. ago Size - Sq. ft. 1200 1100 1200 1400 Architecture ranch ranch colonial ranch Swimming Pool none none above-ground in-ground Fireplace yes yes none none Condition good good good good Assuming real estate values have been increasing 5 percent per year compounded; basic construction costs average $50 per square foot; a colonial home is worth $2,000 more than a ranch; an above-ground swimming pool adds $1,500 to the value of the home, and an in-ground pool adds $5,000; a fireplace is worth $2,000. 7. Which comparable would be the "best" single comparable? a. A b. B c. C d. all are equally comparable to the subject property 8. What is the adjusted indicated value or sales price of Comparable C? a. $64,800 b. $66,930 c. $68,600 d. $72,530 9. What is the adjusted indicated value of Comparable A? a. $60,000 b. $65,000 c. $67,000 d. can't be determined 10. Use the cost approach to estimate the value of a 20 foot by 50 foot building, an acre lot valued at $15,000, and an outside patio 20 feet by 20 feet. Use the following information: 64 three comparable homes in the same neighborhood sold for $41,000; base construction costs are $35 per square foot; a contractor can build a patio for $2.50 per square foot. a $35,000 b. $36,000 c. $41,000 d. $51,000 11. Which of the following would not be included in the definition of market value: a. both parties to the transaction were well informed b. both parties were acting free of any undue pressure c. market value is the average price a property will bring d. the property must be on the market for a reasonable time period 12. In verifying comparable sales, an "arm's length transaction" would indicate that the sale was: a. between family members, such as father and son b. between willing parties under no compulsion to sell c. the result of a foreclosure sale d. made by a seller who was just transferred because of his job 13. A comparable house has a swimming pool, and the subject has none. What is the appropriate adjustment in the sales comparison grid? a. the value of the pool is subtracted from the subject property's value b. the value of the pool is subtracted from the comparable's sales price c. the value of the pool is added to the subject property's value d. none of the above 14. Market value: a. is an opinion of value based on market data b. is the sales price c. is the same as reproduction cost d. is the same as market price 15. Site value plus accrued reproduction or replacement costs will equal: a. an estimate of value from the cost approach b. most probably selling price c. sales price d. an estimate of value from the sales comparison approach 16. Which of the following would be an example of economic obsolescence? a. peeling paint b. outdated kitchen facilities c. poor architectural design 65 d. re-zoning of local schools 17. Depreciation applies to: a. the improvements on the land b. the land only c. the land and the improvements on the land d. the sales comparison approach 18. Inadequate attic insulation is an example of: a. incurable functional obsolescence b. curable physical depreciation c. incurable economic obsolescence d. curable functional obsolescence 19. The loss in value from a design that requires the passage through a bedroom to enter the only bathroom in a house would be an example of: a. physical depreciation b. functional obsolescence c. economic obsolescence d. violation of a zoning code 20. It is necessary to estimate accrued depreciation when using the __________ approach to appraisal. a. market b. cost c. income d. all of the above 21. What approach would an appraiser most likely use to determine the market value of a fire station? a. market or sales comparison b. cost c. income d. none of the above 22. You have been asked to place a value on a single-family dwelling located in a relatively large subdivision. Which of the following appraisal techniques would you most likely give the most weight? a. income b. sales comparison c. cost d. all of the above would arrive at the exact same market value 23. A sewage plant has just been constructed upwind from your home. The subsequent loss 66 in value caused by the plant's location is known as: a. physical depreciation b. functional obsolescence c. economic obsolescence d. escheat SOLUTIONS 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. b d d c d b a b b d c b 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. b a a d a d b b b b c SOLUTION to #8: $72,500 x 1.05 x 1.05 = $79,931. - $10,000 size -$5,000 pool +$2,000 fireplace = $66,930. adjusted price SOLUTION TO #9: 1200 - 1100 s.f. = 100 s.f. x $50. = $5,000. SOLUTION TO #10: 20. x 50 = 100. s.f. x $35. = $35,000. + $15,000. site + $1,000 patio = $51,000. 67 Part 3c 1. The vacancy rate will influence which of the following? a. purchase price b. potential gross income c. effective gross income d. all of the above will be affected by the vacancy rate 2. The overall capitalization rate is defined to be: a. purchase price/ NOI b. NOI/ purchase price c. effective gross income/ NOI d. potential gross income/ purchase price 3. Which of the following would have the least impact on the economic life of a structure: a. physical features within the structure b. functional features c. the surrounding neighborhood d. mortgage financing rates 4. A tenant's lease would become more valuable to the tenant if: a. contract rent exceeds market rent b. market rent exceeds contract rent c. market rent equals contract rent d. a tenant's lease cannot change in value 5. Which of the following would not be excluded by an appraiser from a property's conventional profit and loss statement to estimate net operating income: a. debt service b. personal expenditures c. cost of a lawsuit d. all of the above should be excluded 6. Which of the following would have an impact on the overall capitalization rate? a. the average return on corporate bonds b. the return on similar types of real estate c. the average return on the stock market d. all of the above would affect the capitalization rate 7. Which of the following would not be considered an operating expense? a. payroll b. utilities c. vacancy allowance 68 d. grounds care 8. Sales Price Monthly Market Rent 1 $360,000 $3,100 2 $359,000 $3,100 3 $374,400 $3,250 The above sales are quite comparable to the subject property. Rental differences are due to the physical conditions of the buildings. All sales are in the same neighborhood. Using the gross income multiplier technique, what is the value of the subject property with an estimated annual rental of $36,000 (rounded)? a. $346,000 b. $360,000 c. $375,000 d. $4,140,000 9. An apartment building recently sold for $360,000 with a monthly income of $2,500 The gross income multiplier for the building was: a. 1000 b. 504 c. 300 d. 12 10. If the monthly net operating income from a building is $3,000 and if the investor requires a 12% return on her investment, the value of the property is: a. $25,000 b. $36,000 c. $120,000 d. $300,000 11. When loss for vacancy is deducted from gross revenues, the resulting figure is: a. effective gross income b. operating income c. operating expense ratio d. net operating income 12. The value of an income producing property is: a. the present value of the annual expected returns only b. the future value of all expected returns only 69 c. d. 13. the present value of the asset when sold only the present value of the annual income and the expected worth of the asset when sold Given the following information, what would be the appraised value of an apartment unit having annual gross rental income of $75,000 and operating expenses of $20,000? Assume all comparables are of equal weight. a. b. c. d. Comparable Sale Sales Price Monthly Rental Net Operating Income 1 $430,000 $5,700 $38,485 2 $475,000 $6,600 $42,550 3 $515,000 $7,200 $46,134 $350,000 $400,525 $490,000 $614,525 SOLUTIONS 1. 2. 3. 4. 5. 6. d b d b d d 7. 8. 9. 10. 11. 12. c a D d a d SOLUTION to #2: .3(.18) + .7(.12) = 13.8 SOLUTION to #8: GIM of 9.6 x $36,000. = $346,000 rd. SOLUTION to #9: $2,500. x 12 months = $30,000. $360,000. / 30,000. = 12. SOLUTION TO #10: 70 $3,000 x 12 months = $36,000 / .12 = $300,000. SOLUTIONS to #13: $75,000. - $20,000. = $55,000 / .0895 = $614,525. Part 4d 1. A financial feasibility study attempts to determine: a. what is the best site for a specific geographic market area to place additional space. b. all possible sites that will satisfy the needs of a particular project. c. the structural design of a building that will meet all of the firm’s objectives. d. whether a project will allow a firm to accomplish its investment objectives. 2. A market study specifically: a. compares an investor’s financial requirements to financial returns generated by the property. b. determines whether a firm’s customers are sufficient in number to equal or better the amount of income needed to meet the investor’s financial goals, for that particular property. c. critiques the property to determine if the client’s needs can be satisfied. d. decides at what price is the market rent for the property. 3. A market analysis considers all of these factors except: a. what is the ideal type of structure for the intended use of the property in question. b. when a building should be constructed. c. the anticipated range of return the property investment will generate. d. special appropriate features such as parking space requirements. 4. An economic impact study ignores: a. accrued economic benefits to the community. b. the change in local employment from a new facility. c. the average amount of household income spent on groceries. d. the fluxuation in the unemployment rate prior to the establishment of the facility. 5. Market disaggregation: a. standardizes all real estate commodities. b. makes only broad associations between like properties. c. allows analysts to make distinctions based on physical aspects of a site or structure. d. identifies a standardized market from more specific sub markets. 71 6. The practice of targeting a specific group of consumers from the general population: a. is market segmentation. b. is disaggregation. c. is described in a design study. d. is target market association. 7. Legal activity on a specific property is determined by: a. area regulations. b. occupancy code requirements. c. pollution restrictions. d. all of the above. 8. Consumers: a. will generally travel greater distances to a store that is perceived to be of a higher caliber. b. are time conscious and may frequent businesses that simply satisfy most of their needs. c. a and b are both correct. d. will try to avoid traffic, but generally will not take scenic roads that are much slower. 9. Functional characteristics of a structure: a. include design features. b. include quality of the parking surface. c. make one structure more appealing than that of a competitor. d. a and c are both correct. 10. Which of the following is not included in evaluating linkages: a. pecuniary costs of travel. b. time value. c. architectural features of the residence. d. freedom of movement from off-site areas to on-site. 11. Retail linkages: a. to distribution facilities are used extensively. b. between two sites are always costly and play a substantial part in the location decision. c. are not constructed with concern for labor services. d. none of the above are correct. 12. Cumulative attraction: a. allows businesses to profit from an overall increase in customer traffic. b. is an important element of market segmentation. c. is avoided by businesses as a means to separate consumers from competitors. 72 d. is a result of poor location decision based on a lack of market analysis. 13. Product differentiation: a. consumers view all products as being essentially different. b. consumers see differences between essentially similar products. c. occurs without conditions surrounding the sale. d. is a theory based upon the notion that consumers value products equally. 14. Surveying the competition: a. can identify the tastes and preferences of the consumer. b. tells an analyst that dwelling units (in comparable properties) that best satisfy consumer tastes will have lower absorption rates. c. allows the analyst to advise his client to include features of the competition that are as good as those with the lowest absorption rates. d. allows an analyst to select properties that yield the same amenities as those with the low absorption rates. 15. The market demand analysis process is as follows: a. understanding disaggregation, surveying the competition, comparison of linkage patterns, demand analysis. b. understanding disaggregation, surveying the competition, judging the property’s area of competition, analysis of consumer research and market segmentation, demand analysis. c. understanding disaggregation, surveying the competition, comparison of linkage patterns, judging the property’s area of competition, analysis of consumer research and market segmentation, demand analysis. d. understanding disaggregation, surveying the competition, judging the property’s area of competition, comparison of linkage patterns, analysis of consumer research and market segmentation, demand analysis. 16. Residential demand analysis: a. is based on population. b. reflects that number of households should normally equal number of residential units. c. does not assume that a household’s income is sufficient to make the lowest rent level payment in the market. d. states that a household can usually buy a house that is approximately five times its annual income. 17. A single-family residential demand analysis: a. estimates the number of unemployed households within the geographic area of interest. b. makes estimates for present residential market conditions only. 73 c. d. considers the effect of a change in the mortgage interest rate over the next twelve years. considers the number of households among the alternative housing options. 18. Retail demand analysis: a. calculates the level of purchasing power as product of population times per capita income of the market. b. assumes that consumers rarely change their combination of retail goods purchased. c. assumes that consumers’ spending preferences generally don’t change. d. allows that as purchasing power decreases, the demand for retail space increases. 19. The market analysis process: a. can determine future values of market rent, but not vacancy rate. b. allows an analyst to determine what residents are willing to pay for space. c. can show an analyst the absorption rate of a particular product, but not how responsive the market was to that product. e. excludes the importance of on-site recreational amenities. 20. Consumer research: a. shows that properties that satisfy consumer tastes will have stable absorption rates. b. including past taste and preference patterns, allows an analyst to infer future preference patterns. c. in the form of direct survey is really no more accurate than judgments made on past research data. d. determines the geographic area for analysis, but not demand for space in that market. 1. d 2. b 3. c 4. d 5. c 6. a 7. d 8. c 9. d 10. c 11. d 12. a 13. b 14. a 74 15. c 16. b 17. d 18. a 19. b 20. b 75