Modern Real Estate Practice in Texas, 15th Edition

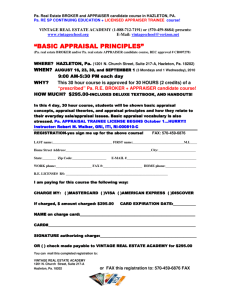

advertisement

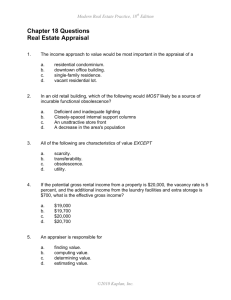

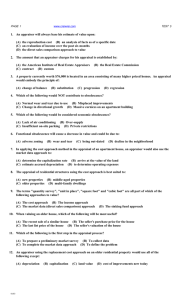

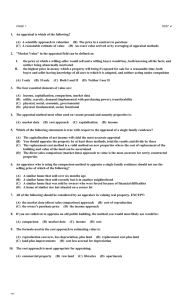

Modern Real Estate Practice in Texas, 16th Edition Chapter 14 Answer Key 1. b 2. b 3. b 4. a 5. d 6. a 7. b 8. b 9. a 10. c 11. b 12. c A competitive market analysis or comparative market analysis (CMA) is a variation of the sales comparison approach used by a certified appraiser; however, it is not an appraisal. The CMA is prepared by a real estate agent to assist the seller in setting a price for the property and should include homes that have sold within the past six months in the same neighborhood as the one being evaluated. To have monetary worth (value) based on desirability in the real estate market, a property must have the following four characteristics: 1) Effective Demand 2) Utility 3) Scarcity 4)Transferability. The increased utility and value resulting from the combining or consolidating of adjacent lots into one larger lot is the principle of plottage value. Market value is the most probable price a property should bring in a competitive and open market. Market price is the actual selling price. Effective September 1, 2011, only persons licensed or certified as an appraiser, registered as a temporary out-of-state appraiser, or approved as an appraiser trainee can perform an appraisal of real estate. Unless also licensed or certified by TALCB, a TREC-licensed broker or salesperson can no longer appraise property. Maximum value is realized if the use of land conforms to existing neighborhood standards; i.e., buildings should be similar in design, construction, size, and age. Reconciliation is the art of analyzing and effectively weighing the findings from the sales comparison approach, the cost approach, and the income approach. Using the quantity-survey method, the appraiser estimates the quantities of raw materials to replace the subject structure such as lumber, plaster, brick, etc. The appraiser also estimates the current price of such materials and installation cost. Annual Net Operating Income ÷ Value = Cap Rate $37,500 ÷ $300,000 = 12.5% Cap Rate Depreciation of the improvements is considered in the cost approach to value. The logical basis of the income approach to value is that there is a relationship between the income a property can earn and property’s value. The resulting formula must, of necessity, utilize gross and net income and the annual return on investment (capitalization rate). Because most people will not pay more for a property than it would cost to acquire a similar site and erect a similar structure on it, the reproduction cost of the building plus the value of the land tends to set the upper limit of the property’s value. Since improvements immediately begin to depreciate, new construction has its upper limit of value the day it is completed. The income capitalization approach is used for the valuation of incomeproducing properties such as apartments, offices, and retail and commercial establishments. The approach assumes that the income derived from a property will influence the value of the property. ©2014 Kaplan, Inc. Modern Real Estate Practice in Texas, 16th Edition 13. a 14. b 15. a 16. a 17. d 18. b 19. c 20. c 21. b The market value of a parcel of real estate is the most probable price a property should bring in a competitive and open market under all conditions requisite to a fair sale, with the buyer and seller each acting prudently and knowledgeably and assuming the price is not affected by undue stimulus. Capitalization is a mathematical process for estimating the value of an incomeproducing property by dividing the annual net operating income by the capitalization rate. Step 3 of the cost approach to value is to estimate the amount of accrued depreciation resulting from physical deterioration, functional obsolescence, and/or external obsolescence. The sales comparison approach compares the subject property with recently sold comparable properties and is based on the principle of substitution. Depreciation, construction cost, and replacement cost are associated with the cost approach to value. The principal factors for which adjustments must be made fall into four basic categories: 1) Date of sale 2) Location 3) Physical features 4) Terms and conditions of sale. Due to the Principle of Change, the original cost is not relevant in determining what the property may sell for today. The premise of the income approach is that there is a relationship between the income produced by a property and the amount an investor would be willing to pay (value) in anticipation of receiving that future income. The capitalization rate (rate of return, return on investment) converts the income stream (net operating income) into an indication of value. Depreciation refers to any condition that adversely affects the value of an improvement to real property and, therefore, is subtracted from the total estimated cost new (either Reproduction or Replacement cost) of all improvements. IRV: Income = Rate × Value Therefore, Rate = Income ÷ Value Functional obsolescence is caused by a relative loss of building utility. This loss may be due to deficiencies such as faulty building design, outmoded equipment, or a poorly arranged floor plan. ©2014 Kaplan, Inc.