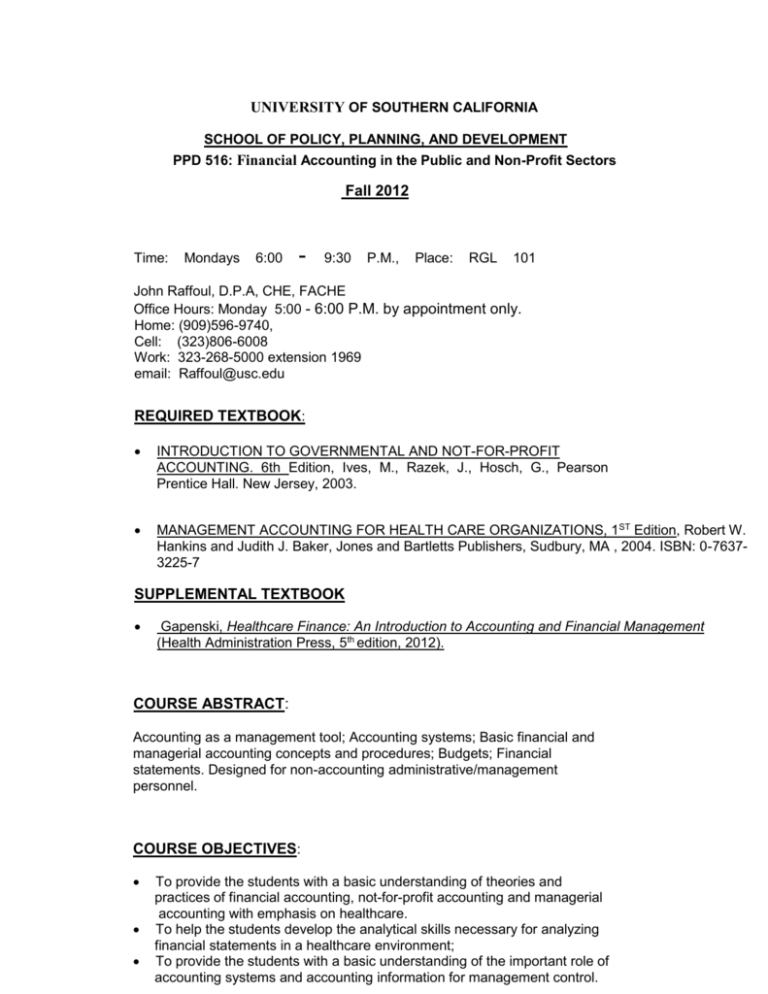

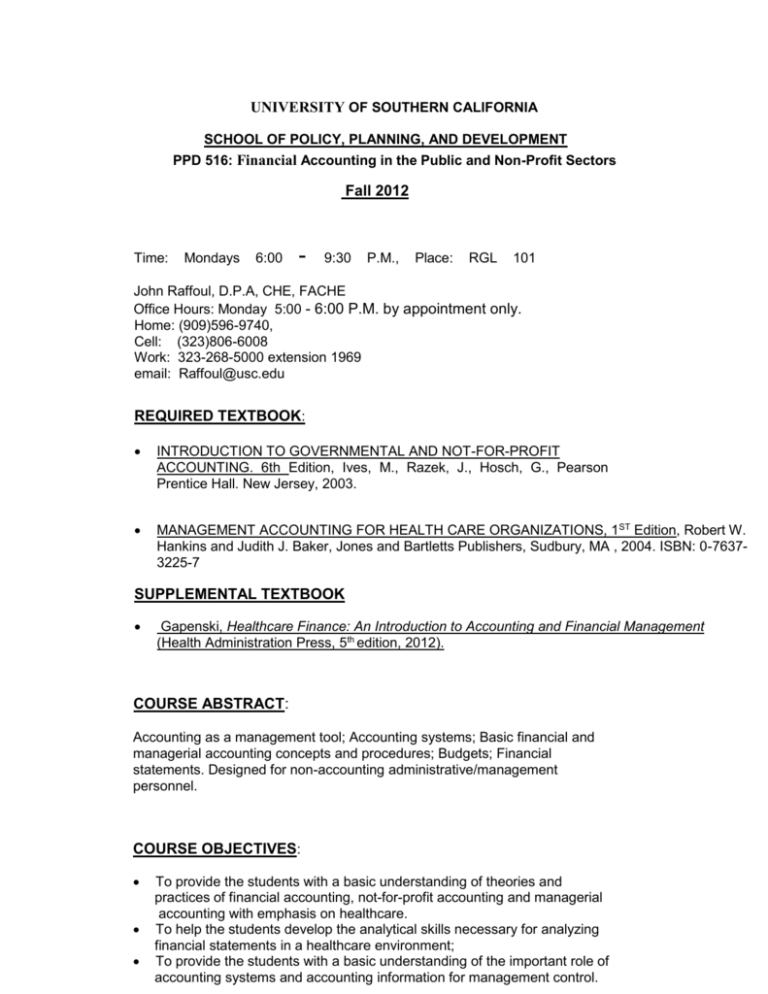

UNIVERSITY OF SOUTHERN CALIFORNIA

SCHOOL OF POLICY, PLANNING, AND DEVELOPMENT

PPD 516: Financial Accounting in the Public and Non-Profit Sectors

Fall 2012

Time:

Mondays

6:00

-

9:30

P.M.,

Place:

RGL

101

John Raffoul, D.P.A, CHE, FACHE

Office Hours: Monday 5:00 - 6:00 P.M. by appointment only.

Home: (909)596-9740,

Cell: (323)806-6008

Work: 323-268-5000 extension 1969

email: Raffoul@usc.edu

REQUIRED TEXTBOOK:

INTRODUCTION TO GOVERNMENTAL AND NOT-FOR-PROFIT

ACCOUNTING. 6th Edition, Ives, M., Razek, J., Hosch, G., Pearson

Prentice Hall. New Jersey, 2003.

MANAGEMENT ACCOUNTING FOR HEALTH CARE ORGANIZATIONS, 1ST Edition, Robert W.

Hankins and Judith J. Baker, Jones and Bartletts Publishers, Sudbury, MA , 2004. ISBN: 0-76373225-7

SUPPLEMENTAL TEXTBOOK

Gapenski, Healthcare Finance: An Introduction to Accounting and Financial Management

(Health Administration Press, 5th edition, 2012).

COURSE ABSTRACT:

Accounting as a management tool; Accounting systems; Basic financial and

managerial accounting concepts and procedures; Budgets; Financial

statements. Designed for non-accounting administrative/management

personnel.

COURSE OBJECTIVES:

To provide the students with a basic understanding of theories and

practices of financial accounting, not-for-profit accounting and managerial

accounting with emphasis on healthcare.

To help the students develop the analytical skills necessary for analyzing

financial statements in a healthcare environment;

To provide the students with a basic understanding of the important role of

accounting systems and accounting information for management control.

PPD 516 SYLLABUS, Fall 2012

CLASS SCHEDULE

SESSION

Aug 27

TOPIC/READING

ASSIGNMENT DUE

Overview of the course; Objectives of financial

reporting; Accounting as an information system; the

entity concept and the accounting equation; the

Balance Sheet.

Chapter 15: Recording and analyzing transactions;

accounts, journal entries; the general ledger Taccounts; posting; trial balance, Textbook: Razek

Sept 3

No Class – Labor Day

No Class – Labor Day

Sept 10

Chapter 15: The accounting cycle; the accrual concept

and measurement; Financial Statements; Adjusting

entries; Closing entries, Textbook: Razek

Chapter 15: Questions: 1-16

Exercises 9, 10

Sept 17

Chapter 15: Review the Fundamentals of Accounting.

Textbook: Razek

Chapter 15: Exercises: 13, 14, 15, 17

Chapter 15: Problems 1 - 5

Sept 24

Chapter 1 Not-for-Profit environment and its unique

aspects of accounting and financial analysis: Textbook:

Razek

Ch 2: Problems: 5, 7, 11, 12, 13

Test 1: Chapter 15 Razek

60 minutes

Chapter 2: Principles of Fund Accounting and

Reporting; Categories and Type of Funds

Oct 1

Oct 8

Oct 15

Chapter 4: Governmental Fund Accounting Cycle:

General Fund and Special Revenue Funds

Ch 4: Problems 2, 4, E10

Chapter 5: Property Tax Accounting, Budgetary

Accounting, Inter-fund Activity

Ch 5: Problem 2, 9, 12

Chapters 9: Reporting Principles and Preparation of

Fund Financial Statements

Ch 9: Problems: 1, 2, 3, 5

Chapter 10: Government-Wide Financial Statements

Ch 10: Problems: 2, 4

Chapter 3: Perspectives on Cost, Textbook: Hankins

Ch 3: Exercises: 1, 2 Pg 45

Chapter 4: Introduction to Costing: Textbook: Hankins

Ch 4: Problem: Pg 77

Test II: Chapters 1,2,4,5,9,10 Razek

Oct 22

Chapter 5: Formalizing the activities and costs

Homework to be handed out

Chapter 6: Organization Structure and Costing.

Textbook: Hankins

Oct 29

Chapter 8-9: Activity Based Costing, Textbook:Hankins

Chapter 10: Traditional Costing: Textbook: HankinS

Ch 10: Problem 1, 2 Pg 223

Oct 29

Chapter 12: Budgets, Budgeting and Control.

Textbook: Hankins.

Chapter 3: Budgeting Process Textbook: Razek

Test III: Chapters 3,4,5,6,9,10 Henkins

Nov 5

Chapter 13: Cost Variance Analysis. Textbook:

Hankins

Ch 13: Problem 1, 3 Pg 295

Nov 12

Chapter 14: Clasical Cost-Based Decision Models:

Textbook: Hankins:

Chapter 16: Management Accounting Reports:

Textbook: Hankins

Nov 19

Chapter 12: Accounting for Not-for-Profit

Organizations: Textbook: Razek

Nov 26

Chapter 13: Accounting for Healthcare Organizations:

Textbook: Razek

Financial Accountability: Handout

Dec 3

Course Review

Dec 10

No Class –Study Period

Dec 17

Final Examination

Problem 14: 1,3,4 Pg 326

Ch 12: Problems: 3, 4

Ch 13: Problems: 1, 2, 3

Test IV: Chapters 12,13,14,16 Hankins

Chapters: 3, 12, 13, 14 Razek

COURSE REQUIREMENTS:

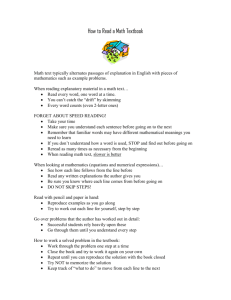

1. Reading assignments: to be completed before attending each class

session. 2. Problem sets: due at the beginning of each class. 3.

Active class participation

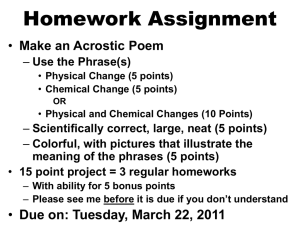

GUIDELINES FOR HOMEWORK PROBLEMS:

1. All homework must be done using an electronic spreadsheet program,

e.g.,Lotus 123, Microsoft Excel, QuattroPro, etc. Students are required to

follow the format used in the textbook for journalizing, preparing T-accounts,

trial balance, balance sheet, and income statement.

2. Late homework will receive no credit. Homework is graded as credit/no credit.

3. Students are required to bring two copies of their homework to the class.

One copy is to be turned In to the Instructor at the beginning of the class. The

second copy will be used by the student for notes and corrections when

problems are discussed in class.

4. On the average, it takes about 3-4 hours to complete the weekly homework

assignment. Homework problems are the foundation of this class. Students

should plan their time appropriately so that they would have enough time to

complete the homework problems before the class.

Continued on next page:

GRADES:

1. If a student is pre-approved to miss a test, the missed test will be assigned a

grade equal to the average of the other three tests.

2. There will not be any make up work for missed tests, homework or

absences.

3. Closed book, 2 hour timed tests, graded on a curve.

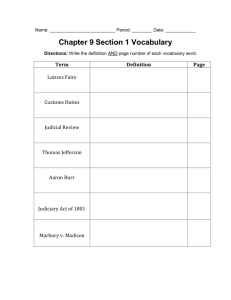

Grading Policy

Weights

Grade Scale

Homework/Participation

20%

Test One

20%

Test Two

20%

Test Three

20%

Test Four

20%

94100%

9093%

8789%

8086%

7779%

7076%

A

AB+

B

BC

Any Student requesting academic accommodations based on a disability is required to register

with Disability Services and Programs (DSP) each semester. A letter of verification for approved

accommodations can be obtained from DSP. Please be sure the letter is delivered to me as early

in the semester as early as possible. DSP is located in STU 301 and is open 8:30 a.m. - 5:00 p.m.,

Monday through Friday. The phone number for DSP is (213) 740-0776.

NO FOOD OR DRINK ALLOWED IN CLASS. NO PHONE CALCULATORS.

PPD 516 SYLLABUS, Fall 2012