Lecture 13

advertisement

Lecture 13: Bargaining

Bargaining is about persons who have opportunity to cooperate

for mutual benefit.

Bargaining problem is defined by:

1. set of players {1, 2,…, N} that participate in the

negotiation,

2. set of utility functions assigning player’s utility to all

solutions,

3. set of all possible solutions,

4. a disagreement point that represents solution if no

agreement is reached.

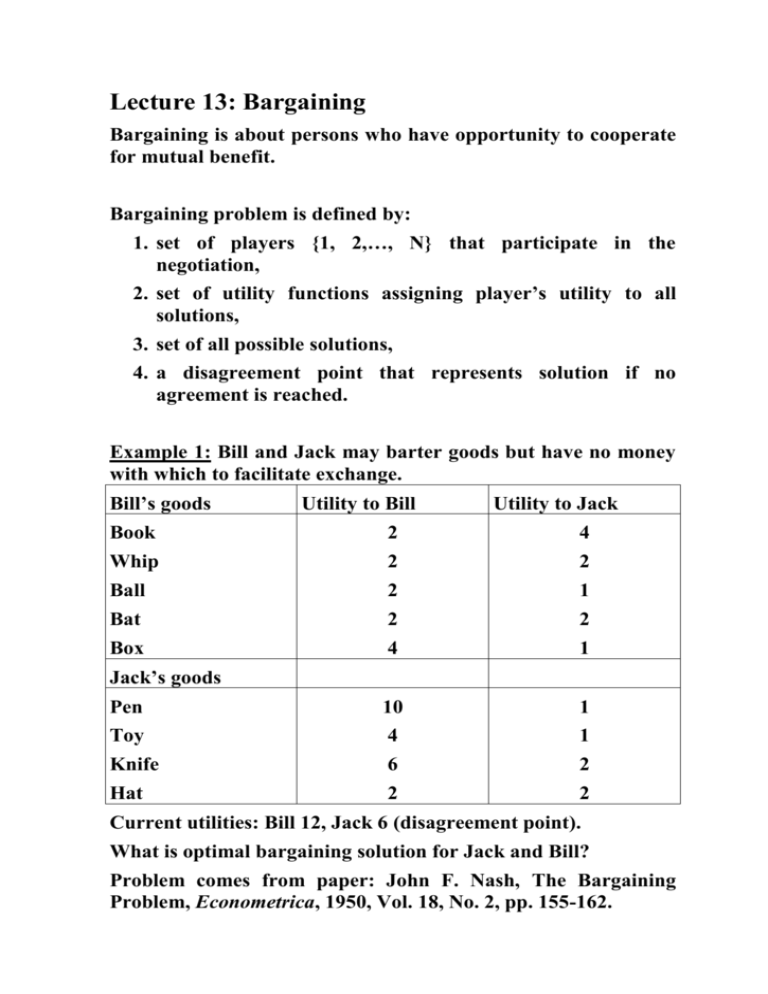

Example 1: Bill and Jack may barter goods but have no money

with which to facilitate exchange.

Bill’s goods

Utility to Bill

Utility to Jack

Book

2

4

Whip

2

2

Ball

2

1

Bat

2

2

Box

4

1

Pen

10

1

Toy

4

1

Knife

6

2

Hat

2

2

Jack’s goods

Current utilities: Bill 12, Jack 6 (disagreement point).

What is optimal bargaining solution for Jack and Bill?

Problem comes from paper: John F. Nash, The Bargaining

Problem, Econometrica, 1950, Vol. 18, No. 2, pp. 155-162.

Nash axiomatic bargaining solution – a set of characteristics

(axioms) that an optimal bargaining solution should satisfy and

a proof that there is only one such solution.

Definition: rationality (utility maximization and equality of

bargaining skills), full knowledge of the preferences of other

player, lottery is allowed.

Nash assumptions:

Pareto efficiency. one could not be better off without making

other person worse off (non-dominated solutions are

considered only). E.g. if utilities are (6, 8) in one solution, and

(7, 9) in other one, then the former solution cannot be

optimal bargaining solution.

Symmetry. Both [u(x), v(y)] and [v(y), u(x)] are bargaining

solutions, and in disagreement point u(x0)=v(y0), then

problem is symmetric.

Invariance to equivalent payoff representations. If u is utility

function, then also is au + b, i.e. solution can be transformed

to point (1, 1).

Independence of irrelevant alternatives. You have problems

P and Q, (Q is subset of P). If [u(x*), v(y*)] is solution of P and

lies in Q, then it is also a bargaining solution of Q.

Finding solution:

Maximizing Nash Product [u(x*) - u(x0)][v(y*) - v(y0)].

Note: after transformation maximum is [1-0][1-0]=1.

Example 2:

Peter and Paul think about investing their money.

Peter’s utility function is:

u(x) = x

if x > -20

4x + 60 otherwise

Paul’s utility function is:

v(x) = x

if x > -30

3x + 60 otherwise

Investment is offered to Peter. Peter can make

investment 60 and earn 160 (net profit is 100) or nothing

with equal probabilities.

u(x) = 0.50*u(100) + 0.50*u(-60) = -40

Peter rejects and investment is offered to Paul.

v(x) = 0.50*v(100) + 0.50*v(-60) = -10

Paul rejects and suggests to invest 60% (that is 36) and

offered Peter to invest 40% (ie. 24). Revenue will be also

divided by the 40/60 ratio.

Does Peter accept this offer?

![Labor Management Relations [Opens in New Window]](http://s3.studylib.net/store/data/006750373_1-d299a6861c58d67d0e98709a44e4f857-300x300.png)