“Viability of Kerbside Recycling Services”

advertisement

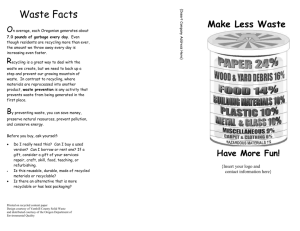

“Viability of Kerbside Recycling Services” The impacts of the global recession on markets for recycled paper and plastics and the implications for South Australian Councils Background Paper Prepared for the Local Government Association of South Australia Prepared by John Comrie Director JAC Comrie Pty Ltd in association with Terry Bruun Principal Consultant Sustainable Outcomes 4 May 2009 DME 47516 1 This paper has been prepared to provide general background information to aid discussions by Council representatives at the meeting organised by the LGA for 7 May 2009. It is anticipated that Councils will contribute additional relevant information at that meeting to help determine what if any future actions are warranted. 1. Introduction The State General Manager (SA and WA) of Visy Paper Pty Ltd, (Visy Recycling) wrote to all South Australian Councils and authorities that offer kerbside collection of recyclables on 26 March 2009 under the heading of “Viability of Kerbside Recycling Services”. The key issues raised in letter were: The prices for recovered commodities have fallen dramatically over the past 6 months and as a result Visy’s kerbside recovery business has become ‘uneconomic’; Visy is seeking a review of “the commercial arrangements that are currently in place between Visy and Council” as a “means to guarantee the long term viability of recycling”. This Paper outlines: What’s happened and why The challenges for the recycling industry The challenges for Local Government A possible way forward. DME 47516 2 2. Consultation with selected key stakeholders The preparation of this background paper involved consultation with a cross-section of stakeholders: (1) State and Local Government LGA Zero Waste SA Environment Protection Authority Northern Adelaide Waste Management Authority East Waste City of Onkaparinga City of Holdfast Bay City of Port Adelaide Enfield City of Whyalla City of Mount Gambier Coorong District Council. (2) Waste industry Australian Council of Recyclers Inc Visy Recycling SITA Australia Pty Ltd TJH Management Services Pty. Ltd. In addition, information was sourced from the following references: The Report on “Future Directions for Waste Management in the Local Government Sector in South Australia”, November 2007 (the Cossey Report); Draft Environmental Protection (Waste to Resources) Policy Desk research 3. Overview of South Australian kerbside recycling sector Typically Councils that offer kerbside collection of recyclable materials have contracts (either directly or through their regional subsidiaries) with kerbside collection firms (for example, Solo, Cleanaway, SITA) for both: kerbside collection of recyclable material and processing of recyclable material at a Material Recovery Facility (MRF). There are some exceptions to this model. For example; East Waste provides the kerbside collection service for its member Councils (and other Councils under contract) and has a contract with a MRF operator for the processing of the recyclable material. Some Councils undertake the kerbside collection service using their own resources, and have a contract with a MRF operator for the processing of the recyclable material. DME 47516 3 A few Councils have a separate contract for collection and another for processing. The recyclable material from the kerbside collections is recovered from one of three MRFs located in metropolitan Adelaide. (1) The Northern Adelaide Waste Management Authority (NAWMA) MRF at Elizabeth West; (2) The Solo MRF at Plympton North; (3) The Integrated Waste Services (IWS) MRF at Wingfield. Visy has the ‘operating rights’ for all three MRFs. Visy exports most of the recovered paper-based recyclable material to China directly from Adelaide. (Visy is also a dominate market player in the eastern states and uses the majority of the recovered recyclable material internally to supply its packing business and exports any that is surplus to its local needs.) 4. The issues In summary, Visy is appealing to Local Government to “help develop a commercial solution that enables current service standards to be maintained” which will overcome the “current challenges”. What are the current challenges for: Visy? Local Government? What is Visy’s proposed solution? It is understood that Visy has also sent a letter similar to the South Australian version to Councils interstate which have a direct or indirect association with it for the disposal of recyclable materials. Visy is also seeking discussions with its commercial/industrial customers. 4.1 The Challenges for Visy It has been widely reported in the media that the prices of recyclable material have dramatically fallen in the past few months due to the global financial crisis. That is, the slowdown in general economic conditions has led to a reduction in market demand for products made with recycled materials. This has led to a reduction in demand and corresponding prices paid for inputs by producers of end-market products. There are no official figures available from independent sources (e.g. ABS) to quantify this impact. DME 47516 4 The Visy letter claims that “most materials have shown drops of between 50% and 80% comparing current prices with those of August 2008”. It is understood that Visy is preparing an ‘information package’ to support its claims which will be presented at the 2009 joint LGA and Zero Waste SA Waste Pathways Forum on 25 May 2009 (refer LGA circular 17.8 of 2009 for details). Market intelligence suggests that paper and cardboard, for example, was selling at about $80 to $100 per tonne in 2005/06 and increased steadily to $160/$180 per tonne by 2007/08 and returned to the 2005/06 prices (or lower) towards the end of 2008. Note: these prices are influenced by significant movements in the US$/A$ exchange rate over that period. (International market prices are typically expressed in US dollars. If the A$ falls in value relative to the $US then an Australian exporter will receive a higher $A price for their products all other things being equal.) How has VIsy been affected by the falling prices for recyclable material? The downturn in prices has meant it is less economically viable to export recyclable material from Adelaide. It is understood that much of it is currently either being transported to Melbourne (typically for internal use by Visy) or stockpiled locally. The fall in prices and associated loss of marketing opportunities has placed significant pressure on Visy. However it needs to be recognised that poor market conditions have only been experienced over a relatively short recent period compared to the very positive market conditions during the preceding years. Some insight into Visy’s position is provided by the following article which was published in the November 2008 edition of Environmental Management News (EMN) (a trade publication with circulation in local government and the waste management industry). “Visy has a large internal demand for material, sheltering it from the worst of the global price squeeze. However, it does export about 50% of the recovered paper fibre it collects and an even higher percentage of the plastics stream. A little known fact is Visy is actually the nation’s largest exporter of containerised material, which gives it another advantage in the current downturn of having a dedicated presence in Asia, allowing it to deal directly with mills without the middlemen. Coupled with the internal demand, it means Visy is better placed than others to weather the commodity downturn. At the other end of the equation, the generators of recyclable material – primarily local councils – are feeling the pinch as material prices plummet. Many councils have gotten used to high commodity prices subsidising their waste collection operations through recent years, although many are now seeing contract variation clauses coming into play.” What about the future market conditions? No commentators or industry representatives are prepared to make any firm predictions about the future prices for recyclable products. DME 47516 5 However, the February 2009 edition of Environmental Management News reported that: “Improving demand from China for recyclable materials is helping lift prices for recycled materials, which went into free-fall late last year, according to data released by the UK’s Waste and Resources Action Program.” Although the above report is a statement about the European position, Visy was making encouraging comments about the Australian mrket in the same edition: “The industry was hoping the market “bottomed out in January” which recorded the lowest prices since the decline last year. “We’ve been seeing a little bit of an increase from January to February though there was only a price increase of about 1-2%”. “We’re not prepared to say ‘hey, it’s over’, but hopefully it looks as if we’ve seen the bottom of it. We’re still pretty close to the bottom. I can only say that the market is not continuing to fall”. It is reasonable to assume that when the global economy returns to growth that demand for recyclables will once again increase. Actual prices achieved will also depend on the quantum of recyclable material available. Market prices are of course a function of both supply and demand. The implications of the Draft Environmental Protection (Waste to Resources) Policy The South Australian Environmental Protection Authority has released a draft Environment Protection (Waste to Resources) Policy that provides regulatory underpinning for ‘South Australia’s Waste Strategy 2005-2010’. It aims to further promote the implementation of the waste management hierarchy (avoid, reduce, reuse, recycle). An intent of the draft Policy is to reduce the potential for disposal to landfill of material collected for recycling. If the draft Policy is implemented in its present form it will present recyclers with a number of challenges. These are highlighted by ACOR’s (Australian Council of Recyclers Inc) in its submission to the Environment Protection Authority in response to public consultation on the draft document. (1) "If government policy seeks to ban materials from landfilling which do not have sufficient market value to cover their recycling costs, then new financial mechanisms (such as rebate and EPR schemes) need to be put in place to cover the recycling cost gap" DME 47516 6 (2) "Circumstance change and where markets collapse or are adverse and/or materials are not in accordance with predetermined specifications, disposal to landfill must be available as a matter of last resort" (3) " Stockpiling is a business decision made at times of market surplus or adverse trade conditions and the sector needs clarity on this matter (inappropriate stockpiling) so we can manage our business" The period for public consultation on the draft Policy has now concluded and the Environment Protection Authority is considering feedback before finalising the preferred Policy content. 4.2 The Challenges for Local Government Current arrangements Unlike in the eastern states most metropolitan SA Councils that offer kerbside collection services have arrangements in place where they pay a fee for disposal of the recyclable material and they are either not exposed (or have only minimal exposure) to the risks and rewards of fluctuating market prices. The above described arrangements are typically enshrined in long-term contracts. Many metropolitan Councils could quite understandably therefore say the recent fall in market prices is not their concern. Nevertheless Councils need to at least recognise that sustained low market prices could eventually lead to some service providers withdrawing from the market place and/or higher tendered prices for renewal of services in future. Even with favourable market prices the transport distances to logistical hubs (Adelaide and possibly Melbourne) and small volumes have made the cost of recycling services prohibitive for many rural and regional Councils. In cases where such a service is provided it varies from one that is comparable to that currently provided by metropolitan Councils to more basic ‘kerbside crate’ and ‘depot drop-off’ arrangements. Some rural Councils that do not have long-term arrangements in place periodically have collected recyclable material transported to an Adelaide MRF. They are fully exposed to market ‘spot’ prices and some have found that it is not viable to currently ship material and are stock-piling it. Some challenges were previously identified in the Cossey Report (“Future Directions for Waste Management in the Local Government Sector in South Australia” prepared by Bill Cossey November 2007). Some of the findings and recommendations of the Report are relevant to assessment of any response to the impact of falling market prices for recyclable material on local government recycling practices and arrangements. Under section 5.8 Kerbside Recycling (page 30), the Report concludes: DME 47516 7 “Councils have been at the forefront of encouraging householders to contribute to recycling through the provision of either separate bins or separate compartments in existing bins for recyclables. This approach has worked hand in hand with the container deposit legislation in South Australia. Of course, not all material that householders place in the recycling bin or compartment is recyclable. Audits conducted by Zero Waste SA indicate as much as 10% of the material is not able to be recycled. In addition, Councils have little or no control over the processes which the recyclers adopt – even though metropolitan Councils generally pay the recycler at a rate of approximately $20 per tonne for potentially recyclable material delivered to the recycler. It should come as no surprise that the commercial imperatives of the recycler will dictate the results that are achieved by the recycler. Those imperatives have a number of components to them including: the ease with which the contaminated material can be removed from the genuinely recyclable material the availability and strength of the markets for recycled product the cost of depositing the non-recycled material in landfill and whether or not the originating Council is bearing this cost. Consistent with the discussion on the objectives of Councils for their involvement in Waste Management in Section 5.2 above, Councils should be aiming to ensure a maximisation of the results from the processes of collecting and processing recyclables. In fairness, some Councils and their subsidiaries have recognised this and have commenced introducing provisions in contracts including: requiring the recycler to make a (relatively small) payment related to the recycling actually performed absolving the Council of any obligation to pay the landfill depositing cost for materials determined by the recycler as not recyclable These are steps in the right direction. The project anticipates that as the Local Government sector strengthens its approach to contracting and contract management other incentives and disincentives will be identified and adopted.” The Cossey Report goes onto recommend as follows: “Recommendation 19 That, as a component of the strengthened approach to contracting proposed in Recommendations 6 to 10, Councils and subsidiaries continue to refine their approach to contracts with recyclers to ensure that there are maximum incentives and minimum disincentives for recyclers to maximise the recovery from the material placed in recycling bins.” The Visy letter serves as a timely reminder of the risks and challenges associated with the development of cost effective arrangements for encouraging greater levels of recycling. DME 47516 8 5. Visy’s proposed way forward Visy has indicated in discussions that it may wish to explore establishing direct contracts with Councils for the processing of recyclable material. This would replace the existing arrangements in which the processing fee is often part of the total collection and processing fee Councils have in place with the kerbside collector. Visy would like to discuss the merit for parties of arrangements that set an agreed “sustainable” (floor price) gate fee which would be adjusted (up or down) in accordance with market conditions. Visy has already commenced discussions with some kerbside collection contractors and a few Councils. How could LG respond? Recycling has always cost Councils more than the alternative of landfill. Councils and their communities have strongly supported recycling because of the environmental benefits and as a result the proportion of kerbside presented material diverted from landfill has steadily grown. Most metropolitan Councils appear to have long-term arrangements (2 to 5 years or more) in place for collection and processing of recyclables with large well established companies where they (the companies) wear the market price risk. It is in local government’s long-term interests for there to be a viable and competitive recycling industry. Council representatives should keep an open-mind about the best way this can be achieved and maintained. Nevertheless unless additional compelling evidence is produced it is likely that most Councils that currently have contracts for the collection and processing of recyclables are unlikely to perceive there will be overall benefits in changed arrangements prior to the expiration of current contracts. Councils that don’t currently have long-term arrangements in place are likely to experience an increase in costs to maintain or introduce recycling services – at least until world economic demand bids up prices again. Depending on the state of markets and the degree of competition in future processors may be wary in about offering councils (or their contactors) new longterm arrangements that leave the processors bearing the full risk of market price falls. DME 47516 9