vaccine_paper - Stanford University

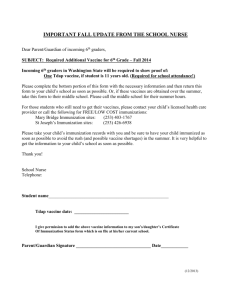

advertisement