Midterm Exam

advertisement

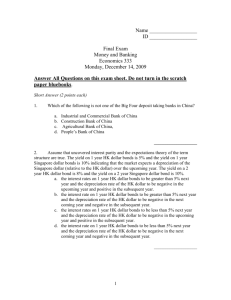

Name __________________ ID __________________ Final Exam Money and Banking Economics 333 Monday, December 14, 2009 Answer All Questions on this exam sheet. Do not turn in the scratch paper bluebooks. Short Answer (2 points each) 1. Which of the following is not one of the Big Four deposit taking banks in China? a. Industrial and Commercial Bank of China b. Construction Bank of China c. Agricultural Bank of China, d. People’s Bank of China ________D___________ 2. Assume that uncovered interest parity and the expectations theory of the term structure are true. The yield on 1 year HK dollar bonds is 5% and the yield on 1 year Singapore dollar bonds is 10% indicating that the market expects a depreciation of the Singapore dollar (relative to the HK dollar) over the upcoming year. The yield on a 2 year HK dollar bond is 8% and the yield on a 2 year Singapore dollar bond is 10%. a. the interest rates on 1 year HK dollar bonds to be greater than 5% next year and the depreciation rate of the HK dollar to be negative in the upcoming year and positive in the subsequent year. b. the interest rate on 1 year HK dollar bonds to be greater than 5% next year and the depreciation rate of the HK dollar to be negative in the next coming year and negative in the subsequent year. c. the interest rates on 1 year HK dollar bonds to be less than 5% next year and the depreciation rate of the HK dollar to be negative in the upcoming year and positive in the subsequent year. d. the interest rate on 1 year HK dollar bonds to be less than 5% next year and the depreciation rate of the HK dollar to be negative in the next coming year and negative in the subsequent year. _______A____________ 1 3. During the year we see that a bank issues subordinated bonds and switches lending from interbank lending to corporate lending. a. Issuing subordinated bonds will increase the CAR and switching to corporate lending will increase the CAR. b. Issuing subordinated bonds will increase the CAR and switching to corporate lending will decrease the CAR. c. Issuing subordinated bonds will decrease the CAR and switching to corporate lending will increase the CAR. d. Issuing subordinated bonds will decrease the CAR and switching to corporate lending will decrease the CAR. __________B_________ 4. A bank with no excess reserves faces a sudden large withdrawal of funds by a depositor. To improve the liquidity of its balance sheet, the bank could a. Sell secondary reserves to adjust the liquidity of the banks assets or lend in the interbank market to adjust the liquidity of the banks liabilities. b. Buy secondary reserves to adjust the liquidity of the banks assets or lend in the interbank market to adjust the liquidity of the banks liabilities. c. Sell secondary reserves to adjust the liquidity of the banks assets or borrow in the interbank market to adjust the liquidity of the banks liabilities. d. Buy secondary reserves to adjust the liquidity of the banks assets or borrow in the interbank market to adjust the liquidity of the banks liabilities. _______ C ____________ 5. The central bank intervenes in the foreign exchange market and sells foreign currency. If this intervention is sterilized, we should expect to see, a. an increase in foreign reserves and an increase in bank reserves b. an increase in foreign reserves and a decrease in bank reserves c. a decrease in foreign reserves and an increase in bank reserves d. a decrease in foreign reserves and a decrease in bank reserves __________ C______ 2 6. Comparing Core Deposits and Managed Liabilities a. Core Deposits have greater non-interest costs and managed liabilities have greater liquidity risk. b. Core Deposits have greater non-interest costs and managed liabilities have lower liquidity risk. c. Core Deposits have greater interest costs and managed liabilities have greater liquidity risk. d. Core Deposits have greater interest costs and managed liabilities have lower liquidity risk. _____ A___________ 7. Subordinated debt is a. Tier One Capital and Managed Liabilities b. Tier One Capital and Core Deposits c. Tier Two Capital and Managed Liabilities d. Tier Two Capital and Core Deposits. _______C____ 8. The central banks of England and Jamaica both set an interest rate target. The biggest driver of business cycle fluctuations in England is unexpected changes in government spending. The biggest driver of business cycle fluctuations in Jamaica is fluctuations in energy prices. a. Having a more inflation sensitive policy will stabilize output in England; having a more inflation sensitive policy will stabilize output in Jamaica. b. Having a more inflation sensitive policy will stabilize output in England; having a less inflation sensitive policy will stabilize output in Jamaica. c. Having a less inflation sensitive policy will stabilize output in England; having a more inflation sensitive policy will stabilize output in Jamaica. d. Having a less inflation sensitive policy will stabilize output in England; having a less inflation sensitive policy will stabilize output in Jamaica. ________B________ 3 9. The central banks of England and Jamaica both set an interest rate target. The biggest driver of business cycle fluctuations in England is unexpected changes in government spending. The biggest driver of business cycle fluctuations in Jamaica is fluctuations in energy prices. a. Having a more inflation sensitive policy will stabilize inflation in England; having a more inflation sensitive policy will stabilize inflation in Jamaica. b. Having a more inflation sensitive policy will stabilize inflation in England; having a less inflation sensitive policy will stabilize inflation in Jamaica. c. Having a less inflation sensitive policy will stabilize inflation in England; having a more inflation sensitive policy will stabilize inflation in Jamaica. d. Having a less inflation sensitive policy will stabilize inflation in England; having a less inflation sensitive policy will stabilize inflation in Jamaica. ________A________ 10. Assume that inflation in the US and HK move independently from one another. Then we could say that a. An increase in US inflation increases HK real interest rates and an increase in HK inflation increases HK real interest rates. b. An increase in US inflation increases HK real interest rates and an increase in HK inflation decreases HK real interest rates. c. A decrease in US inflation increases HK real interest rates and an increase in HK inflation increases HK real interest rates. d. A decrease in US inflation increases HK real interest rates and an increase in HK inflation decreases HK real interest rates. ________B________ Verbal Answers 11. (3 points) Name 3 elements of measuring a bank’s credit risk and a specific way to measure each element. i. Past History – Loan Loss Rates ii. Current Likelihood – Non performing Loans iii. Protection Against Future Losses – Loan Loss Reserves to Loans 4 12. (4 points) List an important new competitor for the US banking system in each of the key activities of a) providing liquidity and b) providing credit. Write at most two sentences describing the new competitor. i. Providing Liquidity Money market mutual funds accept funds from investors and invest the proceeds in money market securities such as commercial paper. MMMF’s also issue checks which can be used in transactions in place of bank accounts. ii. Providing Credit A number or answers are possible. a. Corporate borrowers can increasingly issue securities to raise funds (commercial paper, non-investment grade bonds). b. Also, the shadow banking system of mortgage brokers and investment banks competed with banks in the mortgage issuance/securitization process. 13. i. ii. iii. (3 points) List 3 strategies for the operation of an independent central bank. Central Bank sets monetary policy free of direct government control. Long-terms of Office for Central Bank Policymakers, difficult for Central Bankers to be Fired. Central Bank has independent sources of revenue. 14. (4 points) In 4 sentences or less, describe the different roles of GSE’s and SPV’s in the mortgage securitization market? Government Sponsored Enterprises such as FNMA in the US or HKMC in Hong Kong issue bonds to purchase bundles of mortgages from banks and use the funds generated by the repayment from mortgages to pay off the bonds. GSE’s enjoy implicit government guarantees and are restricted in the types of mortgages that they might buy. Investment banks also set up Special Purpose Vehicles to sell collateralized mortgage obligations (CMO’s) to purchase mortgages from banks and other financial institutions. SPV’s often purchased sub-prime mortgages and payed off investors in tranches ordered by seniority. 5 15. (4 points) What is a CDS? In 4 sentences or less, what is the relationship between CDS and synthetic CDO’s? A CDS is a credit default swap which is an insurance policy on a credit event such as a default by a corporate borrower. Selling a CDS combined with a risk free loan is a synthetic corporate bond that will generate a flow of funds similar to a corporate bond issued by the named corporate borrower. A synthetic CDO is a structured investment product issued by an investment bank in which the investment bank promises to pay the investors funds generated by a bundle of synthetic corporate bonds. Payoffs to investors in synthetic CDOs are structured by seniority to make payoffs to senior tranches quite safe unless the investment bank itself goes bankrupt. 16. (6 points) The regulation of banks in Hong Kong has a number of parts. Describe, in a few sentences, the following aspects. i. CAMEL Grading & Loan Classification HKMA scores according to Capitalization, Asset Quality, Management, Earnings Liquidity. Loans are graded as Pass, Classifed and special mention ii. Capital Requirements CAR Ratio which is Capital (including Tier 2) relative to Risk Adjusted Assets is above 8% iii. Liquidity Requirements Liquidity ratio which is Liquid Assets to Liabilities is above 25% 6 17. (4 points) The Bank of Japan engages in an open market operation of 100 million yen to push up the interbank interest rate. Describe this transaction using the following TAccount. Bank of Japan Liabilities & Net Worth Assets -100 Government Bonds -100 Reserves Graphing Question 18. (4 points) In Europe, the ECB has an interest rate target of 1.5% The ECB accepts deposits at an interest rate of 1% and makes short-term loans at an interest rate of 2%. Draw a graph illustrating the impact of a sudden large increase (shift out) in the demand for reserves at any interest rate, assuming the supply of reserves remains unchanged. Draw a graph of the effect on the interbank interest rate. iIBOR S 2 iLOAN Borrowed Reserves iTGT 1 iDEPOSIT 7 19. (6 points) Economic forecasters are predicting that there will be a recession in the USA in the next year with falling output and slowing inflation. Assume that no such recession occurs in East Asia. Draw two Graphs. The first will show the impact of these events on the interbank market in Hong Kong. Assume that the Fed Funds rate never goes to zero. The second will show the impact on the Korean Won foreign exchange market. Label the graphs clearly, but no further writing is necessary. A. . Hong Kong Interbank Market 1 iUS iUS’ 2 D B. Korean Won Forex Market S Supply Demand’ 1 Demand 2 Supply’ 8 Calculations 20. (5 points) See the attached Consolidated Balance Sheets and Consolidated Profit and Loss Accounts for DBS (Hong Kong). a. Calculate the Return on Assets, Return on Equity, and Equity Multiplier for the bank in 2008. Assets Equity Earnings Net Loans Gross Loans 217029292 15537543 1828881 132384605 135,007,041 ROA ROE EM Loan Loss Reserves 0.008427 0.117707 13.96806 2,622,436 b. The banks total advances to customers in 2008 is HK$135,007,041,000.00 How much is loan loss reserves. 21. (5 points) A borrower can issue a 3 year discount bond with a face value of 100 and sell it for a price of 60. Calculate the yield to maturity for the discount bond. A borrower issues a 3 year coupon bond with a face value of 100 and an annual coupon payment of 20. If the yield to maturity of the coupon bond is the same as the discount bond, what is the price of the coupon bond? 100 1 i 3 1.1856 60 C C C P 2 1 i (1 i) (1 i)3 P C 1 FACE 20 1 100 8 1 1 60 103.096 3 3 3 3 i (1 i ) (1 i ) .1856 (1.1856) (1.1856) .1856 9 22. (5 points) Consider the balance sheets of the following bank. Loans Cash 90 10 Assets 100 Deposits Subordinated Debt Equity 80 10 10 a. The bank’s accountant tells you that the current market value is exactly equal to the book value, the duration of the bank’s assets are dA = 4.5 and the duration of the banks liabilities are dL =2.5. Calculate the duration gap of the bank. D GAP [4.5 .9* 2.5] 2.25 b. The bank’s interest income is 5 and its interest expense is 3. Calculate the net interest margin under both definitions of net interest margin NIM = Net Interest Income/Assets = 2/100 = .02 or Net Interest Income/Interest Earning Assets = 2/90 = .0222 . 23. (5 points) The monetary base is $100. The central bank imposes a required reserves ratio of 20% of demand deposits. The ratio of currency to demand deposits is fixed at .8. Assuming no excess reserves, calculate the level of cash, reserves and M1. At what level of reserves would the money supply be equal to 270? 1 C D 1.8 The money supply is 180. The ratio of reserves to M! Multiplier is C R D D deposits is .2. The ratio cash to deposits is ..8. The ratio of reserves to cash is .25. Cash + Reserves = Base = Cash + .25*Cash implies Cash = 80 and Reserves = 20. 10 24. (4 points) An investment fund will receive 100 in income in 1 year and another 100 in two years. Given a discount factor of 10% (i = .1), calculate the duration of the fund. 100 100 PV1 , PV2 1.1 1.21 110 100 210 MV PV1 PV2 1.21 1.21 110 100 w1 , w2 210 210 310 duration w1 1 w2 2 1.476 210 25. (8 points) Assume that the bond market is restricted to 1 year discount bonds with face value equal to 100. There are two types of borrowers in the bond market: risky borrowers (“lemons”) and non-risky borrowers (“cream puffs). Fifty percent of borrowers are known to be lemons and fifty percent of borrowers are known to be creampuffs. Savers are willing to pay 90 for a lemon bond and 95 for a cream puff bond. Lemon borrowers are willing to borrow if they can pay a yield no greater than 15% and creampuff borrowers will issue bonds if they can pay a yield no greater than 6%. Assume borrowers and savers are equally good bargainers, so that the price of bonds is midway between the maximum price that savers are willing to pay for a bond and the minimum price that borrowers are will to expect. A. If there is perfect information and borrowers and savers can easily distinguish between lemon and creampuff bonds, what will be the prices at which lemon and creampuff bonds will be sold? Savers will pay 90 for a lemon bond. Borrowers will sell bonds for 100 100 86.95652174 . Halfway between is YTM 1 i 1.15 86.95652174+90 P LEMON 88.47826087 2 11 Savers will pay 95 for a creampuff bond and borrowers will sell bonds for 100 100 94.33962264 . Halfway between is YTM 1 i 1.06 94.33962264+95 P PUFF 94.66981132 2 B. Assume that savers cannot distinguish between lemon and creampuff bonds and are willing to pay (at most) the expected value of a bond that is equally likely to be a lemon or creampuff. What will be the price that savers will be willing to pay for a bond of unknown type? Fifty-fifty chance of being lemon and creampuff. Maximum value for a bond of unknown type would be .5*90+.5*95 = 92.5 C. Assume asymmetric information, so borrowers know the type of the bond but savers do not. Is the price that savers will pay for a bond of unknown type greater than or less than the minimum price that issuers of a creampuff bond will be willing to accept? Will any creampuff bonds be sold? What price will prevail for a lemon bond? The price paid for a bond of unknown type is below the minimum price that a creampuff borrower would accept. Therefore, borrowers will all be lemons and the price that savers will pay for a bond would be based on the assumption that there were only lemons. Price is 88.478 12 26. (10 points) A bank’s owners have $200 worth of capital to invest in a banking business. A bank can raise up to $800 in 1-year time deposits by promising to pay a 5% interest rate (so the bank will have to repay $840 in 1 years’ time or default). Assume that the bank takes deposits of $800 and is able to make $1000 in loans. The bank can pursue two strategies. i. Under the first strategy, the bank makes $1000 in simple 1-year loans at an interest rate of 10%. These simple loans are risk-free, so the bank will be able to collect $1100 in 1 year. Calculate the banks profits as the difference between the amount collected from borrowers and the amount that must be paid to depositors. Calculate the return on equity and the net interest margin for a bank that pursues the safe strategy. Bank collects $100 in interest and pays $40 so makes profits of $60. ROE is 30%. Net interest margin is 6%. ii. Under the second strategy, the bank makes a risky loan of $1000 at an interest rate of 55%. In the bad case which occurs with a 50% probability, the borrower defaults and pays nothing. In the good case which occurs with a 50% probability, the borrower pays the bank $1550. In the bad case, the bank will collect no money and pay depositors nothing. In this case, bank owners will lose all of their capital so Profits = -$200. In the good case, the owners will earn profits equal to the interest earned minus the interest they must pay depositors. Calculate the expected value of the bank owners’ profits. Profits in Good Case = $550-$40=510, Profits in Bad Case = -$200. Expected Profits = .5*510 + .5*-200 = 155 13 Now assume that bank regulators limit the Equity Multiplier that a bank can operate at by limiting the amount of deposits that a bank with a given amount of capital can take. The upper limit in deposits that a bank with capital of $200 can take is D , so the bank can lend D +200. The bank can make safe loans with a 10% interest rates or they can make risky loans at an interest rate of 55% (with a 50% chance of default in which case the bank owners have a profit of -200). The bank must pay their depositors an interest rate of 5% on D . iii. Calculate the maximum level of D at which the bank owners would prefer to make safe loans. What is the limit on the bank’s equity multiplier which the regulators should impose if they want banks to lend safely? What would be the bank’s return on equity in this case? Safe Loans Bank profits = .10*( D +200)-.05* D =.05 D +20 Risky Loans Expected Profits = .5*[.55*( D +200)-.05* D ]+.5*-200 = .25 D +55-100=.25 D -45 .05 D +20 > .25 D -45 implies 65 > .2 D implies D <325 26. 14