Midterm Exam

advertisement

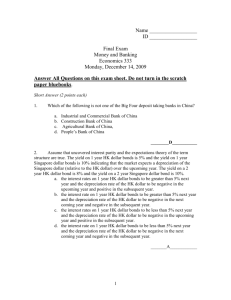

Name __________________ ID __________________ Final Exam Money and Banking Economics 333 Monday, December 14, 2009 Answer All Questions on this exam sheet. Do not turn in the scratch paper bluebooks. Short Answer (2 points each) 1. Which of the following is not one of the Big Four deposit taking banks in China? a. Industrial and Commercial Bank of China b. Construction Bank of China c. Agricultural Bank of China, d. People’s Bank of China ___________________ 2. Assume that uncovered interest parity and the expectations theory of the term structure are true. The yield on 1 year HK dollar bonds is 5% and the yield on 1 year Singapore dollar bonds is 10% indicating that the market expects a depreciation of the Singapore dollar (relative to the HK dollar) over the upcoming year. The yield on a 2 year HK dollar bond is 8% and the yield on a 2 year Singapore dollar bond is 10%. a. the interest rates on 1 year HK dollar bonds to be greater than 5% next year and the depreciation rate of the HK dollar to be negative in the upcoming year and positive in the subsequent year. b. the interest rate on 1 year HK dollar bonds to be greater than 5% next year and the depreciation rate of the HK dollar to be negative in the next coming year and negative in the subsequent year. c. the interest rates on 1 year HK dollar bonds to be less than 5% next year and the depreciation rate of the HK dollar to be negative in the upcoming year and positive in the subsequent year. d. the interest rate on 1 year HK dollar bonds to be less than 5% next year and the depreciation rate of the HK dollar to be negative in the next coming year and negative in the subsequent year. ___________________ 1 3. During the year we see that a bank issues subordinated bonds and switches lending from interbank lending to corporate lending. a. Issuing subordinated bonds will increase the CAR and switching to corporate lending will increase the CAR. b. Issuing subordinated bonds will increase the CAR and switching to corporate lending will decrease the CAR. c. Issuing subordinated bonds will decrease the CAR and switching to corporate lending will increase the CAR. d. Issuing subordinated bonds will decrease the CAR and switching to corporate lending will decrease the CAR. ___________________ 4. A bank with no excess reserves faces a sudden large withdrawal of funds by a depositor. To improve the liquidity of its balance sheet, the bank could a. Sell secondary reserves to adjust the liquidity of the banks assets or lend in the interbank market to adjust the liquidity of the banks liabilities. b. Buy secondary reserves to adjust the liquidity of the banks assets or lend in the interbank market to adjust the liquidity of the banks liabilities. c. Sell secondary reserves to adjust the liquidity of the banks assets or borrow in the interbank market to adjust the liquidity of the banks liabilities. d. Buy secondary reserves to adjust the liquidity of the banks assets or borrow in the interbank market to adjust the liquidity of the banks liabilities. ___________________ 5. The central bank intervenes in the foreign exchange market and sells foreign currency. If this intervention is sterilized, we should expect to see, a. an increase in foreign reserves and an increase in bank reserves b. an increase in foreign reserves and a decrease in bank reserves c. a decrease in foreign reserves and an increase in bank reserves d. a decrease in foreign reserves and a decrease in bank reserves ________________ 2 6. Comparing Core Deposits and Managed Liabilities a. Core Deposits have greater non-interest costs and managed liabilities have greater liquidity risk. b. Core Deposits have greater non-interest costs and managed liabilities have lower liquidity risk. c. Core Deposits have greater interest costs and managed liabilities have greater liquidity risk. d. Core Deposits have greater interest costs and managed liabilities have lower liquidity risk. _______________ 7. Subordinated debt is a. Tier One Capital and Managed Liabilities b. Tier One Capital and Core Deposits c. Tier Two Capital and Managed Liabilities d. Tier Two Capital and Core Deposits. ___________ 8. The central banks of England and Jamaica both set an interest rate target. The biggest driver of business cycle fluctuations in England is unexpected changes in government spending. The biggest driver of business cycle fluctuations in Jamaica is fluctuations in energy prices. a. Having a more inflation sensitive policy will stabilize output in England; having a more inflation sensitive policy will stabilize output in Jamaica. b. Having a more inflation sensitive policy will stabilize output in England; having a less inflation sensitive policy will stabilize output in Jamaica. c. Having a less inflation sensitive policy will stabilize output in England; having a more inflation sensitive policy will stabilize output in Jamaica. d. Having a less inflation sensitive policy will stabilize output in England; having a less inflation sensitive policy will stabilize output in Jamaica. ________________ 3 9. The central banks of England and Jamaica both set an interest rate target. The biggest driver of business cycle fluctuations in England is unexpected changes in government spending. The biggest driver of business cycle fluctuations in Jamaica is fluctuations in energy prices. a. Having a more inflation sensitive policy will stabilize inflation in England; having a more inflation sensitive policy will stabilize inflation in Jamaica. b. Having a more inflation sensitive policy will stabilize inflation in England; having a less inflation sensitive policy will stabilize inflation in Jamaica. c. Having a less inflation sensitive policy will stabilize inflation in England; having a more inflation sensitive policy will stabilize inflation in Jamaica. d. Having a less inflation sensitive policy will stabilize inflation in England; having a less inflation sensitive policy will stabilize inflation in Jamaica. ________________ 10. Assume that inflation in the US and HK move independently from one another. Then we could say that a. An increase in US inflation increases HK real interest rates and an increase in HK inflation increases HK real interest rates. b. An increase in US inflation increases HK real interest rates and an increase in HK inflation decreases HK real interest rates. c. A decrease in US inflation increases HK real interest rates and an increase in HK inflation increases HK real interest rates. d. A decrease in US inflation increases HK real interest rates and an increase in HK inflation decreases HK real interest rates. ________________ Verbal Answers 11. (3 points) Name 3 elements of measuring a bank’s credit risk and a specific way to measure each element. i. ii. iii. 4 12. (4 points) List an important new competitor for the US banking system in each of the key activities of a) providing liquidity and b) providing credit. Write at most two sentences describing the new competitor. i. Providing Liquidity ii. Providing Credit 13. (3 points) List 3 strategies for the operation of an independent central bank. i. ii. iii. 14. (4 points) In 4 sentences or less, describe the different roles of GSE’s and SPV’s in the mortgage securitization market? 5 15. (4 points) What is a CDS? In 4 sentences or less, what is the relationship between CDS and synthetic CDO’s? 16. (6 points) The regulation of banks in Hong Kong has a number of parts. Describe, in a few sentences, the following aspects. i. CAMEL Grading & Loan Classification ii. Capital Requirements iii. Liquidity Requirements 6 17. (4 points) The Bank of Japan engages in an open market operation of 100 million yen to push up the interbank interest rate. Describe this transaction using the following TAccount. Bank of Japan Liabilities & Net Worth Assets Graphing Question 18. (4 points) In Europe, the ECB has an interest rate target of 1.5% The ECB accepts deposits at an interest rate of 1% and makes short-term loans at an interest rate of 2%. Draw a graph illustrating the impact of a sudden large increase (shift out) in the demand for reserves at any interest rate, assuming the supply of reserves remains unchanged. Draw a graph of the effect on the interbank interest rate. 7 19. (6 points) Economic forecasters are predicting that there will be a recession in the USA in the next year with falling output and slowing inflation. Assume that no such recession occurs in East Asia. Draw two Graphs. The first will show the impact of these events on the interbank market in Hong Kong. Assume that the Fed Funds rate never goes to zero. The second will show the impact on the Korean Won foreign exchange market. Label the graphs clearly, but no further writing is necessary. A. Hong Kong Interbank Market B. Korean Won Forex Market 8 Calculations 20. (5 points) See the attached Consolidated Balance Sheets and Consolidated Profit and Loss Accounts for DBS (Hong Kong). a. Calculate the Return on Assets, Return on Equity, and Equity Multiplier for the bank in 2008. b. The banks total advances to customers in 2008 is HK$135,007,041,000.00 How much is loan loss reserves. 21. (5 points) A borrower can issue a 3 year discount bond with a face value of 100 and sell it for a price of 60. Calculate the yield to maturity for the discount bond. A borrower issues a 3 year coupon bond with a face value of 100 and an annual coupon payment of 20. If the yield to maturity of the coupon bond is the same as the discount bond, what is the price of the coupon bond? 9 22. (5 points) Consider the balance sheets of the following bank. Loans Cash 90 10 Assets 100 Deposits Subordinated Debt Equity 80 10 10 a. The bank’s accountant tells you that the current market value is exactly equal to the book value, the duration of the bank’s assets are dA = 4.5 and the duration of the banks liabilities are dL =2.5. Calculate the duration gap of the bank. b. The bank’s interest income is 5 and its interest expense is 3. Calculate the net interest margin under both definitions of net interest margin . 23. (5 points) The monetary base is $100. The central bank imposes a required reserves ratio of 20% of demand deposits. The ratio of currency to demand deposits is fixed at .8. Assuming no excess reserves, calculate the level of cash, reserves and M1. At what level of reserves would the money supply be equal to 270? 10 24. (4 points) An investment fund will receive 100 in income in 1 year and another 100 in two years. Given a discount factor of 10% (i = .1), calculate the duration of the fund. 25. (8 points) Assume that the bond market is restricted to 1 year discount bonds with face value equal to 100. There are two types of borrowers in the bond market: risky borrowers (“lemons”) and non-risky borrowers (“cream puffs). Fifty percent of borrowers are known to be lemons and fifty percent of borrowers are known to be creampuffs. Savers are willing to pay 90 for a lemon bond and 95 for a cream puff bond. Lemon borrowers are willing to borrow if they can pay a yield no greater than 15% and creampuff borrowers will issue bonds if they can pay a yield no greater than 6%. Assume borrowers and savers are equally good bargainers, so that the price of bonds is midway between the maximum price that savers are willing to pay for a bond and the minimum price that borrowers are will to expect. A. If there is perfect information and borrowers and savers can easily distinguish between lemon and creampuff bonds, what will be the prices at which lemon and creampuff bonds will be sold? 11 B. Assume that savers cannot distinguish between lemon and creampuff bonds and are willing to pay (at most) the expected value of a bond that is equally likely to be a lemon or creampuff. What will be the price that savers will be willing to pay for a bond of unknown type? C. Assume asymmetric information, so borrowers know the type of the bond but savers do not. Is the price that savers will pay for a bond of unknown type greater than or less than the minimum price that issuers of a creampuff bond will be willing to accept? Will any creampuff bonds be sold? What price will prevail for a lemon bond? 12 12. (10 points) A bank’s owners have $200 worth of capital to invest in a banking business. A bank can raise up to $800 in 1-year time deposits by promising to pay a 5% interest rate (so the bank will have to repay $840 in 1 years’ time or default). Assume that the bank takes deposits of $800 and is able to make $1000 in loans. The bank can pursue two strategies. i. Under the first strategy, the bank makes $1000 in simple 1-year loans at an interest rate of 10%. These simple loans are risk-free, so the bank will be able to collect $1100 in 1 year. Calculate the banks profits as the difference between the amount collected from borrowers and the amount that must be paid to depositors. Calculate the return on equity and the net interest margin for a bank that pursues the safe strategy. ii. Under the second strategy, the bank makes a risky loan of $1000 at an interest rate of 55%. In the bad case which occurs with a 50% probability, the borrower defaults and pays nothing. In the good case which occurs with a 50% probability, the borrower pays the bank $1550. In the bad case, the bank will collect no money and pay depositors nothing. In this case, bank owners will lose all of their capital so Profits = -$200. In the good case, the owners will earn profits equal to the interest earned minus the interest they must pay depositors. Calculate the expected value of the bank owners’ profits. 13 Now assume that bank regulators limit the Equity Multiplier that a bank can operate at by limiting the amount of deposits that a bank with a given amount of capital can take. The upper limit in deposits that a bank with capital of $200 can take is D , so the bank can lend D +200. The bank can make safe loans with a 10% interest rates or they can make risky loans at an interest rate of 55% (with a 50% chance of default in which case the bank owners have a profit of -200). The bank must pay their depositors an interest rate of 5% on D . iii. Calculate the maximum level of D at which the bank owners would prefer to make safe loans. What is the limit on the bank’s equity multiplier which the regulators should impose if they want banks to lend safely? What would be the bank’s return on equity in this case? 14