volatility - University of North Texas

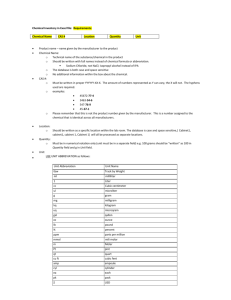

advertisement