Knight Time Review- answers Which of the following would be most

advertisement

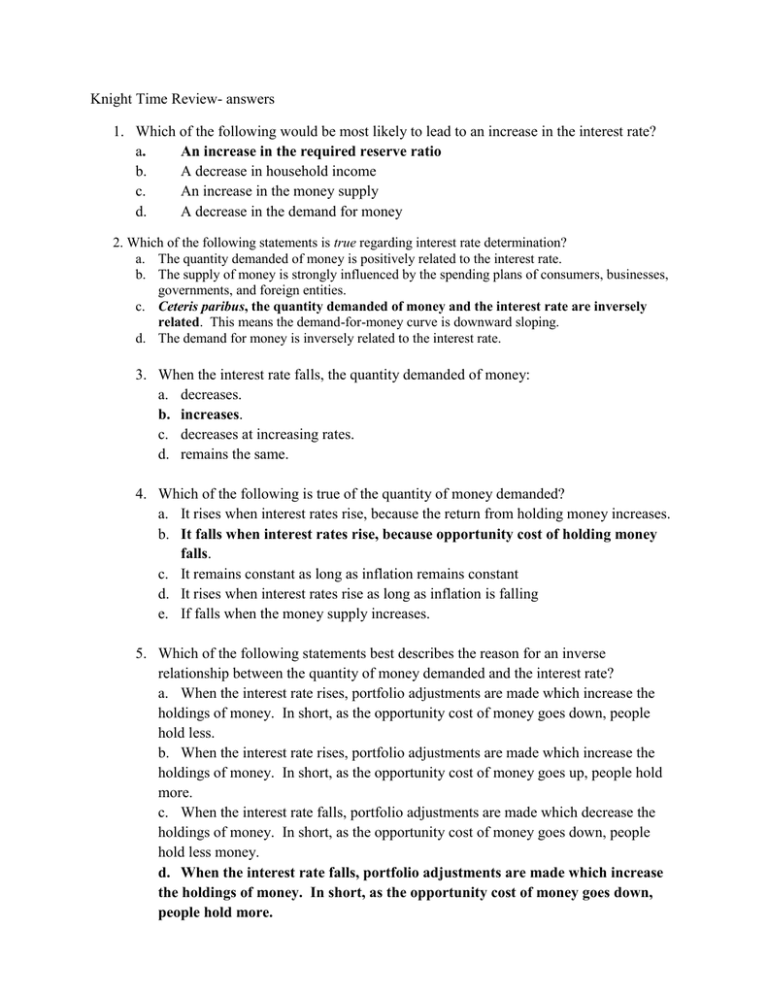

Knight Time Review- answers 1. Which of the following would be most likely to lead to an increase in the interest rate? a. An increase in the required reserve ratio b. A decrease in household income c. An increase in the money supply d. A decrease in the demand for money 2. Which of the following statements is true regarding interest rate determination? a. The quantity demanded of money is positively related to the interest rate. b. The supply of money is strongly influenced by the spending plans of consumers, businesses, governments, and foreign entities. c. Ceteris paribus, the quantity demanded of money and the interest rate are inversely related. This means the demand-for-money curve is downward sloping. d. The demand for money is inversely related to the interest rate. 3. When the interest rate falls, the quantity demanded of money: a. decreases. b. increases. c. decreases at increasing rates. d. remains the same. 4. Which of the following is true of the quantity of money demanded? a. It rises when interest rates rise, because the return from holding money increases. b. It falls when interest rates rise, because opportunity cost of holding money falls. c. It remains constant as long as inflation remains constant d. It rises when interest rates rise as long as inflation is falling e. If falls when the money supply increases. 5. Which of the following statements best describes the reason for an inverse relationship between the quantity of money demanded and the interest rate? a. When the interest rate rises, portfolio adjustments are made which increase the holdings of money. In short, as the opportunity cost of money goes down, people hold less. b. When the interest rate rises, portfolio adjustments are made which increase the holdings of money. In short, as the opportunity cost of money goes up, people hold more. c. When the interest rate falls, portfolio adjustments are made which decrease the holdings of money. In short, as the opportunity cost of money goes down, people hold less money. d. When the interest rate falls, portfolio adjustments are made which increase the holdings of money. In short, as the opportunity cost of money goes down, people hold more. True or False: 6. The difference between the classical approach and the Keynesian approach to fiscal policy is Keynesians believe that it may be necessary that government increase aggregate demand so as to stimulate output and employment, if the economy is to achieve its potential output. True or False 7. The Classical economists believed in the self-correcting nature of the economic system. They believed that the major adjustment mechanisms were flexible wages, prices and interest rates. True or False 8. The FED sells $300 million US government securities to commercial banks. This action leads to _______ in FED assets and ____________ in FED liabilities: a. a $300 million increase; a $300 million increase b. a $300 million increase; a $300 million decrease c. no change in FED assets ; no change in FED liabilities d.a $300 million decrease; a $300 million decrease e. a $300 million decrease; a $300 million increase http://paws.wcu.edu/mulligan/www/mbch15quiz.html The Taylor Rule - Stanford economist John Taylor has proposed a rule for targeting the Federal funds rate. It assumes a target inflation rate of 2% and has three components: 1. If real GDP rises by 1 percent above potential, the Federal funds rate should be raised by one-half a percentage point. 2. If inflation rises by 1 percentage point above its target, the Federal funds rate should be raised by one-half a percentage point. 3. When real GDP is at its potential and inflation is at its target, the Federal funds rate should be at 4% (implying a real interest rate of 2%). 4. The rules work in reverse as well, if real GDP is below its potential and inflation is below the 2% target. 5. While the Fed has roughly followed the Taylor rule in recent years, it has also deviated under certain circumstances (e.g. the threat of deflation)