THIS MS Word file

advertisement

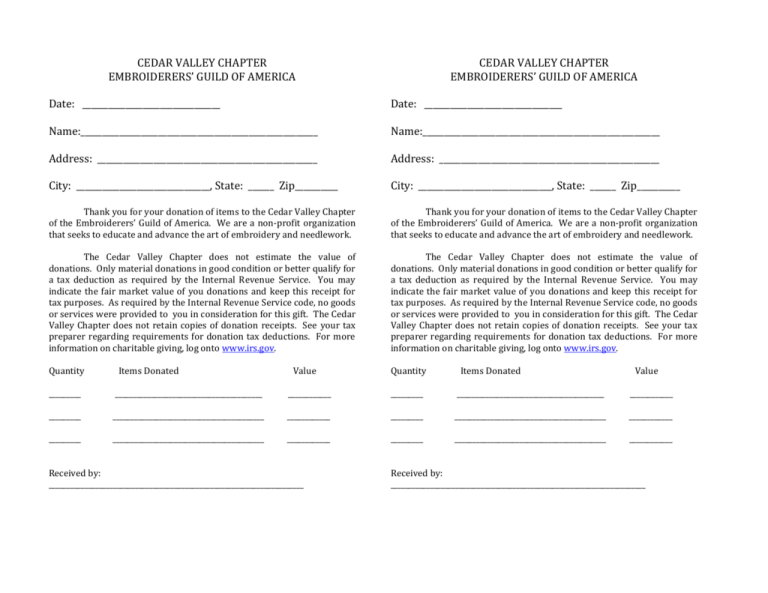

CEDAR VALLEY CHAPTER EMBROIDERERS’ GUILD OF AMERICA CEDAR VALLEY CHAPTER EMBROIDERERS’ GUILD OF AMERICA Date: ________________________________ Date: ________________________________ Name:_______________________________________________________ Name:_______________________________________________________ Address: ___________________________________________________ Address: ___________________________________________________ City: _______________________________, State: ______ Zip__________ City: _______________________________, State: ______ Zip__________ Thank you for your donation of items to the Cedar Valley Chapter of the Embroiderers’ Guild of America. We are a non-profit organization that seeks to educate and advance the art of embroidery and needlework. Thank you for your donation of items to the Cedar Valley Chapter of the Embroiderers’ Guild of America. We are a non-profit organization that seeks to educate and advance the art of embroidery and needlework. The Cedar Valley Chapter does not estimate the value of donations. Only material donations in good condition or better qualify for a tax deduction as required by the Internal Revenue Service. You may indicate the fair market value of you donations and keep this receipt for tax purposes. As required by the Internal Revenue Service code, no goods or services were provided to you in consideration for this gift. The Cedar Valley Chapter does not retain copies of donation receipts. See your tax preparer regarding requirements for donation tax deductions. For more information on charitable giving, log onto www.irs.gov. The Cedar Valley Chapter does not estimate the value of donations. Only material donations in good condition or better qualify for a tax deduction as required by the Internal Revenue Service. You may indicate the fair market value of you donations and keep this receipt for tax purposes. As required by the Internal Revenue Service code, no goods or services were provided to you in consideration for this gift. The Cedar Valley Chapter does not retain copies of donation receipts. See your tax preparer regarding requirements for donation tax deductions. For more information on charitable giving, log onto www.irs.gov. Quantity Quantity Items Donated Value Items Donated Value _________ _________________________________________ ____________ _________ _________________________________________ ____________ _________ __________________________________________ ____________ _________ __________________________________________ ____________ _________ __________________________________________ ____________ _________ __________________________________________ ____________ Received by: _______________________________________________________________________ Received by: _______________________________________________________________________