Reporting blended fuels - Clean Energy Regulator

advertisement

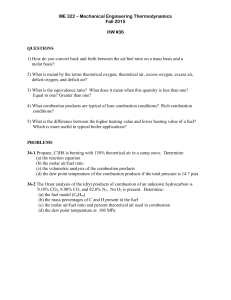

1 Contents Contents .................................................................................................................................................1 What is a blended fuel? .........................................................................................................................3 Reporting blended fuels.........................................................................................................................3 Blending fuels to produce a non-energy commodity ............................................................................4 Reporting consumption of blends which are non-energy commodities ...............................................4 Blending fuels to produce a new energy commodity ............................................................................6 Reporting consumption of blends which are energy commodities ......................................................7 How do I estimate the composition of purchased blended fuels? ........................................................8 Other fuel mixes.....................................................................................................................................8 How do I report bitumen? .....................................................................................................................8 Further information ...............................................................................................................................9 GPO Box 621 Canberra ACT 2601 1300 553 542 enquiries@cleanenergyregulator.gov.au www.cleanenergyregulator.gov.au 2 This document outlines what is required to be reported by corporations that consume and produce blended fuels and other fuel mixes. What is a blended fuel? Under section 1.8 of the National Greenhouse and Energy Reporting (Measurement) Determination 2008 (NGER Measurement Determination)) a blended fuel is a fuel that is a blend of fossil and biogenic carbon fuels. For example, E10 is a blend of gasoline (fossil fuel) and up to 10 per cent ethanol (biogenic carbon fuel). The NGER Measurement Determination defines ‘biogenic carbon fuel’ as energy that is: a) derived from plant and animal material, such as wood from forests, residues from agriculture and forestry processes and industrial, human or animal wastes, and b) not embedded in the earth, like coal oil or natural gas. Examples of biogenic carbon fuels under the NGER legislation are listed in items 10–16 and 28–30 of Schedule 1 of the National Greenhouse and Energy Reporting Regulations 2008 (NGER Regulations). The NGER legislation does not define fossil fuels. However, taking the ordinary meaning of the term, a fossil fuel is a carbon-based fuel from fossil hydrocarbon deposits, including coal, oil and natural gas. Reporting blended fuels Reportable energy commodities under the NGER legislation Energy includes ‘fuel, or any other energy commodity, of a kind specified in the regulations’ (s 7 of the National Greenhouse and Energy Reporting Act 2007 (NGER Act). Fuels and energy commodities are set out at Schedule 1 of the NGER Regulations. Listed items are considered energy commodities for NGER purposes; while commodities not referred to in Schedule 1 are considered non-energy commodities for NGER purposes. Section 19 of the NGER Act requires a controlling corporation to provide a report to the Clean Energy Regulator relating to the energy production, energy consumption and greenhouse gas emissions from the operation of facilities under the operational control of members of the corporation’s group during the previous financial year. This includes reporting in relation to blended fuels. GPO Box 621 Canberra ACT 2601 1300 553 542 enquiries@cleanenergyregulator.gov.au www.cleanenergyregulator.gov.au 3 The reporting requirements for blended fuels will depend on the: ingredients (fuels / energy commodities) in the blend product created by the blending, and end use of the blended fuel. There are two distinct scenarios corporations should consider when determining how to report production of blended fuels under the NGER legislation: 1. blending fuels to produce a non-energy commodity, and 2. blending fuels to produce a new energy commodity. Corporations should note that this document describes the reporting requirements for the lifecycle of blended fuels; this may take place across facility boundaries. Corporations will need to determine which reporting requirements are relevant to their specific circumstances. Blending fuels to produce a non-energy commodity If energy commodities are blended to form a non-energy commodity, corporations should report the: • production of the ingredient energy commodities, and • consumption of the ingredient energy commodities. Corporations should note that when the resulting product is not a listed energy commodity, the blending of the ingredient energy commodities does not need to be reported, as no new energy commodity is produced. That is, the product of the blending is not listed in Schedule 1 of the NGER Regulations. Reporting consumption of blends which are nonenergy commodities The end use of a blended fuel will determine whether a corporation, whose activities consume the resultant blended fuel, will need to report the ingredient energy commodities as consumed with or without combustion. GPO Box 621 Canberra ACT 2601 1300 553 542 enquiries@cleanenergyregulator.gov.au www.cleanenergyregulator.gov.au 4 Reporting consumption without combustion Regulation 4.22 details the reporting requirements for energy consumption reporting under the NGER Act. Energy consumption must be reported where energy is consumed: • by combustion (r 4.22(1)(a)) • by means other than combustion (r 4.22 (1)(b)), and • to produce a mineral, chemical or metal product (r 4.22(2) and (3)). A registered corporation’s report must include: The amount of energy consumed by means other than combustion if the amount: • exceeds the reporting thresholds mentioned in the Measurement Determination for this paragraph, and • is not reported under paragraph 4.22 (1)(a) or subregulation 4.22 (2) or (3). (r 4.22(1)(b) NGER Regulations) If any energy commodity listed in the NGER Measurement Determination or the NGER Regulations is consumed without combustion, then the thresholds and methodology in section 2.68 of the NGER Measurement Determination apply. It is important to note that section 2.68 is only applicable where no combustion of the fuel takes place. GPO Box 621 Canberra ACT 2601 1300 553 542 enquiries@cleanenergyregulator.gov.au www.cleanenergyregulator.gov.au 5 Box 1: Example—reporting blended fuels that are non-energy commodities E10 is a common blended fuel produced by blending up to 10 per cent ethanol with gasoline. A facility (Facility A) purchases 10,000 litres of E10 for use in a transport facility. Using the product specifications provided by the manufacturer, it is determined that the E10 is made up of 7 per cent ethanol and 93 per cent gasoline. Therefore, the E10 contains 700 litres of ethanol and 9300 litres of gasoline. The E10 is used to fuel fleet cars for Facility A, meaning that the fuel is combusted for use in an internal combustion engine. As both ethanol and gasoline are listed energy commodities, the corporation with operational control of Facility A must report the: • use of ethanol (item 51—ethanol for use in an internal combustion engine) as consumed with combustion, and • use of gasoline (item 53—gasoline (other than for use as fuel in an aircraft) as consumed with combustion. The production of the gasoline and ethanol is reported by the corporation (or corporations) that produced the fuels. Blending fuels to produce a new energy commodity If energy commodities are blended to produce a new energy commodity, then corporations should report the: • production of the ingredient energy commodities • blending of the ingredient energy commodities as consumption without combustion under s 2.68 of the NGER Measurement Determination • production of the new energy commodity, and • consumption (with or without combustion, depending on end use) of the new energy commodity. By reporting consumption without combustion, the end use of the ingredient energy commodities is captured. GPO Box 621 Canberra ACT 2601 1300 553 542 enquiries@cleanenergyregulator.gov.au www.cleanenergyregulator.gov.au 6 Reporting consumption of blends which are energy commodities Consumption of the new energy commodity created from the blending will also need to be reported. How this is reported will depend on the way in which consumption of the new energy commodity occurs. That is, if the new energy commodity is used for combustion purposes, then it will be reported as consumed with combustion. If the new product is used for non-combustion purposes, then it will be reported as consumed without combustion. Box 2: Example—reporting blended fuels that are energy commodities for consumption without combustion Facility 1 produces energy commodities A and B and blends them on-site to produce energy commodity C, which is then sold to Facility 2. The corporation with reporting obligations for Facility 1 must report the production of energy commodities A, B and C. In addition, the corporation must report consumption of A and B without combustion. Facility 2 uses energy commodity C without combustion. The corporation with reporting obligations for Facility 2 must report consumption of C without combustion. Box 3: Example—reporting blended fuels that are energy commodities for consumption with combustion Facility 3 produces energy commodities X and Y and blends them on-site to produce energy commodity Z, which is then sold to Facility 4. The corporation with reporting obligations for Facility 3 must report the production of energy commodities X, Y and Z. In addition, the corporation must report consumption of X and Y without combustion. Facility 4 uses energy commodity Z by combustion. The corporation with reporting obligations for Facility 4 must report consumption of energy commodity Z with combustion. GPO Box 621 Canberra ACT 2601 1300 553 542 enquiries@cleanenergyregulator.gov.au www.cleanenergyregulator.gov.au 7 How do I estimate the composition of purchased blended fuels? Part 2.6 of the NGER Measurement Determination sets out the ways in which corporations can determine the amounts of each kind of fuel that are in blended solid and liquid fuels. Corporations are able to adopt the outcome of: 1. sampling undertaken by the manufacturer, or 2. their own sampling. The NGER Measurement Determination sets out the standards that must be met in order to adopt each of these methods. Other fuel mixes Under the NGER Measurement Determination, blended fuels refer to fuels that are a blend of fossil and biogenic carbon fuels. However, corporations are still required to report the production and use of other fuel mixes, such as explosives and bitumen used in the manufacture of asphalt. In general, the production and consumption of all energy commodities listed in the NGER legislation must be reported. Where a corporation is unsure how to report a fuel mix, they should contact the Clean Energy Regulator. How do I report bitumen? Bitumen is a heavy petroleum derivative used in asphalt production and is used in the majority of road surfaces around Australia. All bitumen in Australia is consumed without combustion. An amendment to the NGER Regulations (item 49 Schedule 1) redefined bitumen to exclude reporting of bitumen that is consumed for non-combustion purposes. Corporations are still required to report bitumen production. This amendment for bitumen took effect from the 2011–12 reporting year onwards. GPO Box 621 Canberra ACT 2601 1300 553 542 enquiries@cleanenergyregulator.gov.au www.cleanenergyregulator.gov.au 8 Box 4: Example—reporting bitumen (after 2011-12 reporting year) Asphalt is a composite material commonly used in the manufacture of road surfaces. It is produced by mixing bitumen, heated aggregate and filler. A facility (Facility B) mixes 20 tonnes (t) of bitumen with heated aggregate and filler to produce asphalt. The asphalt is mixed at a batching plant prior to delivery to the site where it is to be laid. The batching plant is part of Facility B which is under the operational control of Corporation Y. As bitumen consumed without combustion is excluded from reporting, Corporation Y does not report the consumption without combustion of the 20 t of bitumen. As the aggregate, filler and asphalt are not listed energy commodities, their production and use is not reportable under the NGER legislation. The production of the bitumen must still be reported by the corporation with operational control of the facility that produced the bitumen. Further information Email: reporting@cleanenergyregulator.gov.au Phone: 1300 553 542 within Australia Web: www.cleanenergyregulator.gov.au This guideline should be read in conjunction with the National Greenhouse and Energy Reporting Act 2007, the National Greenhouse and Energy Reporting Regulations 2008 and the National Greenhouse and Energy Reporting (Measurement) Determination 2008 (current versions can be found on the Comlaw website). Changes to the legislation may affect the information in this guideline. This guideline is not intended to comprehensively deal with its subject area or to provide legal advice. If corporations have concerns about the application of legislation in their particular circumstances, they should seek professional advice. GPO Box 621 Canberra ACT 2601 1300 553 542 enquiries@cleanenergyregulator.gov.au www.cleanenergyregulator.gov.au 9