CHAPTER 18 ASSIGNMENT: Deconstructing Client Bias Questions

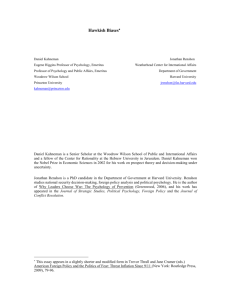

Daniel Kahneman and Mark Riepe (Kahneman, D., and M. Riepe, 1998, “Aspects

of investor psychology,” Journal of Portfolio Management 24, (Summer), 52-65)

argue that behavioral finance can make a substantial contribution to client

management:

To advise effectively, advisors must be guided by an accurate picture of the

cognitive and emotional weaknesses of investors that relate to making

investment decisions: their occasional faulty assessment of their own

interests and true wishes, the relevant facts that they tend to ignore, and

the limits of their ability to accept advice and to live with the decisions

that they make.

They go on to propose that a questionnaire be administered whose purpose is to

ascertain individual-specific “cognitive and emotional weaknesses.” One of the

questions was briefly discussed in the chapter. Based on how clients answer

these questions, a number of recommendations to improve the client

management process are made. In this exercise, students are presented with

several questions from their questionnaire and are asked to consider which

behavioral biases are being addressed. Some guidance on these four sample

questions follows.

PERSPECTIVE

1. The point of this question is to see if there is a pronounced tendency

towards hindsight bias, with a high probability leading the advisor to

suspect this bias. A discussion of the dangers of such a bias and the errors

that it leads to is appropriate. It exacerbates overconfidence. Moreover it

2|Page

“often turns reasonable gambles into foolish mistakes in the minds of

investors.” The appearance of inevitability may lead to the client being

unfairly blamed.

2. This question gets at non-linear weighting of probabilities, with a

tendency to say that these probability changes do not have equal impact

suggesting non-linear preferences. In particular, most people will that the

first and last have most impact. Since it has been suggested that nonlinear weighting of probabilities may be emotion-driven, this is a potential

problem to keep in mind.

3. This question gets at reference point preferences and integration vs.

segregation. Let’s assume integration. Since A is in the domain of gains,

because of concavity a $10 loss will not hurt much. This is the house

money effect. Little losses after big gains do not risk hitting the lossaversion drop-off. On the other hand, B is in the domain of losses and

because of convexity, a further loss will hurt relatively more. Reference

point preferences may be a driver of the disposition effect. Because of the

power of the disposition effect it may be helpful to discuss the conditions

under which a sale would be made. A process of this type can mitigate

bias.

4. This question gets at how difficult it is for someone to get past a narrow

frame – in other words, to take a long view. The ratio of the average loss

to the average gain is 97%/63% when the horizon is one month/five

years. Did the client realize that there was such a large difference? A key

job of the advisor is to persuade clients that they should take the long

view. As Kahneman and Riepe say, “many clients like to talk long-term

and act short-term.” Again, process is key. It would be wise to agree on a

set of procedures to follow as events (especially market declines) unfold.

©2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or

duplicated, or posted to a publicly available website, in whole or in part.

3|Page

STUDENT EXERCISE: QUESTIONS

BEHAVIORAL BIASES of CLIENTS

DESIGNED

to

EXPLORE

the

Suppose you are a financial planner. In a questionnaire you ask among others

the following questions.

1. Recall the latest action of the Fed about which there was speculation in the

press.

On the day before the event, what was your estimate of the

probability that the Fed would act as it did?

2. You are facing a chance for a gain of $20,000. You do not know the exact

probability. Consider the following three pairs of probabilities:

a. The probability is either 0% or 1%.

b. The probability is either 41% or 42%.

c. The probability is either 99% or 100%.

Are the three differences, a, b and c, equally significant to a decisionmaker? Could you order them by their impact on preferences?

3. Investor A owns a block of a stock, which he originally bought at $100 per

share. Investor B owns a block of the same stock for which she paid $200

per share. The value of the stock was $160 per share yesterday, and today

it dropped to $150 per share. Who is more upset?

4. In what percentage of months during the last 71 years did stocks make

money? What was the ratio of the average loss to the average gain? Also

answer the same questions for the percentage of consecutive five-year

periods (starting at the beginning of a month)?

DISCUSSION QUESTIONS

For each question, what bias or suboptimal tendency is being

investigated? What recommendations might be appropriate?

©2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or

duplicated, or posted to a publicly available website, in whole or in part.