JOHNS HOPKINS UNIVERSITY

CENTER FOR LEADERSHIP EDUCATION

THE WILLIAM P. CAREY PROGRAM IN ENTREPRENEURSHIP AND MANAGEMENT

ADVANCED CORPORATE FINANCE, 660.401.01, SPRING 2010

T, 6:15 – 9:00 PM

DAY/TIME/LOCATION

OF CLASS:

INSTRUCTOR:

Tuesday Evenings, 6:15 – 9:00 PM, Location TBD

Jack Powell

Center For Leadership Education

Rm. 104, Whitehead Hall, x7197

E-mail: WebCT or jpowell1@vt.edu

Office Hours: 4:30-6:00 PM, T in Whitehead Rm. 102

COURSE DESCRIPTION:

The advanced course in corporate finance is designed to provide the upper level business student

with a background in the more complex applications of financial management practice. A primary

objective of the course is to complete the student’s preparation for financial sector employment

and/or graduate business education. A secondary objective of the course is to introduce the

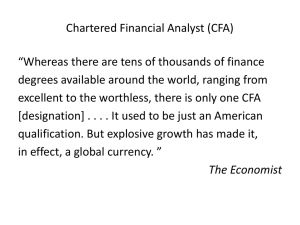

student to selected topics covered on the Chartered Financial Analyst (CFA©) Level I

examination. Students will be exposed to advanced financial management concepts through a

pedagogy combining classroom instruction, problem solution, business case analysis and work on

a group project with coverage of the topics of fixed income analysis, capital markets, portfolio

theory, cost of capital, capital formation, capital structure, corporate dividend policy, real

property valuation, working capital analysis, commercial leasing strategies, international finance

and derivatives analysis. In addition to the topics above, students will receive a refresher in

CFA©Level I quantitative methods, financial reporting and equity analysis.

REQUIRED TEXT:

Ross, Westerfield & Jordan, Fundamentals of Corporate Finance, 8th Edition, 2008, McGraw-Hill

Irwin, New York, NY, ISBN-13: 978-0-07-334188-0

COURSE PREREQUISITES:

It is assumed that all 660.401 students have taken 660.302 (Corporate Finance) or an appropriate

alternative. Students are expected to be proficient in financial accounting and all time value of

money applications. It is also assumed that students have a basic understanding of business

mathematics, statistics, and economics.

USE OF BUSINESS CALCULATORS:

THIS IS A CALCULATOR COURSE! The course involves the use of certain mathematical

formulas and functions which are pre-programmed into such business calculators as the HP 10B,

12C, and 17B and the TI BA 35, BA II Plus, etc. Use of these calculators for solving homework

and test problems is expected in the interest of time and on the basis that such calculators are used

extensively in almost every financial job setting.

COURSE OBJECTIVES:

This course presents opportunities for the student to apply financial management concepts in

developing strategies to address a variety of problem scenarios. Upon completion of this course,

the student should be fully capable of using the tools covered in the course to understand and

evaluate a broad sample of complex financial management problems and strategies. Specifically,

a student who successfully completes this course should be capable of:

1. Analyzing fixed income duration, convexity and embedded options.

2. Calculating financial asset returns and other basic quantitative and statistical

techniques of financial analysis.

3. Performing mean/variance optimization and portfolio risk analysis.

4. Calculating firm cost of capital considering investment risk.

5. Conduct advanced analysis of reported investments, inventories, long-lived assets,

income taxes, leases, EPS and Statement of Cash Flows.

6. Conduct basic company analysis and stock valuation and price an Initial Public

Offering (IPO) of common stock.

7. Evaluating the impact of capital structure on capital cost and firm value.

8. Evaluating the components of a corporate dividend policy.

9. Valuing income producing real estate assets.

10. Accomplishing a complete working capital analysis.

11. Evaluating basic foreign currency exposures.

12. Valuing options, and other derivative instruments.

13. Evaluating a lease versus buy decision.

The course accomplishes the above objectives using a combination of classroom demonstration,

problem analysis and extensive group business case analysis.

CLASS TOPICS AND HOMEWORK ASSIGNMENTS:

1/26

Hour 1: Course Introduction

Hour 2: CFA©Level I Fixed Income Analytics

2/2

Hour 1: Capital Markets, Ch. 12

Hour 2: CFA©Level I Quantitative Techniques Part 1

Hour 3: CFA©Fixed Income Analytics Problem Solution/Discussion and Quiz 1

2/9

Hours 1&2: Portfolio Theory and Risk Analysis, Ch. 13 and CFA©Level I Portfolio

Management

Hour 3: CFA©Quantitative Techniques Problem Solution/Discussion and Quiz 2

2/16

Hours 1&2: Cost of Capital, Ch. 15 and CFA©Level I Cost of Capital

Hour 3: CFA©Portfolio Management Problem Solution/Discussion and Quiz 3

2/23

Hour 1: Raising Capital, Ch. 16. HW: Problems 9-15

Hour 2: CFA©Level I Financial Reporting and Analysis Part 1

Hour 3: CFA©Cost of Capital Problem Solution/Discussion and Quiz 4

2

CLASS TOPICS AND HOMEWORK ASSIGNMENTS (Cont’d):

3/2

Hour 1: Capital Structure, Ch. 17. HW: Problems 16-22, Stephenson Case

Hour 2: CFA©Level I Financial Reporting and Analysis Part 2

Hour 3: Ch. 16 HW and CFA©Financial Reporting Part 1Problem Solution/Discussion

and Quiz 5

3/9

MID-TERM EXAM

3/16

SPRING BREAK

3/23

Hour 1: Dividend Policy, Ch. 18. HW: Problems 14-18

Hour 2: CFA©Level I Quantitative Techniques Part 2

Hour 3: Ch. 17 HW and CFA©Financial Reporting Part 2Problem Solution/Discussion

3/30

Hour 1: Real Estate Valuation. HW: Real Estate Valuation Problems and Case (Handout)

Hour 2: CFA©Level I Equity Review Part 1

Hour 3: Ch. 18 HW and CFA©Quantitative Techniques Part 2 Problem

Solution/Discussion and Quiz 6

4/6

Hour 1: Advanced Working Capital Management, Chs. 19-21. HW: Basic Problems and

Cases

Hour 2: CFA©Level I Working Capital Management

Hour 3: Real Estate Problems and Case, CFA©Equity Review Part 1Problem

Solution/Discussion and Quiz 7

4/13

Hour 1: International Corporate Finance, Ch. 22. HW: Basic Problems and S&S Air Case

Hour 2: CFA©Level I Equity Review Part 2

Hour 3: Chs. 19-21 HW and CFA©Working Capital Management Problem

Solution/Discussion and Quiz 8

4/20

Hour 1: Option Valuation, Chs. 14 & 24. HW: Basic Problems Only

Hour 2: CFA©Level I Derivatives and Alternative Investments Part 1

Hour 3: Ch. 22 HW and CFA©Equity Review Part 2Problem Solution/Discussion and

Quiz 9

4/27

Hour 1: Lease Financing, Ch. 26. HW: Basic Problems

Hour 2: CFA©Level I Derivatives and Alternative Investments Part 2

Hour 3: Chs. 14 & 24 HW and CFA©Derivatives and Alternative Investments Problem

Solution/Discussion and Quiz 10

5/11

FINAL EXAM

3

CLASS POLICIES:

(1)

(2)

(3)

(4)

(5)

(6)

Class attendance and preparation. Class attendance is vital to the successful

completion of this course. With the exception of the first class meeting, students are

expected to come to class having read the chapter material referenced.

Homework and Quizzes. Homework will not be collected, however, students will be

given quizzes on most of the homework assigned. Homework solutions will be

posted on WebCT after the subject material has been covered in class. The format of

the quizzes will be short answer, multiple choice and problem solution. Make-up

quizzes will be administered at the full discretion of the instructor. Please note that

make-up quizzes will not be administered as the result of travel plans, job interviews,

or lack of preparedness.

Examinations. There will be one mid-term examination and a final examination given

during the course. On-line review sessions will be provided for each exam (WebCT).

Calculators are permissible for use during all exams and quizzes. Make-up exams

will be administered at the full discretion of the instructor. Please note that make-up

exams will not be administered as the result of travel plans, job interviews, or lack of

preparedness.

Group Project. Groups will be formed and a group project will be assigned during the

first few weeks of the course.

Senior option. Senior option will not be offered in this course.

WebCT. This course has a WebCT site. The site will be used as a communication

and course administration tool. All e-mail communication with the instructor should

go through WebCT. Students are encouraged to bring laptops to class, as most lecture

material will be presented electronically using WebCT.

EVALUATION:

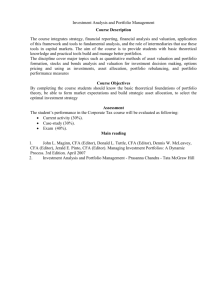

Each course participant will be evaluated as follows:

Quizzes – 20%

Mid-Term Exam –25%

Project – 20%

Final Exam – 35%

EVALUATION (Cont’d):

Letter grades awarded shall correspond to the following scale:

Letter Grade

Percentage Points

A+

97-100

A

93-96

A90-92

B+

87-89

B

83-86

B80-82

C+

77-79

C

73-76

C70-72

D

60-69

F

Below 60

4

ETHICS:

The strength of the university depends on academic and personal integrity. In this course, you

must be honest and truthful. Ethical violations include cheating on exams, plagiarism, reuse of

assignments, improper use of Internet and electronic devices, unauthorized collaboration,

alteration of graded assignments, forgery and falsification, lying, facilitating academic dishonesty,

and unfair competition.

In addition, the specific ethics guidelines for this course are:

(1) If you are taking a make-up quiz or exam, discussing the quiz or exam material with

anyone who has already taken the quiz or exam prior to taking the make-up is cheating.

(2) Discussing a quiz or exam with anyone who is scheduled to take a make-up is also

cheating.

Report any violations you witness to the instructor. You may consult the associate dean of student

affairs and/or the chairman of the Ethics Board beforehand. See the guide on “Academic Ethics

for Undergraduates” and the Ethics Board website (http://ethics.jhu.edu) for more information.

© 2009 CFA Institute. All Rights Reserved

5