Family Law Outline_Ross

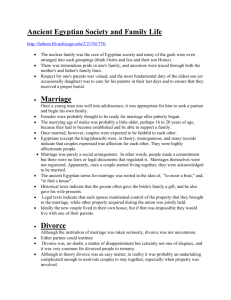

advertisement