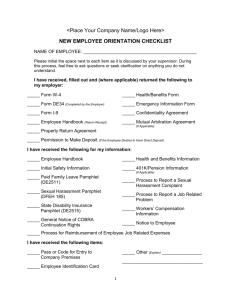

Employee Handbook

advertisement