ECO424 Homework Assignment-Key Chapters 10

advertisement

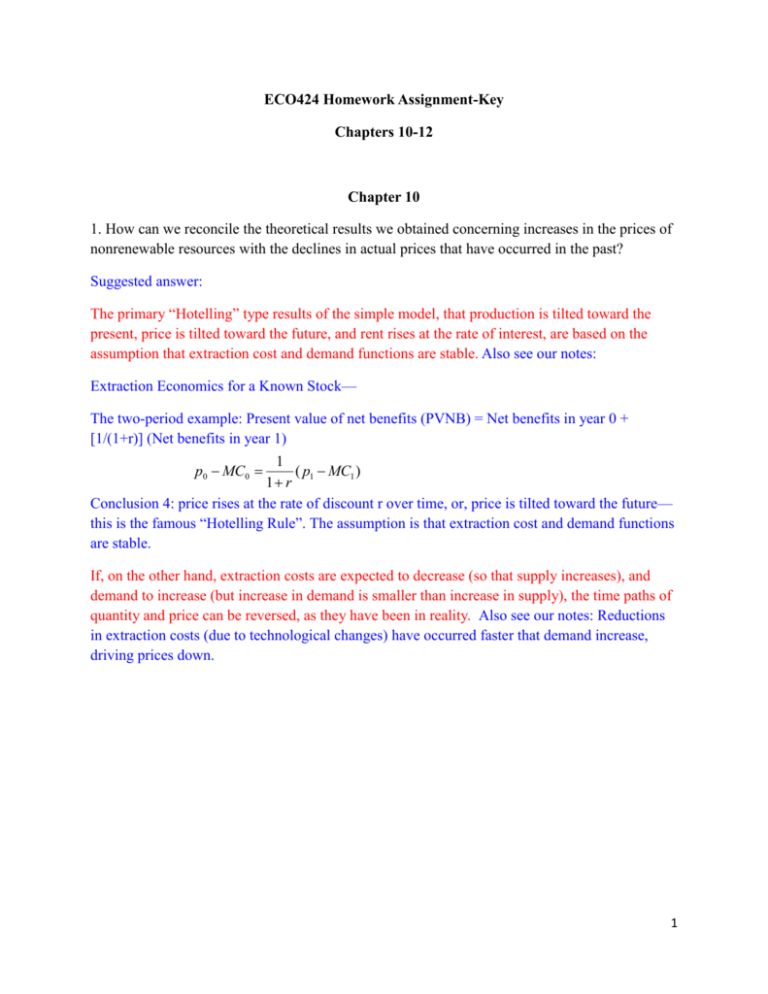

ECO424 Homework Assignment-Key Chapters 10-12 Chapter 10 1. How can we reconcile the theoretical results we obtained concerning increases in the prices of nonrenewable resources with the declines in actual prices that have occurred in the past? Suggested answer: The primary “Hotelling” type results of the simple model, that production is tilted toward the present, price is tilted toward the future, and rent rises at the rate of interest, are based on the assumption that extraction cost and demand functions are stable. Also see our notes: Extraction Economics for a Known Stock— The two-period example: Present value of net benefits (PVNB) = Net benefits in year 0 + [1/(1+r)] (Net benefits in year 1) 1 ( p1 MC1 ) 1 r Conclusion 4: price rises at the rate of discount r over time, or, price is tilted toward the future— this is the famous “Hotelling Rule”. The assumption is that extraction cost and demand functions are stable. p0 MC0 If, on the other hand, extraction costs are expected to decrease (so that supply increases), and demand to increase (but increase in demand is smaller than increase in supply), the time paths of quantity and price can be reversed, as they have been in reality. Also see our notes: Reductions in extraction costs (due to technological changes) have occurred faster that demand increase, driving prices down. 1 2. Consider a three-period model of nonrenewable resource extraction. Lay out the maximization problem in a way analogous to the two-period model of our lecture notes, and determine the explicit expression for user cost. (optional; 10 extra points!) Suggested answer: The three-period model: Present value of net benefits (PVNB) = Net benefits in year 0 + [1/(1+r)] (Net benefits in year 1) + [1/(1+r)2] (Net benefits in year 2) PVNB = B0 – C0 + [1/(1+r)](B1 – C1) + [1/(1+r)2](B2 – C2) Solving for intertemporal efficiency means to find a serial of extraction levels (q0*, q1*, and q2*) in different years which can maximize PVNB; PVNB is a function of q0, q1, and q2. So, d ( PVNB) ( PVNB) ( PVNB) ( PVNB) dq0 dq1 dq2 0 q0 q1 q2 2 d ( PVNB) [ B0 C0 1 1 ( B1 C1 ) ( B2 C2 )] 1 r (1 r ) 2 dq0 q0 [ B0 C0 1 1 ( B1 C1 ) ( B2 C2 )] 1 r (1 r ) 2 dq1 q1 [ B0 C0 1 1 ( B1 C1 ) ( B2 C2 )] 1 r (1 r ) 2 dq2 0 q2 ( p0 MC0 )dq0 1 1 ( p1 MC1 )dq1 ( p2 MC 2 )dq2 0 1 r (1 r ) 2 q0 + q1 + q2 = q, and q is a given number. Thus, q1 = q – q0 – q2, and dq1 = d(q – q0 – q2); q2 = q – q0 – q1, and dq2 = d(q – q0– q1) ( p0 MC0 )dq0 ( p0 MC 0 ) 1 1 ( p1 MC1 )d (q q0 q2 ) ( p2 MC 2 )d (q q0 q1 ) 0 1 r (1 r ) 2 dq0 d ( q q0 q 2 ) d (q q0 q1 ) 1 1 ( p1 MC1 ) ( p2 MC 2 ) 0 2 dq0 1 r dq0 (1 r ) dq0 p0 MC0 1 1 ( p1 MC1 )( 1) ( p2 MC 2 )( 1) 0 1 r (1 r ) 2 p0 MC0 User cost = 1 1 ( p1 MC1 ) ( p2 MC 2 ) 1 r (1 r ) 2 1 1 ( p1 MC1 ) ( p2 MC2 ) 1 r (1 r ) 2 Chapter 11 1. The most dominant source of global energy is fossil fuels which include coal, petroleum, and natural gas. In the U.S., in 2005, fossil fuel made up 86% of total energy consumption. For petroleum, percentage of consumption that was imported rose from 25% in 1970 to 71% in 2005 due to the boom in automobile transportation. 2. With energy subsidies, the market prices of energy are too low as compared to prices that would be socially efficient; energy consumption is too high. Please draw a graph first and then explain. 3 Suggested answer: With energy subsidies, the supply of energy curve shifts to the right. Compared with socially efficient price and quantity, market price is too low and market quantity is too high. 3. What are the arguments of people who support replacing conventional gasoline with ethanol? Suggested answer: Although ethanol involves burning carbon-based plant materials, the carbon is contemporary carbon in the sense that is was recently absorbed from the atmosphere as the plants grew. Replacing conventional gasoline with ethanol is seen by its advocates as a way of moving to lower greenhouse gases as well as toward greater energy independence. 4. What is energy intensity? If energy consumption is 100.6 quads, GDP is $13 trillion, how much is energy intensity? Suggested answer: Energy intensity … (100.6 *1015 Btus) / ($13 * 1012) = (100.6 * 103) / 13 = 100600 / 13 = 7,738.26 Btus per dollar 4 Chapter 12 1. Using Table 12-1 (page 222) to explain maximum sustainable yield. Suggested answer: Table 12-1 tells us that, if we cut at 60 years when the average yield is the highest, it would yield the largest volume of any cycle (over 600 years, this would yield 16,600 cubic feet, as against a 100-year cycle which would yield 12,540 cubic feet). The highest average volume, 27.7 cu ft/year, is the maximum sustainable yield (MSY) for the forest. In addition, if we refer to Dr. David’s notes on pages 3-4, we also know that: slope of a ray = average volume; slope of a tangent = annual increase or marginal growth. Through the origin, draw a ray that is tangent to the growth function. It has the maximum average volume (27.7 cu ft/yr) which equals marginal growth (30 cu ft/yr), in year 60. (MSY) Thus, in order to harvest the MSY, we should cut the stand of trees when marginal growth equals average growth of the stand. Where this condition is met, the average growth is tangent to the growth function. In Biology, MSY is known as Maximizing the Mean Annual Increment. 2. How should we identify the optimal rotation interval t*? (Please use the formula and graph to explain.) Suggested answer: To find the optimal rotation interval, we need to maximize the present value of net benefits of the forest with respect to the time period of harvest. We select any two consecutive years. V0: the monetary value of the wood that would result if the forest were harvested this year V1: the monetary value of the wood that would be produced if the harvest is delayed one year C: harvest costs, the monetary costs of felling the trees and getting them to market S: the present value of the vacant site after the trees have been harvested Net proceeds in year 0 = V0 – C + S Net proceeds in year 1 = V1 – C + S = V0 + ΔV – C + S where ΔV is the value of 1-year growth When the forest is young and ΔV is relatively large, we should wait to harvest until next year since (V0 + ΔV – C + S)/(1+r) > (V0 – C + S) As the forest gets older and ΔV is small, it is time to harvest the trees! At this time, (V0 + ΔV – C + S)/(1+r) = (V0 – C + S) 5 V0 + ΔV – C + S = (V0 – C + S) (1+r) V0 + ΔV – C + S = V0 – C + S + (V0 – C + S)r ΔV = (V0 – C + S)r ΔV = (V0 – C)r + Sr MB of waiting (value of new growth) = MC of waiting (lost interest on total revenue or net benefits) Figure 12-3, page 225: the optimal rotation is identified by the intersection of two functions, labeled as t* on the horizontal axis. (I did not draw the graph; please refer to page 225!) 3. If the timber is harvested and converted into building materials, the carbon stays sequestered until the materials decay. Suppose that these building materials did not decay at all. If there were a market for carbon sequestration services, the market values of timber would reflect its value as building materials and its value for carbon sequestration. How will this situation (increasing the market price of timber by including the timber’s value for carbon sequestration) affect the optimal rotation interval t*? Suggested answer: This higher timber price will increase ΔV, V0, and S and shift the ΔV function and the (V0 – C + S)r function outward. The optimal rotation interval could increase, decrease, or remain unchanged. (I did not draw three situations. Refer to our extra notes in class—three graphs!) 6