EWU – ECON 477 - Natural Resource Economics

advertisement

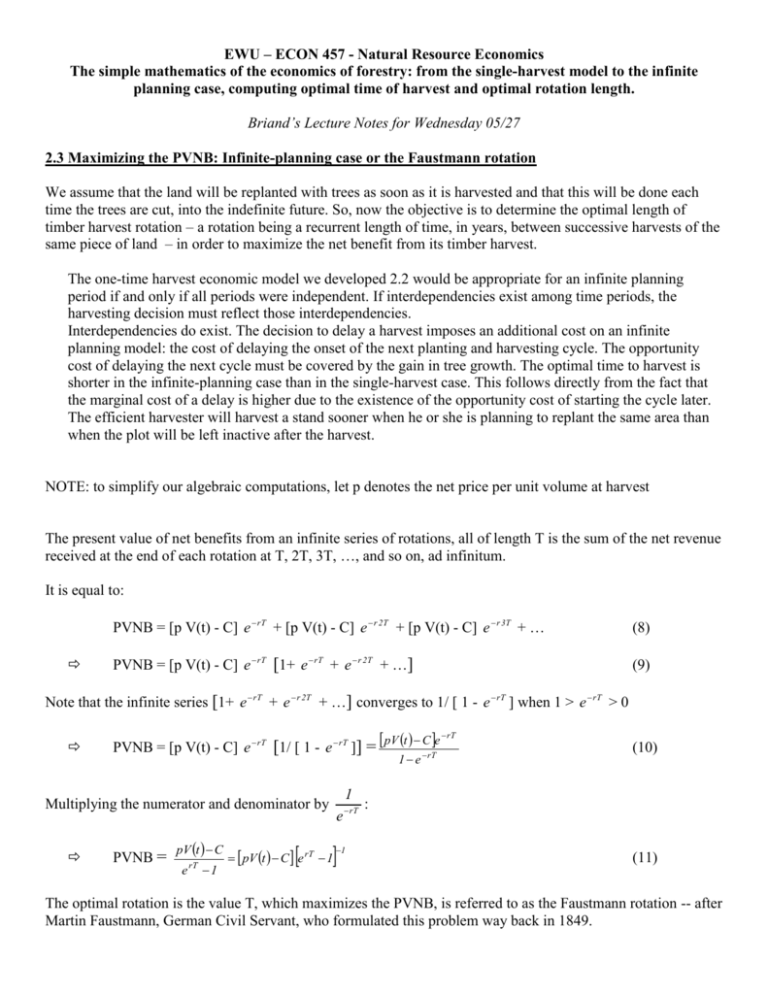

EWU – ECON 457 - Natural Resource Economics The simple mathematics of the economics of forestry: from the single-harvest model to the infinite planning case, computing optimal time of harvest and optimal rotation length. Briand’s Lecture Notes for Wednesday 05/27 2.3 Maximizing the PVNB: Infinite-planning case or the Faustmann rotation We assume that the land will be replanted with trees as soon as it is harvested and that this will be done each time the trees are cut, into the indefinite future. So, now the objective is to determine the optimal length of timber harvest rotation – a rotation being a recurrent length of time, in years, between successive harvests of the same piece of land – in order to maximize the net benefit from its timber harvest. The one-time harvest economic model we developed 2.2 would be appropriate for an infinite planning period if and only if all periods were independent. If interdependencies exist among time periods, the harvesting decision must reflect those interdependencies. Interdependencies do exist. The decision to delay a harvest imposes an additional cost on an infinite planning model: the cost of delaying the onset of the next planting and harvesting cycle. The opportunity cost of delaying the next cycle must be covered by the gain in tree growth. The optimal time to harvest is shorter in the infinite-planning case than in the single-harvest case. This follows directly from the fact that the marginal cost of a delay is higher due to the existence of the opportunity cost of starting the cycle later. The efficient harvester will harvest a stand sooner when he or she is planning to replant the same area than when the plot will be left inactive after the harvest. NOTE: to simplify our algebraic computations, let p denotes the net price per unit volume at harvest The present value of net benefits from an infinite series of rotations, all of length T is the sum of the net revenue received at the end of each rotation at T, 2T, 3T, …, and so on, ad infinitum. It is equal to: PVNB = [p V(t) - C] e rT + [p V(t) - C] e r 2T + [p V(t) - C] e r 3T + … (8) PVNB = [p V(t) - C] e rT [1+ e rT + e r 2T + …] (9) Note that the infinite series [1+ e rT + e r 2T + …] converges to 1/ [ 1 - e rT ] when 1 > e rT > 0 PVNB = [p V(t) - C] e rT [1/ [ 1 - e rT ]] = 1 Multiplying the numerator and denominator by PVNB = pV t C e rT 1 e pV t C e rT 1 rT 1 pV t C e rT 1 e rT (10) : (11) The optimal rotation is the value T, which maximizes the PVNB, is referred to as the Faustmann rotation -- after Martin Faustmann, German Civil Servant, who formulated this problem way back in 1849. The optimal rotation must satisfy PVNB 0. T Setting the first derivative of the objective function, when evaluated at a candidate extremum equal to zero: We make use of the exponential rule, the product rule and the power chain rule of differentiation: d[ef(x)]/dx=f '(x).ef(x) d[f(x).fg(x)]/dx=f(x).g'(x) + f '(x).g(x) df(x)n/dx=n f(x)n-1 f '(x) pV T C 1e rT 1 e r pV T e rT 1 pV T C 1e rT 1 e r pV T 2 rT => => 1 0 1 rT r pV T C e rT e rT 1 (12) (13) pV T (14) => rpV T e rT rCe rT pV T e rT pV T (15) => rpV T rC pV T pV T e rT (16) => pV T r pV T C pV T e rT (17) Using equation (14), the second factor on the right hand side of equation (17) can be rewritten as: pV T e rT r pV T C e rT e rT 1 e rT r pV T C e rT 1 (18) And using equation (11): pV T e rT rPVNB (19) Finally, using equation (19) to rewrite equation (17): => pV T r pV T C rPVNB (20) The left hand side of equation (20) represents the value of one year incremental growth, i.e. the benefits of waiting one more year for harvest. The right hand side of equation (20) represents the incremental return from delaying the cutting of the current stand one more year, i.e. the costs of waiting one more year for harvest. The first term on the right hand side of equation (20) represents the forgone interest payment on the net benefits if the current stand were not cut at instant T. The second term on the right hand side of equation (20) is the cost of incrementally delaying all future stands, or alternatively, if the land were sold, the forgone interest payment on the value of the sale.