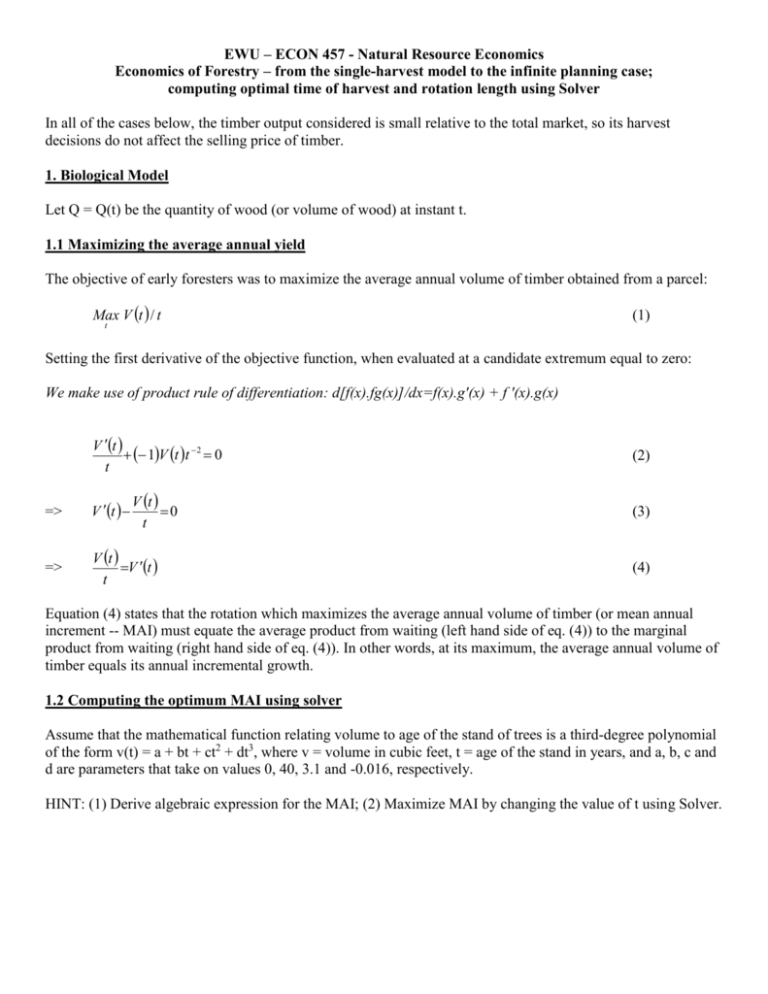

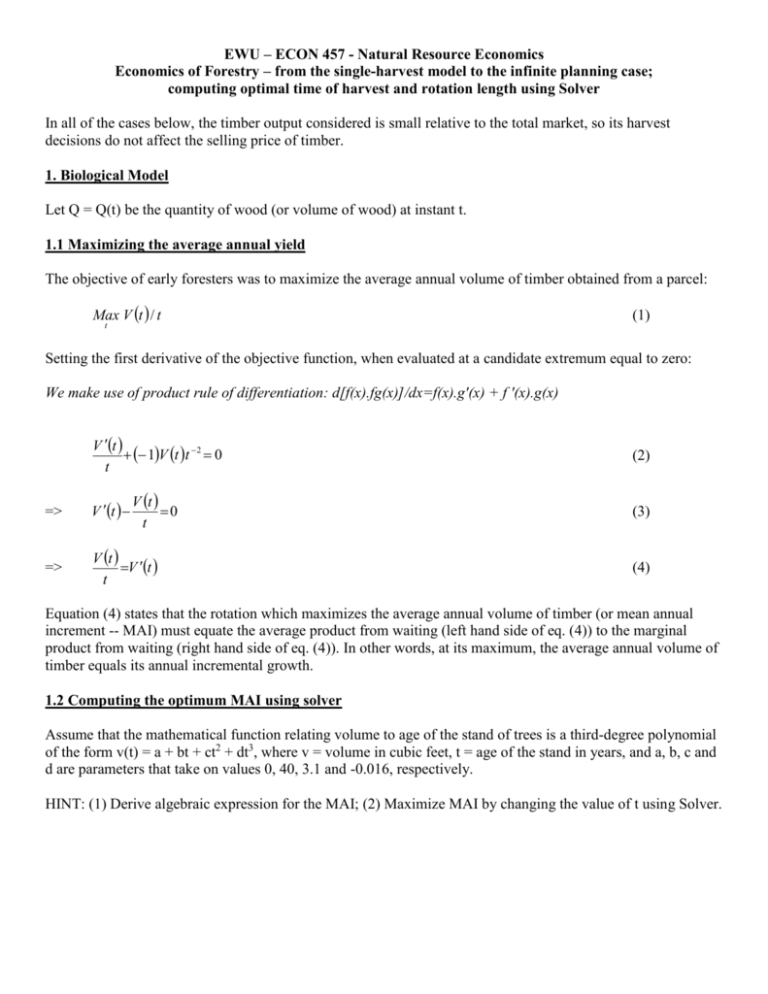

EWU – ECON 457 - Natural Resource Economics

Economics of Forestry – from the single-harvest model to the infinite planning case;

computing optimal time of harvest and rotation length using Solver

In all of the cases below, the timber output considered is small relative to the total market, so its harvest

decisions do not affect the selling price of timber.

1. Biological Model

Let Q = Q(t) be the quantity of wood (or volume of wood) at instant t.

1.1 Maximizing the average annual yield

The objective of early foresters was to maximize the average annual volume of timber obtained from a parcel:

Max V t / t

t

(1)

Setting the first derivative of the objective function, when evaluated at a candidate extremum equal to zero:

We make use of product rule of differentiation: d[f(x).fg(x)]/dx=f(x).g'(x) + f '(x).g(x)

V t

1V t t 2 0

t

(2)

V t

0

t

(3)

=>

V t

=>

V t

V t

t

(4)

Equation (4) states that the rotation which maximizes the average annual volume of timber (or mean annual

increment -- MAI) must equate the average product from waiting (left hand side of eq. (4)) to the marginal

product from waiting (right hand side of eq. (4)). In other words, at its maximum, the average annual volume of

timber equals its annual incremental growth.

1.2 Computing the optimum MAI using solver

Assume that the mathematical function relating volume to age of the stand of trees is a third-degree polynomial

of the form v(t) = a + bt + ct2 + dt3, where v = volume in cubic feet, t = age of the stand in years, and a, b, c and

d are parameters that take on values 0, 40, 3.1 and -0.016, respectively.

HINT: (1) Derive algebraic expression for the MAI; (2) Maximize MAI by changing the value of t using Solver.

2. The Bio-Economic Model

NOTE: If $X is put in the bank at interest rate r, after being compounded continuously over a period t, it is

worth $ X e rt ; i.e. with time a continuous variable, e rt is the appropriate discount factor for calculating the

present value of a financial outcome at instant t.

2.1 Maximizing the PVNB: Single-harvest model

The age that maximizes the present value of the harvested timber can be found by: (1) defining the present

value of the harvested timber as a function of the age of the stand, and (2) maximizing the function with respect

to age.

Suppose C is the cost of replanting the parcel, and p denotes the net price per unit volume at harvest.

PVNB = [p V(t)] e rt - C

(5)

Taking the derivate of the PVNB function with respect to age and setting it equal to zero yields1:

We make use of the exponential rule and the product rule of differentiation specified below.

d[ef(x)]/dx=f '(x).ef(x)

d[f(x).fg(x)]/dx=f(x).g'(x) + f '(x).g(x)

[p V(t)] (-r ) e-rt + [p V'(t)] e-rt = 0

=>

p V'(t) = r p V(t)

(6)

=>

V'(t) / V(t) = r

(7)

Equation (6) has an important economic interpretation. The LHS is the marginal value of allowing the stand to

grow an increment (dt > 0) longer; the RHS is the marginal cost of allowing the stand to grow an increment

longer – it represents the forgone interest payment on not cutting the standing now. Thus the optimal single

rotation will balance the marginal value of waiting with the marginal cost of waiting. Cutting a stand at an

earlier age would produce less wood but it would be available sooner. Thus there is a trade-off, and the solution

depends as much on the value that society places on time as it does on the value that society place on wood.

The interpretation of the equivalent equation (7) is that the optimal single rotation equates the percentage rate of

increase in volume to the rate of discount; i.e. the rate of return from letting the stand grow over the last

increment of age should be equal to the market rate of return.

2.2 Computing the optimal time to harvest using Solver: Single-harvest model

The value of the timber is directly proportional to its volume; a unit price of $1 per cubic feet is assumed. This

stand costs $1,000 to plant, and $0.30 per cubic foot of wood to harvest. Note that planting costs are borne

immediately, whereas harvesting costs are borne at the time of harvest. Assume a discount rate r = 0.01.

HINT: (1) Derive algebraic expression for the PVNB; (2) Maximize PVNB by changing the value of t using

Solver.

1

If we had used a discrete time framework (i.e. (1+r) t were used for discounting instead of ert), then the optimal condition would be

the same except r would be replace by ln(1+r).

2.2 Maximizing the PVNB: Infinite-planning case or the Faustmann rotation

We assume that the land will be replanted with trees as soon as it is harvested and that this will be done each

time the trees are cut, into the indefinite future. So, now the objective is to determine the optimal length of

timber harvest rotation – a rotation being a recurrent length of time, in years, between successive harvests of the

same piece of land – in order to maximize the net benefit from its timber harvest.

The one-time harvest economic model we developed 2.1 would be appropriate for an infinite planning

period if and only if all periods were independent. If interdependencies exist among time periods, the

harvesting decision must reflect those interdependencies.

Interdependencies do exist. The decision to delay a harvest imposes an additional cost on an infinite

planning model: the cost of delaying the onset of the next planting and harvesting cycle. The opportunity

cost of delaying the next cycle must be covered by the gain in tree growth. The optimal time to harvest is

shorter in the infinite-planning case than in the single-harvest case. This follows directly from the fact that

the marginal cost of a delay is higher due to the existence of the opportunity cost of starting the cycle later.

The efficient harvester will harvest a stand sooner when he or she is planning to replant the same area than

when the plot will be left inactive after the harvest.

The present value of net benefits from an infinite series of rotations, all of length T is the sum of the net revenue

received at the end of each rotation at T, 2T, 3T, …, and so on, ad infinitum.

It is equal to:

PVNB = [p V(t) - C] e rT + [p V(t) - C] e r 2T + [p V(t) - C] e r 3T + …

(8)

PVNB = [p V(t) - C] e rT [1+ e rT + e r 2T + …]

(9)

Note that the infinite series [1+ e rT + e r 2T + …] converges to 1/ [ 1 - e rT ] when 1 > e rT >0

PVNB = [p V(t) - C] e rT [1/ [ 1 - e rT ]] =

1

Multiplying the numerator and denominator by

PVNB =

pV t C

e

rT

1

e

pV t C e rT 1

rT

1

pV t C e rT

1 e rT

(10)

:

(11)

The optimal rotation is the value T, which maximizes the PVNB, is referred to as the Faustmann rotation -- after

Martin Faustmann, German Civil Servant, who formulated this problem way back in 1849.

The optimal rotation must satisfy

PVNB

0.

T

Setting the first derivative of the objective function, when evaluated at a candidate extremum equal to zero:

We make use of the exponential rule, the product rule and the power chain rule of differentiation:

d[ef(x)]/dx=f '(x).ef(x)

d[f(x).fg(x)]/dx=f(x).g'(x) + f '(x).g(x)

df(x)n/dx=n f(x)n-1 f '(x)

pV T C 1e rT 1

e r pV T e rT 1

pV T C 1e rT 1

e r pV T

2 rT

=>

=>

1

0

1 rT

r pV T C e rT

e

rT

1

(12)

(13)

pV T

(14)

=>

rpV T e rT rCe rT pV T e rT pV T

(15)

=>

rpV T rC pV T pV T e rT

(16)

=>

pV T r pV T C pV T e rT

(17)

Using equation (14), the second factor on the right hand side of equation (17) can be rewritten as:

pV T e rT

r pV T C e rT

e

rT

1

e rT

r pV T C

e

rT

1

(18)

And using equation (11):

pV T e rT rPVNB

(19)

Finally, using equation (19) to rewrite equation (17):

=>

pV T r pV T C rPVNB

(20)

The left hand side of equation (20) represents the value of one year incremental growth, i.e. the benefits of

waiting one more year for harvest. The right hand side of equation (20) represents the incremental return from

delaying the cutting of the current stand one more year, i.e. the costs of waiting one more year for harvest. The

first term on the right hand side of equation (20) represents the forgone interest payment on the net benefits if

the current stand were not cut at instant T. The second term on the right hand side of equation (20) is the cost of

incrementally delaying all future stands, or alternatively, if the land were sold, the forgone interest payment on

the value of the sale.

Sources:

Jon M. Conrad, Resource Economics, Cambridge University Press, 1999.

Barry C. Field, Natural Resource Economics: An Introduction, Irwin McGraw-Hill, 2001.

Tom Tietenberg, Environmental Economics and Policy, 4th Ed., Pearson Addison Wesley, 2004.

Tom Tietenberg, Environmental and Natural Resource Economics, 6th Ed., Addison Wesley, 2002.