Risk Management Policy

advertisement

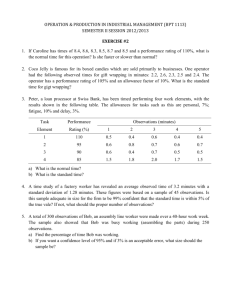

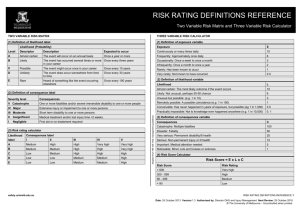

[Company Logo] Risk Management Policy [Date] [Author] [Company Name] [AFSL] Contents 1. Introduction ........................................................................................................................ 3 1.1. Commitment to Risk Management ................................................................................ 4 2. Scope .................................................................................................................................. 4 3. Risk Management & Planning ........................................................................................... 4 4. 5. 3.1. Risk Tolerance .............................................................................................................. 5 3.2. Risk Categories ............................................................................................................. 5 The Risk Planning Process ............................................................................................... 6 4.1. Risk Identification .......................................................................................................... 7 4.2. Risk Rating .................................................................................................................... 8 4.3. Treatment Options ........................................................................................................ 8 4.4. Ongoing Monitoring and Review ................................................................................... 9 4.5. Risk Reporting............................................................................................................... 9 Maintain Risk Register ....................................................................................................... 9 APPENDIX 1 – Regulatory Guide 104: Licensing: Meeting the general obligations ................ 10 APPENDIX 2 – Key Definitions .............................................................................................. 11 APPENDIX 3 – Risk Process ................................................................................................. 12 APPENDIX 3 – Risk Process (Continued) .............................................................................. 13 APPENDIX 4 – Risk Table ..................................................................................................... 14 APPENDIX 5 - Risk Register .................................................................................................. 15 Risk Management Policy | June 2014 Page | 2 1. Introduction Risk management aims to manage uncertainty and includes actions taken to identify, assess, monitor and reduce the impact of risks to the business. The purpose of this Policy is to provide “xxxxxx” with a clear and consistent understanding of the legislative requirements and business requirements applicable to Risk Management. An Australian Financial Services (AFS Licensee) is subject to the conduct obligations of Chapter 7 of the Corporations Act 2001 (Cth) (Corporations Act) , and as such, is obliged to have adequate risk management systems (see s912A(1)(h)). Regulatory Guide 104, states that an AFS Licensee’s risk management systems should: (a) be based on a structured and systematic process that takes into account the licensee’s obligations under the Corporations Act; (b) identify and evaluate risks faced by the Licensee’s business, focusing on risks that adversely affect consumers or market integrity and including risks of non-compliance with financial services laws; (c) establish and maintain controls designed to manage or mitigate those risks; and (d) fully implement and monitor those controls to ensure they are effective. An effective risk management system will depend on the nature, scale and complexity of the business and the firms risk profile. This risk management Policy encompasses the following key objectives: To identify its’ business environment, stakeholders and legal and business obligations; To identify risks to the business, its’ clients or broader market; To analyse those risks; To design and implement controls to manage these risks; To test the controls; and To monitor risk issues on an ongoing basis and if necessary mitigate and change risks. Risk Management Policy | June 2014 Page | 3 1.1. Commitment to Risk Management The Board and management of “xxxxxxx” are committed to the implementation and maintenance of a formal risk management system, including the integration of risk management throughout the organisation which is integral to achieving ”xxxxxx” strategic and operational objectives. Specific benefits of effective risk management include: Improved planning, performance and effectiveness Improved information for decision making Improved stakeholder relationships Economy and efficiency Enhanced reputation Director protection 2. Scope This policy applies to the Board and to all staff at “xxxxxx”. 3. Risk Management & Planning As a general principle, the risk management process should be undertaken in conjunction with strategic planning, however risk management overall is a dynamic process and all parties covered by this Policy are expected to manage risk and/or identify new risks on a day- to- day basis. Risk Management Policy | June 2014 Page | 4 3.1. Risk Tolerance Risk tolerance is the amount of risk, on a broad level, that “xxxxxxx" is willing to accept in pursuit of value, and should reflect the Company’s: risk management philosophy; capacity to take on risk; objectives, business plans and respective stakeholder demands; evolving industry and market conditions; and tolerance for failures with quantitative values, where applicable. 3.2. Risk Categories Based on their nature and source “xxxxxx” risks are broadly categorised as follows: Regulatory and Compliance Risks – relates to the risks of failure to comply with the applicable statutory or compliance regime or licence obligations, which includes: Impact of regulatory changes on the Company; Legislative obligations under, for example, the Corporations Act, ASX Listing Rules, AML/ CTF, Privacy Act, Income Tax Assessment Act, ASIC Act, Competition and Consumer Act 2010(Cth), Tax Agent Services Act 2009; and AFS Licence conditions. People – risks associated with key person reliance, human behaviour, or risks relating to the harm of people or assets, including: Key person risk or single point sensitivity risk; Risk of physical or mental harm to staff; Human behaviour – errors, fraud, costs, turnover; Monitoring, supervision and training; and Authorised representatives. Reputation Risk - risks relating to the Company’s reputation and standing which could affect the business, stakeholders and staff, including: Media scrutiny and headline reputation risk, Regulator interest; and Business relationships. Risk Management Policy | June 2014 Page | 5 Business Process and Systems - risks relating to the business process and systems including: Internal governance; Processing errors, delays or failure to meet standards; and Knowledge risks within the business such as IT systems, intellectual property. Financial Risks - risks of negative financial impact to the Company through inappropriate management of areas such as: Revenue; Compliance with relevant regulatory guides and any AFS licence conditions; Adequate financial records; Professional & public liability; Compensation arrangements; Occupational health and safety implications; and Property damage and security. These categories of risk must be reviewed at least annually to ensure that all relevant risks have been considered and if necessary mitigation steps to be adjusted where necessary. 4. The Risk Planning Process “XXXXXX” uses a risk management process that consists of the following key stages: Risk identification: Identifying all reasonably foreseeable risks associated with its activities. Risk rating: Quantifying those risks. Risk controls: Assessing the risk, identifying options to treat risks and developing mitigation plans. Risk monitoring and reporting: Reporting risk management activities and risk specific information to the Board as required. Risk Management Policy | June 2014 Page | 6 RISK MANAGEMENT PROCESS 4.1. Risk Identification A key mechanism for the identification of the Company’s risks is the development and maintenance of the Risk Register. The Risk Register identifies the key risks that may potentially prevent the Company from achieving its objectives. The register outlines the inherent risk rating, the controls currently in place to manage those risks and the residual risk rating. Risks are added to the Risk Register on a periodic basis throughout the year, when necessary. Risk Management Policy | June 2014 Page | 7 4.2. Risk Rating Once risks have been identified, risks will be assessed and rated in terms of the potential consequence of the risk and the likelihood of the risk occurring (see risk table in the Appendix). This assessment should include consideration of the controls in place to mitigate those risks. A risk may be classified into more than one category, for example it could have People, Financial and Reputational implications. The category with the highest risk rating is chosen for the risk (see Appendix 1 for process). Risks are assessed at three different levels, namely, inherent risk rating, residual risk rating and the current risk rating. Inherent Risk Rating: This is the level of risk to the business when there are no controls in place, which can also be understood as the level of risk if all the controls were to fail. It shows the level of risk (which is a combination of the likelihood and consequence) that exists if nothing was done about the risk. Current Risk Rating: This the level of risk given the current controls in place. This risk rating shows the current level of risk in the business. To determine the current risk rating the effectiveness of current controls in reducing the likelihood and/or consequence of a risk must be assessed. If the current risk rating is assessed as being unacceptable, options to reduce the risk rating need to be explored. These options are referred to as ‘treatment options’. Treatment options must be developed for all risks with a current rating of Very High and High, unless the Board determines that no treatment is required. Residual Risk Rating: This is the level of risk after accepted treatment options are implemented. This involves assessing the effectiveness of proposed control or treatment options to reduce the likelihood and/or consequence of a risk. Unless all of the treatment options have been implemented, the current risk rating will sit somewhere between the inherent risk rating and the residual risk rating. 4.3. Treatment Options Options for treating each risk with a current risk rating assessed to be unacceptably high will be identified (which includes all risks with a current risk rating of High or Very High. The options will be evaluated and those found to be most efficient and effective will be flagged for implementation. Only those treatment options required to achieve an acceptable level of risk in the most efficient and effective manner need to be implemented. Risk treatment plans will be prepared and implemented. The following options may be used for treating risks and will be determined in the light of risk appetite, risk and treatment option assessment: Avoid the risk; Mitigate the risk; Transfer the risk; and Accept the risk. Risk Management Policy | June 2014 Page | 8 4.4. Ongoing Monitoring and Review Ongoing review is essential to ensure that our Risk Management Framework remains relevant the risk controls. Priority should be given to monitoring the risks with the highest inherent risk ratings. 4.5. Risk Reporting The Risk Officer must report risks with High and Very High current risk ratings quarterly to the Board. Updates will also be provided on current treatment plans / control effectiveness for specific risks as requested from time-to-time. On a quarterly basis reports are obtained from the risk data base which reports, including but not limited to, the following information: Risks current in relation to the issues above The impact level of those risks outlined Risks where the inherent or current risk has increased over the quarter All new risks identified in the quarter with risk rating, and treatment plan if required Furthermore, formal reviews of the identified risks should be conducted at least annually. This process will involve internal consultation and reassessing the appropriateness of the evaluation of the risk and the treatments/controls established. 5. Maintain Risk Register Regularly update the Register and undertake a full review of the Register annually. See Appendix 5 for details. Risk Management Policy | June 2014 Page | 9 APPENDIX 1 – Regulatory Guide 104: Licensing: Meeting the general obligations Risk Management Policy | June 2014 Page | 10 APPENDIX 2 – Key Definitions Term Definition Risk The effect of uncertainty on objectives. It is measured in terms of consequence and likelihood. (Ref: AS/NZS ISO 31000:2009 ) Risk assessment The overall process of risk identification, risk analysis and risk evaluation. See Appendix 4 for details. Residual risk The level of risk that remains after assessing the effectiveness of the controls, management strategies and other mechanisms currently in place to mitigate a particular risk. Risk management Co-ordinated activities to direct and control an organisation with regard to risk. (Ref: AS/NZS ISO 31000:2009) Risk tolerance The level of risk deemed (usually by the governing body) acceptable to the organisation, where no further treatment is required to reduce either the likelihood of an occurrence or its consequence, or both. Risk treatment The process of selection and implementation of measures to modify risk. (For example, key risk treatment measures may include: avoiding, modifying, sharing or retaining risks). Risk Capacity Risk capacity is the amount of money the Company could afford to lose without putting the achievement of (financial) goals at risk. It represents an absolute, downside constraint on strategy selection. The Company should not embark on a course of action where the worst case scenario involves the possibility, no matter how remote, of a loss greater than its risk capacity. Risk Management Policy | June 2014 Page | 11 APPENDIX 3 – Risk Process Where a risk may fall within more than 1 category (e.g. People, Financial or Reputational) please use the following steps to determine the appropriate category: Step 1 Identify the risk: e.g. using Non-Approved Products Step 2 What are the categories of consequences? 1. Financial consequence – there could be a risk in a professional indemnity policy that there is no cover in place for client losses relating to the use of non-approved products. Likelihood: Consequence: Risk Rating: 2. Reputational consequence – where a non-approved product collapses and an adviser is associated with recommending the product, both the Adviser and Licensee can suffer significant reputational damage. Likelihood: Consequence: Risk rating will be: 3. Possible Severe HIGH Possible Severe HIGH Regulatory and Compliance consequence – Increased risk of failure to provide appropriate advice, as the product would not have had due diligence and may not have met the research requirements. There could also be licencing implications from the regulator. Likelihood: Consequence: Risk rating will be: Possible Moderate MEDIUM Step 3 What is the risk rating for this risk? There are two high risks (financial & reputational) and 1 medium risk rating (regulatory and compliance). The highest risk rating is nominated as the risk rating associated with the risk, making this a High risk rating. The risk categorisation nominated is the one which is associated with the highest risk and as the most appropriate. In this example we would identify this as a “Financial risk”. Risk Category Financial Risk Rating High Risk Management Policy | June 2014 Page | 12 APPENDIX 3 – Risk Process (Continued) Identify Risk Reference: RISK-1 The Risk: Failure to adequately monitor and supervise advisers Date Risk Identified: 01-Jan-12 Reported By: R isk M an ag er R eview D ate: 01-Jan-13 Company: Category: Regulation and Compliance Department: R isk T yp e: Assess Inadequate resources including: - auditors not adequately performing their duties - higher risk advisers monopolizing auditor time - resignation of auditors - failure to complete scheduled audits - inadequate tool or process Risk Source / Casual Factor: IMPACT: The risk of inadequately monitoring and supervision of Advisers, may lead to: - Advisers acting without authority or outside authority or outside of AFSL - failure of business protocols - brand damage - fraud - increase in complaints / claims - poor client outcomes - corporations Act breaches - regulatory action - dedicated adviser audit manager Existing Controls: - current adviser audit monitoring program - auditor panels - ongoing training of auditors - ongoing training of advisers for quality outcomes - audit tools Inherent Risk Rating Likelihood Rating: 5. Very Likely Consequence Rating: 5. Severe Inherent Risk Rating: 4. Very High Inherent Risk Score: 25 Control Risk Owner: Treatment Review Date: Approach: 7-Nov-13 Mitigate Estimated Cost to Treat: Treatment Option 1 1. Complete annual audit plan. Work in progress. Risk Rating after treatment: Accept or Reject: Accept Time for Implementation: Ongoing Action Plan 1. Implementation of Business Health (Online Compliance System) to assist in automating the audit process, assist with reporting and monitoring adviser audit results and also removing some of the subjectivity Proposed Actions: 2. Risk Trigger Reporting requested from IRESS (still waiting draft report) 3. CRM reporting on outstanding audits almost complete Advice Resource Requirements: Human Resources Business Health as a system Responsibilities: Management team Timing: Ongoing Reporting and Monitoring Requirements: Monthly Residual Risk Rating Likelihood Rating: 3. Possible Consequence Rating: 3. Moderate Residual Risk Rating: 2. Medium Residual Risk Score: 9 Current Risk Rating: 2. Medium Current Risk Score: 9 Current Risk Rating Current Likelihood Rating: 3. Possible Risk Management Policy | June 2014 Current Consequence Rating: 3. Moderate Page | 13 APPENDIX 4 – Risk Table Consequence Regulatory & Compliance People Reputation Business Process & Systems Financial Likelihood Probability: Serious breach of regulation or systemic noncompliance. Intervention by regulator highly likely. Serious effect on physical or mental well-being. Major or ongoing treatment required. Technical noncompliance. No reporting obligations and ongoing scrutiny or attention from regulator unlikely. Non-compliance or breaches requiring reporting to regulator. Minor remedial action. Physical or mental well-being affected. No treatment required. Physical or mental well-being affected. Minor treatment required. Non-headline Industry press headline exposure Major headline exposure (industry and non-industry) Minor errors in systems or processes requiring corrective action, or minor delay without impact on overall schedule. Policy procedural rule occasionally not met or services do not fully meet needs. One or more key requirements not met. Inconvenient but not client threatening. Strategies not consistent with corporate agenda. Trends show service is degraded. Critical system failure, bad policy advice or ongoing non-compliance. Business severely affected. <$XXXK Flat Dollar <$XXXXK Flat Dollar <$XXXXXK Flat Dollar <$XXXXXM Flat Dollar >$XXXXM Flat Dollar Negligible Minor Moderate Major Severe 1 2 3 4 5 exposure Major breach of regulation likely to lead to significant regulatory action (e.g. suspension from ASX or EU). Life threatening physical or mental injuries. Hospitalisation required. Repeated highprofile headline exposure. Regulator interest. Licence to operate threatened (e.g. show cause for AFSL, delisting from ASX). Physical or mental injury(ies) causing death. Intense public, political and media scrutiny. Once a year 5 Very Likely L 5 M 10 H 15 VH 20 VH 25 Once every 2 years 4 Likely L 4 M 8 H 12 H 16 VH 20 Once every 5 years 3 Possible L 3 M 6 M 9 H 12 H 15 Once every 10 years 2 Unlikely L 2 L 4 M 6 M 8 M 10 Unlikely to happen within 10 years 1 Rare L 1 L 2 L 3 L 4 M 5 Risk Management Policy | June 2014 Page | 14 APPENDIX 5 - Risk Register Inherent Risk Rating 4. Very High 4. Very High 4. Very High 4. Very High 4. Very High 4. Very High 4. Very High 3. High 3. High 3. High 3. High 3. High 3. High 3. High 3. High 3. High 3. High 1. Low Current Risk Rating Residual Risk Rating Risk Reference 3. High 2. Medium RISK-1 3. High 3. High RISK-2 3. High 2. Medium RISK-3 4. Very High 3. High RISK-4 3. High 2. Medium RISK-5 3. High 3. High RISK-6 4. Very High 3. High RISK-7 3. High 2. Medium RISK-8 3. High 3. High RISK-9 3. High 2. Medium RISK-10 3. High 2. Medium RISK-11 2. Medium 2. Medium RISK-12 2. Medium 2. Medium RISK-13 3. High 3. High RISK-14 3. High 1. Low RISK-15 2. Medium 1. Low RISK-16 2. Medium 2. Medium RISK-17 1. Low 1. Low RISK-18 Risk Management Policy | June 2014 The Risk Approach Date Risk Identified Risk OwnerRisk Manager Review Date Non-compliance with legislation (Corporations Act, Mitigate Taxation - Income,12/2/2011 GST, Payroll) xxxx 2/18/2014 Loss of key personnel Mitigate 12/2/2011 xxxx 5/6/2014 Lack of a Defensible Basis for Asset Allocation Mitigate 11/2/2012 xxxx 5/5/2014 Revenue model becomes impaired Mitigate 5/6/2014 xxxx 5/6/2014 Inadequate business growtth Mitigate 5/6/2014 xxxx 5/14/2014 Loss of clients Mitigate 12/6/2011 xxxx 5/14/2014 Unavailability of Debt Funding Mitigate 6/15/2012 xxxx 5/2/2014 Revenue model becomes impaired Mitigate 3/26/2012 xxxx 5/7/2014 Inadequate business growth Mitigate 7/1/2011 xxxx 5/6/2014 Loss of revenue from major client Mitigate 12/31/2006 xxxx 5/2/2014 Loss of revenue from major partner Mitigate 12/31/2008 xxxx 5/2/2014 Non-compliance with legislation Mitigate 5/2/2014 xxxx 7/31/2014 Non-compliance with Credit Licence conditions Mitigate 5/2/2014 xxxx 7/31/2014 Non-compliance with AFS Licence conditions Mitigate 5/2/2014 xxxx 5/6/2014 Failure of hardware & infrastructure Mitigate 5/6/2014 xxxx 5/6/2014 Lack of occupational health safety & welfare Mitigate 5/7/2014 xxxx 5/7/2014 Breach of confidentiality Mitigate 11/1/2012 xxxx 5/2/2014 Loss of key personnel Accept 5/11/2012 xxxx 5/2/2014 Page | 15