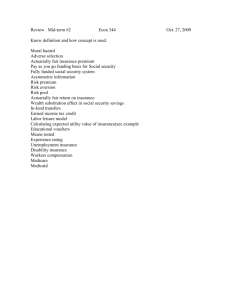

Midterm Exam

advertisement

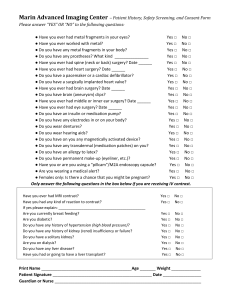

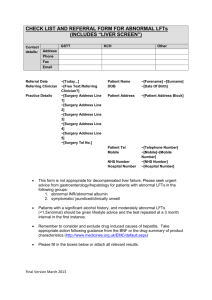

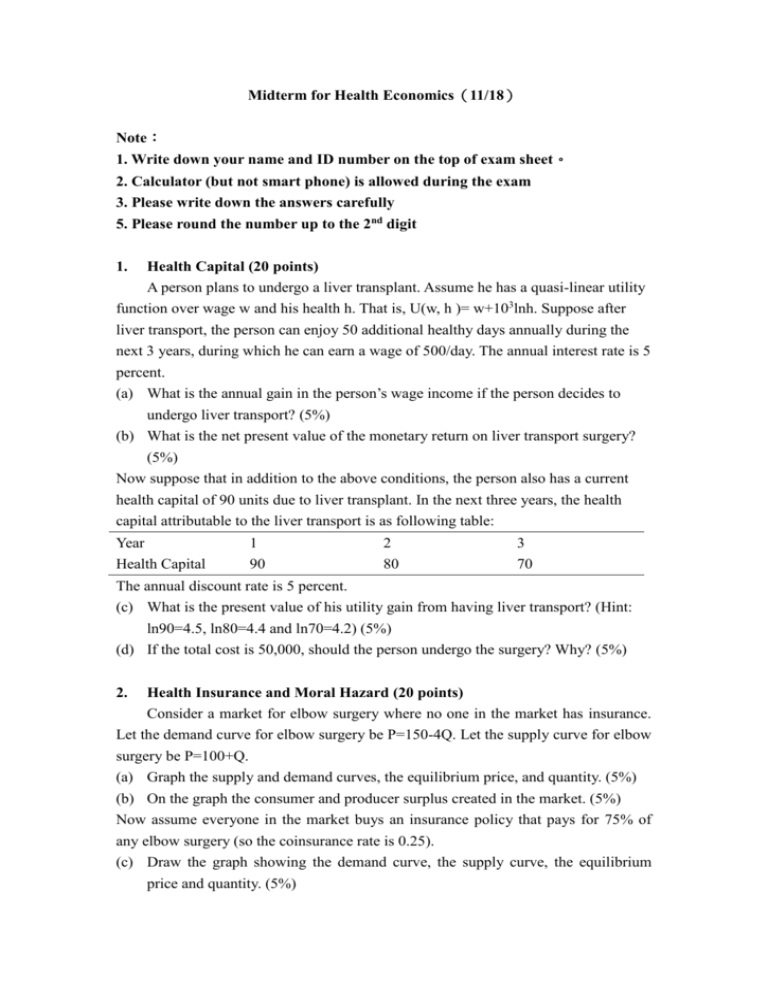

Midterm for Health Economics(11/18) Note: 1. Write down your name and ID number on the top of exam sheet。 2. Calculator (but not smart phone) is allowed during the exam 3. Please write down the answers carefully 5. Please round the number up to the 2nd digit 1. Health Capital (20 points) A person plans to undergo a liver transplant. Assume he has a quasi-linear utility function over wage w and his health h. That is, U(w, h )= w+103lnh. Suppose after liver transport, the person can enjoy 50 additional healthy days annually during the next 3 years, during which he can earn a wage of 500/day. The annual interest rate is 5 percent. (a) What is the annual gain in the person’s wage income if the person decides to undergo liver transport? (5%) (b) What is the net present value of the monetary return on liver transport surgery? (5%) Now suppose that in addition to the above conditions, the person also has a current health capital of 90 units due to liver transplant. In the next three years, the health capital attributable to the liver transport is as following table: Year Health Capital 1 90 2 80 3 70 The annual discount rate is 5 percent. (c) What is the present value of his utility gain from having liver transport? (Hint: ln90=4.5, ln80=4.4 and ln70=4.2) (5%) (d) If the total cost is 50,000, should the person undergo the surgery? Why? (5%) 2. Health Insurance and Moral Hazard (20 points) Consider a market for elbow surgery where no one in the market has insurance. Let the demand curve for elbow surgery be P=150-4Q. Let the supply curve for elbow surgery be P=100+Q. (a) Graph the supply and demand curves, the equilibrium price, and quantity. (5%) (b) On the graph the consumer and producer surplus created in the market. (5%) Now assume everyone in the market buys an insurance policy that pays for 75% of any elbow surgery (so the coinsurance rate is 0.25). (c) Draw the graph showing the demand curve, the supply curve, the equilibrium price and quantity. (5%) (d) On the graph please show the quantity increase and the deadweight loss due to moral hazard? (5%) 3. Health Insurance and Rand Experiment (25 points) The U. S. government funds an experimental study (Rand Experiment) of health care costs, utilization and outcomes, which assigned people randomly to different kinds of plans and followed their behavior, from 1974 to 1982. The following table shows the findings of health expenditures for people randomly assigned to different coinsurance group (95%, 25%, Free, and Individual Deductible). (a) How does the Rand Experiment solve the endogeneity problem of coinsurance rate? (5%) (b) Based on the numbers of total expenses in the table, please indicate the increase of total expenditure due to free health care. (5%) (c) Compare the numbers of inpatient and outpatient expenditure in the table, please indicate which component (inpatient or outpatient) has a larger demand response in face of free care. (5%) (d) Based on results in (c), which component (inpatient or outpatient) should enjoy a larger coinsurance rate? (5%) (e) Based on the numbers of outpatient expenditures, please explain why 25% co-insurance is large enough to reduce the extent of moral hazard. (5%) 4. Uncertainty and Risk Aversion (25 points) The following table displays uncertainties in John’s monthly income: State Probability Income Utility Stick Healthy 0.4 0.6 2500 6400 U(2500) U(6400) (a) What is John’s expected value of income? (5%) (b) Suppose John’s utility function is U=Y0.5, where Y is John’s monthly income. What is John’s expected value of utility of income? (5%) (c) Is John risk adverse or not? Explain your answer by a graph, with income on the horizontal axis and utility on the vertical axis. (Hint: 48400.5=69.57) (5%) (d) Calculate the maximum amount that John is willing to pay to avoid the risk of income loss resulting from becoming sick? (5%) 5. Adverse Selection(20%) Insurance company A is planning to offer health insurance to residents of Town B. Based on the real data, Company A obtained several findings: There are in total 200 families; half reside by the mountain and half by the sea. There is only one illness in this town. The probability for having the illness is 0.4% for families residing by the mountain, and 4% for those by the sea. The cure of illness is NT5000 per family. If not compulsory, the maximum acceptable premium for families by the mountain and by the sea is 200 and 100 respectively. Insurance company A would like to roll out a health insurance based on the finding above. (a) Suppose company A can learn the residence place of every family before selling the insurance. Assuming that the insurance policy is fair, what should be the premium Company A charges for families living by the sea and for those living by the mountain respectively? (5%) (b) Suppose Company A has no ways to identify the residence location. In that case, if company A continues to sell the policy like (a) (separate policies for mountain and for sea), what is the profit from selling this policy? (5%) (c) The government calls Company A’s separate policies which offers different premiums for families of different residence as discrimination. Therefore, Company A is asked to offer an insurance policy that consists of all residents with the same premium. Please calculate the fair premium for this insurance policy (pooling policy) (5%) (d) Suppose company A offers this insurance policy (pooling policy). If not compulsory, what is Company’s profit for offering this insurance policy? (5%)