Report on H

advertisement

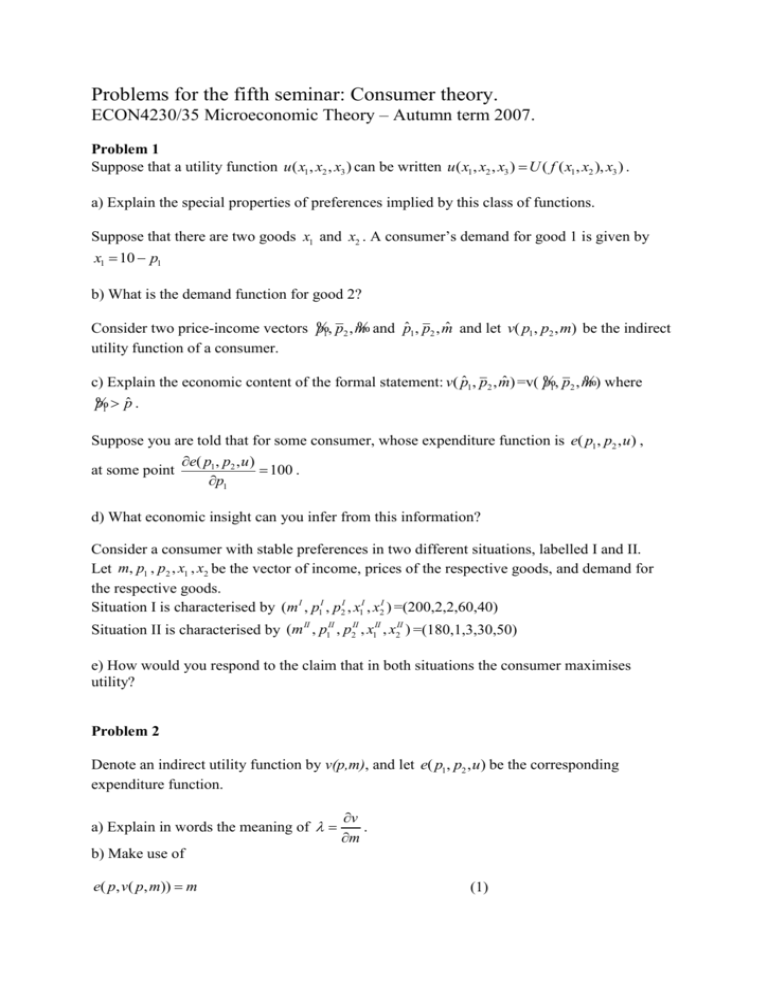

Problems for the fifth seminar: Consumer theory. ECON4230/35 Microeconomic Theory – Autumn term 2007. Problem 1 Suppose that a utility function u ( x1, x2 , x3 ) can be written u ( x1, x2 , x3 ) U ( f ( x1, x2 ), x3 ) . a) Explain the special properties of preferences implied by this class of functions. Suppose that there are two goods x1 and x2 . A consumer’s demand for good 1 is given by x1 10 p1 b) What is the demand function for good 2? % and pˆ1 , p2 , mˆ and let v( p1, p2 , m) be the indirect p1 , p2 , m Consider two price-income vectors % utility function of a consumer. %) where p1 , p2 , m c) Explain the economic content of the formal statement: v( pˆ1, p2 , mˆ ) =v( % % p1 pˆ . Suppose you are told that for some consumer, whose expenditure function is e( p1, p2 , u) , e( p1 , p2 , u ) 100 . at some point p1 d) What economic insight can you infer from this information? Consider a consumer with stable preferences in two different situations, labelled I and II. Let m, p1 , p2 , x1 , x2 be the vector of income, prices of the respective goods, and demand for the respective goods. Situation I is characterised by (m I , p1I , p2I , x1I , x2I ) =(200,2,2,60,40) Situation II is characterised by (m II , p1II , p2II , x1II , x2II ) =(180,1,3,30,50) e) How would you respond to the claim that in both situations the consumer maximises utility? Problem 2 Denote an indirect utility function by v(p,m), and let e( p1, p2 , u) be the corresponding expenditure function. a) Explain in words the meaning of v . m b) Make use of e( p, v( p, m)) m (1) to show that 1 ( p, v( p, m)) e v Denote by (2) the partial derivate of ( p, v) with respect to the i’th argument. pi c) What is the economic meaning of ? pi d) Make use of xi hi ( p, v( p, m)) (3) to show that xi hi v hi m v m v (4). e) Show that x i p i m (5) It follows that x / i pi m (6) or pi x pi i pi m (7) f) Explain the economic meaning of the right hand sides of (6) and (7). g) Try to give an economic interpretation of (6) and (7). Problem 3 Suppose a consumer considers buying a house which he intends to sell after one period. For simplicity we assume the interest rate is zero in the period and that the consumer derives no benefit from the house beyond its final market value. The agent considers two scenarios: the economy may be booming with probability p and the house price in the next period will be H , or with probability 1-p there will be a recession and a house price L < H . Assume that without a house the agent will have a wealth w after one period. Let B denote his willingness to pay for the house, and let u() denote his utility function. a) Assume a consumer is risk neutral and explain what he is willing to pay for the house. Assume in the following that a consumer is risk averse. b) Explain how we can determine how much he is willing to pay for the house. c) Compare the latter amount with the willingness to pay of the risk neutral consumer. d) What is the expected capital gain of the buyer when paying B? Assume decreasing absolute risk aversion in the following. e) Show the implication for u’’’() . f) Let W be stochastic wealth and make use of Jensen’s inequality to show that E(–u’(W))< – u’(EW)) and E(u’(W))> u’(EW)) Problem 4 Let u (c, l ) be the utility function of a consumer where the arguments are consumption and labour, respectively. Let p and w be the price and wage associated with these two arguments. Formulate and interpret the Slutsky equations for the wage effects on c and l .