DOCX: 223 KB

advertisement

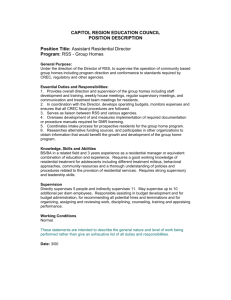

to the Federal Government on the Green Paper on Developing Northern Australia 8 August 2014 Introduction .................................................................................................................................3 About the Housing Industry Association .....................................................................................4 Housing price growth over the last decade ................................................................................5 Infrastructure: Removing the cost burden from households.....................................................6 Land: Improving supply for residential development ................................................................7 Land: Improving planning processes ........................................................................................7 Business, Trade and Investment: Reforming the taxation system ...........................................8 Business, Trade and Investment: Red Tape ............................................................................9 Business, Trade and Investment: Industrial relations ............................................................ 10 Education, Research and Innovation: Increasing industry capacity ...................................... 11 Conclusion ............................................................................................................................... 11 HIA contact: Greg Weller National Director Communications Housing Industry Association 79 Constitution Ave Campbell ACT 2600 Phone: 02 6245 1388 Email: g.weller@hia.com.au HIA is the leading industry association in the Australian residential building sector, supporting the businesses and interests of over 40,000 builders, trade contractors, manufacturers, suppliers, building professionals and business partners. HIA members include businesses of all sizes, ranging from individuals working as independent contractors and home based small businesses, to large publicly listed companies. 85% of all new home building work in Australia is performed by HIA members. Introduction The Housing Industry Association (HIA) broadly welcomes the vision for further developing northern Australia and agrees that a number of important policy issues need to be addressed for this to achieve the desired outcomes. The six policy directions identified in the Green Paper appear to adequately capture the range of issues that will need to be addressed to successfully develop the region on a major scale. With its geographic proximity and existing close cultural ties with Asia, northern Australia is uniquely placed to take advantage of opportunities to increase trade within the region. Northern Australia already enjoys significant natural advantages in agriculture, mineral, energy resources and tourism, which can potentially be exploited further. HIA’s commitment to the region is evident with the launch in July 2014 of the $5.5 million HIA Multipurpose Training Centre in Darwin, which will provide ongoing support to the building construction sector and train future generations of builders and related industry practitioners for decades to come. However, housing affordability and the pace with which new dwellings are being delivered to the community remains a challenge in many parts of Australia, and this is particularly prevalent in northern Australia. Issues such as access to land, competition for labour with the resources sector and transport costs for materials all contribute to increasing the cost of construction. In cyclone prone areas, building requirements also add additional costs to home building. These effects can be seen in cities such as Darwin and Cairns, where relatively modest development in terms of what is being envisioned by the White Paper process, is placing enormous pressure on land prices, construction costs and rents. Access to affordable and appropriate housing will be essential to provide shelter for the forecast growth in population that will accompany a significant increase in development in the region. However, the high cost of housing in turn acts as a disincentive to attracting the necessary skills to make any such development plan effectively work. While some of these cost impediments on housing are unique to northern Australia – such as transport and building requirements – it is essential that the excess costs on new housing that can be addressed through policy changes are tackled. In this submission HIA outlines a number of measures required to address housing affordability issues that will need to be addressed in northern Australia, and indeed across the nation. These include funding of infrastructure, planning reform, taxation reform, labour mobility, creating a flexible industrial relations environment and industry skills and capacity. 10/02/2016 Page 3 of 11 About the Housing Industry Association HIA is Australia’s only national industry association representing the interests of the residential building industry, including home builders, renovators, trade contractors, related building professionals, and suppliers and manufacturers of building products. As the voice of the home building sector, HIA represents some 40,000 members throughout Australia. The residential building industry includes land development, detached home construction, home renovations, medium-density housing and high-rise apartment buildings. The residential building industry is one of Australia’s most dynamic, innovative and efficient service industries and is also a key driver of the Australian economy. The residential building industry has a wide reach into manufacturing, supply, and retail sectors. The aggregate industry value to the Australian economy is over $150 billion per annum, with over one million employees, tens of thousands of small businesses, and over 200,000 subcontractors heavily reliant on the industry for their livelihood. HIA develops and advocates policy on behalf of members to further advance the efficiency of new home building and renovating, allowing it to provide affordable and appropriate housing to the growing Australian population. The Association provides a wide range of support services and products to members, including technical and compliance advice, training services, contracts and stationary, industry awards for excellence, and member only discounts on goods and services. Importance of Increasing New Home Building Australia must build a considerably higher level of new homes each year than has been achieved in recent decades, to house a growing population, and help address affordability challenges in much of the country. In the context of a debate about the development of northern Australia – or more generally the economy adjusting to the end of the mining construction engineering phase – housing affordability is a significant barrier to relocation for employment purposes. In terms of the national position, Australia needs to build at the very minimum 180,000 dwellings per annum over coming decades to meet the demographic demands for housing based on population projections. However, over the last 20 years new housing supply has averaged around 155,500 dwellings per annum. In the Northern Territory, most recent data for dwelling commencements are encouraging and may go some way to tackling the existing shortage of housing. However, the current improvement in building activity does not reflect the longer term average building rates. In the past five years, the Territory has built an average of 1,600 dwellings per annum, and over the past decade annual dwelling starts falls to around 1,400. This compares with the projected requirement for the Northern Territory to build around 1,700 dwellings per annum, based on conservative assumptions of population growth. As an aside to the pressing need to increase the volume on speed of delivery of housing stock, independent research also shows how construction activity has wider economic effects. The Centre for International Economics has estimated that for every $1 increase in construction activity, GDP rises by $4.75 with obvious positive implications for employment at the economy wide level. It has also been estimated that for every 1 per cent increase in Total Factor Productivity in residential construction, GDP will increase by $2.36 billion. 10/02/2016 Page 4 of 11 Housing price growth over the last decade Housing costs have grown at rates well above general inflation and household income growth. This is evident in both growth in home prices and growth in rents. The chart below shows that residential property prices have grown by 62 per cent over the last decade while rents have grown by a similarly large 55 percent. There has been some suggestion that the strong price growth has been due to speculative (investor) demand, however commensurate growth in rental prices is not consistent with this thesis. Rental prices reflect the value of housing services rather than any entitlement to future growth. Strong concurrent growth in home prices and rental prices is consistent with the demand for housing services exceeding the supply. The price of new homes, excluding the cost of the land, has also grown at a rate above the rate of overall inflation (CPI) over the last decade, but the margin above overall inflation is far less conspicuous. The price of new homes (ex-land) grew by 39 percent, a growth rate only modestly higher than overall inflation where prices increased by 33 per cent. There have been innovations in building methods and materials during this period which have delivered efficiencies and acted to contain price growth. However, there are many factors that have contributed to the faster rate of inflation of new dwelling prices relative to CPI. Inter alia, technological advances, quality improvements, and energy efficiency improvements. Throughout the last decade there have been consistent developments in the regulatory environment for building new homes and these have also contributed to price inflation. It is useful to compare the price growth of new homes (ex-land) with the broader measure of residential property price growth. The price index of new homes reflects the cost of the dwelling structure and is not affected by changes in the price of land, whereas the residential property price index reflects the combined changes in the price of the dwelling structure and land. The price of new homes (ex-land) grew by 39 per cent whereas residential property prices grew by 62 per cent. The margin by which growth in the residential property price index has exceeded growth in the price index of new homes (ex-land) provides a good proxy for the appreciation in home prices attributable to growth in the price of residential land. Housing Price Growth Over the Last Decade Source: HIA Economics, ABS 6401.0, ABS 6416.0 Index level (Base of 100 in Sept 2003) 170.0 160.0 150.0 140.0 130.0 120.0 110.0 100.0 Sep-2003 Sep-2004 Sep-2005 Sep-2006 Residential property 10/02/2016 Sep-2007 Sep-2008 Rents Sep-2009 Sep-2010 New homes (ex-land) Sep-2011 Sep-2012 Sep-2013 CPI Page 5 of 11 This situation is very much paralleled in northern Australia, where dwelling prices and rents have grown significantly as evidenced by the following table. In June 2004, the median price in Darwin was $225,000 for a detached house. One decade on, by June 2014 this had increased to $570,000 after having peaked at $590,000 in November 2013. The ten year increase to June 2014 equates to an increase over the period of 153 per cent. Infrastructure: Removing the cost burden from households State and local governments are increasingly reliant on the complex array of levies charged throughout the residential development process to fund social and community infrastructure. Development contributions represent the most significant of these charges and are adversely affecting housing affordability. It is expected that future significant development across northern Australia, which would require matching new home building, would occur primarily on greenfield sites. It is in this type of development where such charges are at the most extreme. High infrastructure charges contribute greatly towards the unaffordability of housing as many authorities charge for items of infrastructure which are unreasonable. Development-specific infrastructure items within the boundaries of the development should be provided by the developer as part of the cost of development. Development-specific infrastructure is infrastructure which provides essential access and service provision, and without which the development could not proceed. These items are considered to be core requirements for housing development and should be provided in a timely manner to facilitate affordable development. This includes local roads, drainage, stormwater, land for local open space and direct costs of connecting to local water, sewerage and power supplies. Community and regional infrastructure, on the other hand, are items of broader physical, community and social infrastructure. These items are ancillary to the direct provision of housing for a larger population and provide a benefit to the broader community. They include headworks for water, sewerage and power supplies which may be part of a specific contributions plan; community facilities such as schools, libraries & child care; district and regional improvements such as parks, open space and capital repairs; public transport capital improvements; district and regional road improvements. 10/02/2016 Page 6 of 11 HIA opposes the charging of development contributions on new housing for broader community and regional infrastructure items. The excessive costs levied from the developer are passed on to new homebuyers who in effect partially or wholly fund infrastructure items from which the whole community derives benefit. The cost of community infrastructure should be met by general revenue rather than an inequitable tax levied on new home buyers. Removal of the excessive infrastructure charges incurred during the production of new homes will lower the final purchase price to consumers. HIA calls on the federal government to facilitate access to alternate financing mechanisms for community and regional infrastructure in light of the limited capacity of state and local government to fund this infrastructure and particularly given the national approach being taken to northern development. Land: Improving supply for residential development The assessment, development and delivery of new land to market can take over 10 years, yet accurate and holistic information about Australia’s land supply pipeline is scarce. HIA recommends the federal government establish a mandatory national reporting framework for land supply as a matter of priority. State and territory governments collect and publish information on land supply. However, in several instances it is not timely, in some cases it is not accurate, and in all cases it is not related to the projected housing delivery commitments envisaged in capital city metropolitan strategies. The federal government needs to play a role in the co-ordination of this information, which is critical to supporting the delivery of homes to meet Australia’s growing population. The accurate collection of data on land supply needs to capture all stages of the land supply pipeline. This should include nationally consistent definitions to describe the various stages of the land supply pipeline. Timely periodic reporting should include information on land that has received ‘works approvals’ to more accurately identify any blockages in the planning process. Much of the information needed to achieve a holistic grasp of land, infrastructure and housing supply is captured variously by local and state/territory governments. However, the scope of data collection and its interpretation lacks consistency and is rarely compiled and shared across agencies. HIA supports the establishment of a national unit within Commonwealth Treasury with a sole focus being to collect, analyse, interpret and report on both housing and land supply pipelines, with a terms of reference similar to those of the Indicative Planning Council for Housing, which undertook this important function during the 1990’s. Land: Improving planning processes Australia needs a forward thinking and efficient planning system which supports population and economic growth. There are many examples where planning is acting as a disincentive, or worse still, a barrier to growth. The development of appropriate polices and frameworks to guide planning processes are also a source of ongoing frustration to the housing industry. By way of example, the current Draft Darwin Regional Land Use Plan 2014 is on public exhibition on comments is being sought from the community. While HIA welcomes the preparation of a strategic plan to guide the future growth of the region this process has been ongoing since at least 2011. Such delays create uncertainty for investors, potentially generate holding costs for developers and delay projects. Whilst the planning system is managed by the states and territories, the federal government can have a significant influence in the delivery of streamlined approval processes and in encouraging greater standardisation across borders. In recent years, the federal government 10/02/2016 Page 7 of 11 and COAG have recognised this opportunity, recommending a range of activities be undertaken to improve development assessment. It is important for there to be portfolio responsibility at a federal level to guide the delivery of reforms nationally. The federal government has a key role to play in leading planning reform and to actively participate in this work, with the support of both COAG and the residential development and building industry. Across Australia, detached housing traditionally required only one approval from the relevant authority in most locations. In recent years, it has become much more common for a single house on residential land adjoining existing single detached houses to require two approvals. This can take up to 12 months, costing thousands of dollars in submission fees, detailed reports and holding costs. Every state and territory has made a commitment to increase the density of housing within our major cities through metropolitan planning strategies. Yet low and medium scale housing developments such as dual occupancies, villas and townhouses, require two approvals, public notification and in many jurisdictions are open to third party appeals. Detached housing and low scale medium density housing projects – such as dual occupancies – need to be facilitated to assist in delivering both cost effective and timely housing supply, but also to meet targets for housing delivery under each metropolitan strategy. One way to achieve this is to ensure a streamlined approval process where constraints on the land are clearly identified in the first instance, and standards for the subsequent design and construction of housing are specified in single residential housing codes for all jurisdictions. HIA recommends development of a nationally consistent single approval process for detached housing and low scale housing development, including dual occupancy housing developments. The application assessment process should be underpinned by a domestic code compliance mechanism based on transparency, certainty and plain language criteria. Importantly, housing supply and housing affordability should be specifically listed as an objective of planning legislation across all states and territories, and regulations should reflect these objectives. Business, Trade and Investment: Reforming the taxation system Taxation, levies and charges on residential building add significant costs to the price of a home and mortgage repayments over time, and create an impediment to greenfield development. Across all tiers of government, the taxation of housing contributes almost $40 billion to revenue each year, which equates to 11.3 per cent of total local, state and commonwealth government revenue. Among Australia’s largest industrial sectors (those with a value added of more than $10 billion per annum) the residential building sector is the second most heavily taxed in relative terms. Independent analysis undertaken by the Centre for International Economics demonstrated that taxation throughout the production of a new house in Sydney was estimated to account for 44 per cent of the final purchase price. The analysis also showed that similarly large tax burdens were evident in other capital and regional cities around the country. The federal government’s tax reform agenda needs to address this unequal taxation structure. Arguably one of the most inefficient of these taxes is stamp duty, which not only increases the cost of a new home, but acts as a disincentive for employees to relocate and take up new opportunities. Stamp duty is levied when a property is sold and this tax can be paid multiple times along the process of bringing a new home to the market. The cost of these taxes is embedded in the final purchase price paid by the consumer. 10/02/2016 Page 8 of 11 The current process for levying stamp duty can involve ‘triple taxation’. Stamp duty can be imposed at three stages in the construction of a new house: - Sale of land to developer; - Sale of land from developer to builder; and - Sale of house and land package to purchaser. At each stage in housing production stamp duty can be collected on the contract sale price and levied on items such as GST, development charges, and stamp duty applied in previous transactions. This transaction and taxation process which can apply to the new home building sector is essentially treating new housing as ‘trading stock’ and is unique to this sector. In other industries, for example the used car industry, the ‘commodity’ is regarded as holding stock and does not attract stamp duty until the sale to the ultimate consumer. For the new home building sector, the taxes paid whilst approvals are being sought during the development phase can be significant and should be addressed by either a cut in rates or an exemption. Stamp duty is a major source of revenue for state governments, but it is a highly inefficient tax. ‘Australia’s Future Tax System’ report (Australian Treasury, 2010) notes: “Ideally, there would be no role for any stamp duties, including conveyancing stamp duties, in a modern Australian tax system. Recognising the revenue needs of the States, the removal of stamp duty should be achieved through a switch to more efficient taxes, such as those levied on broad consumption or land bases.“ Effective labour mobility allows the economy to grow and distribute wealth as employees move to accept job opportunities across the country, due to new opportunities created by government policy directions as is being considered by the Green Paper, or as the economy adjusts to changing circumstances. However, the limitation paced on labour mobility by stamp duty has recently been recognised by the Productivity Commission in its report on Geographic Labour Mobility. It concluded that poorly designed policies in areas such as housing – including stamp duty - have a negative effect on labour mobility. The report subsequently acknowledged that state and territory governments should remove or significantly reduce housing related stamp duties and increase reliance on more efficient taxes. Independent economic modelling commissioned by HIA demonstrates that implementation of reforms which remove inefficient taxes that specifically effect housing - such as stamp duty on conveyancing - improve housing affordability. Furthermore, such reforms are also likely to have broader economic benefits that deliver higher living standards to Australian households. A national tax reform agenda should develop a strategy and timeframe to replace stamp duty with more efficient taxes such as a broader based and/or higher rate of GST or a well-designed land tax. A Federally-led tax reform strategy is the only option for ensuring such change occurs. Business, Trade and Investment: Red Tape Unnecessary red and green tape across the building and construction sector results in time delays, inefficiencies and ultimately higher costs. A significant example of red tape impacting on the sector is the contractor reporting requirements, which were introduced by the Commonwealth Government in 2012. 10/02/2016 Page 9 of 11 These regulations require businesses in the building and construction industry to prepare and lodge an annual report providing the names, details and payments made to all contractors they have engaged. HIA supports the government’s desire to deal with those businesses engaging in tax evasion and supports efforts to improve both voluntary and compulsory compliance with taxation obligations. However, this new regulatory framework imposes significant additional administrative and accounting costs onto principal contractors. Coupled with existing Business Activity Statement (BAS) reporting obligations, it adds a further compliance burden on business and costs of home building. Business, Trade and Investment: Industrial relations Australia’s residential building industry is comprised of many small contracting businesses. This model is characterised by businesses that are responsible for their own work, set their own hours and move flexibly from site to site. The remuneration mechanism of working on a contract basis creates an incentive for these small businesses to operate efficiently and perform to the highest standards. Over the years, federal and state governments have progressively ‘deemed’ that many classes of contractors should be covered by regulations that had previously only ever applied to employees. At a federal level these measures have included taxation, superannuation and industrial relations laws. States have also spread the coverage of payroll tax and workers compensation to capture an increasing share of small businesses in their net. In the process small contracting businesses are being overburdened with administrative processes. To ensure Australia’s residential building industry can operate as efficiently as possible, governments must acknowledge that small contracting businesses are a worthy and legitimate form of business, recognising they are business people who take personal financial risks, employ others and invest their own capital. Contractors are not ‘quasi-employees’ or ‘deemed employees’. Looking to the future, a greater share of new residential dwellings is likely to be in higher density developments. Governments must ensure that inefficiencies stemming from the industrial relations practices within the commercial construction sector do not impose additional costs on the residential building industry and suppress the supply of new homes. Most recent unemployment figures point to an increase in people looking for work, which has negatively impacting on the national rate. The jobless rate rose to a seasonally adjusted 6.4 per cent from 6 per cent in June, its highest point since August 2002. This is particularly acute in youth unemployment figures, which are well above the national average at often at their worst in regional Australia. In May, the youth unemployment rate was 12 per cent in Cairns and 9.2 per cent in Darwin. The housing industry is therefore frustrated at recent decisions by the Fair Work Commission to significantly increase rates paid to apprentices, failing to recognise the training nature of their engagement. Equally, the cessation of junior award rates for young people – based on a percentage of adult labourer rates – has ended what has been a traditional pathway for many young people into the industry, and often towards a future career as skilled tradespeople. In both cases, these decisions have the net result in reducing employment for young people and must be reconsidered, in particular in light of the current conditions. 10/02/2016 Page 10 of 11 Education, Research and Innovation: Increasing industry capacity Building a larger number of new homes will place greater demands on the resources of the residential building. Inadequate expansion of the housing industry’s output capacity under stronger demand conditions may contribute to price pressures. Price pressures can be contained by ensuring the housing industry has adequate capacity to build homes to meet the demands of a growing population. Building a larger volume of homes will require a larger workforce and a larger volume of building material inputs. Two significant challenges to growing the labour force are the large cohort of workers approaching retirement, and the high rate of attrition amongst new apprentices. In tandem with supporting traditional apprenticeships, government policies must enable flexible pathways into the industry and facilitate opportunities for career progression. This can be achieved through: - Development of pathways to redeploy the ageing workforce to complementary activities; - Development of intermediate qualifications which recognise defined skills sets as intermediate qualifications prior to completion of a full apprenticeship; and. - Recognise competency based training in a fair and transparent assessment system in which the employer, the Registered Training Organisation and the apprentice are all active participants and have confidence in the system and outcome. As referenced earlier, HIA recently opened its Multi‐Purpose Building Industry Training Centre in Darwin, which was constructed with the support of funding through the Regional Development Australia Fund, reflecting the industry’s commitment to growth in Australia north. When the centre becomes fully functioning, there will be over 500 people trained each year. These will comprise school students undertaking certificate 1 in construction, unemployed people undertaking pre-vocational training, apprentices undertaking certificate 3 in various trades, and existing workers up-skilling their knowledge in a range of areas such as safety training or gaining qualifications which lead to becoming a builder. As the federal government considers its approach to funding skills development and support for apprenticeships post the 2014 budget, it is essential that it recognises opportunities to support young people into the trades that will be needed to support the project development. Equally, as the mining boom contracts there will be a number of employees with skills in construction, which will require additional training to support a career in residential building. Conclusion Access to shelter is a basic human need and is critical to allow all Australians to participate in society to their full economic and social potential. If visions for the development of northern Australia are to be realised then housing affordability and related issues must be addressed. The Federal Government should take a proactive leadership role in addressing the nation’s housing affordability issues by: - Ensuring strategic plans include a sufficient flow of appropriately located residential land available for timely development; - Addressing the distortionary taxes and layers of regulation that add unnecessary costs along the new home production process which end up embedded in the final purchase price of new homes. - Removing disincentives for employment relocation such as stamp duties. - Expanding the productive capacity of the residential building sector through greater investment in workforce development. 10/02/2016 Page 11 of 11