Florida Senate Banking and Insurance Committee Testimony

advertisement

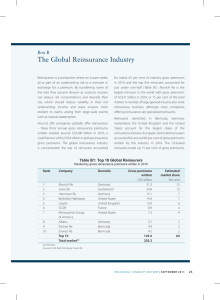

Florida Senate Banking and Insurance Committee Testimony (12/10/13) Abundant Reinsurance Capacity, Falling Prices; Opportunity to “Right Size” the Florida Hurricane Catastrophe Fund and Reduce the Policy Count of Citizens Association of Bermuda Insurers and Reinsurers (ABIR) Bradley L. Kading, President 1. Reinsurers support Florida domestic insurers with record amounts -- and growing reinsurance capacity, in a stable to declining pricing environment that benefits Florida’s insurers, taxpayers and policyholders; a. Bermuda’s reinsurers are committed to Florida and represent 60% of that supply b. Bermuda is the global center for property catastrophe reinsurance c. ABIR’s 21 (re)insurer members at yearend 2012 wrote $66 billion in global gross premium on a $90 billion capital base 2. Reinsurers are financially strong, very well capitalized and rated highly by the rating agencies; and provide cheaper alternative capital to insurers to help them grow their businesses 3. Use of private reinsurance spreads risk beyond Florida; it is valuable to Florida because it means not all the cost of hurricane risk has to be financed within the state by citizens and taxpayers: a. economic research shows that reinsurance payments for catastrophe claims from external sources (global markets) leads to faster economic recovery post event 4. Reinsurance capacity is abundant, with additional providers of capital eager to take on hurricane insurance risk 5. Reinsurance prices are expected to fall in 2014 for the second year in a row, based on published press articles:i a. reinsurance prices have been steady to declining in Florida since 2009 6. During the last legislative session reinsurance prices in 2013 were reported to be declining, based on broker and trade press reports. There was a skeptical audience for this message in Tallahassee in 2013, but: a. The June 1 results proved an average 15% price decrease for reinsurance; amounts will vary by insurer b. The CFO’s consumer advocate was correct in her testimony that Cat Fund changes proposed in 2013 would have not increased consumer prices 7. Alternative capital providers (pension funds, private investors, sovereign wealth funds, hedge funds) are providing additional capital to take on catastrophe reinsurance risk; they now provide an estimated 15% of catastrophe reinsurance capacity, an amount that is estimated to grow to 50% in the next decade; a. this is the one of two primary drivers leading to lower rates – an abundance of capacity; Representing Bermuda’s Major International Insurers and Reinsurers 1 b. the second is the record 8 year dry spell of Florida land-falling hurricanes 8. Alternative capital is in this business for the long haul, having tested this market now for 20 years; this is good news for Florida policymakers – it’s a new opportunity -- and allows for a re-think of the need for Citizens and the Cat Fund as currently structured: b. both can be subject to “rightsizing” by statutory change; c. both can use reinsurance to reduce their own risk and reduce the risk of policyholder assessments -- “hurricane taxes”-- on businesses and consumers with cars; no legislative changes are needed to pursue this goal d. these are not mutually exclusive options; they work in tandem to accomplish your goals; use both for quicker and better outcomes 9. Citizens' has reduced its policy count by more than 30% and that is an example of the interest investor capital has in Florida hurricane risk. Further reductions can be expected with the Clearinghouse which you wisely enacted 10. With the Cat Fund, further efforts can be undertaken to reduce the size of the Cat Fund, to provide second season stability, and to reduce the risk of further policyholder assessments for the bond debt that will have to be issued to pay Cat Fund claims 11. Reduction of the Cat Fund will not have a negative effect on the supply of reinsurance available for private insurers; a. again abundant amounts of reinsurance are available, additional capacity has been parked on the sidelines waiting to be used if needed b. According to AM Best reinsurers have earmarked for return to shareholders this year $25 billion in excess capital via share buybacks 12. Sen. Hays’ bill is a good approach to “right sizing” of the Cat Fund; a. Floridians have paid $5.4 billion in assessments (Citizens, FHCF, FIGA) from the 2004 and 2005 hurricanes, with more likely to come b. Trade press reports and rating agency analyses confirm abundant capacity and that further reinsurance price decreases are expected for Florida at June 1; thus the statement of the CFO’s consumer advocate earlier this year that Sen. Hay’s bill will not impact consumer insurance rates will again hold true c. By contrast, proposals to reduce the Cat Fund trigger are counterproductive: i. lead to increased risk of policyholder and taxpayer assessments ii. reduce Cat Fund capacity available for the second or subsequent storm or season iii. discourage private capital in global markets from devoting resources to Florida iv. lead to increased costs for consumers due to “concentration” and “ring fencing” of risk within Florida v. create greater government involvement -- not less -- in the private markets vi. reduce incentives for “storm proofing” or mitigation vii. bottom line: risk is shifted from private financial markets to Florida’s families and businesses via “hurricane taxes”. i In compliance with anti-trust law, ABIR as a trade association does not collect price or coverage information from its members; market information is from published, public information 2