Portfolio Managers – $2 bn Multistrategy Quantitative HF

advertisement

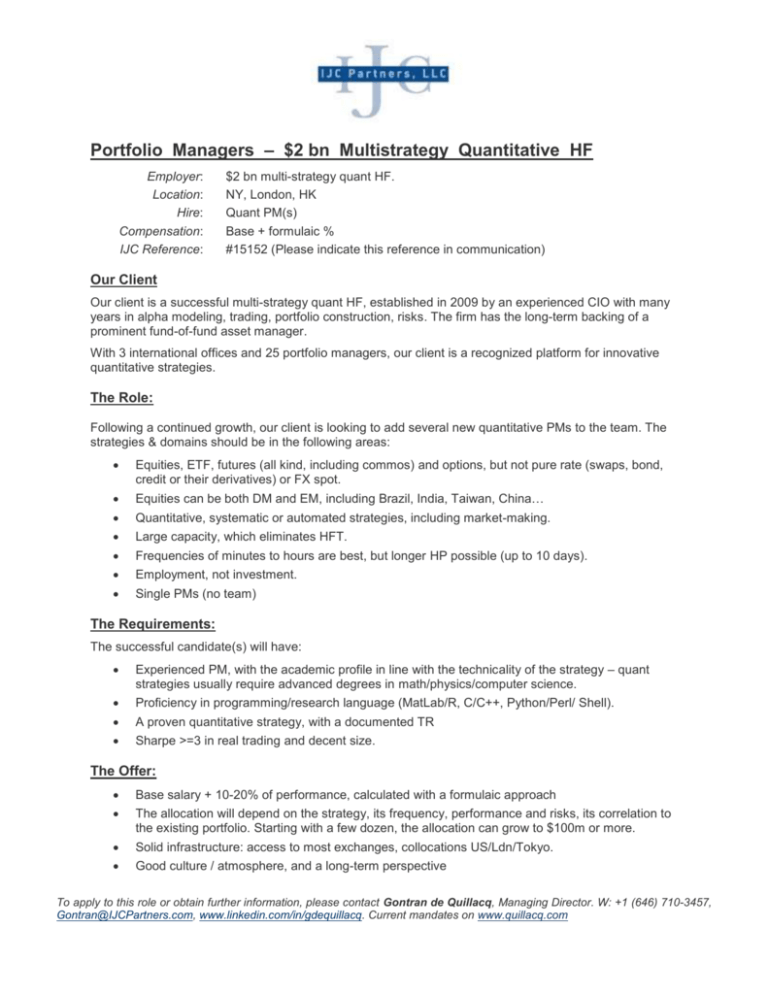

Portfolio Managers – $2 bn Multistrategy Quantitative HF Employer: Location: Hire: Compensation: IJC Reference: $2 bn multi-strategy quant HF. NY, London, HK Quant PM(s) Base + formulaic % #15152 (Please indicate this reference in communication) Our Client Our client is a successful multi-strategy quant HF, established in 2009 by an experienced CIO with many years in alpha modeling, trading, portfolio construction, risks. The firm has the long-term backing of a prominent fund-of-fund asset manager. With 3 international offices and 25 portfolio managers, our client is a recognized platform for innovative quantitative strategies. The Role: Following a continued growth, our client is looking to add several new quantitative PMs to the team. The strategies & domains should be in the following areas: Equities, ETF, futures (all kind, including commos) and options, but not pure rate (swaps, bond, credit or their derivatives) or FX spot. Equities can be both DM and EM, including Brazil, India, Taiwan, China… Quantitative, systematic or automated strategies, including market-making. Large capacity, which eliminates HFT. Frequencies of minutes to hours are best, but longer HP possible (up to 10 days). Employment, not investment. Single PMs (no team) The Requirements: The successful candidate(s) will have: Experienced PM, with the academic profile in line with the technicality of the strategy – quant strategies usually require advanced degrees in math/physics/computer science. Proficiency in programming/research language (MatLab/R, C/C++, Python/Perl/ Shell). A proven quantitative strategy, with a documented TR Sharpe >=3 in real trading and decent size. The Offer: Base salary + 10-20% of performance, calculated with a formulaic approach The allocation will depend on the strategy, its frequency, performance and risks, its correlation to the existing portfolio. Starting with a few dozen, the allocation can grow to $100m or more. Solid infrastructure: access to most exchanges, collocations US/Ldn/Tokyo. Good culture / atmosphere, and a long-term perspective To apply to this role or obtain further information, please contact Gontran de Quillacq, Managing Director. W: +1 (646) 710-3457, Gontran@IJCPartners.com, www.linkedin.com/in/gdequillacq. Current mandates on www.quillacq.com