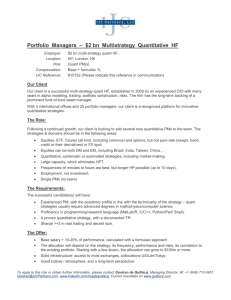

“The Quant’s Blueprint: A roadmap for Building a Career in Quanti... 1 of 16 https://medium.com/@akjha22/the-quants-blueprint-a-roadmap-f... Sign up Open in app Sign in Search “The Quant’s Blueprint: A roadmap for Building a Career in Quantitative Finance” Amit Kumar Jha · Follow 7 min read · Feb 10, 2023 Listen Share A quant analyst, also known as a quantitative analyst, is a professional who uses mathematical and statistical models to solve financial problems and make investment decisions. My Dream Desk :) Here’s a general overview of the steps you can follow to become a quant analyst: 1. Gain a solid understanding of mathematics, statistics, and finance. This will be the foundation for your work as a quant analyst. 2/23/2024, 6:38 PM “The Quant’s Blueprint: A roadmap for Building a Career in Quanti... 2 of 16 https://medium.com/@akjha22/the-quants-blueprint-a-roadmap-f... 2. Learn programming languages such as Python or R, which are commonly used in financial data analysis and modelling. 3. Learn how to operate Bloomberg or Reuters terminal to extract financial data. 4. Familiarize yourself with financial markets, instruments, and regulations. 5. Build a portfolio of projects that demonstrate your skills in data analysis and financial modelling. 6. Consider obtaining relevant certifications, such as the Chartered Financial Analyst (CFA) designation or the Financial Risk Manager (FRM) certification. 7. Network with other professionals in the field, such as traders, portfolio managers, and other quants, to gain insights into the industry and learn about job opportunities. 8. Seek out internships or entry-level positions in the financial industry to gain practical experience. Remember that becoming a quant analyst can be a long-term process, but with dedication and hard work, you can achieve your goal. Let’s start with gaining a solid understanding of mathematics, statistics, and finance, which is the foundation for work as a quant analyst. Mathematics: • Linear algebra: Matrices, vectors, eigenvalues and eigenvectors, etc. • Calculus: Differentiation, integration, and optimization. • Probability theory: Random variables, distributions, and statistical inference. • Numerical methods: Numerical integration, differential equations, and optimization. Statistics: 2/23/2024, 6:38 PM “The Quant’s Blueprint: A roadmap for Building a Career in Quanti... 3 of 16 https://medium.com/@akjha22/the-quants-blueprint-a-roadmap-f... • Descriptive statistics: Measures of central tendency, dispersion, and skewness. • Inferential statistics: Hypothesis testing, confidence intervals, and regression analysis. • Time series analysis: Autocorrelation, stationarity, and forecasting. Finance: • Financial markets and instruments: Stocks, bonds, derivatives, etc. • Financial regulation: Securities laws, market structure, and ethical considerations. • Financial modelling: Valuation, risk management, and portfolio optimization. • Economic concepts: Interest rates, inflation, gross domestic product, etc. Let me explain each of the mathematical concepts listed earlier and how they can be applied in the financial market: Linear Algebra: • Matrices: Matrices can be used to represent large sets of data in a compact and organized form. In finance, matrices can be used to represent portfolios of assets or the covariance matrix of returns. • Vectors: Vectors can be used to represent variables with multiple dimensions, such as stock prices or returns. In finance, vectors can be used to represent portfolios or to perform principal component analysis. • Eigenvalues and Eigenvectors: Eigenvalues and eigenvectors can be used to find the most important underlying factors driving the variability of a set of variables. In finance, eigenvalues and eigenvectors can be used to perform factor analysis or to identify the dominant sources of risk in a portfolio. Calculus: 2/23/2024, 6:38 PM “The Quant’s Blueprint: A roadmap for Building a Career in Quanti... 4 of 16 https://medium.com/@akjha22/the-quants-blueprint-a-roadmap-f... • Differentiation: Differentiation can be used to find the rate of change of a function at a given point. In finance, differentiation can be used to calculate the sensitivity of a portfolio to changes in market conditions or to find the optimal hedge ratios for derivatives positions. • Integration: Integration can be used to find the total change in a function over a given interval. In finance, integration can be used to calculate the present value of future cash flows or to determine the cumulative distribution function of a security’s return distribution. • Optimization: Optimization can be used to find the best values of a set of variables that satisfy a set of constraints. In finance, optimization can be used to determine the optimal portfolio weights or to find the best fit line in regression analysis. Probability Theory: • Random Variables: Random variables can be used to represent uncertain quantities, such as stock prices or interest rates. In finance, random variables can be used to model the distribution of returns or to calculate value at risk. • Distributions: Distributions describe the likelihood of observing different values for a random variable. In finance, distributions can be used to model the distribution of returns or to perform Monte Carlo simulations. • Statistical Inference: Statistical inference can be used to make conclusions about a population based on a sample of data. In finance, statistical inference can be used to test hypotheses about stock returns or to estimate the parameters of a financial model. Numerical Methods: • Numerical Integration: Numerical integration can be used to estimate the value of a definite integral when an analytical solution is not available. In finance, numerical integration can be used to calculate the present value of future cash 2/23/2024, 6:38 PM “The Quant’s Blueprint: A roadmap for Building a Career in Quanti... 5 of 16 https://medium.com/@akjha22/the-quants-blueprint-a-roadmap-f... flows or to determine the cumulative distribution function of a security’s return distribution. • Differential Equations: Differential equations can be used to model dynamic systems, such as interest rate or stock price models. In finance, differential equations can be used to model the evolution of interest rates or to determine the price of a derivative. • Optimization: Optimization can be used to find the best values of a set of variables that satisfy a set of constraints. In finance, optimization can be used to determine the optimal portfolio weights or to find the best fit line in regression analysis. I hope these examples give you a better understanding of how these mathematical concepts can be applied in the financial market. Now Let me explain each of the statistical concepts listed earlier and how they can be applied in the financial market: Descriptive Statistics: • Measures of central tendency: Measures of central tendency, such as the mean, median, and mode, can be used to summarize a set of data and describe where the majority of the data points lie. In finance, measures of central tendency can be used to describe the average return of a stock or portfolio. • Measures of dispersion: Measures of dispersion, such as the variance and standard deviation, can be used to describe how spread out a set of data is. In finance, measures of dispersion can be used to describe the risk of a stock or portfolio. • Skewness: Skewness can be used to describe the asymmetry of a distribution. In finance, skewness can be used to describe the asymmetry of a stock or portfolio’s return distribution. Inferential Statistics: 2/23/2024, 6:38 PM “The Quant’s Blueprint: A roadmap for Building a Career in Quanti... 6 of 16 https://medium.com/@akjha22/the-quants-blueprint-a-roadmap-f... • Hypothesis testing: Hypothesis testing can be used to determine whether a claim about a population is supported by a sample of data. In finance, hypothesis testing can be used to determine whether a stock’s return is significantly different from zero or whether the beta of a stock is different from one. • Confidence intervals: Confidence intervals can be used to provide a range of values that are likely to contain the true value of a population parameter. In finance, confidence intervals can be used to estimate the likely range of a stock’s future returns or the likely range of a portfolio’s future return. • Regression analysis: Regression analysis can be used to determine the relationship between a set of independent variables and a dependent variable. In finance, regression analysis can be used to determine the relationship between a stock’s returns and macroeconomic factors or to estimate the alpha of a hedge fund. Time Series Analysis: • Autocorrelation: Autocorrelation can be used to describe the degree of similarity between a time series and a lagged version of itself. In finance, autocorrelation can be used to describe the degree of persistence in a stock’s returns or to determine the order of a time series model. • Stationarity: Stationarity can be used to describe the stability of the mean and variance of a time series over time. In finance, stationarity can be used to determine whether a stock’s returns are mean-reverting or whether they have a trending pattern. • Forecasting: Forecasting can be used to predict future values of a time series. In finance, forecasting can be used to predict future stock prices or future interest rates. I hope these examples give you a better understanding of how these statistical concepts can be applied in the financial market. 2/23/2024, 6:38 PM “The Quant’s Blueprint: A roadmap for Building a Career in Quanti... 7 of 16 https://medium.com/@akjha22/the-quants-blueprint-a-roadmap-f... Finally, Let me explain each of the finance concepts listed earlier and how they can be applied in the financial market: Financial Markets and Instruments: • Stocks: Stocks are securities that represent ownership in a corporation. In the financial market, stocks can be bought and sold on stock exchanges, such as the NYSE or NASDAQ. • Bonds: Bonds are debt securities that represent a loan made by an investor to a corporation or government. In the financial market, bonds can be bought and sold on bond exchanges, such as the London Stock Exchange. • Derivatives: Derivatives are financial instruments whose value is derived from the price of an underlying asset. In the financial market, derivatives can include options, futures, and swaps. Investment Portfolio Theory: • Diversification: Diversification is the process of spreading investments across multiple assets to reduce risk. In the financial market, diversification can be achieved by investing in a mix of stocks, bonds, and other asset classes. • Modern Portfolio Theory (MPT): MPT is a theory that argues that an investor can create a more efficient portfolio by diversifying across multiple assets. In the financial market, MPT can be used to construct portfolios that maximize returns for a given level of risk or that minimize risk for a given level of return. Capital Markets Theory: • Capital Asset Pricing Model (CAPM): The CAPM is a model that describes the relationship between risk and expected return for a security. In the financial market, the CAPM can be used to estimate the expected return of a stock or to determine the required rate of return for an investment. • Efficient Market Hypothesis (EMH): The EMH is a theory that argues that 2/23/2024, 6:38 PM “The Quant’s Blueprint: A roadmap for Building a Career in Quanti... 8 of 16 https://medium.com/@akjha22/the-quants-blueprint-a-roadmap-f... financial markets are “informationally efficient,” meaning that all publicly available information is reflected in the prices of securities. In the financial market, the EMH has implications for the ability of investors to “beat the market” through active management. Financial Econometrics: • Time Series Analysis: Time series analysis can be used to model and forecast financial data, such as stock prices or interest rates. In the financial market, time series analysis can be used to make investment decisions or to develop trading strategies. • Event Studies: Event studies can be used to measure the impact of a specific event on the price of a security. In the financial market, event studies can be used to measure the impact of an earnings announcement or a merger announcement on a stock’s price. • Risk Management: Risk management is the process of identifying, assessing, and controlling risks faced by an individual or an organization. In the financial market, risk management can involve the use of derivatives, such as options and futures, to hedge against market risk. I hope these examples give you a better understanding of how these finance concepts can be applied in the financial market. Quantitative Finance Trading Finance Economics Quantitative Research Follow 2/23/2024, 6:38 PM “The Quant’s Blueprint: A roadmap for Building a Career in Quanti... 9 of 16 https://medium.com/@akjha22/the-quants-blueprint-a-roadmap-f... Written by Amit Kumar Jha 1.1K Followers Quant at UBS, MS from Indian Institute of Technology Jodhpur More from Amit Kumar Jha Amit Kumar Jha Portfolio Management, Analysis,and Optimization using Python-1 Portfolio management selects the right mix of investments to achieve specificgoals. Python is a popular language for implementing… 7 min read · Dec 12, 2022 141 1 2/23/2024, 6:38 PM