Case Studies

advertisement

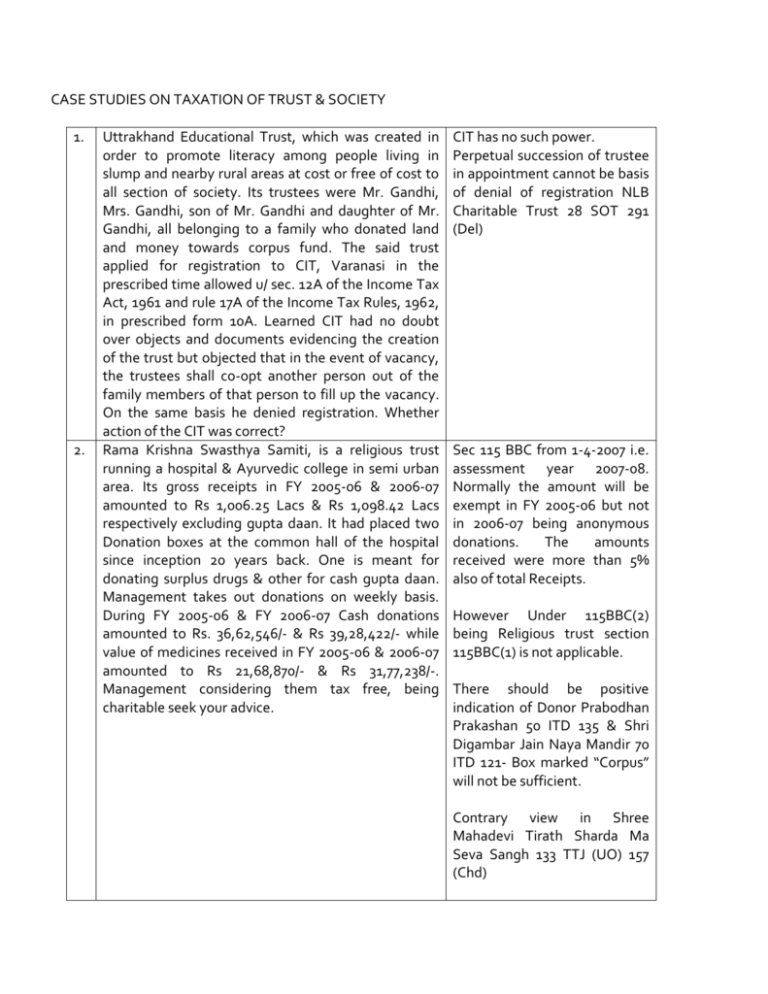

CASE STUDIES ON TAXATION OF TRUST & SOCIETY 1. 2. Uttrakhand Educational Trust, which was created in order to promote literacy among people living in slump and nearby rural areas at cost or free of cost to all section of society. Its trustees were Mr. Gandhi, Mrs. Gandhi, son of Mr. Gandhi and daughter of Mr. Gandhi, all belonging to a family who donated land and money towards corpus fund. The said trust applied for registration to CIT, Varanasi in the prescribed time allowed u/ sec. 12A of the Income Tax Act, 1961 and rule 17A of the Income Tax Rules, 1962, in prescribed form 10A. Learned CIT had no doubt over objects and documents evidencing the creation of the trust but objected that in the event of vacancy, the trustees shall co-opt another person out of the family members of that person to fill up the vacancy. On the same basis he denied registration. Whether action of the CIT was correct? Rama Krishna Swasthya Samiti, is a religious trust running a hospital & Ayurvedic college in semi urban area. Its gross receipts in FY 2005-06 & 2006-07 amounted to Rs 1,006.25 Lacs & Rs 1,098.42 Lacs respectively excluding gupta daan. It had placed two Donation boxes at the common hall of the hospital since inception 20 years back. One is meant for donating surplus drugs & other for cash gupta daan. Management takes out donations on weekly basis. During FY 2005-06 & FY 2006-07 Cash donations amounted to Rs. 36,62,546/- & Rs 39,28,422/- while value of medicines received in FY 2005-06 & 2006-07 amounted to Rs 21,68,870/- & Rs 31,77,238/-. Management considering them tax free, being charitable seek your advice. CIT has no such power. Perpetual succession of trustee in appointment cannot be basis of denial of registration NLB Charitable Trust 28 SOT 291 (Del) Sec 115 BBC from 1-4-2007 i.e. assessment year 2007-08. Normally the amount will be exempt in FY 2005-06 but not in 2006-07 being anonymous donations. The amounts received were more than 5% also of total Receipts. However Under 115BBC(2) being Religious trust section 115BBC(1) is not applicable. There should be positive indication of Donor Prabodhan Prakashan 50 ITD 135 & Shri Digambar Jain Naya Mandir 70 ITD 121- Box marked “Corpus” will not be sufficient. Contrary view in Shree Mahadevi Tirath Sharda Ma Seva Sangh 133 TTJ (UO) 157 (Chd) but the intention of the donor is to give money to the trust which will keep it in the trust account in deposit and income from the same is utilized for carrying on charitable and religious activities, it satisfies the definition part of corpus and, in such a situation assessee would be entitled to benefit of exemption from payment of tax u/s 11(1)(d). [DIT vs. Sri Ramakrishna Seva Ashrama 205 Taxman 26 (Kar.) (HC) (2012)] 3. 4. Doon Researchers Association is a society of scientists carrying out activity of holding conferences for its members, social awareness program for members & public at large on different illness for last two years. During the financial year 2008-09, its members researched on medicine and found it useful in preventing a virus infected disease. Medicine was distributed amongst its 2000 members and family first at cost plus 10% resulting into realization of Rs 25 lacs. Cost incurred on research studies were around 5%. It incurred difference amount on paying honorarium to member scientists’ majority of who were office bearers. On finding it very useful, it proposes to distribute amongst general public at same cost in FY 2009-10. It applied to Income Tax department to get registered u/sec 12A. CIT refuses the registration referring noncompliance of provisions of section 13(1)(c )(ii) Avadh Educational Institute is Society running educational Institution. All object clauses in memorandum are charitable in nature. Upto year ended on 31-3-2010, it had gross receipts of Rs 95 Lacs from Fee and Rs 2 Lacs from Interest income. It had no surplus till that date & Income & Exp A/C showing Dr Rs 50,000/- Society was not registered in 12A For year ended 31-3-2011 society had following financial disclosures:Receipts from Fee Rs 1,25,00,000/- NO CIT cannot refuse AO can see contravention of Sec 13(1)(c)(ii) Ref 13(2)(c)- if payment reasonable no con compliance. For Asstt Year 2010-11 there being no surplus there will not be any tax implications hence no provision for tax would be required. In Asstt yr. 2011-12 also net income will be taxable Rs 3,12,500/- less 1,20,000/- = Receipts from Bank Interest Rs 2,25,000/Income from School Bus Transportation Rs 20,000/Corpus donation received for Building construction Rs 25 Lacs During the year Excess of Income over Expenditure amounted to Rs 3,12,500/- before allowing salary to Society Secretary Rs 1,20,000/- 1,92,500/- + 25,00,000/-. Being registered society tax will be levied on this as Individual Sheth Mafatlal Gagalbhai Foundation Trust 249 ITR 533 (Bom) for which provision would be made. Amount Received for building fund will not be exempted because sec 11 will not be applicable as society not registered u/s 12 Vidyananda Educational Society, ... vs Assessee on 30 April, 2012 989/Hyd/2010 “Further, we make it clear that donations towards corpus funds of charitable trust are exempt under Section 12. However, Section 12 provides that provisions of Section 11 and 12 shall not apply unless the trust is registered under Section 12AA. In this view of the matter even corpus contribution for the assessment years 2003-04 and 04-05 will not be eligible for exemption under Section 11, as the Assessee trust did not have requisite approval under Section 12AA. Further, we make it clear that there was insertion of clause (d) to section 11(1) by the Direct Tax Laws (Amendment) Act, 1987, with effect from 1.4.1989. Section 2(24) of the Act has also been amended by the same Amendment Act. The effect of amendment is that although corpus donation should be treated as income in the hands of the recipient, but in the case of trust or institution, who comply with the requirement for exemption u/s. 11, they will be exempted from their income. However, the trust or institution loses the exemption u/s. 11, either by not complying with the condition laid down in section 12A or by falling within the mischief of section 13, corpus donation will be included in the income of the institution and to be assessed accordingly. On 1-4-2011, Society applied for registration for 12A which is yet to be disposed by concerned authorities. 5. You being both Auditor as well as Tax Consultant are required to audit with due precautions and reporting & computing taxable income. Bright Educational Society’s objects contain solely for running some schools. Society runs these schools in its own building premises. Society has been filing its income tax return since inception claiming exemption under section 10(23C) (iiiad). Now the society wants to donate one of its schools to another similar objects society Decent Educational Society along with land, building and other infrastructure. Please discuss tax implications over both societies. CBDT instruction No. 1132, dt. 05.01.1978 and Sarladevi Sarabhai Trust 172 ITR 698 (Guj.) following 133 ITR 494 (Bom) and 243 ITR 93 (Mad) Proviso 12 of 10(23C) not applicable on (iiiad). For receiving trust it will be donation received and application of donation also. The amendment to section 11(2) effected by the Finance Act, 2002 with effect from 1st April 2003 effectively nullifies the decisions in M. Ct. Muthaiah Chettiar Family Trust and CIT v. Sarladevi Sarabhai Trust (No. 2) to the extent that it concerns donation of funds accumulated under section 11(2) to another trust. The Amendment does not affect the position as regards donations to another trust out of current income or income accumulated within 15%, which continues to be regarded as application of income by the donor trust. 6. 7. BBD trust carries out multiple activities and it sold text books and note books to general public. Trust has following options for investing/utilizing income from such activity amounting to Rs 38.50 lacs. Discuss tax implication for each such activity:To acquire printing machines. To build college library To make temple in educational institution‘s campus. To run ambulance free of cost. To run a mobile van for sale of books etc. Rishi shiksha Samiti was running an Inter college. Upto FY 2009-10 it had receipts amounting to Rs. 98.76 lacs. It earned surplus of Rs 14 lacs which was invested in a partnership firm in which two out of three partners were office bearers in Samiti. Please discuss the taxability for Asstt Year 2010-11. Selling text books and note books does not seem to be Charitable object. Further in FY 2010-11 its receipts amounted to Rs. 103 lacs. Samiti applied for registration u/sec 12A in which CIT questioned such investment (which remained as such in partnership firm) –why not to reject its application. Discuss legality of action of CIT (If application rejected) Further after rejection, please discuss taxability of society for Asstt Year 2011-12. Cannot reject application u/s 12A. If rejected assessee should file appeal before ITAT. If adequate security and interest is charged from firm then no problem For FY 2009-10 section 10(23C)(iiiad) was applicable hence the investment in partnership firm will not have any impact. Proviso 3 not applicable on (iiiad)