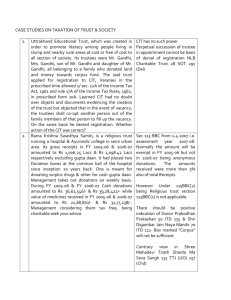

Market History

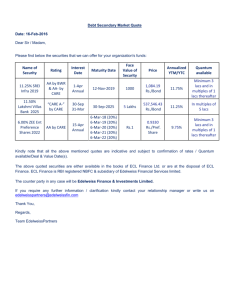

advertisement

Managing Financials Why Invest Goal Achievement How to Invest Financial Freedom Where to Invest Wealth Creation Financial Planning with LIC Failure Analysis Why Invest Product 1985 2012 Growth % 2030 Tooth Paste 5 60 8 280 Milk Masala Dosa 5 40 7.5 150 5 80 12 600 House Hold Expanses 1000 25000 15 3 Lacs Professional Qualification 10000 7 Lacs 18 1 Cr Increasing Life Style Scooter Car ? SUV ? 3 BHK ? ? Costly Accommodation Medical Expanses Joint Family Own 1BHK ? ? Mr. X a Common Man Age-35, Child Age-3, Monthly Income-30K Child’s Higher Education Child’s Marriage At age 21 after 18 year Rs. 6 Lacs At age 25 after 22 year Rs. 15 Lacs Rs. 24 Lacs Rs. 81 Lacs Retirement / Pension At age 60 after 25 year Rs. 20K Rs. 1.3 Lacs Total Corpus required between 50 to 70 Rs2.5 Cr 2.5 Cr in 25 Years between 50 to 70 Years of Age @ 0% @ 8% Rs. 84000/- Rs. 27000/- @ 15% Rs. 9000/Return on Investments vs Return of Investments Basic Financial Planning 3 Major Parts of Financial Planning Risk Management Life Insurance Permanent Loss Income Child/Retirement Future Emergency & Short Needs Short Term Needs Medical Emergencies Temporary Loss Income 12X of Monthly Income Future Goals & Dreams Life Time Targets Future Income Dream Life Need Base Allocation A Common Man Life Cycle High Age Close Targets No Room for Risk Low Age Low Risk Low Liabilities Mid Age Mid Term Targets Age-40-55 Years YOUNG AGE MEDIUM AGE OLD AGE Risk Mgm-20% Contigency-20% Future-60% Risk Mgs-30% Contigency-30% Future-40% Risk Mgs-10% Contigency-70% Future-20% Some Common Thumb Rules Investment 20% of Monthly Income Risk Management 12X of Annual Income Contingency Funding 12X Monthly Income Growth Allocation 100-Your Age Person to Person Need base Calculation at different stages Common & Ideal Allocation Risk Management & Family Protection Emergency & Short Needs Future Goals & Dreams Life Life Time Targets 100- Your Age Child Education/Marriage Retirement Solutions Future Income Dream Life 12X of Yearly Income Family Protection Child Future Security Temporary Loss of Income 12X of Monthly Income Emergency Condition Short Term Needs Medical Emergencies 33% 33% 33% High Insurance Health Insurance Child /Retirement Plans Gold, Bonds, RD/FD /CD Mediclaim Property /Shares Kitty/ Pvt. Interest Mutual Fund SIP Permanent Loss Income Generally What Happens 1st Job with 40K Salary Mobile/ Vehicle/ Luxury EPF/PPF Life Insurance & ULIP/MF SIP Flat on Monthly Installments Marriage Honeymoon Delivery & School Admission Financial Medical Problem Products & Suitability Foot Walk/Motor Cycle, Luxury Car, Train/Aero Plane Next or Back Side Nabors Luxury Car Mumbai or Bangkok Vegetable, Whets & Fruits 3-6 Months 6-12 Months Mango & Apple Tree 10 Years Why Contingency Funding Product If I Need Money after 3 Years PPF/EPF No Banking/ Postal Gold/ Bond Funds Life Insurance 4 Lacs Real Estate/ Mutual Funds 2 Lacs or 5 Lacs 4 Lacs No Why Risk Management Product If my Family needs Money PPF/EPF 4 Lacs Banking/ Postal Gold/ Bond Funds Life Insurance 4 Lacs Real Estate/ Mutual Funds 4 Lacs 40 Lacs or 4 Cr 2 Lacs or 5 Lacs Why Growth Instruments Product What after 20 Year PPF/EPF 57 Lacs Banking/ Postal Gold/ Bond Funds Life Insurance 57 Lacs Real Estate/ Mutual Funds 2.5 Cr 75 Lacs 57 Lacs Why Proper Insurance 1 4 www.fortunefinancials.com DEATH IN FRONT TITANIC Now water inside everywhere First portion already drowned Some decided to die together. Desperation for life. Life Boats in Titanic 500/2200 Only Why How Much Insurance ELV & HLV My Home, My Wife, My Child 12 X Annual Income = 1% Monthly 80-Remaining Years X Expanses + Inflation How Much Amount you would like to leave 4D Protection Sampoorna Suraksha •Death • •Disability • Disease • Disaster Plan vs Planning Instead of single Plan/Policy take go for Portfolio Tripe Matrix 33% 33% Real Estate Equity/MFs Banking/postal 20-25% Bonds/Gold 12-18% 33% Life Insurance Child/Pension 8-12% Selection Parameters Any Consumer Product TV/Mobile/Vehicle /Tour/Professional Life Time Things Home/Life Partner/Child Schooling /Professional Medical Treatment Science / Surgery / Medicines/ Professional Financial Product & Services ???????????? Beating Inflation Banking/Postal/Corporate F D of Rs. 1 Lac @ 9% Interest earned in 1 year Rs. 9000/- Standard Inflation - Rs. 7000/- Principal Value after 1 Year Rs. 93000/- Actual Return 93K + 9K Rs. 102000/- Tax Liability on Rs. 9000 Interest - Rs. 2700/- Post Tax Returns 102000-2700/- Rs. 99300/- Is it really Safer Investment & Beating Inflation SENSEX Large Cap & Leading Stock in SENSEX 30 or NIFTY 50 BSE SENSEX started with 100 rate point in 1979 & Now 29000 Market has maintain a good historical return of 18% annualized Market History Market vs FD Year Sensex 31-Mar-00 31-Mar-01 31-Mar-02 31-Mar-03 31-Mar-04 31-Mar-05 31-Mar-06 31-Mar-07 31-Mar-08 31-Mar-09 31-Mar-10 31-Mar-11 31-Mar-12 31-Mar-13 31-Mar-14 31-Jan-15 5001 3604 3469 3049 5591 6493 11280 13072 15644 9709 17528 19445 17404 18836 22386 28000 Sensex FD Growth Growth % % 34% 9 -28% 9 -4% 9 -12% 9 83% 9 16% 9 74% 9 16% 9 20% 9 -38% 9 81% 9 11% 9 -10% 9 8% 9 19% 9 25% 9 Rs. 1 Lac Grwoth Sensex FD 100000 100000 133725 109000 96375 118810 92764 129503 81517 141158 149483 153862 173607 167710 301606 182804 349525 199256 418305 217189 259588 236736 468662 258043 519931 281266 465358 306580 503636 334173 598563 364248 One Time Rs. 1 Lac Sensex FD 18% 9% 3.27 Cr 20 Lacs 700000 600000 500000 400000 Series1 Series2 300000 200000 100000 0 1 2 3 4 5 6 7 8 9 10111213141516 SENSEX vs FD in long term of 35 Years Rs. 2K Monthly SIP Sensex FD 18% 9% 4.77 Cr 54 Lacs Income vs Consumption 1st Job to 100 People by 100 Companies Bank Account SBI,/PNB, HDFC,/ICICI, Employee, Loans, Renting, Software Mobile/Bike/Cloths Airtel/Nokia, Bajaj,/Hero, Raymond's Employee, T&P, Lands, Sub-Vendors Car/Flat/Marriage Maruti,/M&M, DLF,/Unitech, Hotels Land, Steal, Cements, Electrical, Luxury Vacation/Child/ Jet Air, Cox & King, Max/Apollo, Tourism, Medicine, Employment, Loans Schooling/Fooding Akaash, Educomp, Nestle, Jubilant Food Laptop, Junk Food, Oral Care Medical LIC Business New Clients, Big Premium, Wealth Creation, Agents own Wealth Market Future Future Projection with just 18% CAGR. Future Outlook Now you have to decide the Future India Highest Population & High Earnings of India’s Next Generation. The Power of Indian Retail & Strong Domestic Consumption. Huge Infrastructure Spending & Good Order Book. More FDI / FII Investment & Corporate Mergers in Indian Market. More International tie-ups & Nuclear Deal. Service Class & Export Oriented Economy. Stable Government & Strong Planning for next 10-20 year. And Many More. LIC ULIP 13 Year Old Funds Bima Plus 2001 87 18% 9 Year Old Funds Future Plus 2005 35 6 Year Old Funds Child Fortune Plus 2008 25 16% 17% Wealth Creation One Time Investment of Rs. 1 Lac in 20 year @ 6% 3.20 Lacs @ 8% 4.66 Lacs @ 15% 16.36 Lacs Wealth Creation Monthly Investment of Rs. 1000/- (20 Years) @ 6% 4.55 Lacs @ 8% 5.72 Lacs @ 15% 13.27 Lacs Future Approach Targeted Goal Base approach Current Cost 10 Lacs Future Cost @ 6% 32 Lacs 8% 15% 6.86 L 1.95 L 5588/- 2411/- CHANGE cant CHANGE Cooking Style Chulha > Stove > LPG > Microwave > Induction Cooker Child Education Pathshala > Govt School > Public School > Coaching Communication Letters > Telephone > Mobile/SMS/E Mail > BBM/Whats app Investment Planning ??? ACTION PLAN Stop thinking now and plan you Investment THANKING YOU Ritesh-9350892225 Disclaimer: * Mutual Fund Investments are subject to Market Risk & Past Performance may or may not be sustain in future. * Insurance is Subject matter of solicitation.